- BNB has seen strong bullish momentum, with its price at $585.40, rising 4.49% over the last day.

- Short positions around $583 could face pressure if BNB surpasses $590, potentially sparking volatility.

Binance Coin’s [BNB] price has shown robust bullish momentum of late. At press time, it was trading at $585.40, reflecting a daily rise of 4.49%.

The market capitalization of BNB totaled $84.36 billion at the time of writing, with a 4.49% growth over the last 24 hours. As trading interest heightens, there could be a continued uptrend on the horizon for the altcoin.

In the last 24 hours, BNB’s trading volume surged to $2.09 billion, an increase of 30.91%, indicating heightened market activity.

This rise in volume has pushed the volume-to-market cap ratio to 2.46%, showing a surge in trader interest. The considerable boost in trading volume may signal further bullish movement as demand for BNB intensifies.

Traders eye $600 as BNB nears resistance

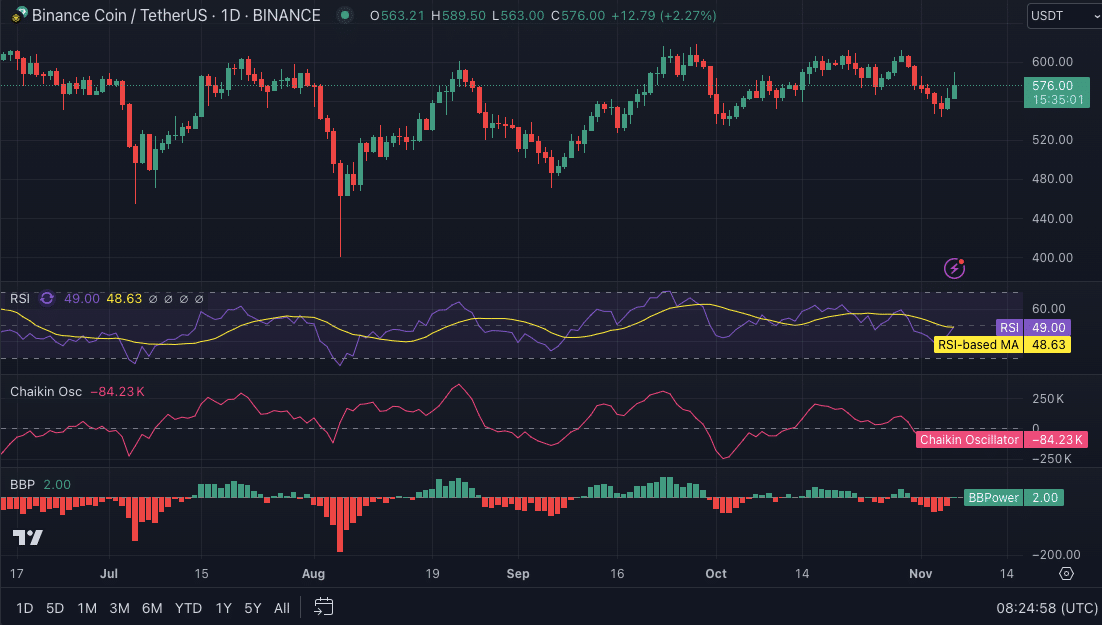

With an observed 3.49% price increase to $582.86 over the past day, BNB displayed a consistent upward momentum. The Relative Strength Index (RSI) rested at 51.61, signaling a neutral sentiment in the market.

Although there’s some buying pressure, the RSI suggested no immediate signs of extreme movement, leaving room for BNB’s price to maneuver either way.

The Chaikin Oscillator for BNB price displayed a negative reading at -35.529K, signaling limited buying accumulation within the market.

This indicator often points to reduced capital inflow, which may impact the durability of current bullish trends.

Consequently, the lack of strong accumulation could be a caution for short-term bulls seeking stronger support.

While the oscillator suggests a conservative approach, monitoring shifts in buying activity remains essential.

If BNB’s momentum gains additional backing, it may overcome this indicator’s warning signal, supporting further price increases.

However, this metric could curb strong upward movements without a shift in market liquidity, particularly for short-term traders.

Looking forward, the Bull Bear Power (BBP) was slightly positive at 1.5, indicating a mild upward bias in BNB’s trading range.

This slight positive reading showed that BNB was trading within the upper hand, suggesting that the current bullish sentiment may continue.

Traders may find this balance favorable, yet they should stay alert to potential shifts as BNB nears the $600 resistance level.

Short positions face pressure above $590

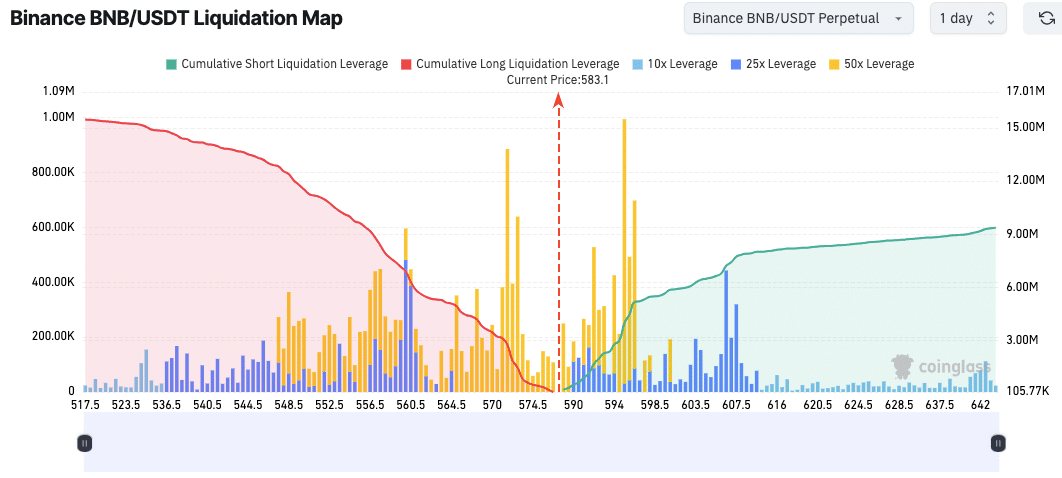

BNB’s liquidation map revealed concentration points, focusing on positions near $583.1, which could drive price volatility.

The map highlighted a gradual buildup of short positions that could face liquidation pressure if prices surpass $590.

Below $570, long liquidations dominate, indicating that price drops could trigger a cascade of long positions closing.

High-leverage positions, especially those at 50x leverage, cluster around $575 and $594, highlighting price points of heightened market risk.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

If BNB moves strongly in either direction, these clustered positions may drive further volatility, with the potential for a series of liquidations.

This setup suggests that any substantial price movement near these levels could prompt significant price action in the near term.