- LDO’s breakout from a descending wedge, with volume and market cap surging, points to a potential bullish trend.

- Strong Price DAA divergence and rising open interest support continued upward momentum for Lido DAO.

Lido DAO [LDO] has jumped 32% over the past 24 hours, boosting its market cap to $1.22 billion, an increase of 19.3%. Additionally, trading volume has surged by 188.65% to $306.58 million, reflecting heightened investor interest.

This volume spike points to strong buying pressure that could support further gains. At press time, Lido DAO trades at $1.36, indicating a solid bullish sentiment that may fuel continued upward momentum.

Chart analysis: Breakout from a descending wedge and price prediction

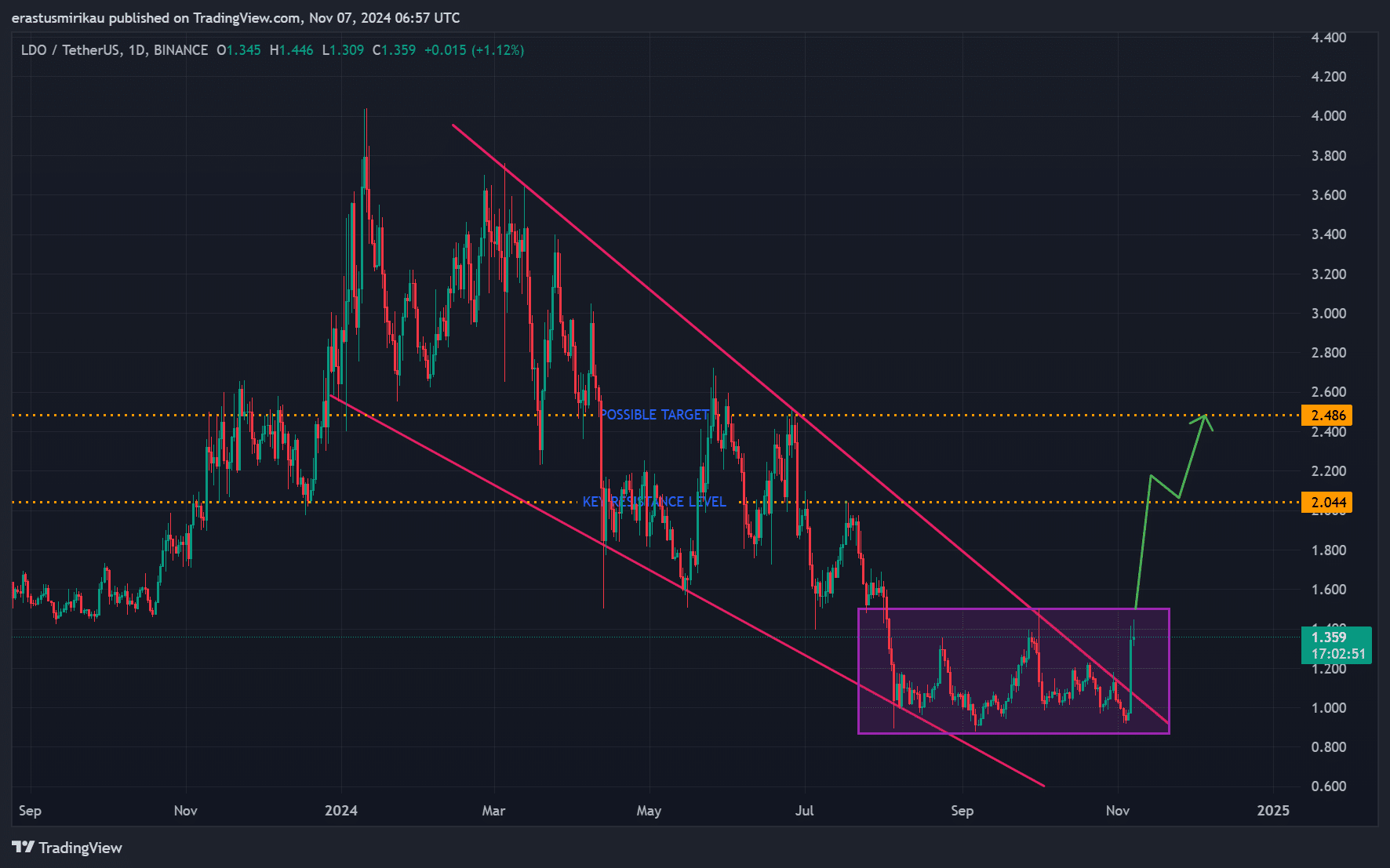

The recent price action on LDO’s chart shows a breakout from a descending wedge pattern, typically signaling a bullish reversal. Consequently, this breakout suggests a potential upward trend.

LDO has pushed past a crucial resistance level at $1.36, aiming for higher levels. The next significant resistances are $2.04 and $2.48, levels that could act as key price targets.

Therefore, if Lido DAO continues this breakout, a sustained rally could be on the horizon.

With current momentum, the $2.04 level appears to be within reach. Furthermore, if Lido DAO maintains its upward pace, breaking past $2.04 could lead to a push toward $2.48. This resistance point, if surpassed, could spark even stronger bullish movement.

However, achieving this target relies on sustaining buying interest. Consistent volume and price strength will be essential for LDO to hit these ambitious levels.

