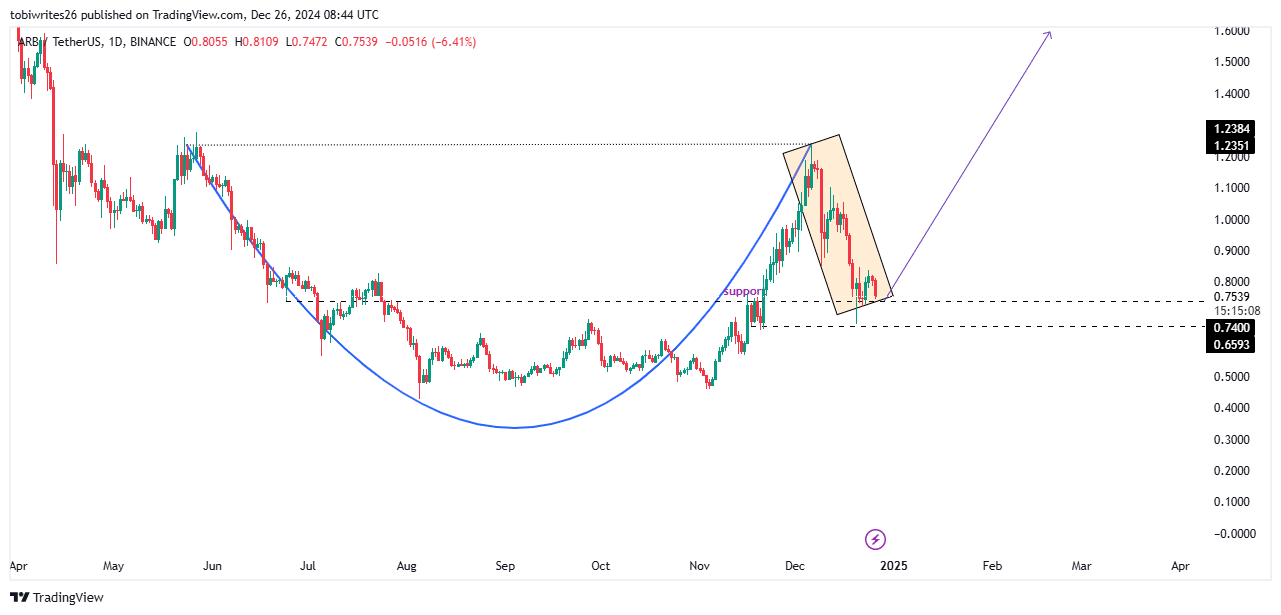

- At press time, ARB seemed to be trading within a cup and handle pattern – A bullish signal that often precedes a significant upswing

- Rally depends on ARB entering a major demand zone, and whales could play a role in driving this move

ARB has struggled to maintain its bullish momentum lately, with the altcoin beginning to decline on the charts already. In fact, over the past month, the altcoin has dropped by 14.28% on the charts – A trend that has continued over the past week and the last 24 hours too.

While ARB may see further declines in the short term, it could recover soon and resume its bullish trend, offering the potential for higher returns.

Bullish pattern forms for ARB

ARB has begun trading within a bullish cup and handle pattern, as shown on the chart with the marked lines. This pattern typically signals upward movement for the asset, at least in the short term.

For ARB, the expected rally could push the price to at least $1.5 once the pattern fully develops.

Before the rally takes off, however, ARB is likely to drop further as it seeks a demand zone with sufficient momentum between $0.74 and $0.659. Once this level is reached, the asset can be expected to trend higher.

Buy orders in place for ARB

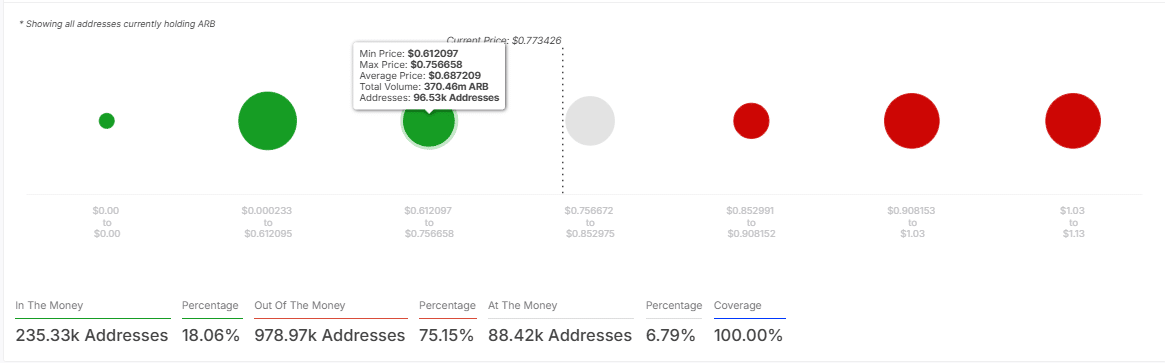

AMBCrypto’s analysis found that the demand level on the chart could push ARB higher. According to the IOMAP, this demand zone aligns with the “In the Money” region, where 13,200 addresses hold 320,000 ARB – Marking it as a high-impact support level.

IOMAP, a tool used to identify key support and resistance areas, revealed the distribution of addresses based on profitability. Here, “In the Money” refers to addresses in profit, while “Out of the Money” signifies addresses at a loss.

As ARB enters this “In the Money” zone, the price can be expected to begin its uptrend from this point on.

The Bull-Bear ratio, which compares the number of bullish versus bearish whales, revealed 39 bulls and 49 bears. This suggested that bearish whales are likely driving ARB lower, pushing it towards the demand zone as they seek favorable prices aligned with buying activity before re-entering.

Given this sentiment, ARB’s drop could extend beyond the 5.06% decline recorded on the daily timeframe.

Derivative traders are entering the market

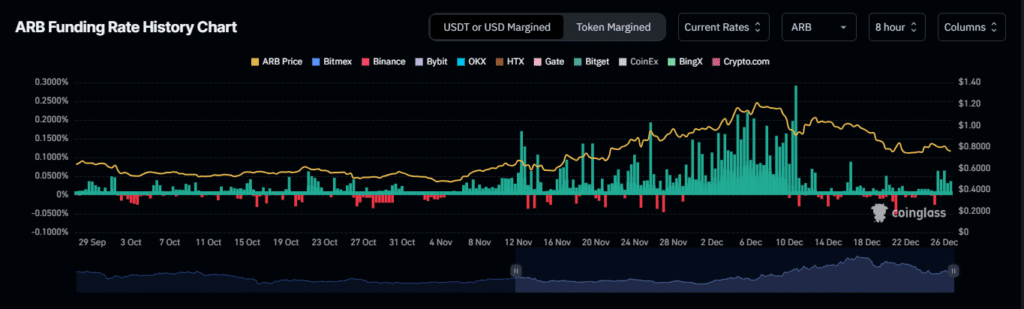

According to Coinglass, ARB’s funding rate has started to rise. It climbed to register a reading of 0.0097% over the last 24 hours, placing it in the positive zone.

A positive funding rate indicates that long derivative traders, particularly those using leverage, are dominating the market, helping to maintain price stability.

Simply put, sentiment around ARB remains bullish, and its slight decline may just be part of the necessary correction before an upward move.