- FLOKI has dropped to a three-week low amid bearish pressures across the memecoin market

- Derivative traders have remained active, with declining funding rates and long/short ratio showing a surge in short positions

The total memecoin market capitalization dropped by 17% over the past week alone, with the same hitting $94 billion as per CoinMarketCap. FLOKI, the sixth-largest memecoin by market cap, has mirrored these bearish trends given that at press time, it was trading at a three-week low of $0.000155 after a 5% drop in 24 hours.

This drop has stirred a spike in activity across both the spot and derivative markets, which could precede a hike in volatility.

Derivative traders remain active

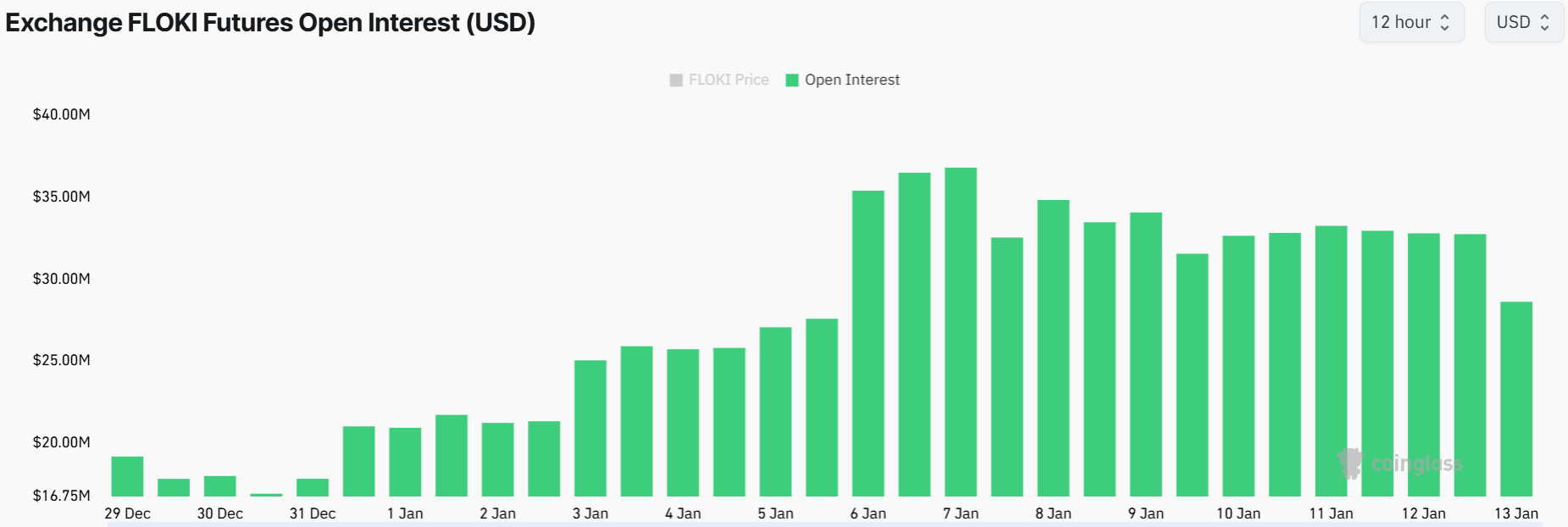

Data from Coinglass revealed that derivatives trading activity around FLOKI remains significantly high, despite the bearish trend. In fact, Open Interest (OI) has risen to $28M from $21M when the year began.

This data suggested that few traders are closing their open positions on FLOKI. However, it could also indicate an influx of short traders in the market, which often leads to negative market sentiment.

Funding rates have also dropped significantly to 0.0028%, indicating that long traders are unwilling to pay high fees to maintain their open positions.

FLOKI price analysis as sellers fuel the downtrend

At press time, FLOKI’s four-hour chart hinted that the memecoin may be oversold after the Money Flow Index (MFI) hit 21. This drop could precede a reversal if sellers are exhausted.

However, a bullish reversal may not happen soon after the 50-day Simple Moving Average (SMA) moves below the 150-day SMA. This bearish crossover indicated that FLOKI has entered a long-term downtrend.

The surging selling activity has also seen FLOKI make a bearish breakout from its consolidation range. Hence, traders should watch out for the support level at $0.000145, as a drop below it will result in a monthly low.

On-chain signals suggest…

An overview of on-chain data on IntoTheBlock revealed that despite the price drop, FLOKI whales have been unwilling to buy the dip. This, after large transaction volumes dropped by 14%.

However, there was a slight uptick in large holder positions.

At the same time, the profitability of wallets holding FLOKI declined. This could fuel the selling pressure if traders choose to move their tokens to exchanges to minimize losses.

Nevertheless, there were several bullish signals including a slight growth in the network activity, which could bode well for the altcoin’s long-term performance.

Is a short squeeze looming?

FLOKI’s long/short ratio revealed a spike in the number of short sellers betting that the memecoin will continue to decline further. This, after the ratio approached a weekly low following a drop to 0.856.

When short sellers are many and FLOKI makes an unexpected move to the upside, the forced closure of these positions could spur buying pressure that will aid an uptrend. This short squeeze scenario could aid the memecoin’s recovery.