- Chainlink’s whale activity surged to hit a 3-month high

- LINK’s price appreciated by 28.16% over the past month

Over the last 30 days, Chainlink’s [LINK] price has registered a sustained uptrend. In fact, since hitting a local low of $10, the altcoin has gained significantly on its price charts.

That’s not all though as during this period, LINK decoupled from the rest of the market’s altcoins too. What this implied was that LINK outperformed other altcoins to move independently. By doing so, the altcoin managed to breach the $13.65 resistance level for the first time since July.

With Bitcoin surging to a new ATH of $76k, LINK followed suit, with the BTC/LINK exchange rate climbing too. The conversion rate for BTC/LINK fell by 0.46% in the last hour and shrunk by 4.61% in the last 24 hours alone.

Simply put, LINK has been recording stronger demand or better price performances, compared to BTC in the short term. Additionally, the 3-month correlation between Chainlink and Bitcoin was 0.72, at press time. This implied that over the last few months, both LINK and BTC have been largely following the same trend.

In light of LINK’s rising strength against other altcoins and Bitcoin, the question is this – What’s driving this trend?

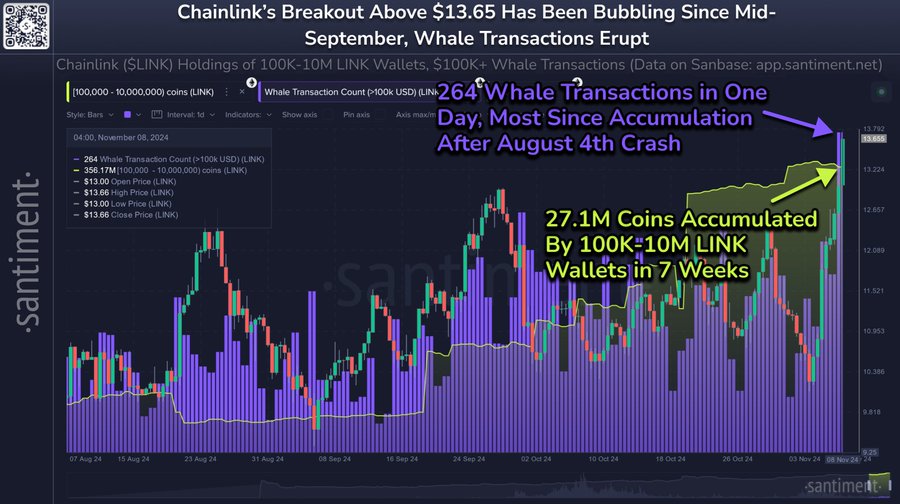

Chainlink whale activity hits a 3-month high

According to Santiment, a hike in whale activities and large holders’ accumulation have played a major role in LINK’s recent rallies. Thus, the main driver behind the altcoin’s recent momentum is an uptick in whale activity.

According to Santiment’s data, large holders with balances between 100k and 10 million LINK tokens have increased their holdings. These whales accumulated an additional $369.8 million worth of LINK over the last 7 weeks alone.

This surge represents an 8.2% expansion in whale holdings, with figures for the same now at a three-month high. Usually, whale accumulation is a sign of investors’ confidence in the asset’s long-term prospects as they anticipate more gains on the price charts.

