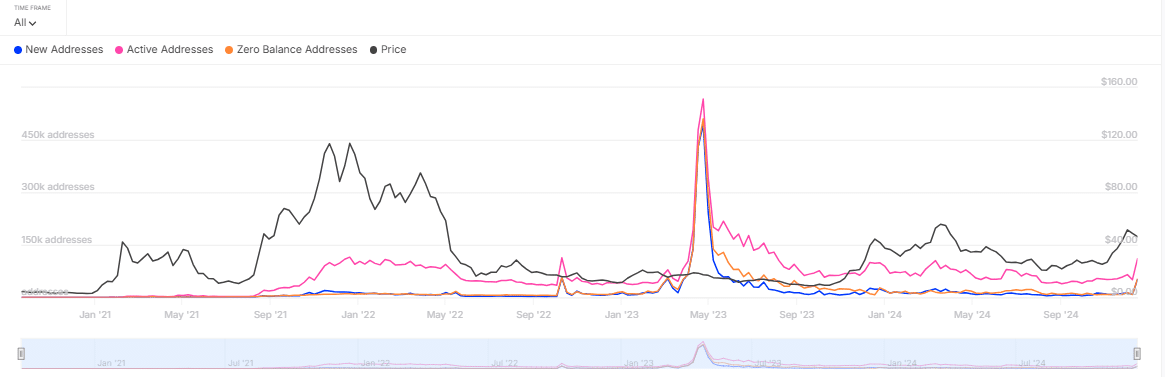

- Recent data shows a surge in several address metrics, most notably active addresses—a positive signal for AVAX.

- Whales might be driving this increase in active addresses, as well as the uptick in USD balances held by large accounts.

Avalanche’s [AVAX] price has declined in the past 24 hours, dropping 14.05%, and extending its weekly losses to 29.12%. Despite this bearish trend, a shift in market sentiment could be imminent.

According to AMBCrypto, whale activity appears to be intensifying, which could position AVAX for a new market phase.

Growing addresses show increased market interest

Market interest in AVAX is rising, as both Active Addresses (AA) and New Addresses (NA) have surged simultaneously.

In the past seven days, AA increased by 44.50%, indicating more transactions by existing participants. Meanwhile, NA saw a remarkable rise of 142.90%, suggesting growing adoption of AVAX, possibly driven by new market entrants finding the asset appealing.

This combination of heightened market participation and an influx of new addresses is a bullish indicator, suggesting the market may trend higher.

According to AMBCrypto, large holders, or whales, could be driving this growth by accumulating millions of dollars worth of AVAX, contributing to the surge in activity.

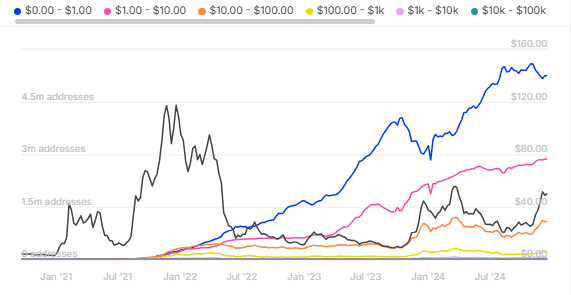

Large holders are accumulating AVAX

There has been a notable surge in AVAX acquisition across various address categories, particularly among those holding between $1 million and $10 million worth of AVAX in the past seven days.

Addresses in this range grew by 24.08% during this period, indicating that whales are gradually entering the market.

Similar growth trends were observed in other categories: addresses holding between $100,000 and $1 million in AVAX saw a 20.13% increase, while those with balances between $10,000 and $100,000 recorded a 23.56% spike.

This collective accumulation by large traders suggests a bullish outlook. When market sentiment among these key players aligns, it typically signals a healthy buying trend, potentially driving the coin’s price higher from its current levels.

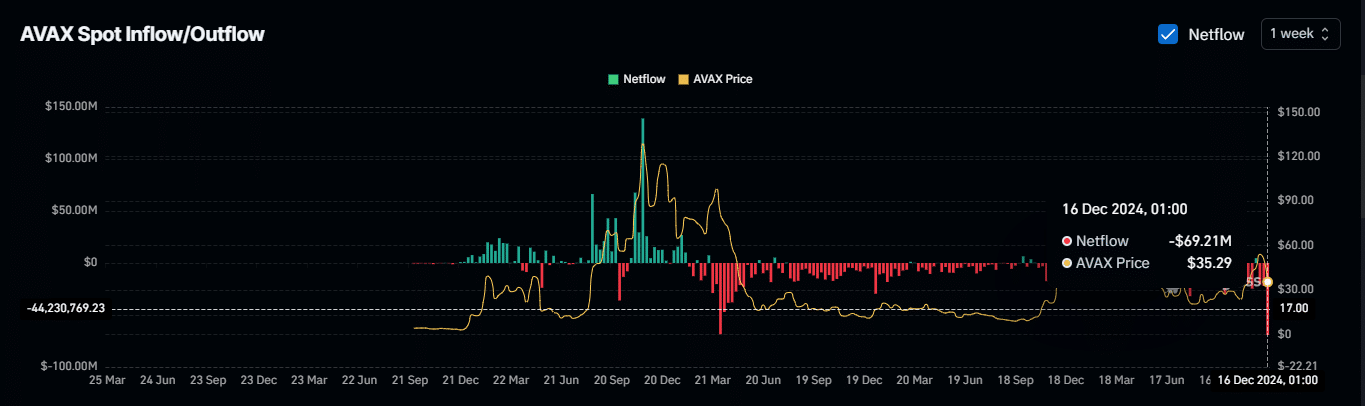

Supply of AVAX Is gradually declining

The available supply of the coin in the market is steadily decreasing, with exchange net outflows dropping significantly.

In the past 24 hours alone, $9.61 million worth of AVAX was withdrawn from exchanges, bringing its weekly net outflow to $69.21 million—the highest level since the 4th of April 2022.

At the same time, the Open Interest Weighted Funding Rate has returned to positive territory, signaling that sophisticated traders are positioning for a potential rally.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

If market sentiment shifts decisively toward bullish momentum, AVAX could experience a substantial price surge, recovering from its weeks-long decline.