- Ethereum’s weekly transaction volume hits $60 billion as activity surges across its network.

- 78% of Ethereum holders remain in profit amid growing usage and bullish on-chain signals.

Ethereum’s [ETH] mainnet saw a sharp increase in activity, with nearly $60 billion worth of ETH settled in the past week. This marks the highest weekly transaction volume since July, indicating rising demand for the network.

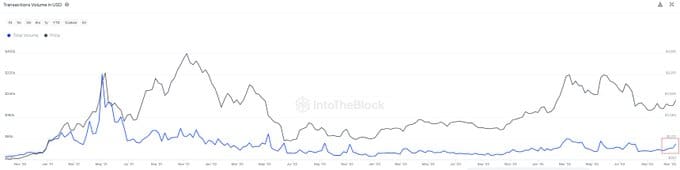

Data from IntoTheBlock shows a steady recovery in transaction volume since mid-2022, when market activity slowed. Despite Ethereum’s price being below its all-time highs, the network continues to attract significant activity.

Price and volume dynamics

Ethereum’s price and transaction volume have historically moved in tandem. During late 2021 and early 2022, both metrics peaked amid increased speculative activity. However, both declined in mid-2022 as the market entered a bearish phase.

At press time, Ethereum traded at $3,178.93, with a 24-hour trading volume of $48.48 billion. While the asset saw a slight 0.70% decline in the past 24 hours, it has gained 28.92% over the past week.

The recent surge in transaction volume signals growing usage despite price fluctuations.

Key on-chain metrics

DefiLlama data shows Ethereum’s Total Value Locked (TVL) at $59.327 billion. Stablecoins on the network have a combined market cap of $89.517 billion.

In the last 24 hours, Ethereum processed $2.387 billion in transaction volume and recorded $72.74 million in inflows.

Active addresses in the past day totaled 391,248, while 64,793 new addresses were created. The network also recorded 1.23 million transactions.

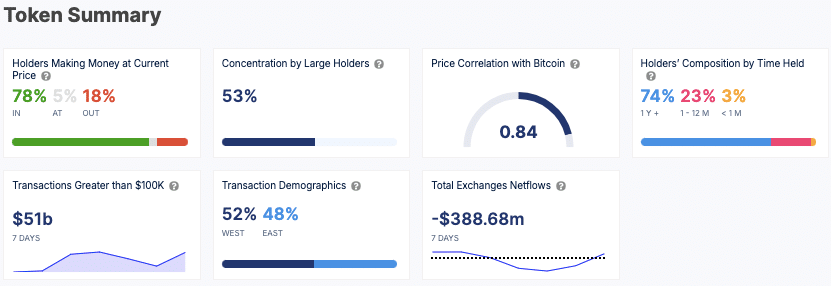

High-value transactions exceeding $100,000 accounted for $51 billion in activity over the past week, suggesting strong participation from large investors.

Holder composition and market signals

Ethereum’s profitability remains strong, with 78% of holders currently in profit. Large holders control 53% of the token supply, indicating a high concentration of wealth.

The token also has a strong correlation of 0.84 with Bitcoin, showing that its price movements closely follow the broader crypto market.

The majority of Ethereum holders are long-term investors, with 74% holding their tokens for over a year. Net exchange flows indicate that $388.68 million in ETH was withdrawn from exchanges over the past week, suggesting reduced sell pressure as more users move assets to private wallets.

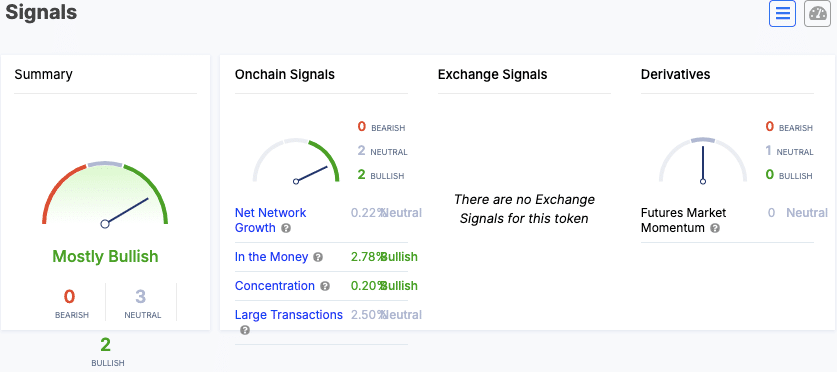

Market signals are mostly bullish, with indicators like “In the Money” and “Concentration” showing positive trends.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Net Network Growth and Large Transactions remain neutral, while futures market momentum also sits at a neutral level.

Ethereum’s growing transaction activity and favorable on-chain metrics point to an active and engaged network.