- The accumulation\distribution indicator was relatively flat, showing limited buying interest.

- Uniswap faced a potential support breakdown, targeting $4.68.

Uniswap [UNI] faced significant selling pressure over the past week, with AMBCrypto noting a potential 30% price decline.

Despite this, trading volumes on Uniswap’s Celo deployment have increased, highlighting a contrast between market sentiment and adoption trends.

Uniswap’s price has been consistently falling, reaching $6.6 on the 4th of November, its lowest level since October. This marked a 60% drop from its yearly peak.

The upcoming U.S. elections have added to the volatility, with traders now looking for lower support levels for stability.

Uniswap breaks bearish pennant

The technical analysis pointed to further downside for Uniswap, as it has broken below a bearish pennant formation on the daily chart.

Key support at $4.68 aligned with the projected price target from the pennant pattern, marking a floor for this sell-off.

With the Stochastic RSI in the oversold territory below 20, bearish momentum appears entrenched, indicating that downward pressure may continue before a possible reversal.

The token’s movement below the 200-day and 50-day Exponential Moving Averages (EMA) introduces the likelihood of a death cross pattern.

This pattern, a signal of extended bearish trends, last appeared on the 25th of July, leading to a subsequent 40% drop.

The recent break below critical moving averages reaffirms the bearish outlook.

Despite the price decline, deployment on Uniswap’s Celo has seen substantial growth, with trading volumes increasing approximately 20-fold since January 2024.

Weekly trading on Celo grew from $10 million to nearly $350 million, underscoring Uniswap’s traction in the decentralized finance (DeFi) space.

