- Bitcoin Cash has surged by 15.38% to hit a 7-month over the last 24 hours.

- Market indicators suggested that BCH was on the verge to make a bullish crossover, signaling further uptrend.

Over the past month, Bitcoin Cash [BCH] has experienced a strong upsurge. Since hitting a local low of $321, the altcoin has seen a sustained upward momentum.

As such, over the past 24 hours, Bitcoin Cash has surged to hit a 7-month high of $536.

This bullish trend has been maintained on monthly and weekly charts too. In fact, as of this writing, BCH was trading at $512.

This marked a 15.38% rise on daily charts, with the altcoin gaining by 15.86% on weekly charts and 42.65% on monthly charts.

Despite the recent price pump, BCH still remained approximately 88.18% below its ATH of $4355.

With BTC continuing to make new ATH, BCH will also continue to enjoy the momentum. Therefore, our analysis indicates that BCH is well-positioned for more gains on its price charts.

What BCH charts say

According to AMBCrypto’s analysis, BCH is experiencing increased buying activity and a strengthening upward momentum.

Over the past 24 hours, RSI has surged from 57 to 68 signaling that buyers are dominating the market.

This increased buying pressure was evidenced in the trading volume, which surged by 314% to $1.75 Billion over the past day, according to CoinMarketCap.

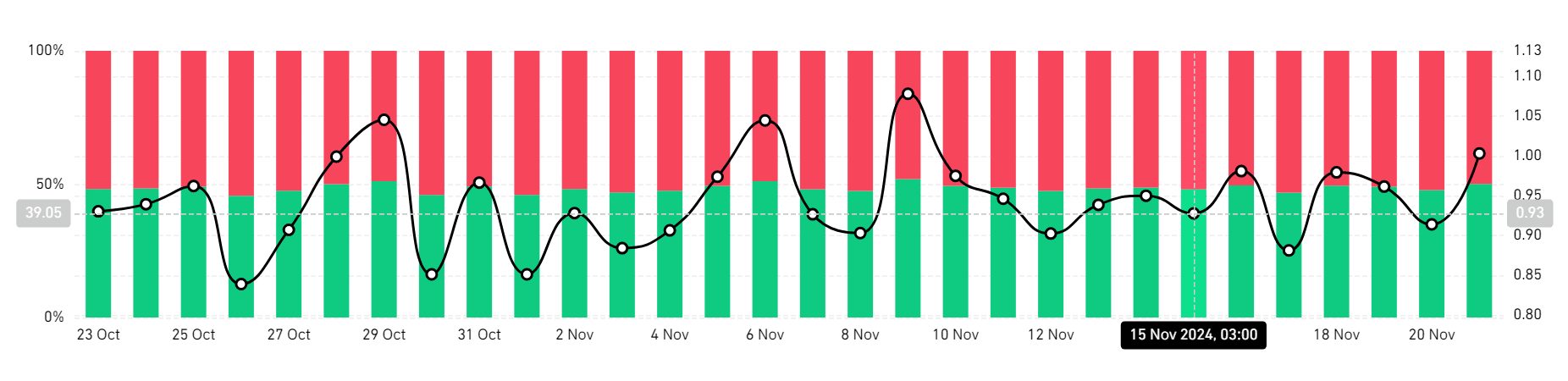

Additionally, BCH’s Stoch RSI was on the verge of a bullish crossover, signaling the start of a new bullish wave while maintaining the existing bullish momentum.

When this occurs, it suggests that an asset is experiencing higher inflows with investors continuing to purchase fearing to miss out, especially after a short uptrend.

Looking further, Coinglass data showed that most investors were bullish and anticipated prices to rise. Thus, the Long/Short Ratio at 50% suggested that longs were dominating the market.

This bullishness is evident among long position holders. According to Santiment, MVRV Long/Short difference has surged over the past week to -4.13 from -7.56.

When this rises, it shows that longs are not only in profit but also confident with the altcoin future prospects.

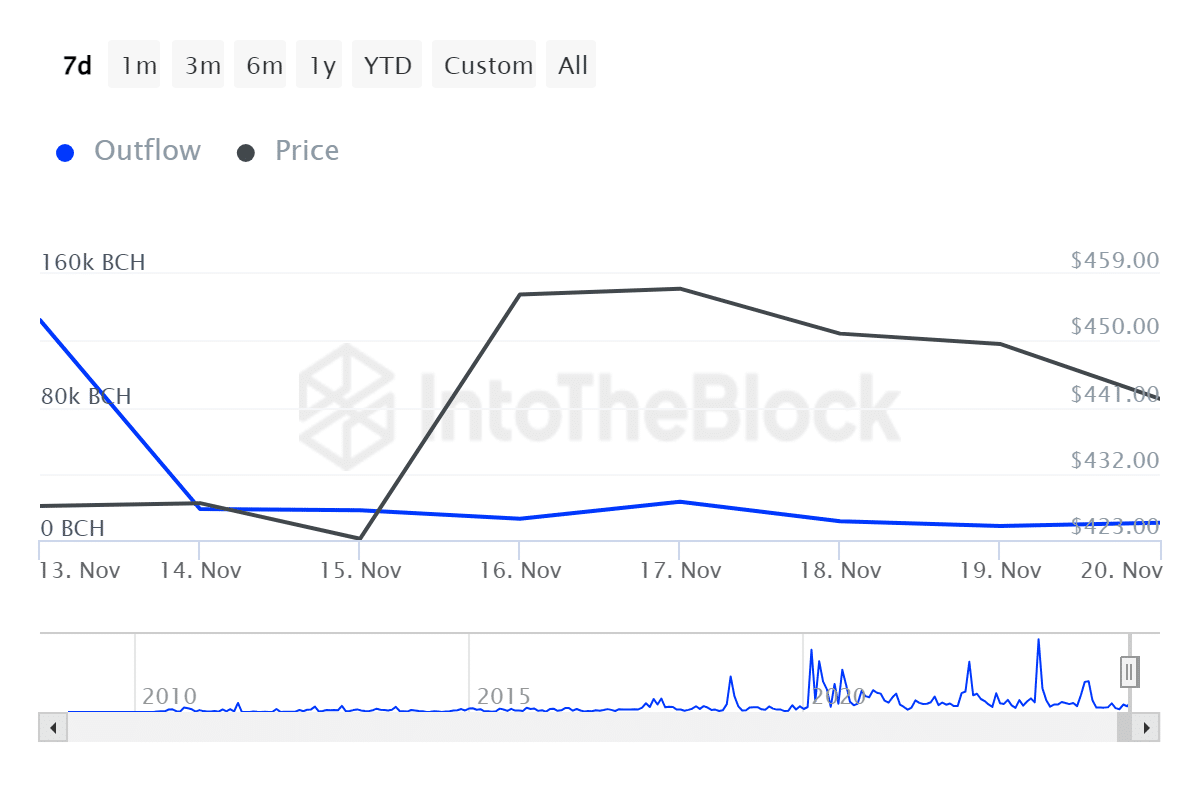

Finally, BCH’s large holder’s outflow has declined to reach a monthly low of 10.42k. Such a decline here suggests that fewer large holders are withdrawing their funds.

So, large holders were bullish and appeared to anticipate further price gains.

Read Bitcoin Cash’s [BCH] Price Prediction 2024–2025

What next?

If positive sentiment holds, BCH could make a bullish crossover and start a new wave. As such, after hitting a 7-month, BCH will find the next significant resistance around $620 if the current sentiment holds.

Consequently, if it faces rejection, the altcoin will find support around $407.