- Bitcoin surged past $89,000, rising by 30% in the past week leaving many to wonder what’s behind the surge.

- Rising open interest and increased trading volume indicate strong market activity, but have triggered significant liquidations.

Bitcoin [BTC] has recently captured the crypto market’s attention, surging by an impressive 30% over the past week. The leading cryptocurrency has been setting new all-time highs for more than three consecutive days.

The latest peak was recorded at $89,864, with BTC currently trading at $89,319—a slight 0.6% dip from its high.

This rapid rise in price has positively impacted Bitcoin’s market cap, bringing it to nearly $2 trillion, a figure that places it among the top eight largest assets globally.

This surge has also lifted the broader crypto market, with the global market cap increasing by 7.5% to over $3.1 trillion. Moreover, Bitcoin’s daily trading volume has seen a significant boost, climbing from below $50 billion just last week to over $140 billion today.

Why is Bitcoin up?

As Bitcoin’s bullish momentum continues, several factors are contributing to the ongoing rally. One of the key reasons to the question “why is Bitcoin up” is the recent re-election of pro-Bitcoin politician Donald Trump as the 47th president of the United States.

Trump’s support for BTC and the broader crypto industry has fueled optimism in the market.

Investors are betting that his presidency will bring much-needed regulatory clarity, fostering a more favorable environment for cryptocurrency. During his campaign, Trump’s promises—including the creation of a Bitcoin national reserve—further boosted investor confidence, contributing to the positive price movement.

Another factor answering the question is the recent high-profile institutional activity. MicroStrategy, a prominent institutional investor in Bitcoin, announced a $2 billion purchase of the cryptocurrency.

The firm acquired 27,200 BTC at an average price of $74,463 per coin, resulting in an immediate gain of over $300 million on this latest investment. Such large-scale purchases from institutional players not only validate Bitcoin’s position as a key asset but also influence market sentiment, driving further price appreciation.

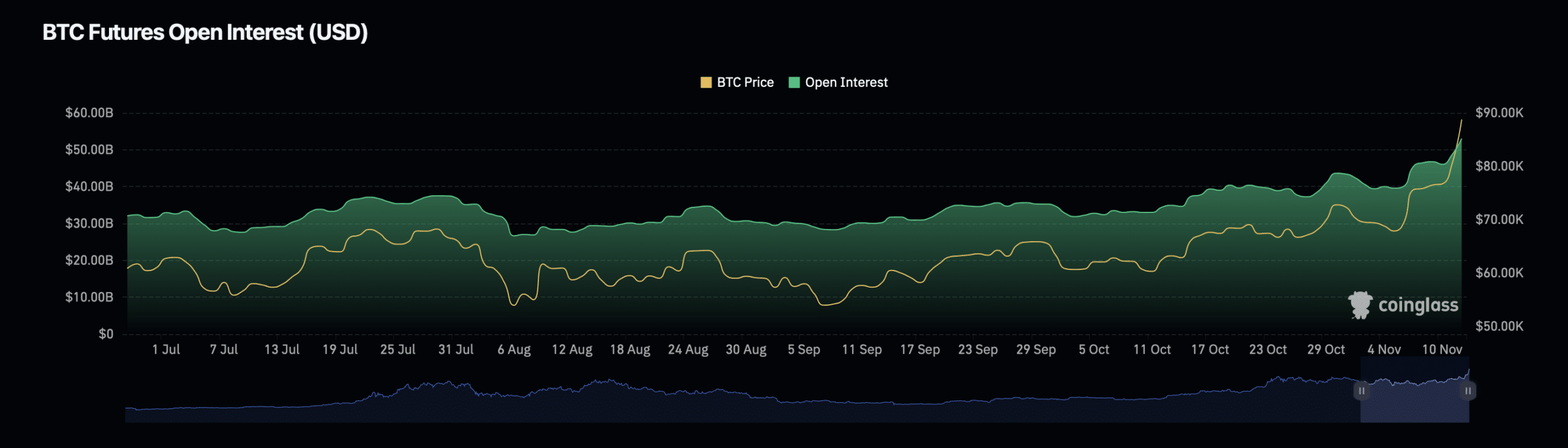

In addition to these macroeconomic and institutional factors, Bitcoin’s open interest has been on the rise.

Data from Coinglass indicated a 10.26% increase, with a current valuation of $54.38 billion. Open interest volume has surged even more significantly, increasing by 111% to reach $221.58 billion.

Rising open interest suggests growing market participation and heightened interest in BTC derivatives, which often signals an increase in trading activity and market engagement.