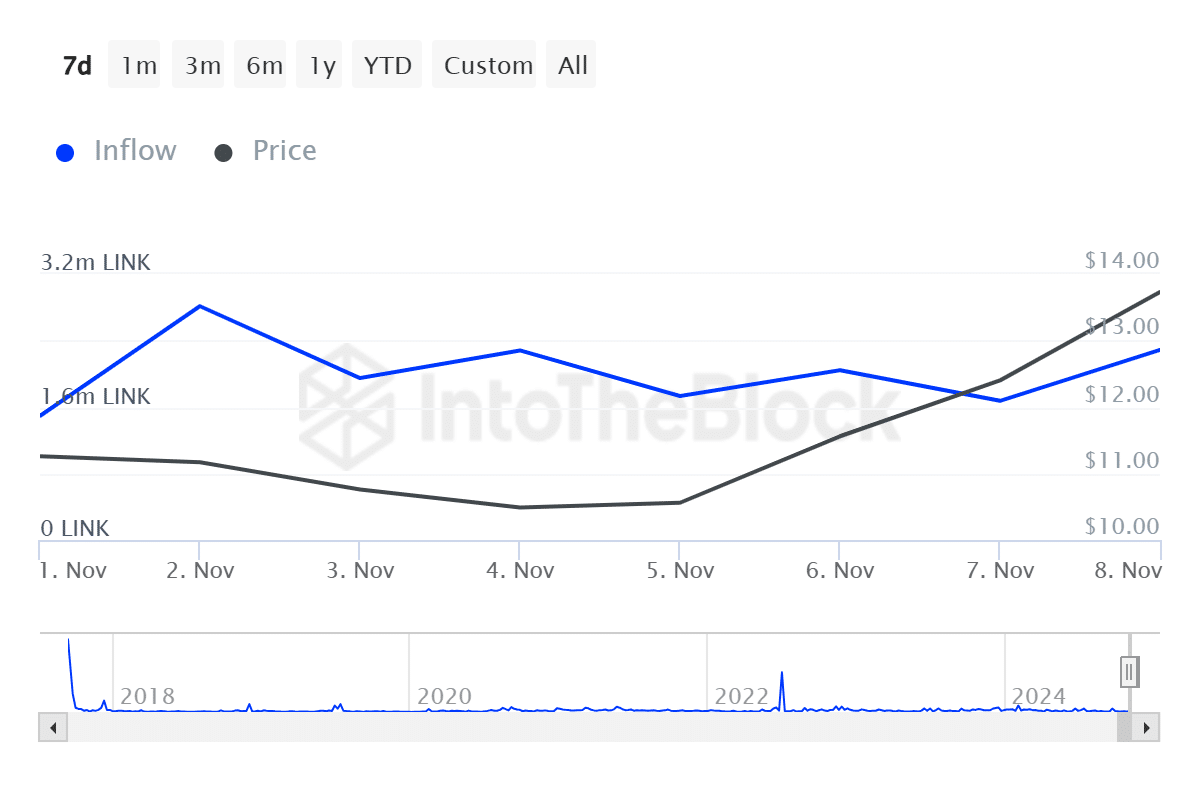

This is further evidenced by a surge in large holders inflows.

According to IntoTheBlock, large holders’ inflow climbed from a local low of 1.49 million to 2. 29 million LINK tokens. This implied that large holders have been actively accumulating the altcoin, hoping for a further hike on the charts.

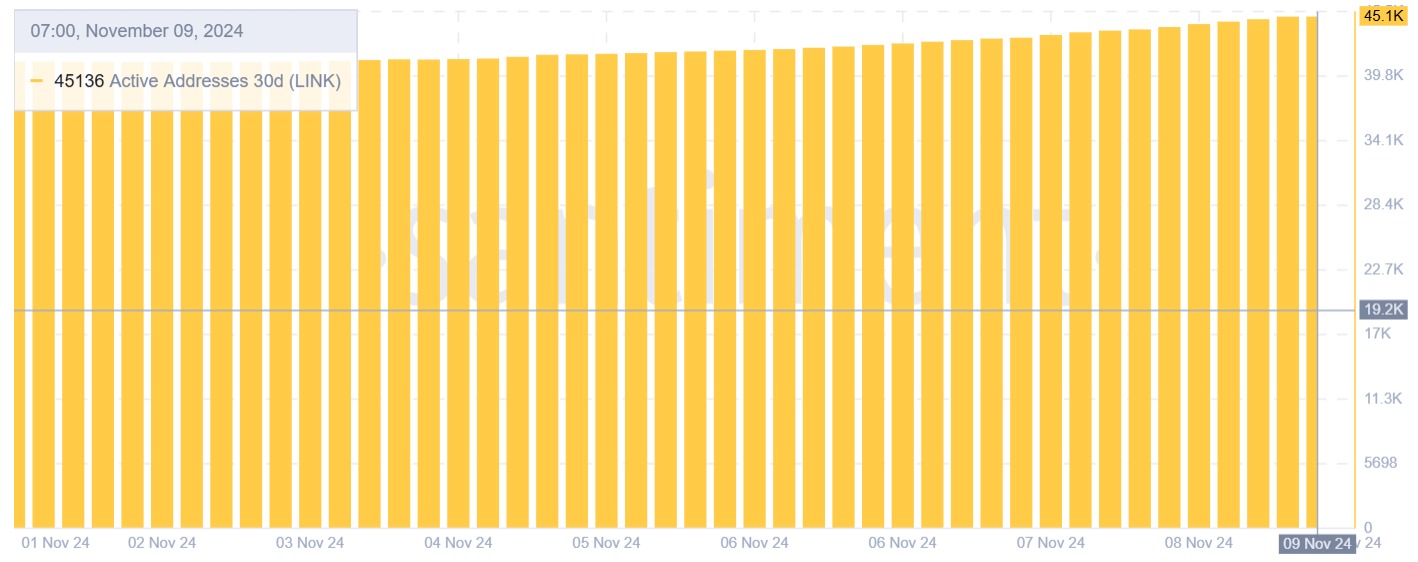

Additionally, active addresses (30 days) climbed from 41.1k to 45.1k. This pointed to sustained demand and participation for the altcoin – Both essentials for a price rally.

Impact on LINK’s price action?

As expected, the hike in whale activity, especially accumulation, had a major impact on the altcoin’s price charts.

At the time of writing, Chainlink was trading at $13.66. This marked a 6.86% hike in 24 hours, with the altcoin gaining by 21.07% and 28.16% on the weekly and monthly charts, respectively.

Its latest price action also suggested that the altcoin has been seeing strong upward momentum and positive sentiment. Therefore, if the prevailing market conditions hold, LINK could hit $15 for the first time since July. A breakout from here will push the altcoin towards the $19 resistance level.