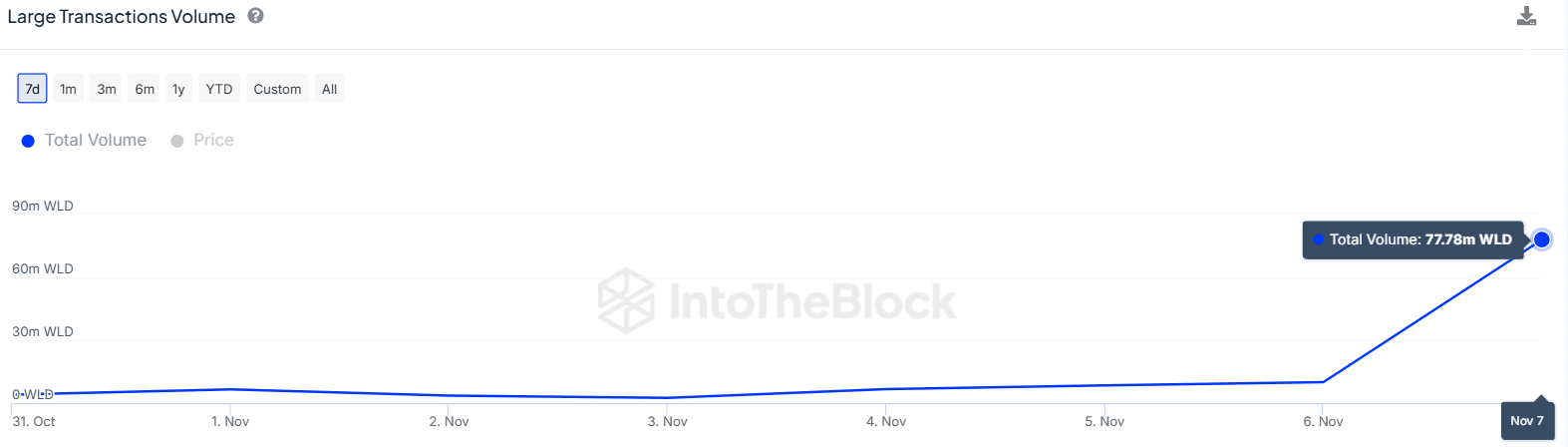

- Worldcoin large transaction volumes have surged by 600% from 9.98 million to 77.78 million in 24 hours.

- Despite this rise in whale activity, WLD price has failed to record significant gains.

