- $48 resistance holds the key for Avalanche’s next big move.

- Stochastic Oscillator warns of overbought levels for AVAX.

Avalanche [AVAX] was priced at $45.28 at press time, reflecting a 3.60% increase in the past 24 hours.

The market cap was $18.53 billion, with a 24-hour trading volume of $827.93 million.

Over the past day, AVAX has fluctuated between a low of $43.37 and a high of $45.95.

While the token has made significant strides recently, its all-time high of $146.22, reached on the 21st of November 2021, remains far out of reach, marking a 68.89% decline from that peak.

$48 resistance stands in the way

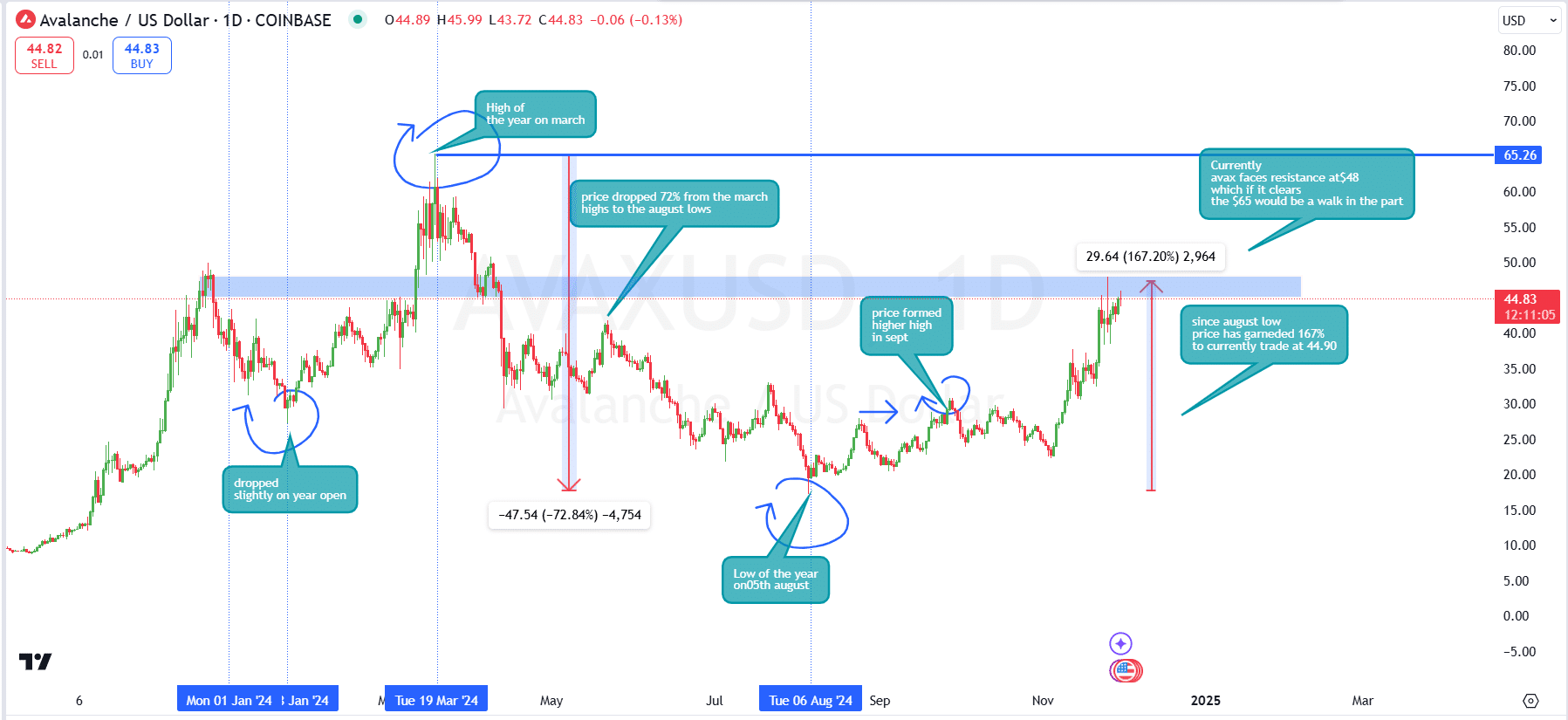

Avalanche displayed a volatile performance in 2024, starting the year with a slight drop before hitting its yearly high in March at $65.26.

