- BlackRock’s Bitcoin ETF achieved a record $4.1 billion trading volume.

- BTC ranked as the ninth-largest asset globally.

Bitcoin [BTC] exchange-traded funds (ETFs) had a rough start in November. However, after three consecutive days of outflows, the ETFs finally recorded massive inflows.

According to data from Farside Investors, daily total net inflows on the 6th of November soared to $621.9 million, effectively breaking the prior streak of outflows.

This surge coincided with Donald Trump’s return to the presidency for a second term.

Trump had promised regulatory reform and firm support for the crypto industry, which could be another reason for this surge.

IBIT sees outflows

Surprisingly, IBIT did not lead the recent surge of inflows this time.

Instead, it posted a daily net outflow of $69.1 million, following an outflow of $44.2 million the previous day.

IBIT was joined by BRRR, which saw a daily outflow of $2.6 million.

On the other hand, ETFs such as GBTC, FBTC, ARKB, BITB, BTC, and HODL recorded positive inflows, while the remaining funds experienced no inflows at all.

BlackRock’s Bitcoin ETF makes history again

Despite the dip, Eric Balchunas, senior ETF analyst at Bloomberg, highlighted on X (formerly Twitter) that IBIT achieved an unprecedented trading volume of $1 billion within the first 20 minutes of market opening.

This surge, which equaled a typical full-day volume, contributed to IBIT’s record-breaking day with $4.1 billion traded. He remarked,

“It was also up 10%, its second best day since launching”

Balchunas elaborated that the collective group of Bitcoin ETFs recorded $6 billion in trading volume.

In addition, most ETFs doubled their average volume. The analyst described it as,

“An all-around banger day for an infant category that never ceases to amaze.”

At press time, IBIT held 433,644 BTC worth over $30 billion, solidifying its position as the leading Bitcoin ETF currently listed in the U.S.

BTC’s performance post-election

In the wake of Trump’s re-election, IBIT wasn’t the only one setting new highs.

Bitcoin also experienced a significant surge, setting a new all-time high at over $76,000. This came shortly after BTC hit a record peak of $75,000 before the election results.

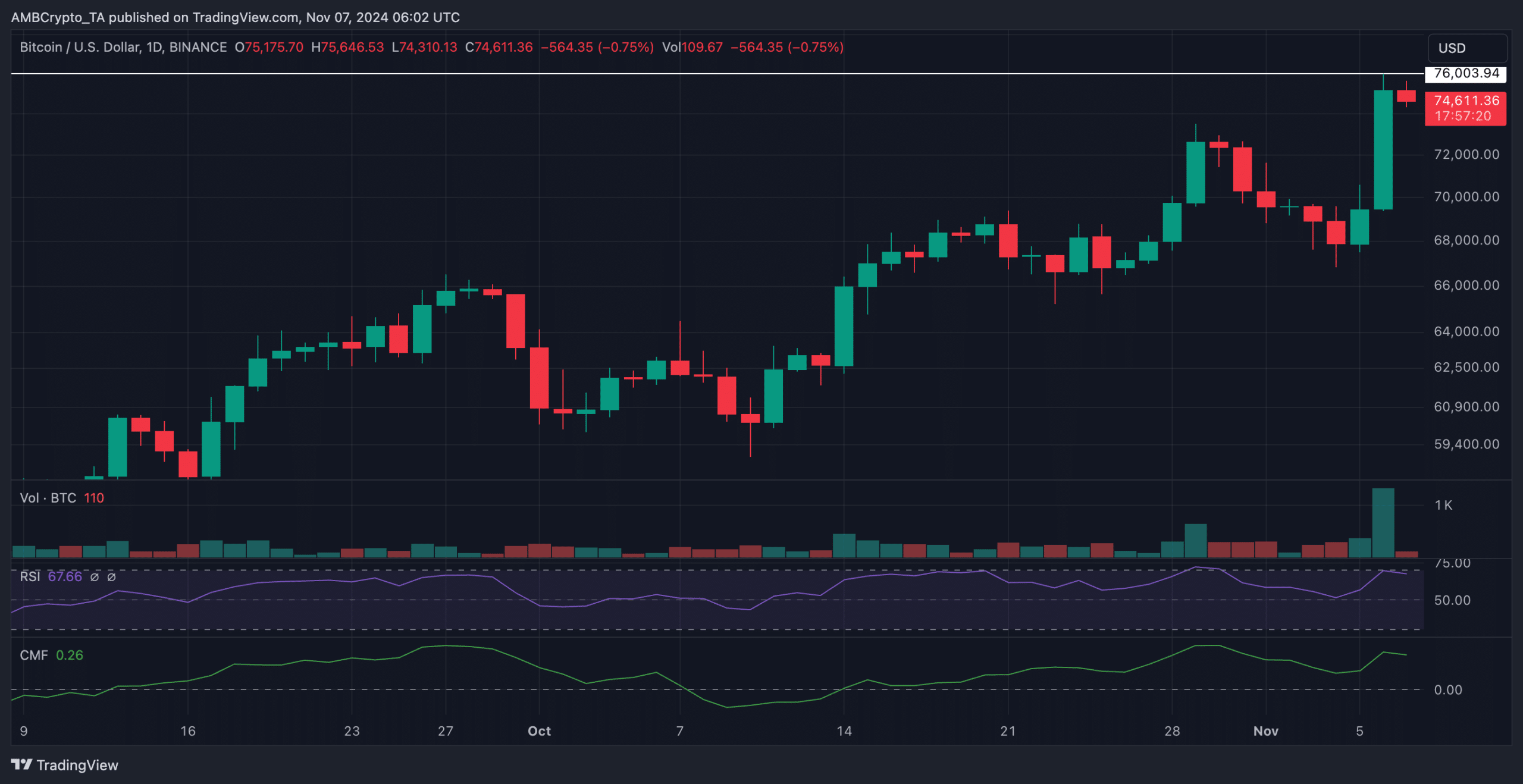

At the time of writing, BTC’s price had retreated to $74,611, reflecting a 1.83% decrease from its peak.

Over the past 24 hours, it witnessed a minor dip of 0.32%, according to CoinMarketCap.

Meanwhile, on the daily chart, the RSI was recorded at 67.66, signifying strong bullish momentum.

This reading indicated that while BTC remains below the overbought threshold, there was still potential for additional upward movement if buying pressure persists.

Additionally, the CMF indicator was at 0.26. This signaled a strong inflow of capital into BTC and reinforced the overall positive trend.

BTC overtakes Meta

Notably, the price rally pushed BTC’s market cap to an impressive $1.48 trillion, at press time. This allowed it to surpass Meta, which has a market cap of $1.44 trillion.

As a result, the king coin secured its position as the 9th largest asset in the world, as per CompaniesMarketCap.

The IBIT and the price milestone underscored BTC’s growing recognition as a key player in the global financial landscape.

This marked a historic moment for the cryptocurrency market, as it continues to challenge traditional assets for dominance.