- BONK’s breakout past $0.000025, combined with strong MACD momentum, signaled a bullish trend.

- Mixed long/short ratios and a slight dip in social dominance introduced cautious optimism.

Bonk [BONK] has taken the crypto market by storm, skyrocketing by an impressive 23% and printing what analysts call a “GOD candle.”

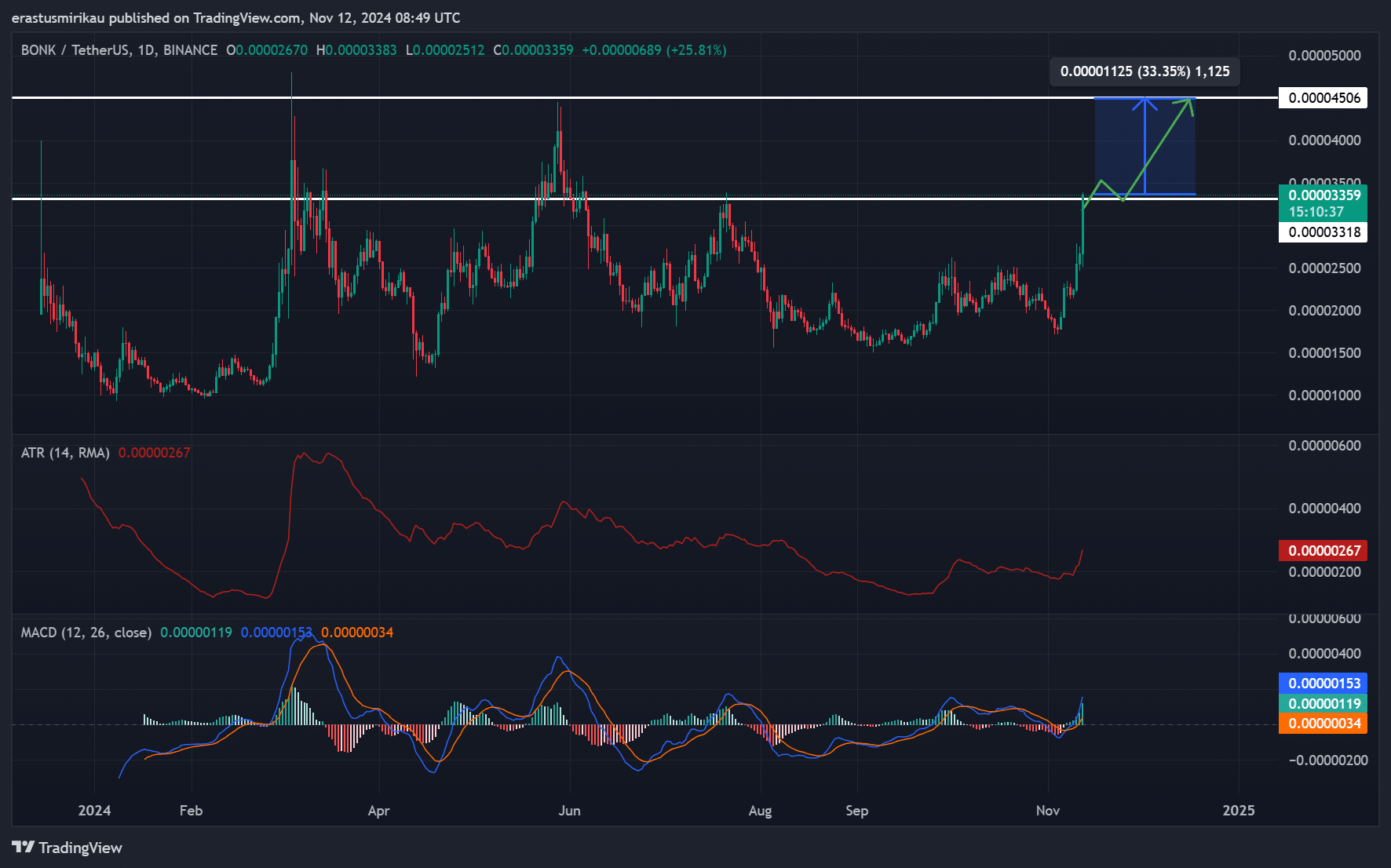

Breaking past a crucial resistance level at $0.000025, BONK traded at approximately $0.00003359, up 25.81% at press time.

This breakout, combined with surging MACD momentum, signaled substantial buying interest.

Bullish momentum ahead?

Recently, BONK’s chart showed it smashing through a key resistance level of $0.000033. This breakthrough often suggested a bullish trend ahead, especially as high volume accompanies the move.

Therefore, with this level now behind, BONK eyed the next resistance $0.000045. However, whether it can sustain this momentum depends heavily on upcoming trading activity and market sentiment.

Additionally, the MACD indicator pointed to a robust upward movement, as the MACD line remained significantly above the signal line.

This alignment is typically a clear sign of bullish momentum, implying that buyers are in control. Should this momentum continue, BONK could rally further into its next target range.

However, any sudden crossovers in MACD should be closely monitored, as they may indicate a possible reversal.

Furthermore, BONK’s Average True Range (ATR) indicator revealed a notable increase, underscoring elevated volatility in recent sessions.

While increased volatility may offer traders exciting opportunities, it also poses heightened risks.

Consequently, it’s essential for traders to approach the meme coin with a strategy that accounts for potential price swings.

This volatility reflects strong market interest, yet it also serves as a reminder of BONK’s unpredictable movements.