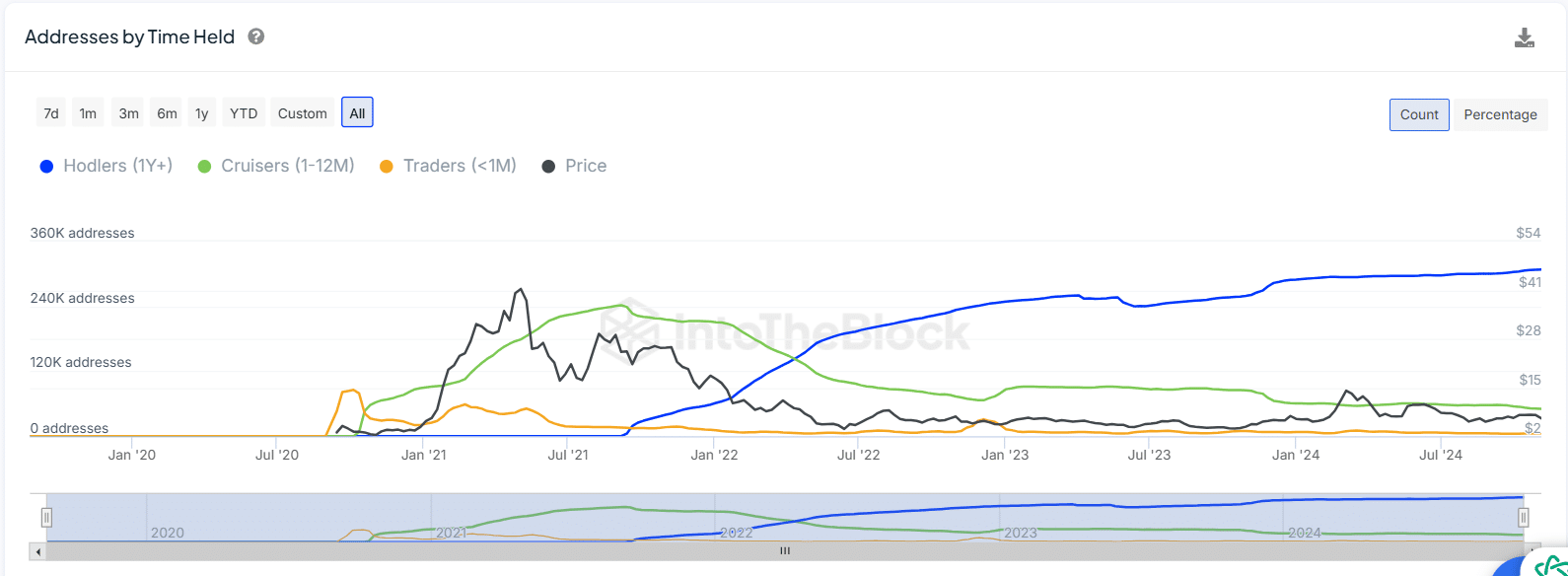

On-chain metrics show steady growth

Address analysis revealed a steady increase in long-term holders, with over 360,000 addresses holding Uniswap for more than a year.

This rise in holders suggested a core base of long-term investors, providing a degree of stability despite the current sell-off pressure.

Meanwhile, cruisers, or those holding between one and twelve months, have stabilized around 120,000 addresses after peaking in early 2021.

Short-term traders, who typically hold for less than a month, remain a minor group, indicating that speculative interest has diminished as the market matures.

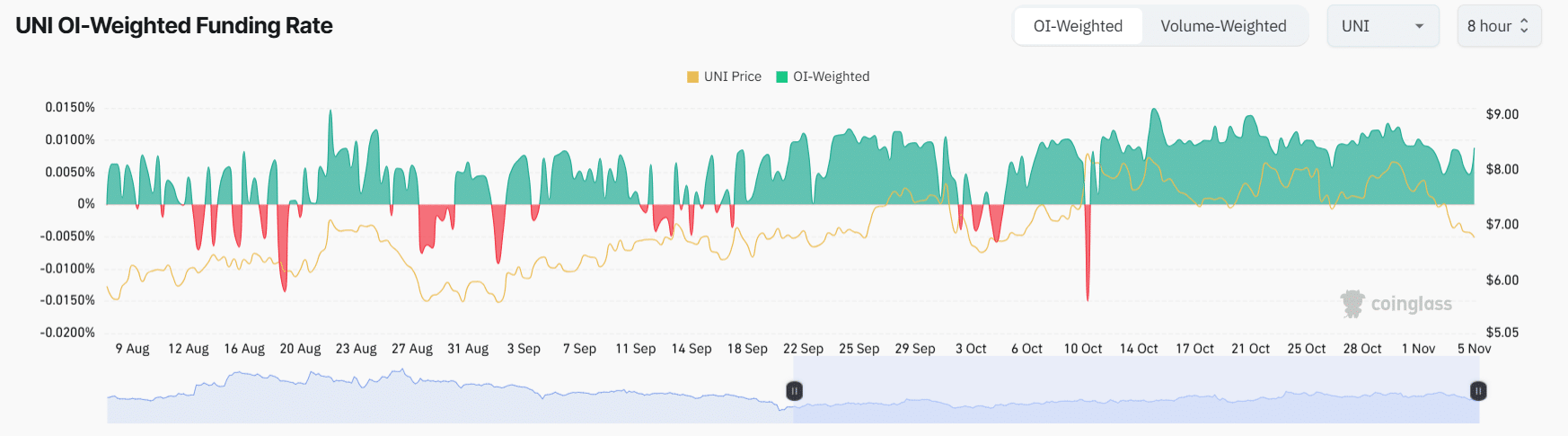

Divergence in UNI funding rates signals…

Positive funding rates, shown in green, indicate times when long positions were dominant, highlighting bullish sentiment.

However, intermittent red dips below the neutral line reveal periods of negative funding, highlighting bearish pressure. Since late October, the funding rate has been predominantly positive, but the UNI price trend shows a consistent decline.

Is your portfolio green? Check out the UNI Profit Calculator

This signaled that despite the willingness of traders to go long, the underlying market sentiment remained weak.

Such a divergence between funding rates and price suggests caution among investors as the price continues its downtrend, with long positions potentially facing mounting pressure as the market corrects.