- Adventure Gold crypto trading volume jumps 4105.82%, signaling rising trader interest.

- Technical analysis pointed to $1.77 resistance, with potential targets at $3.39 and $7.78.

Adventure Gold [AGLD] recorded a 24-hour trading volume of $1.58 billion, representing a staggering 4105.82% increase in the past 24 hours.

This sharp rise in activity pointed to growing trader interest and heightened participation in the market.

Adventure Gold was trading at $1.62 at press time, reflecting a 31.36% decrease in the last 24 hours, despite a 21% rise over the past seven days.

However, the combination of rising volume and price suggested strong demand and increased attention from both retail and institutional traders.

Key price levels to monitor

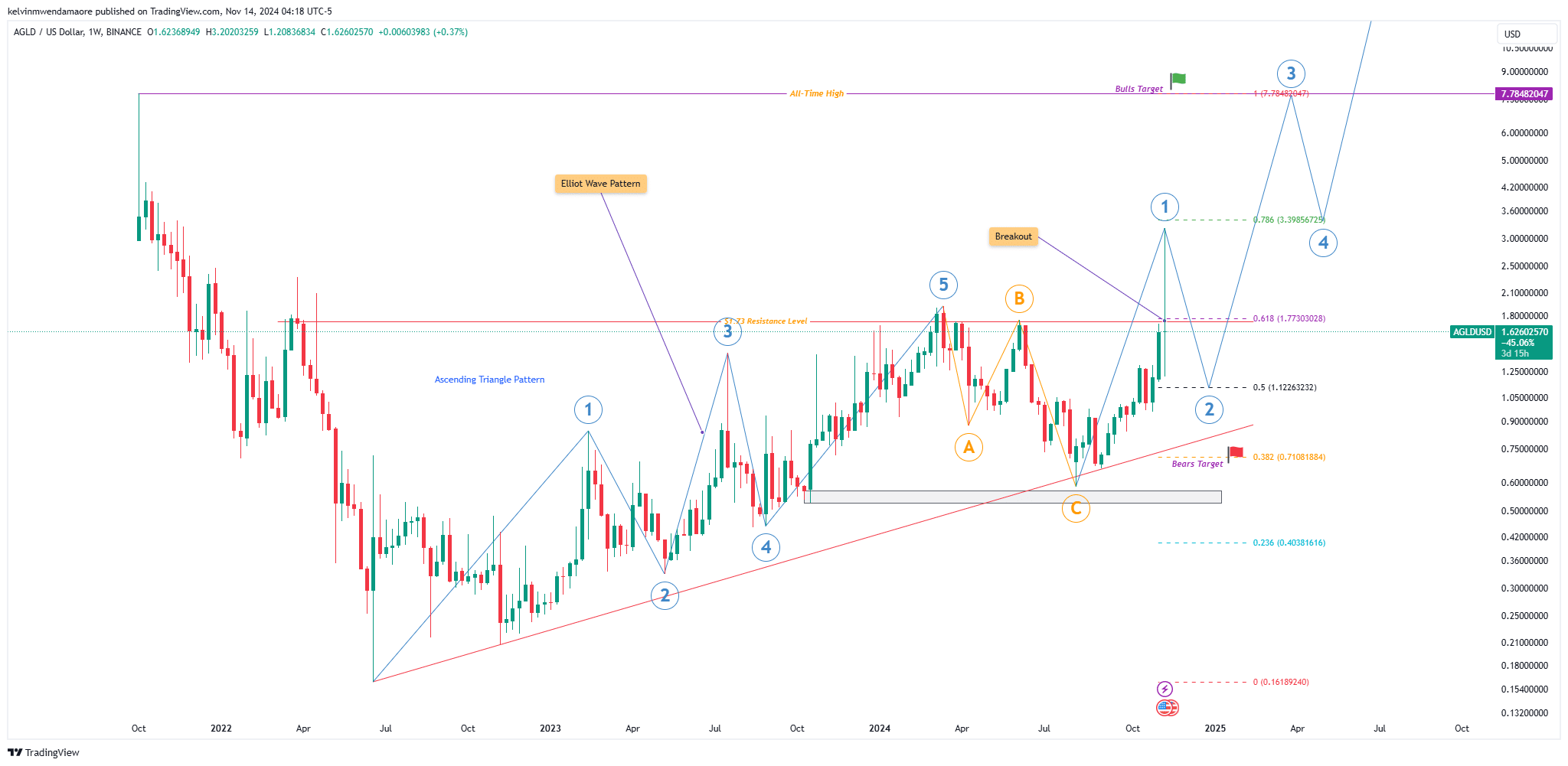

From a technical perspective, AGLD recently broke above an Ascending Triangle Pattern, facing resistance at $1.77 (Fib 0.618).

If the token clears this level, potential targets lie at $3.39 (Fib 0.786) and $7.78, the latter aligning with historical price highs.