Balanced Long/Short Ratio

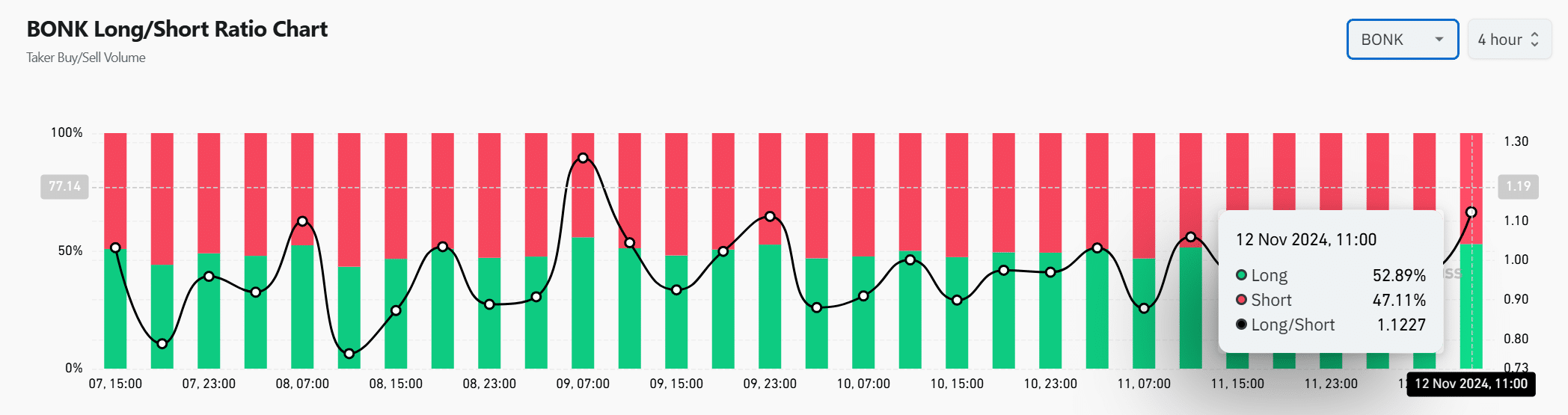

The press time Long/Short Ratio showed a slight bullish inclination, with 52.89% of traders going long versus 47.11% short. Therefore, while optimism leads, a strong presence of shorts suggests caution among traders.

This balanced sentiment might contribute to continued volatility, as shifting positions could either support further gains or trigger a pullback.

BONK social dominance dip raises questions

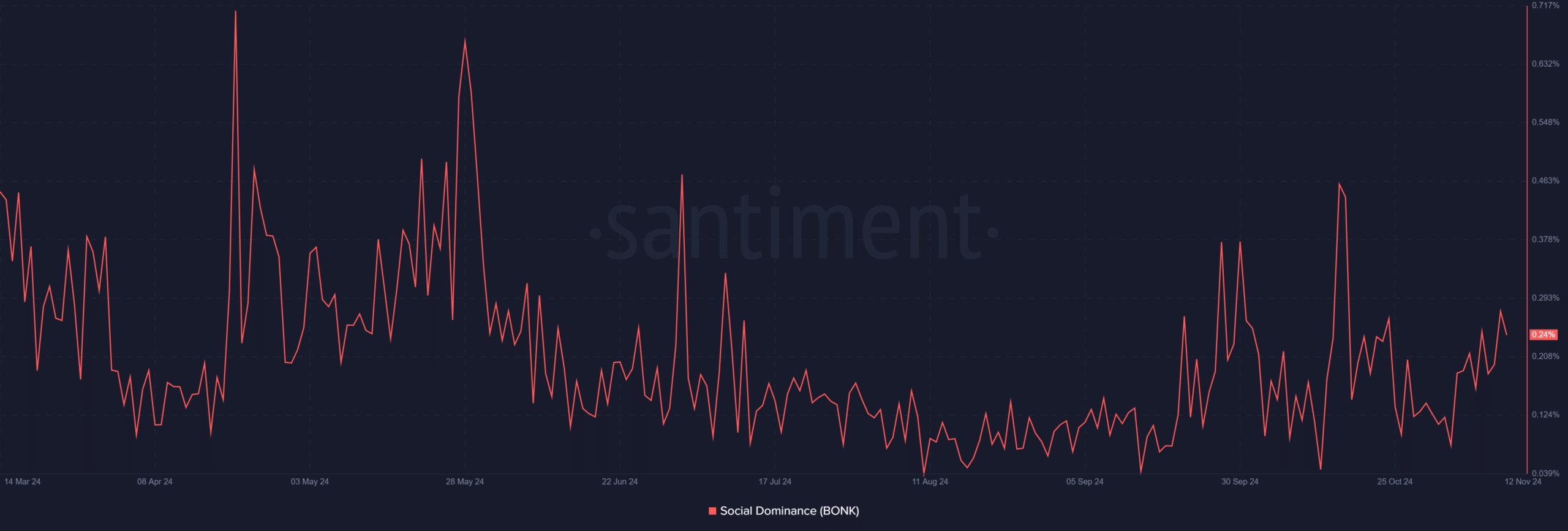

Meanwhile, the social dominance has dipped slightly, hinting at cooling retail interest. Since social buzz often drives the initial hype for meme-based coins, a continued dip might affect BONK’s momentum.

However, if social interest revives, it could fuel another wave of buying. Thus, maintaining visibility and engagement on social platforms may be crucial for its sustained rally.

Will BONK maintain its momentum?

With its powerful surge past resistance and strong technical indicators, BONK appears well-positioned to sustain its bullish momentum.

The solid MACD alignment, combined with a slight bullish tilt in the long/short ratio, suggests that the upward trend is likely to continue in the short term.

Read Bonk’s [BONK] Price Prediction 2024–2025

However, traders should remain cautious due to the elevated volatility and mixed social signals.

All in all, BONK’s rally shows strong potential for continuation, but vigilant monitoring of key indicators is essential to navigate this high-energy ascent.