- Bitcoin’s on-chain data suggested the bull market may still be intact

- Last 24 hours have seen BTC climb by just under 2% on the charts

Against market expectations, Bitcoin [BTC] has started the year with a strong upswing. Since New Year’s Eve, for instance, BTC has surged to a high of $97,745 from a low of $91k.

This recent uptrend has left analysts talking about BTC’s future trajectory. In fact, according to one CryptoQuant analyst, BTC is still in a bull market, with its recent retracement simply a market cool-off.

Is Bitcoin still in a bull market?

According to Cryptoquant‘s latest analysis, four key on-chain indicators suggested that the bull phase may still be intact.

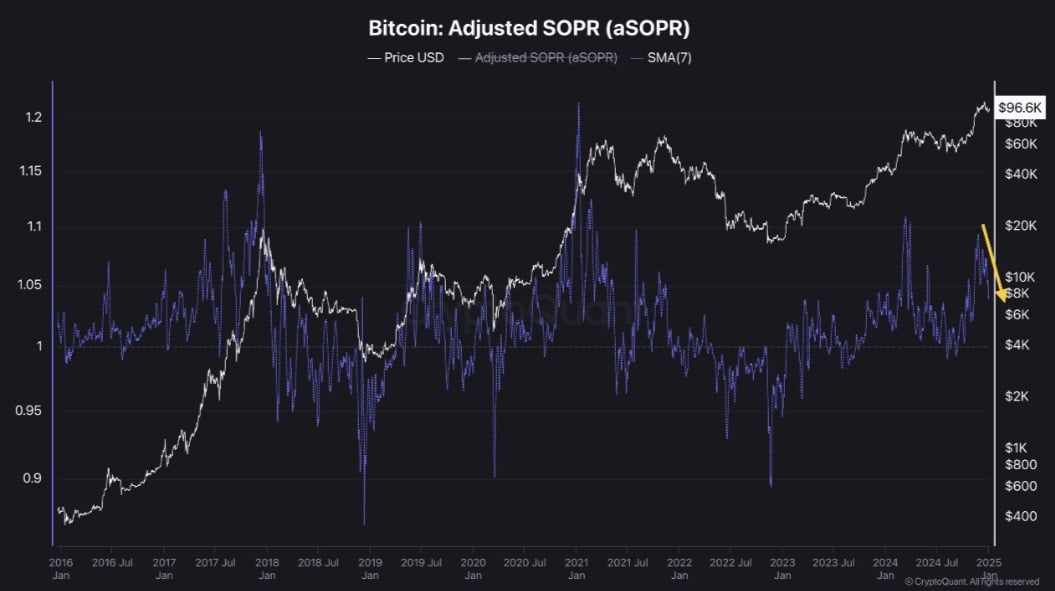

For starters, Bitcoin’s Adjusted SOPR has been experiencing a strong downtrend, hitting a low of 1.

When the SOPR drops below 1, BTC often sees a price rebound as selling at a loss usually triggers reversal – Common in bull markets.

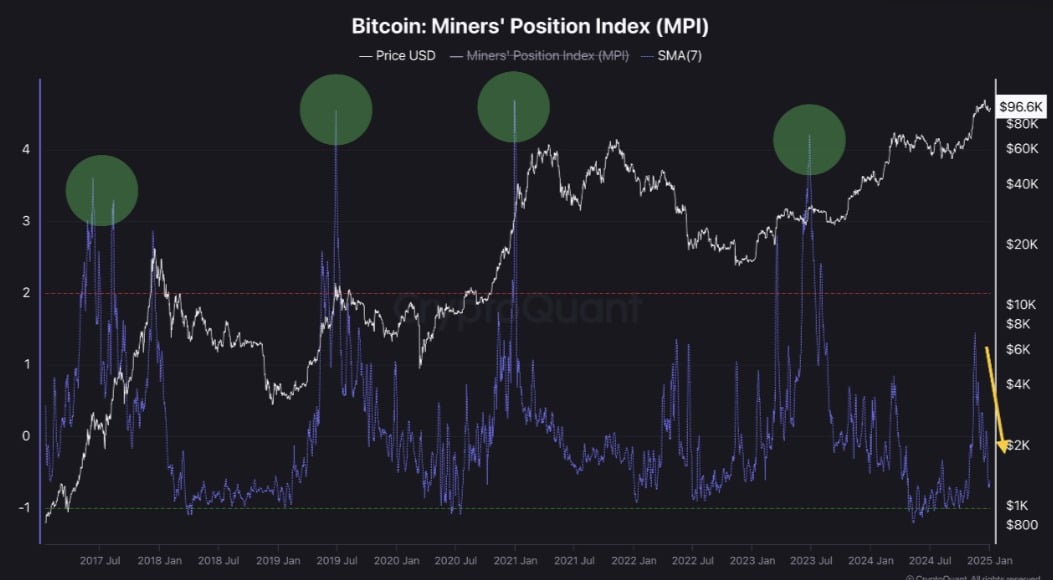

Secondly, Bitcoin’s Miner Position Index (MPI), analyzed with the 7-day SMA, has been trending south with no large transfers into exchanges.