This peak marked a strong start to the year, driven by bullish sentiment and increased activity.

However, from March onward, AVAX experienced a steep decline, losing 72% of its value and hitting its yearly low of $17.72 on the 5th of August.

Following the August low, AVAX began a strong recovery phase, gaining 167% to its press time of $44.83. In September, the token formed a higher high, signaling a shift in market sentiment.

Currently, AVAX is testing the $48 resistance level. Clearing this barrier could set the stage for a rally toward its previous high of $65 and potentially $100.

Short-term cooling on the way?

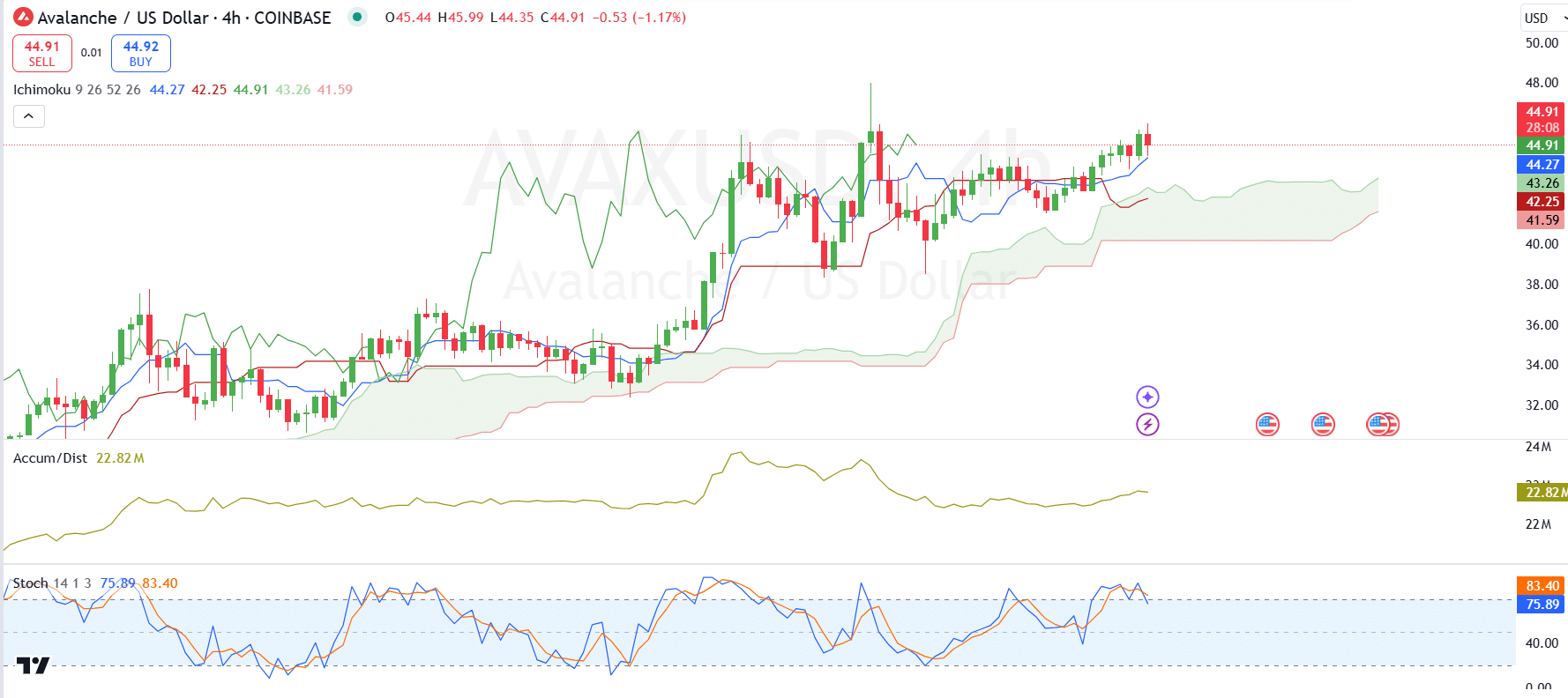

The Ichimoku Cloud indicated a bullish trend at the time of writing, with the Tenkan-sen (blue line) and Kijun-sen (red line) providing short-term support at $44.27 and $42.25, respectively.

