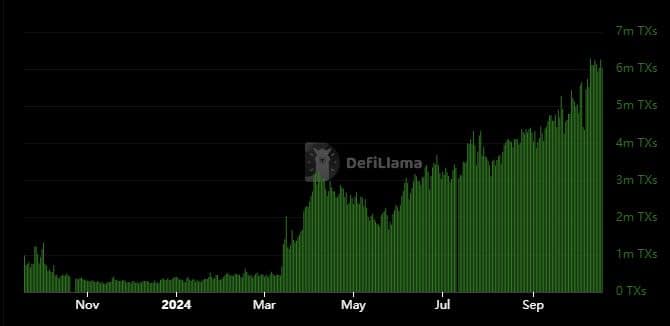

- Base transactions soared to a new ATH on the back of strong network activity

- Base continues to maintain its top dog position in the Ethereum layer 2 landscape

The Base network has been enjoying robust activity recently, especially since last week. In fact, the crypto market experienced one of its most active weeks, one characterized by new milestones.

Fast forward to this week and Base does not appear to be slowing down either. In fact, the network’s daily transaction count recently soared to 7.63 million txs on 18 November. This was the highest single-day transaction count that the network has achieved in its entire history.

The aforementioned transaction milestone underscored the level of network utility that has been taking place in Base. Despite this surge in transactions, its on-chain volume pulled back considerably from its historic high achieved last week.

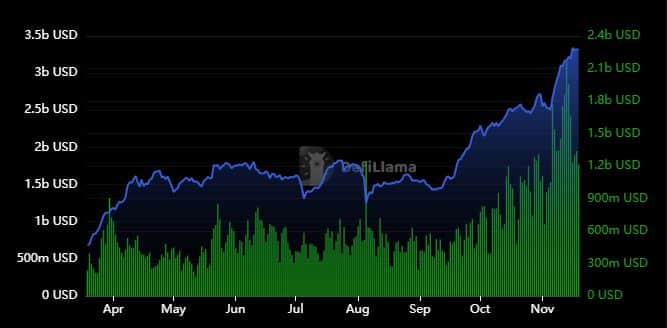

Daily volume came in at $1.33 billion on Monday, and $1.21 in the last 24 hours. Additionally, last week’s peak volume was $2.1 billion.

On the other hand, the total value locked in the Base network just soared to its highest historic level during the weekend. It peaked at $3.33 billion on Saturday, but it has since then been hovering near the same level.

In fact, the figures for the network’s TVL almost tripled from its lowest level in August this year.

Base stablecoin marketcap drops despite growing activity

Most blockchain networks usually record a surge in stablecoins’ marketcap as network activity grows. However, Base has been noting a different situation recently, with the stablecoin count declining across its ecosystem.

Base had a stablecoin marketcap of $3.81 billion on 31 October, which was also its ATH. That figure has since dropped to $3.59 billion.

A potential reason for the decline could be growing competition for yield farming, leading to lower incentives. Nevertheless, growth remained positive in terms of network fees.

Fees jumped to $423,000 in the last 24 hours. For context, the fees peaked at $496,300 in mid-November, but were less than $50,000 at their lowest point in the last 3 months. This was a reflection of the budding activity within the network.

The scale of this impressive performance allowed Base to secure its position as the leading Ethereum layer 2 network. This was both in terms of volume and TVL. It enjoyed a dominance of 30.08% in the Ethereum ecosystem, with Arbitrum as the runner-up at 26.79%.

Base has so far managed to outperform Layer 2s that existed in the previous bull run. Hence, the network may be poised to retain this lead if it keeps up its press time momentum in the coming months.