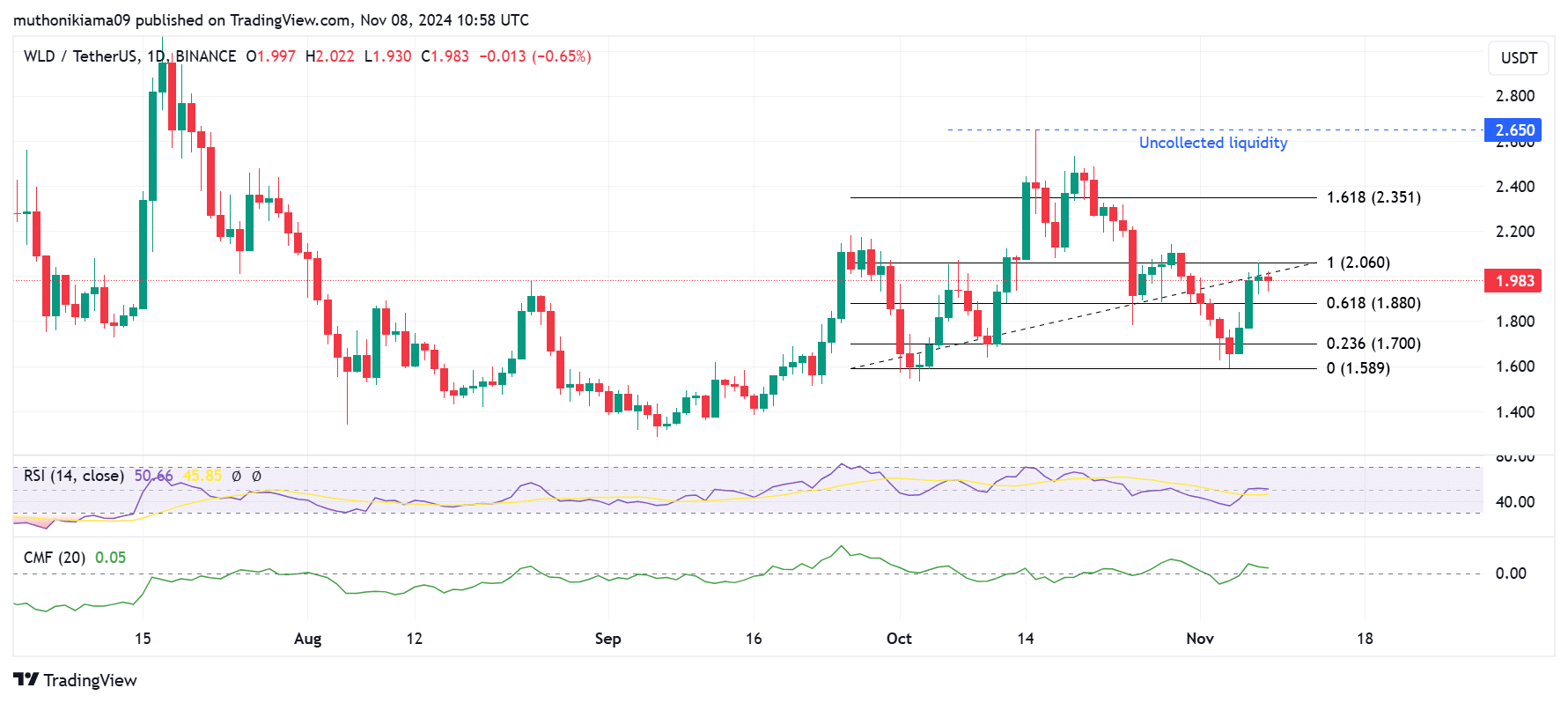

Worldcoin [WLD] posted slight gains earlier this week as Bitcoin [BTC] and the broader cryptocurrency market rallied. However, at press time, WLD had shed some of these gains after a slight 0.35% drop to trade at $1.98.

Despite the choppy price movements, a look at on-chain metrics suggests that WLD is at a tipping point where a trend reversal is likely.

Whale volumes spike

Whale activity around Worldcoin has increased significantly. In just 24 hours, volumes for large transactions exceeding $100,000 worth of WLD tokens have spiked from 9.98 million to 77.78 million.

Whale activity could play a role in breaking WLD out of bearish trends. This is because whales make up 84% of Worldcoin’s supply.

For WLD to rally because of whale activity, this cohort needs to be buying the token. The Relative Strength Index (RSI) on the one-day chart stood at a neutral level of 50 showing that sellers and buyers have equal control.

However, the RSI line was above the signal line, indicating that bullish momentum was surging.

At the same time, the Chaikin Money Flow (CMF) with a value of 0.05, indicating buying activity. However, additional buying pressure is needed to strengthen the uptrend.

If this uptrend continues, $2.35 is the immediate resistance level. Traders should also watch out for a liquidity trap at $2.65. The uncollected liquidity at this price could act as a magnet that could push the prices higher.

In case the bullish trend fails due to a lack of adequate buying pressure, WLD could drop towards the support level at $1.58.

