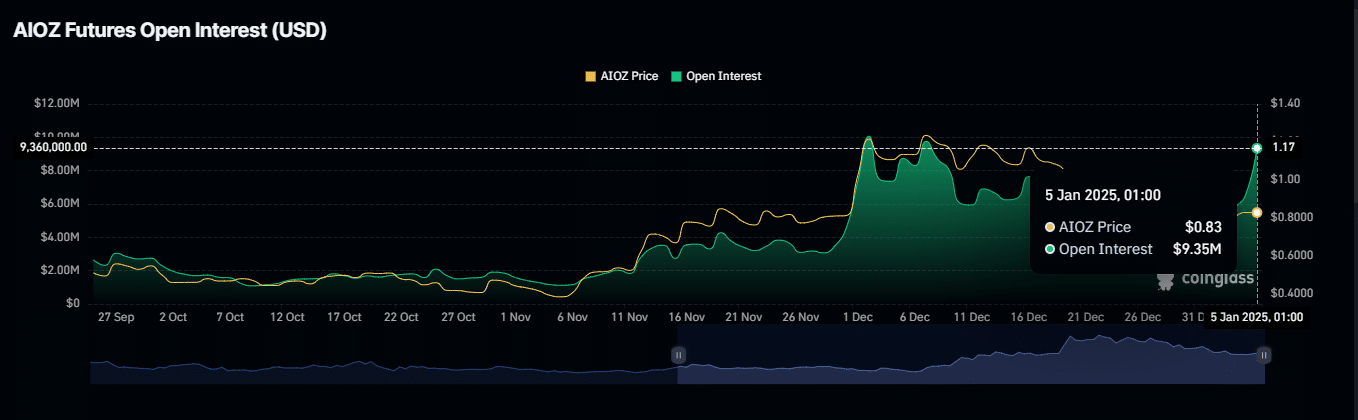

- Open Interest and trading volume have surged significantly, signaling potential for further gains.

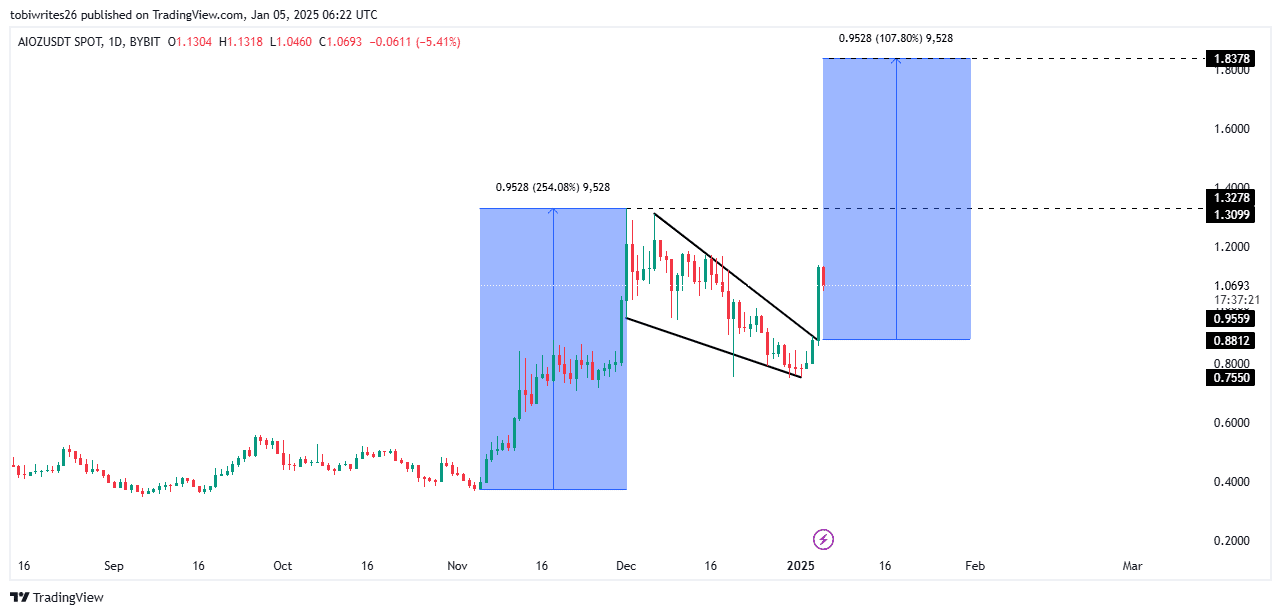

- On the charts, AIOZ was trading within a bullish flag pattern, typically a precursor to continued upward movement.

