- Gox FUD threatens to push Bitcoin prices lower despite the latest recovery attempts.

- A look at the next potential price bottom based on Fibonacci, if BTC bears extend their dominance.

Bitcoin [BTC] experienced six days of consecutive downside. This performance reflected the prevailing cautious sentiment due to the U.S. elections, but a new FUD event might ensure more downside in the coming days.

The wallet holding Mt. Gox Bitcoin has reportedly transferred 32,371 BTC to an unknown wallet. The value of the transferred coins was estimated at roughly $2.9 billion.

Many analysts have been expecting a bearish outcome when the Mt. Gox payout eventually takes place.

The bearish expectations are mainly because the holders awaiting payment have been waiting for years and are deep in profit.

Thus, they might be incentivized to sell, potentially triggering another major price meltdown for Bitcoin.

Will Mt. Gox FUD add more fuel to the Bitcoin bears?

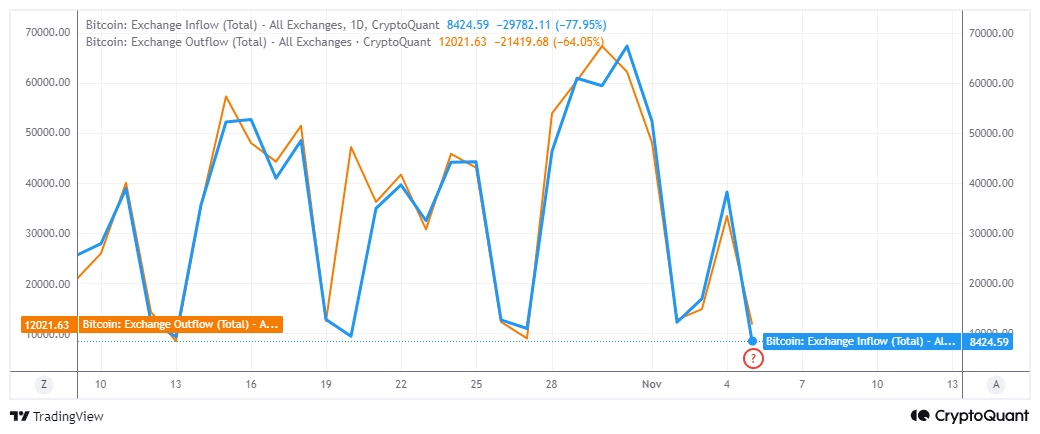

Exchange flows have been declining since the end of October and have since tanked to a historically relevant level.

A pivot could be on the cards, meaning the battle between BTC bulls and bears is about to intensify.

However, the odds of a strong bullish recovery are lower, especially now that Mt. Gox FUD is adding to the selling pressure previously fueled by U.S. election concerns.

Bitcoin exchange inflows recently slowed down to 8,424 BTC in the last 24 hours, at the time of writing.

Exchange outflows were notably higher at 12,021 BTC, which suggested that the wave of sell pressure cooled down, allowing for some buying at discounted prices.

The higher exchange outflows versus inflows reflected in the form of some recovery in the last 24 hours.

At press time, BTC bounced back to $68,778 after bottoming out at $66,813 on the previous day. This bounce occurred before the Mt. Gox news, hence the possibility that the news may erase the slight confidence coming back into the market.

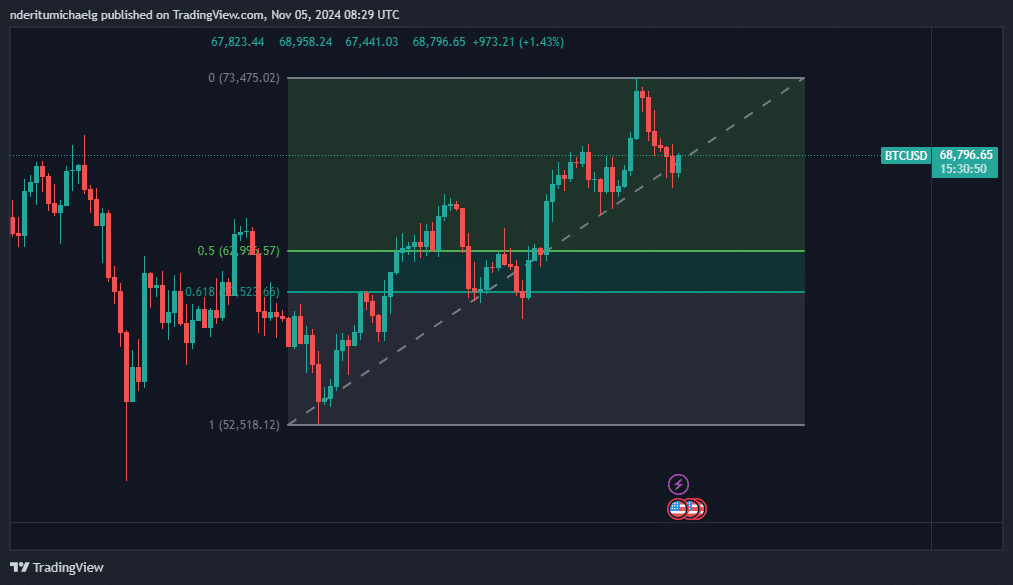

But what should traders expect in case the bears resume dominance?

Fibonacci retracement pointed out that Bitcoin could find the next major support between $60,000 and $63,000. This is based on the uptrend from September lows to its latest local high in October.

Read Bitcoin (BTC) Price Prediction 2024-25

While it is possible that Bitcoin could pull back towards the $60,000 range, the U.S. election outcome may shield the price from more downside.

A favorable outcome may send BTC back above the $70,000 range, but that remains to be seen.