Analyzing Worldcoin’s NVT ratio

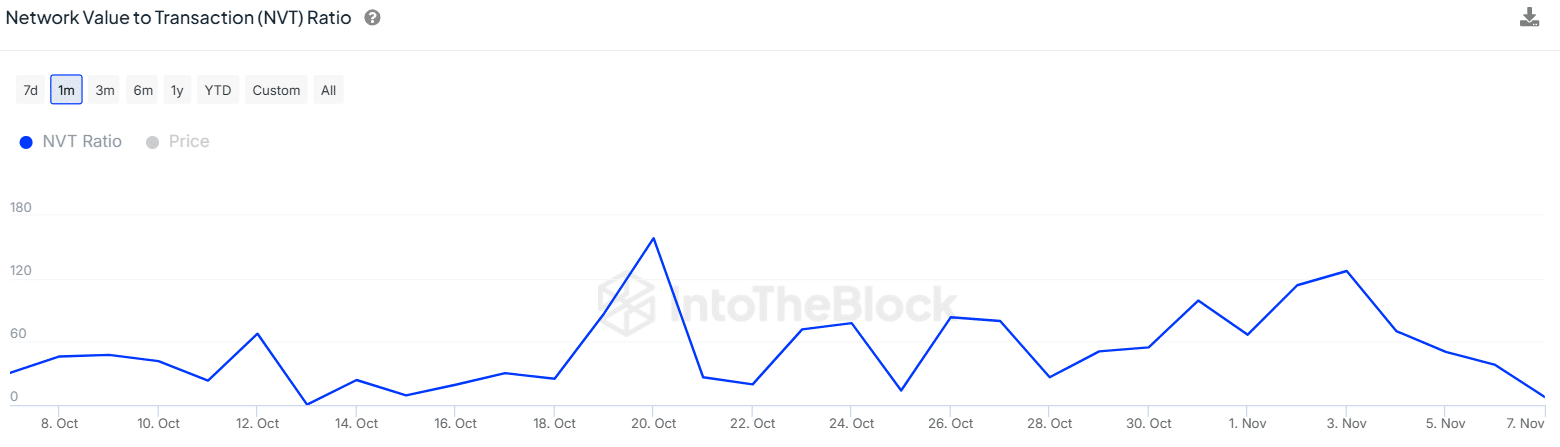

The Network Value to Transaction (NVT) ratio shows that Worldcoin could be undervalued. This metric has been declining, given that at press time, it was at its lowest level in three weeks.

A declining NVT ratio shows that there is high on-chain activity around Worldcoin, which is a bullish sign for WLD.

If the network is experiencing growth that is not being reflected in the price, it could indicate that WLD is undervalued. This could pave the way for upside potential.

Realistic or not, here’s WLD market cap in BTC’s terms

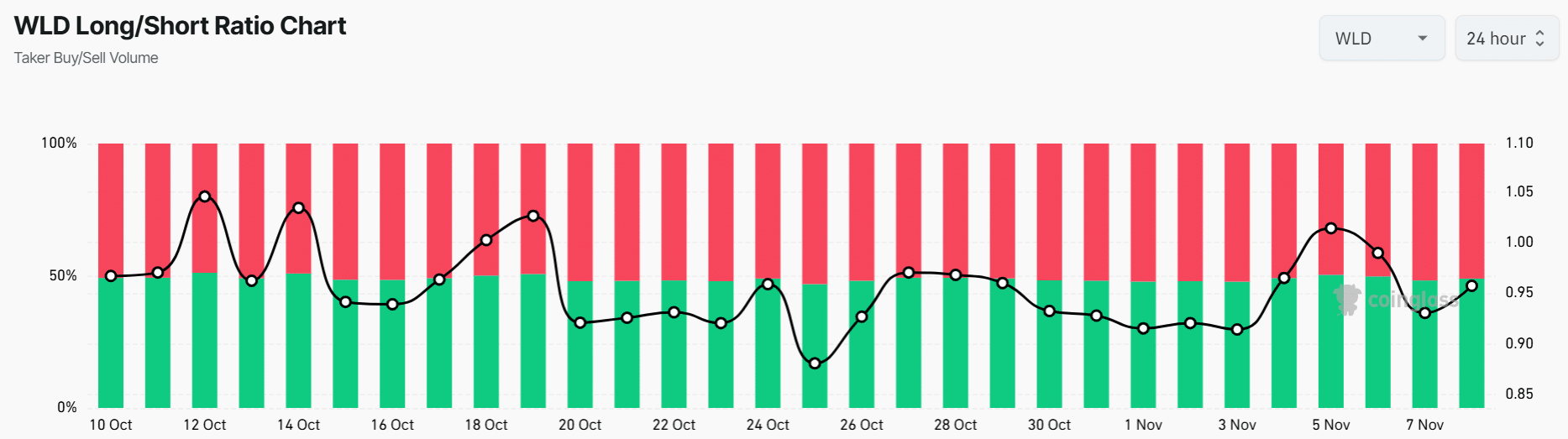

However, despite WLD showing signs of being undervalued, derivative traders continue to bet against the altcoin.

The long/short ratio has been below 1 in the last three consecutive days, indicating that short sellers are more than traders taking long positions. This depicts a bearish market sentiment.