What this implied was that miners have been holding their BTC as part of their assets with periodic expected selling activities.

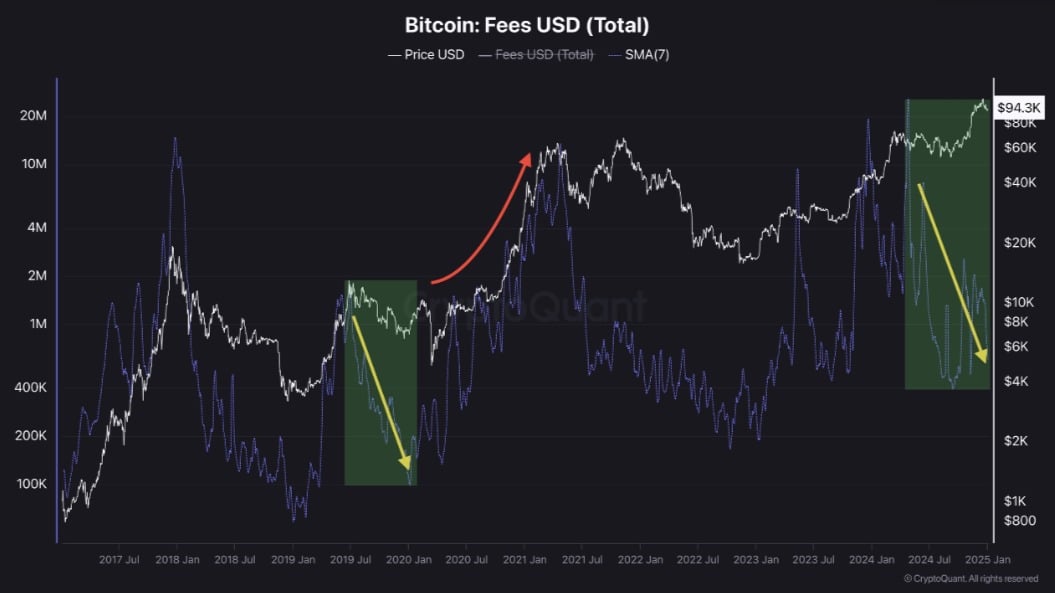

Thirdly, Bitcoin’s Total Network Fees indicates that fees have declined recently – A sign of reduced on-chain activity and a cooling phase. Simply put, this indicated that the signs of the crypto market overheating have been gradually subsiding.

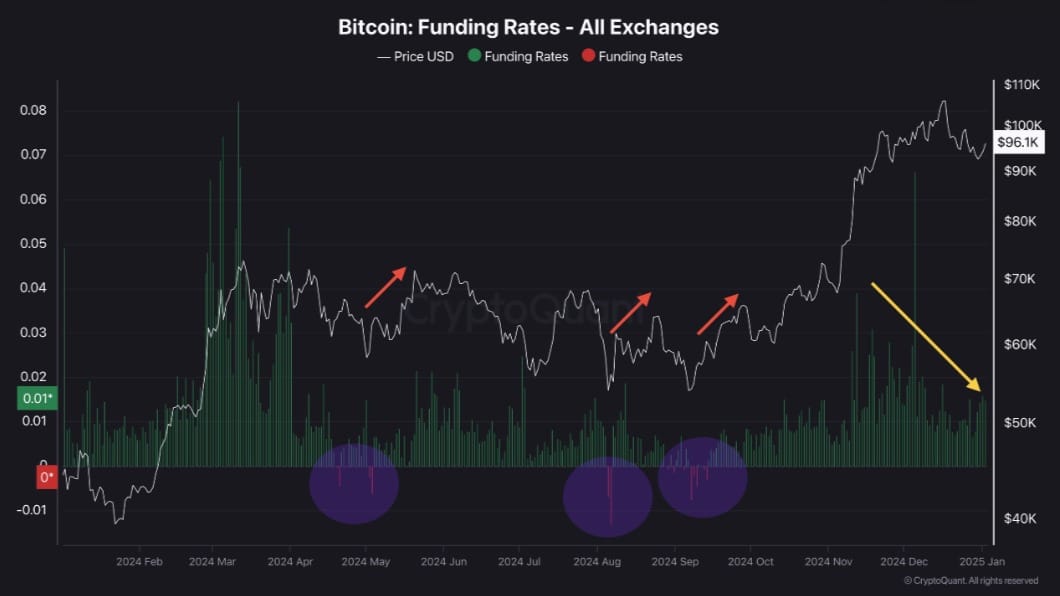

Finally, Bitcoin’s funding rate has turned south too. If the funding rate continues to decline, while market sentiment turns bearish, another strong upswing will occur.