AIOZ Network’s [AIOZ] price has risen 21.75% in the past 24 hours, reducing its monthly loss to 7.86%. Its market cap also climbed 21.77% in the same period, reaching $1.22 billion.

With bullish momentum intact, AIOZ appears poised for further significant growth.

Major momentum build up in AIOZ

AIOZ has attracted strong market interest over the past 24 hours, with key metrics highlighting growing bullish sentiment.

Open Interest in derivatives spiked by 27.47% to $9.35 million, reflecting heightened trading activity. While this alone doesn’t confirm bullish intent, the simultaneous surge in volume and price indicates positive sentiment.

Trading volume for AIOZ skyrocketed by 445.98%—a 4.4x increase—reaching $18.01 million and coinciding with notable price gains.

Additionally, the Funding Rate, a key indicator of market positioning, climbed to 0.0282%, according to Coinglass, signaling sustained bullish interest. With market activity on the rise, the Funding Rate may trend even higher.

Bullish flag positions AIOZ for a rally to $1.8

AIOZ’s recent gains stem from breaking out of a consolidation phase within a bullish flag pattern.

Consolidation phases often see buyers accumulating the asset as prices dip within a confined range, setting the stage for a breakout.

In AIOZ’s case, a price range analysis indicated that the asset was poised for a potential 107.80% return, with a final target of approximately $1.84.

Since initiating its upward movement, AIOZ has remained firmly in bullish territory, as confirmed by technical indicators, suggesting the rally is gaining strength.

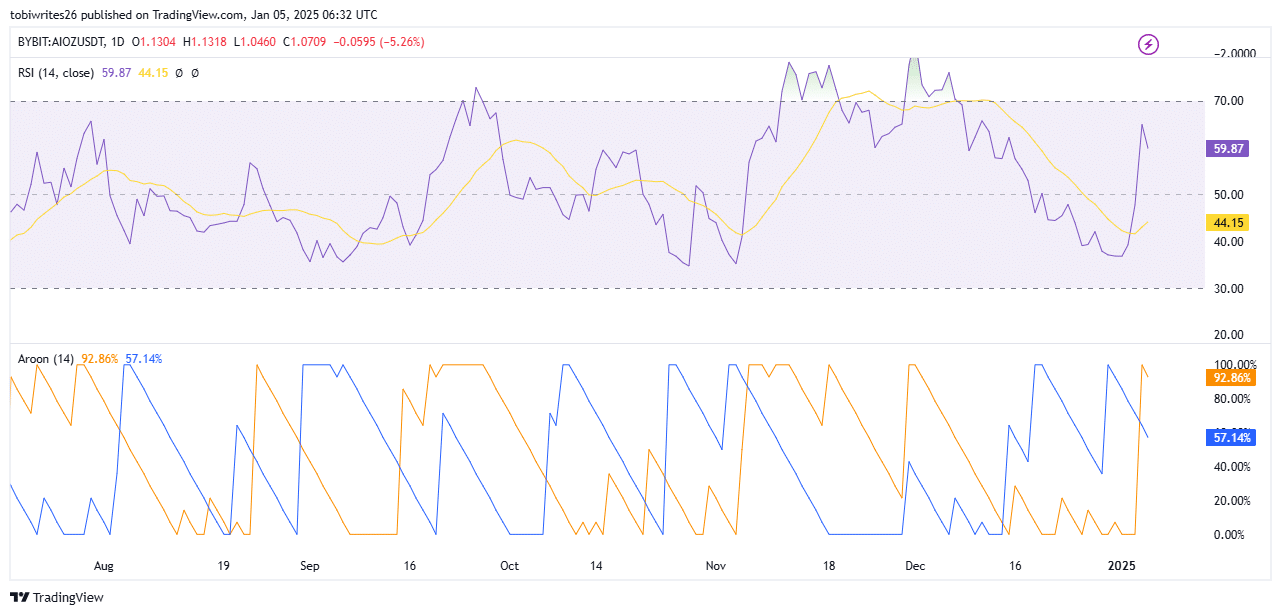

More room for an upswing

The Relative Strength Index (RSI) remained firmly in bullish territory, currently reading 59.87, well above the neutral 50 level.

As a measure of price momentum, an RSI above 50 signaled that the momentum driving the ongoing price surge was strong and favored further gains.

The Aroon indicator supported this outlook, with the Aroon-Up at 92.86% and the Aroon-Down at 57.14%.

Read AIOZ Network’s [AIOZ] Price Prediction 2025–2026

When the Aroon-Up significantly outpaces the Aroon-Down, it reflects a strengthening bullish trend with room for additional upside.

These metrics suggest AIOZ could experience notable gains in the coming trading sessions.