The upward momentum was supported by increasing accumulation, as the Accumulation/Distribution indicator showed a rising trend at 22.82 million.

The Stochastic oscillator suggested AVAX was entering overbought territory, with the blue line at 83.40 crossing above the orange line at 75.89.

This signals a potential slowdown or minor pullback in the short term.

AVAX is in a bullish phase with strong support levels, but overbought conditions may lead to short-term corrections before resuming its upward momentum.

Traders should watch the $44 and $42 levels for support during any retracements.

Rising volume powers AVAX comeback

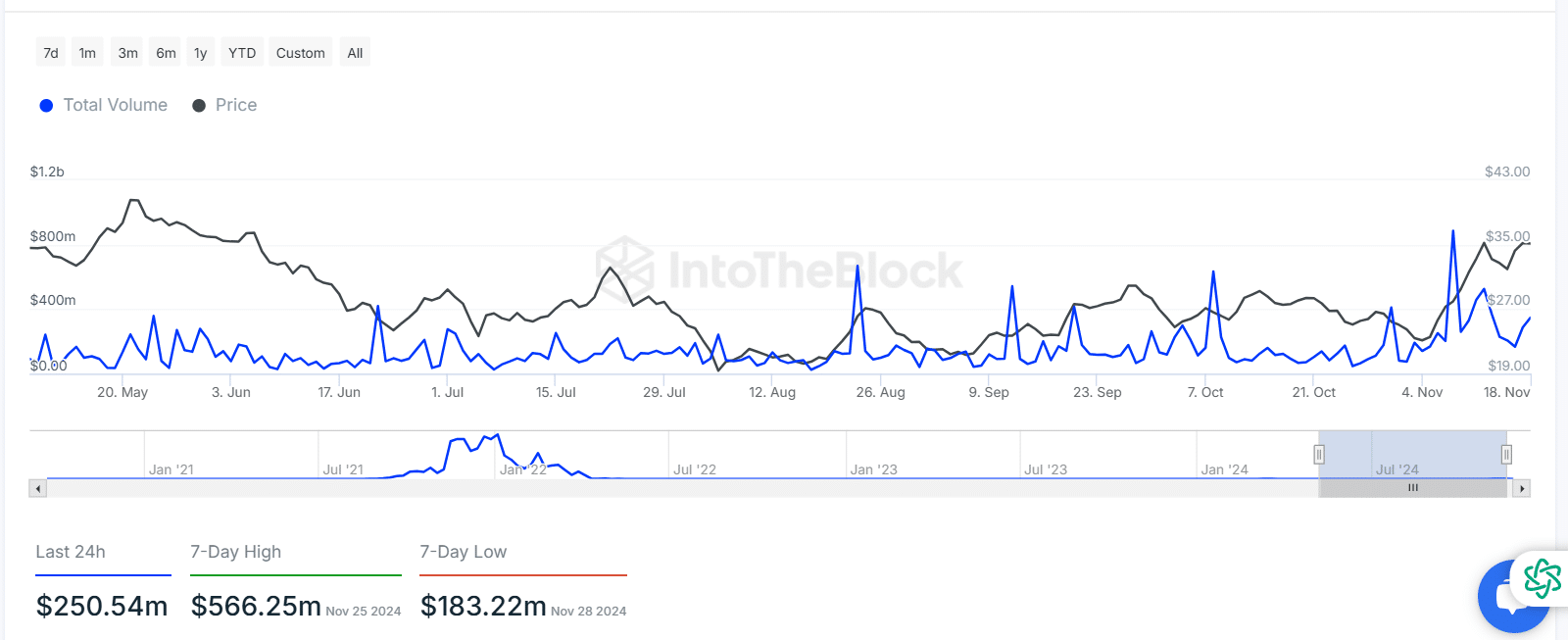

IntoTheBlock data showed that AVAX’s transaction volume peaked at $800 million in May and June, pushing the price to $43.