Taken together, on-chain data suggested that the bull market may still be intact. Additionally, BTC may be in a cooling-off period and not at a cycle peak.

Is BTC set to start another rally?

While BTC has seen a period of correction and traded sideways over the last few weeks, on-chain data pointed to a potential rebound on the charts.

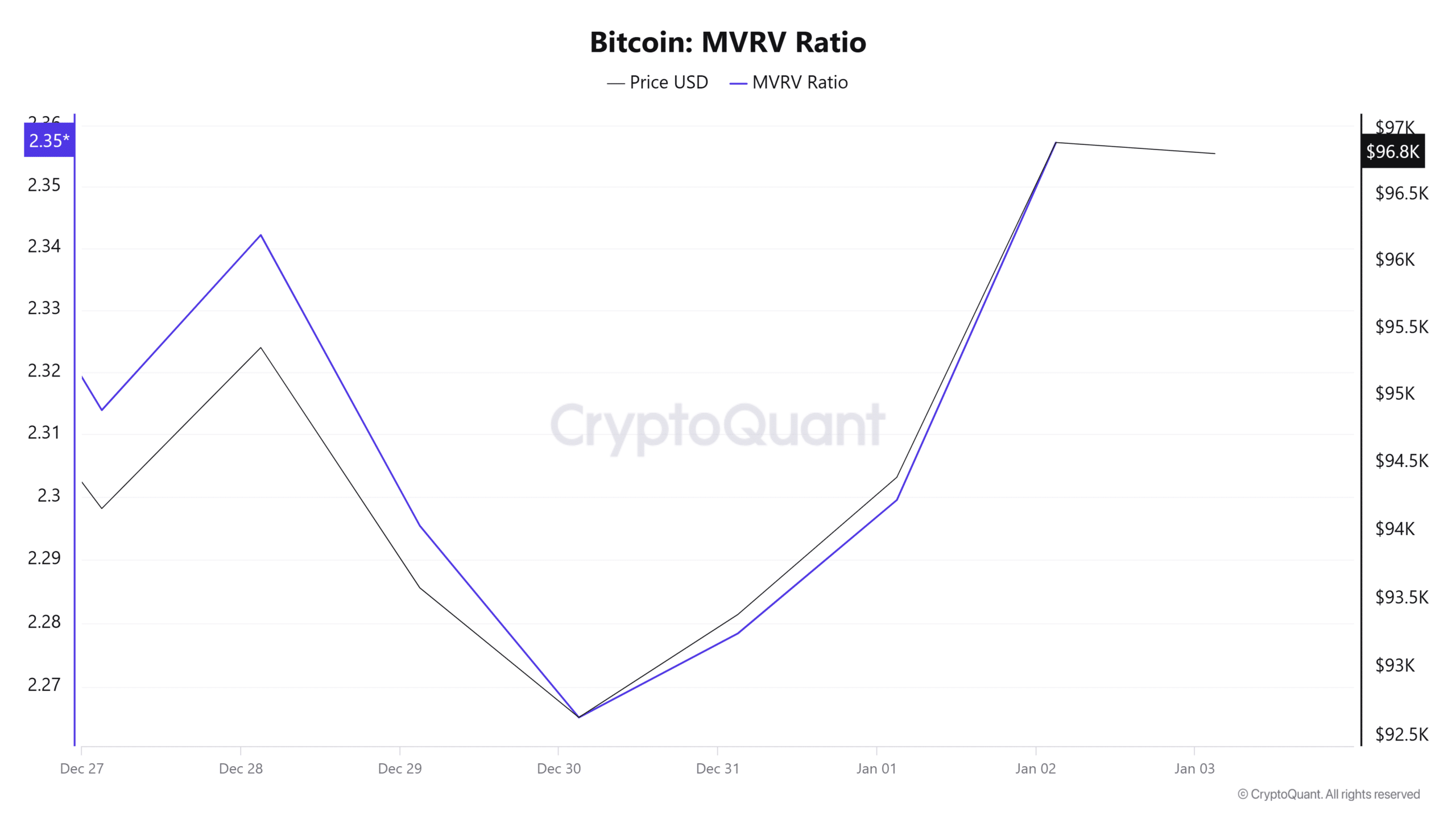

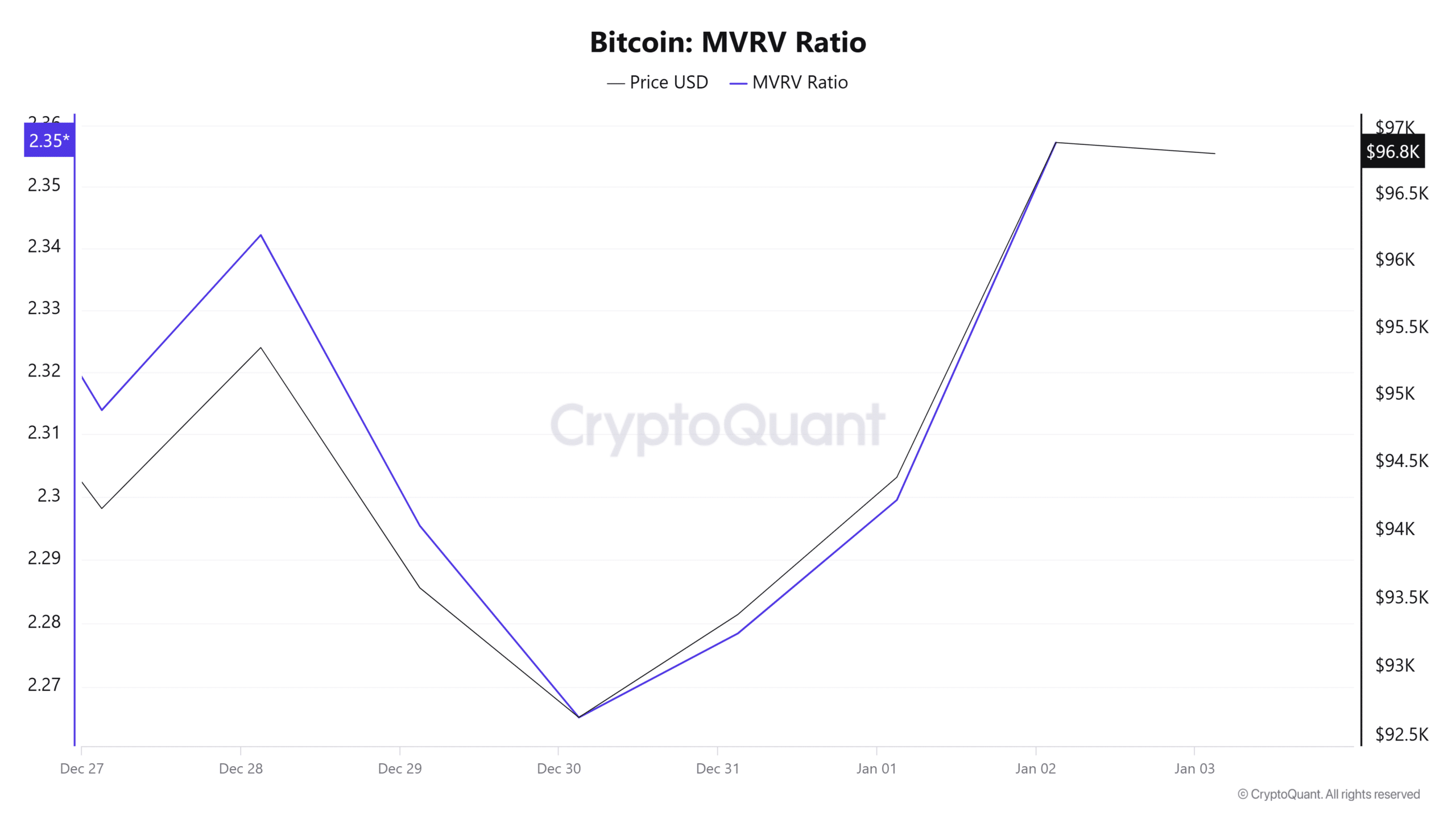

Source: Cryptoquant

For example, Bitcoin’s MVRV Ratio reversed to the upside after its previous decline. With the MVRV ratio at 2.3, it underlined positive market sentiment as the prices rose. At this level, it alluded to a healthy market with more room for further price growth.

Additionally, Bitcoin’s NUPL climbed over the last 3 days to 0.57 too.

When BTC’s NUPL rises above 0.5 and below 0.75, it is a sign that the market has entered its optimism phase. At this phase, participants are optimistic and not overly euphoric – A sign of further upside.

Finally, Bitcoin’s scarcity has continued to rise over the past week. This can be evidenced by the rising stock-to-flow ratio, with the same climbing to 826 BTC. A hike in scarcity is key for a price rally, especially if demand rises or remains constant.

Simply put, although BTC has seen some price fluctuations over the last 3 weeks, it is yet to reach its cycle peak. What this means is that Bitcoin could soon sustain its uptrend. If these market conditions hold, BTC will reclaim the $99,500 resistance. A breakout from here will see the crypto surge past $100k.