Support levels to watch include $1.12 (Fib 0.5) and $0.71 (Fib 0.382). A breakdown below these could signal further downside, with the next major support between $0.40-$0.50.

Price movement within these levels will be crucial for determining the token’s next direction.

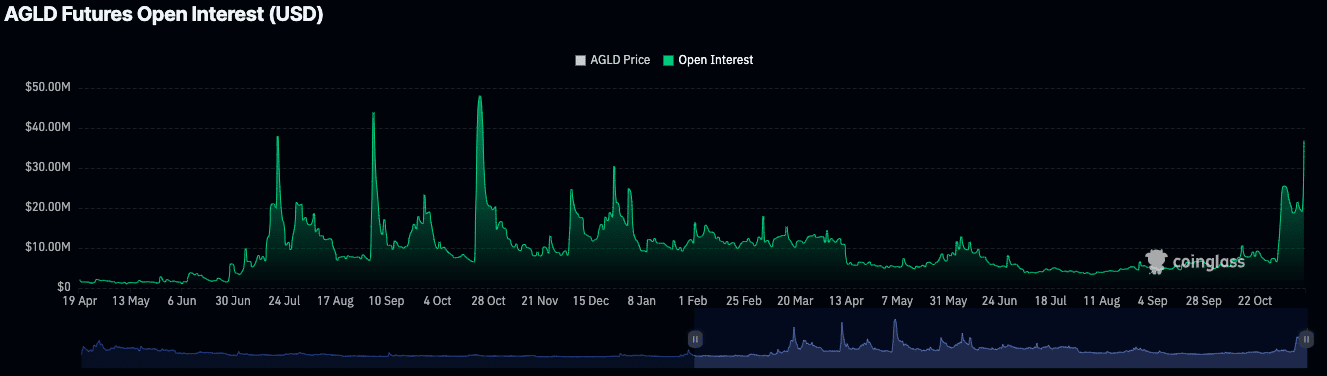

Futures data shows rising speculation

Futures market data indicated a sharp increase in trading activity. AGLD’s Futures volume surged by 2716.14% to $2.40 billion, while Open Interest rose by 74.09% to $33.27 million.

These figures suggest that traders are positioning for further volatility.

Rising Open Interest often pointed to an influx of new positions, indicating that both long and short traders are anticipating significant price movements in the near term.

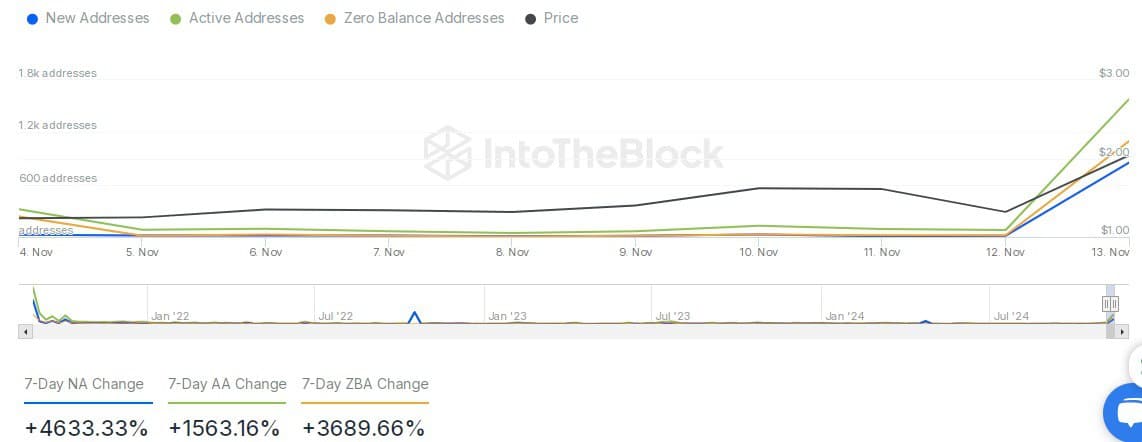

Adventure Gold crypto shows growing user interest

On-chain data revealed a sharp increase in user activity. The number of new addresses grew by 4,633.33%, while active addresses increased by 1,563.16% over the past week.

Meanwhile, zero-balance addresses rose by 3,689.66%, signaling a surge in wallet creation.

This rapid expansion in user engagement indicated increased adoption and activity within the AGLD ecosystem. A growing user base is often a sign of rising interest, which could sustain the token’s current momentum.

Potential cooling ahead?

Despite the recent rally, technical indicators pointed to possible consolidation. The RSI has retreated to 59.48, moving out of overbought territory.

Additionally, the Chaikin Money Flow (CMF) was at -0.23, signaling net capital outflows and selling pressure.

Read Adventure Gold’s [AGLD] Price Prediction 2024–2025

The MACD remained in bullish territory at press time, but shrinking histogram bars suggested that momentum may be slowing.

While AGLD’s outlook remains positive, traders should remain cautious as the market could see short-term pullbacks before any further upside.