- APT pivots in favor of the bulls after entering key Fibonacci range, indicating possibility of more upside.

- Aptos’ on-chain data revealed that the state of activity with the network and whether it could support more upside.

Aptos [APT] has been on a bearish retracement since the last week of October. However, its performance in the last two days indicated that it was ready to resume the bullish trajectory observed from mid-September.

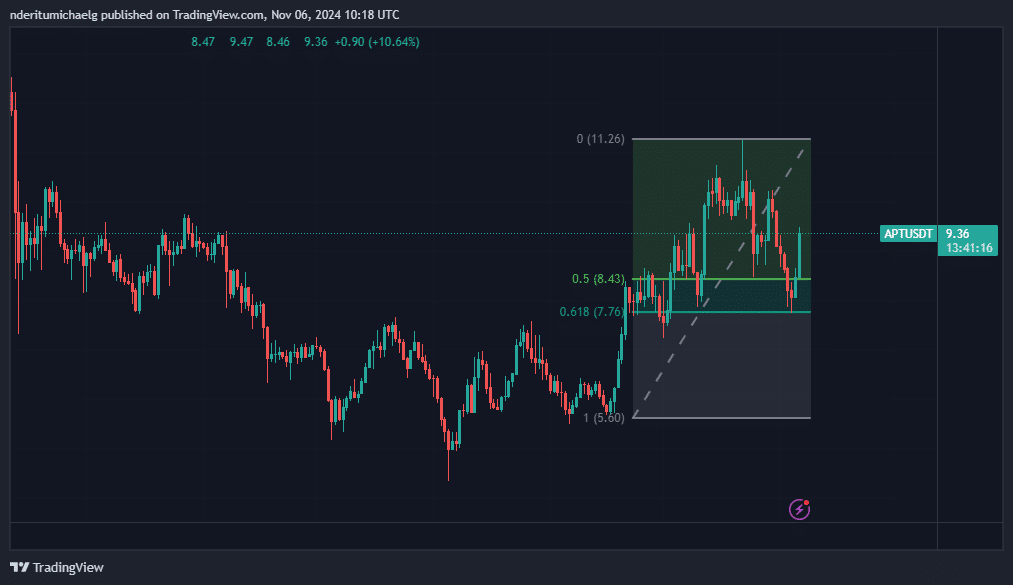

APT recently pulled back by as much as 30% from its October top. However, the pullback concluded at a noteworthy price range.

This is because the pullback was expected to conclude within the $7.68 to $8.43 range — this was picked based on Fibonacci retracement from its lowest price point in September to its highest October price.

APT dropped as low as $7.74 earlier this week, followed by a bullish pivot, which means the Fibonacci retracement zone was spot on.

The cryptocurrency has since rallied by roughly 21% to its $9.38 press time price. Despite the recovery, APT still had a 19% upside to go before reaching its October lows.

Assessing Aptos network activity

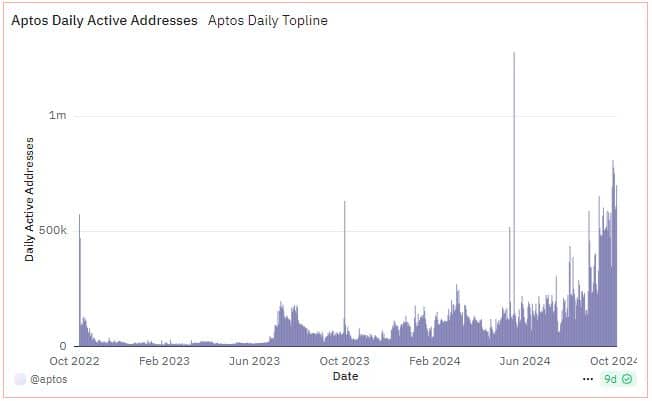

Will Aptos network activity support APT’s recovery? The network has been experiencing growth in multiple key areas. For example, Aptos has so far experienced robust address growth in the second half of 2024.

Daily active addresses peaked above 1.27 million addresses in June which was the highest registered level. The lowest level of daily active addresses in H2 2024 was slightly below 50,000 addresses.

Meanwhile, address growth has been consistently growing in the last three months, reaching as high as 808,313 addresses.

A surge in daily active addresses suggested that the network has been experiencing healthy network usage.

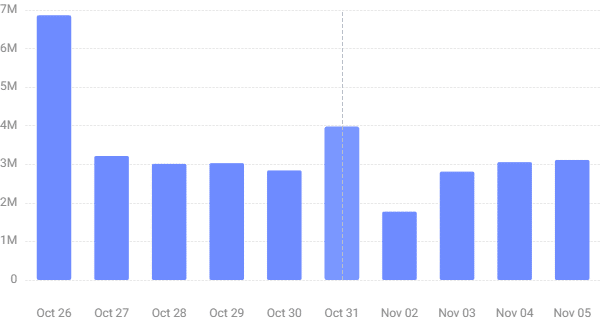

This outcome that also reflected on daily user transactions, although transactions dropped considerably towards the end of November.

The network had as much as 6.86 million transactions on 26 October, but it cooled down to 1.77 million transactions as of the 2nd of November, the lowest transaction count in the last 10 days.

However, Aptos transactions have been recovering since then and recently clocked 3.11 million transactions as of the 5th of November.

The slight drop in transactions from the end of September was in line with the uncertainty ahead of the U.S. elections. However, the markets are expected to embark on more recovery and excitement following Trump’s win.

Read Aptos’ [APT] Price Prediction 2024–2025

Healthy network utility combined with an overall bullish sentiment may contribute to APT recovery in the coming weeks.

However, investors should also be cautious of unexpected large pullbacks as more volatility comes back into the market.