By July, both transaction volume and price declined sharply, with AVAX falling to the $19–$27 range.

From August to September, intermittent spikes in transaction volume briefly supported minor price recoveries, though the overall trend remained flat.

In November, transaction volume surged to a 7-day high of $566 million, lifting AVAX’s price to $35.

The volume remained at $250 million at press time, supporting stability in the mid-$30s. Rising activity indicates renewed interest, suggesting potential for further price appreciation.

AVAX sees rising adoption

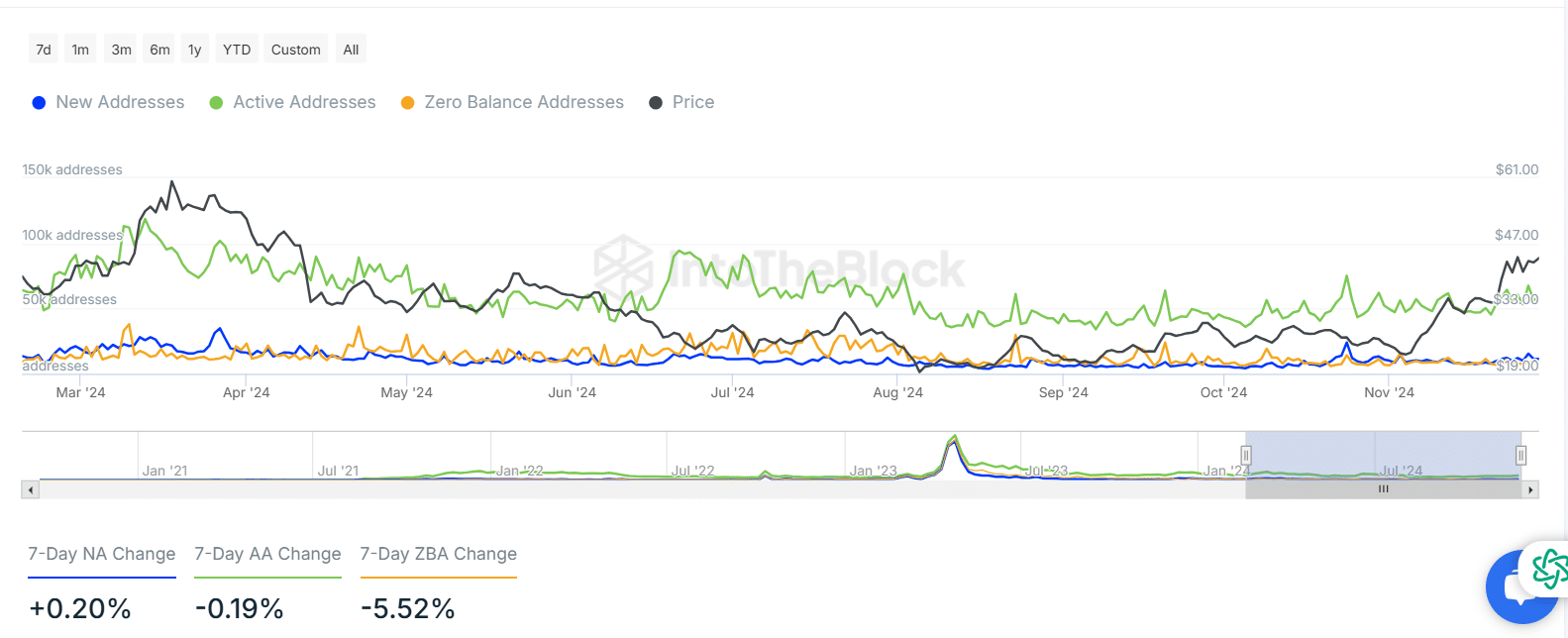

From March to June, active addresses peaked near 150K alongside a price increase to $61. However, both active addresses and price declined steadily into August, reflecting reduced network activity and market interest.

In the second half of 2024, active addresses stabilized, while new addresses saw modest growth, supporting a gradual price recovery.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

By November, the price reached $47, as zero-balance addresses decreased by 5.52% over seven days, indicating a shift of funds back into circulation.

This renewed activity signals growing market confidence and increased utility for AVAX.