BTC liquidation trends

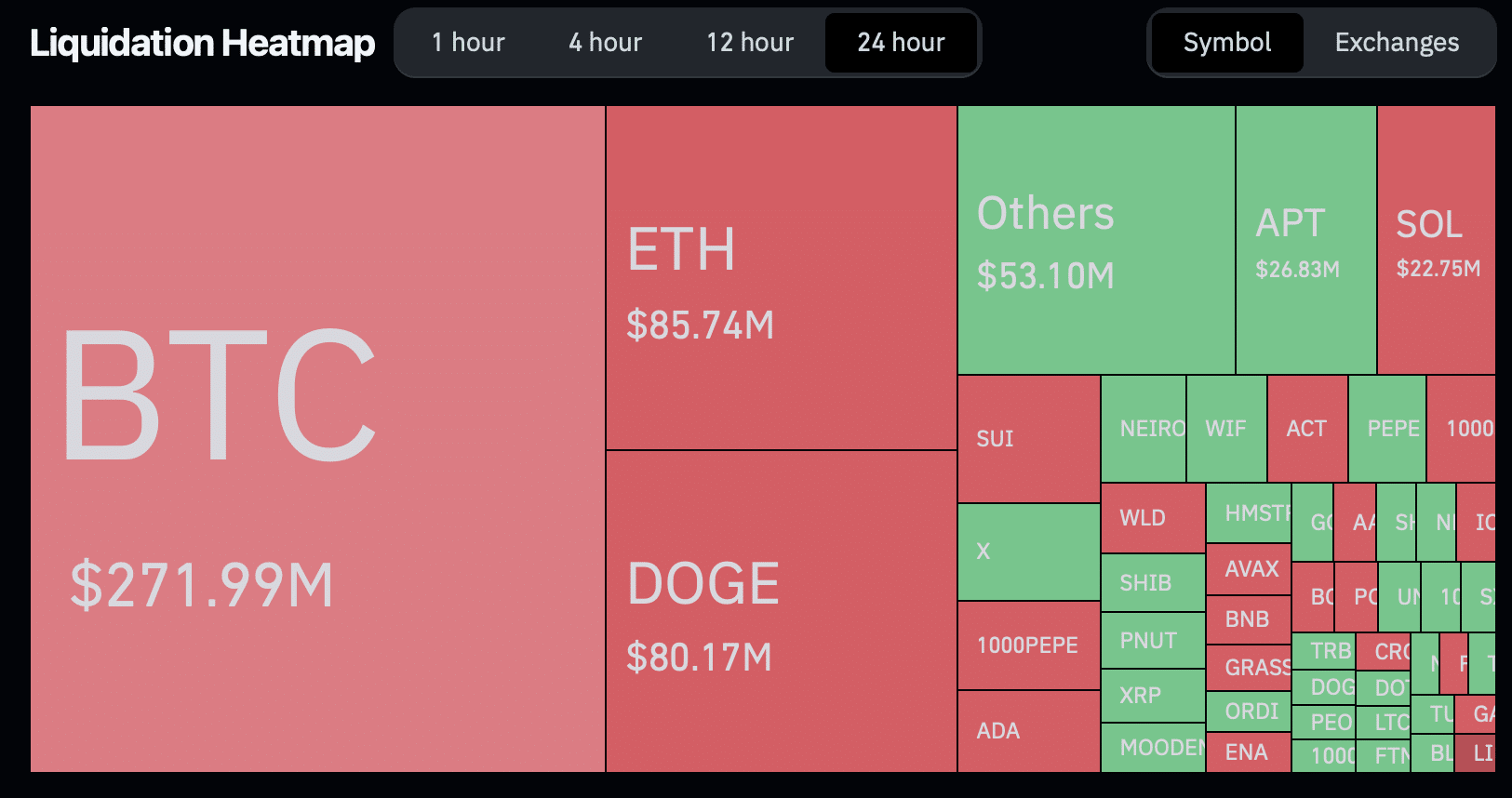

While Bitcoin’s price surge has generated excitement, it has also led to heightened market volatility and risks for certain traders.

Data from Coinglass showed that a total of 175,515 traders were liquidated in the past 24 hours, resulting in total liquidations of $693.87 million.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The majority of these liquidations involved BTC and Ethereum, with $271.99 million and $85.74 million in liquidations, respectively.

Notably, short traders have borne the brunt of this market movement, with $218 million in Bitcoin short positions and $48.78 million in Ethereum short positions being wiped out.