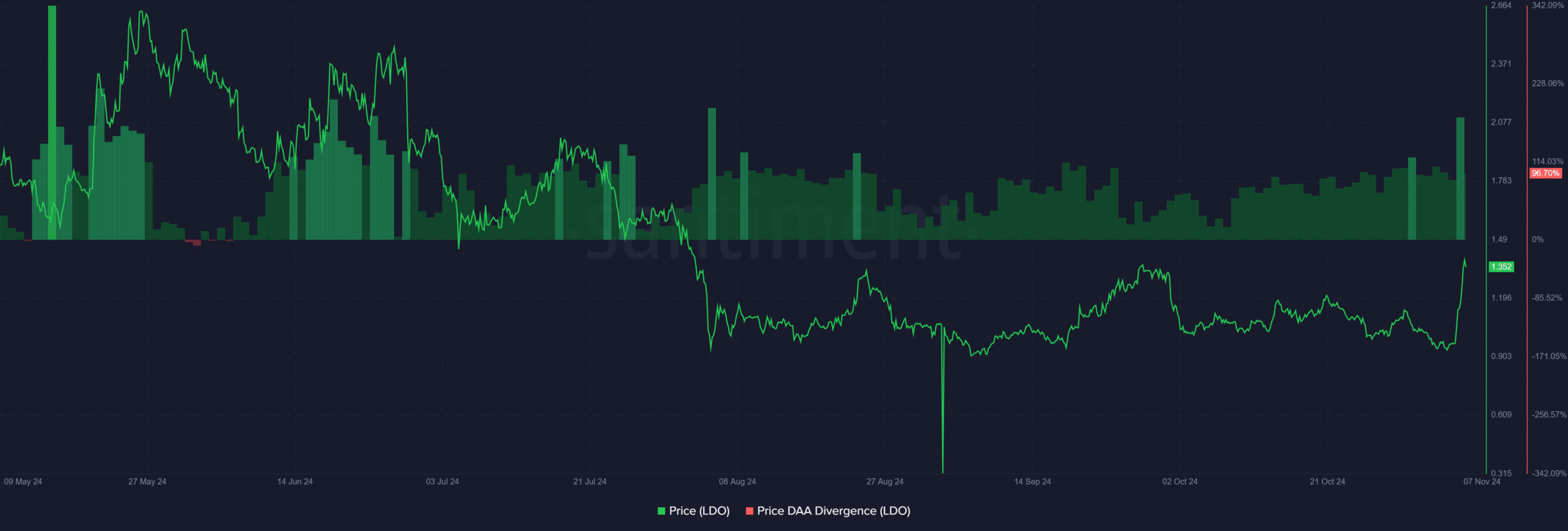

LDO price DAA divergence: Bullish confirmation?

The Price DAA Divergence chart shows a 96.7% positive divergence, indicating that on-chain activity aligns with the recent price surge. This divergence typically precedes further gains, signaling strong support from user activity.

This on-chain strength enhances confidence in a sustained rally, adding weight to the bullish scenario.

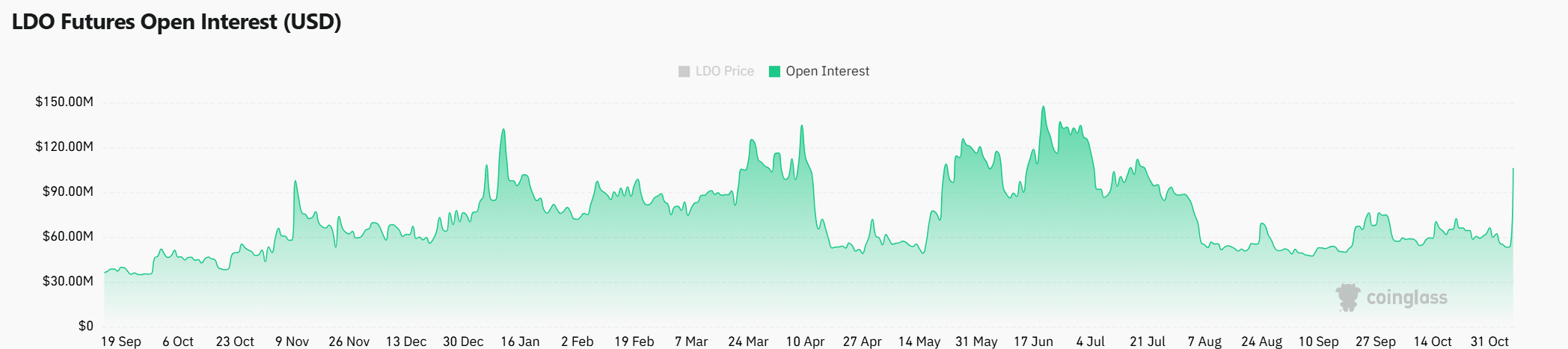

Market sentiment: Open interest surge strengthens outlook

Additionally, open interest has surged 47.4% to $112.97 million, indicating that traders are increasingly engaged with LDO.

This increase in open interest, along with rising volume, underscores a bullish sentiment in the derivatives market, suggesting growing confidence in LDO’s rally potential.

Read Lido DAO’s [LDO] Prie Prediction 2024-25

Can LDO sustain the rally?

LDO’s breakout, combined with increased volume, positive Price DAA Divergence, and rising open interest, suggests the potential for continued gains. Therefore, if Lido DAO holds above $1.36 and approaches $2.04 and $2.48, a sustained rally could materialize.

However, maintaining this momentum will require ongoing buying pressure. As it stands, LDO’s bullish setup may reward investors ready to capitalize on this breakout.