- Whales scooped 560 million DOGE amid its latest price dip

- Will Grayscale’s DOGE ETF application fuel recovery odds?

The original memecoin, Dogecoin [DOGE], continues to attract whale and institutional interest. Especially amid significant Spot ETF speculation in the United States.

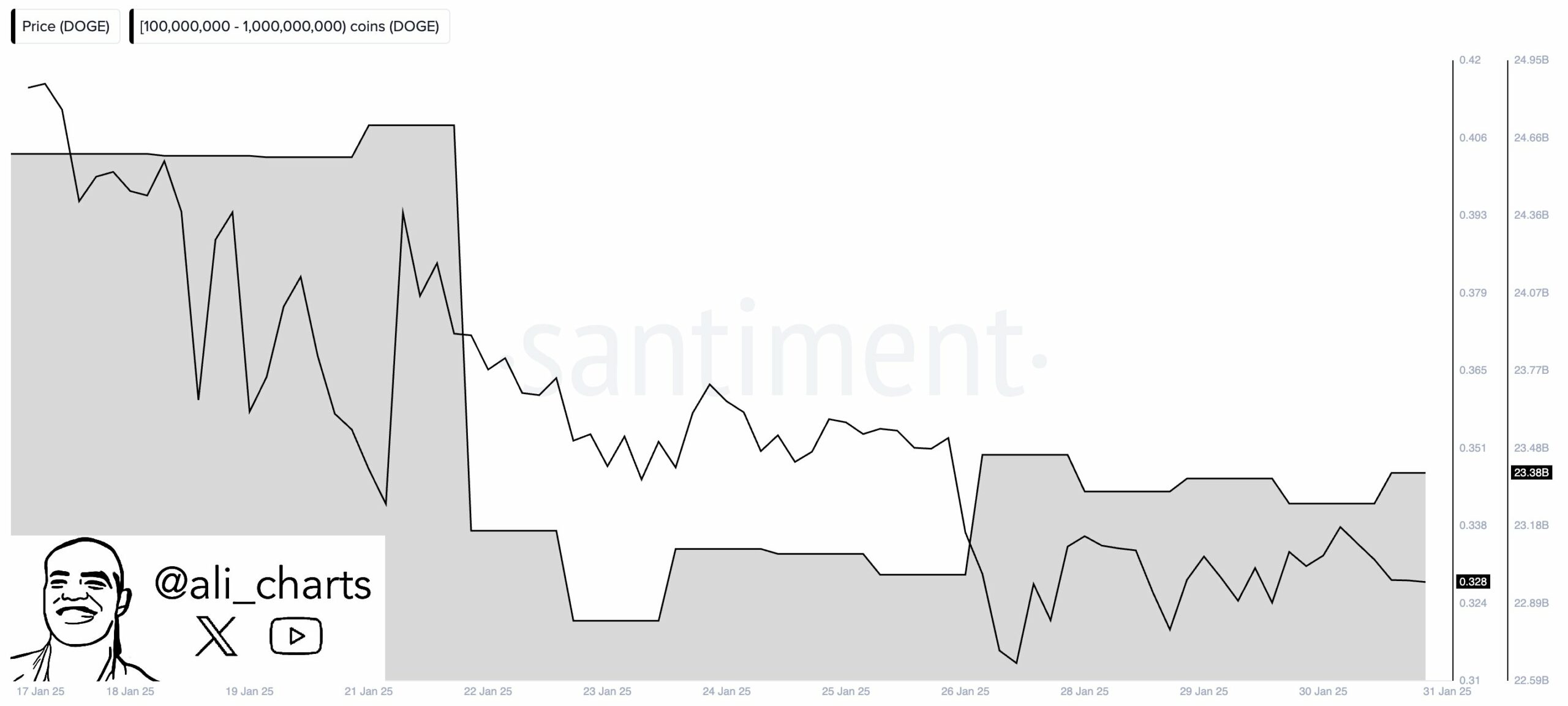

In fact, despite its 23% slump from January’s highs of $0.43, whale entities have scooped 560 million DOGE tokens. This revealed that large players took advantage of the latest price discount to add positions. According to analyst Ali Martinez’s analysis,

“Whales have accumulated 560 million #Dogecoin $DOGE in the past week following an intense sell-off, signaling renewed interest from large holders!”

Grayscale eyes DOGE ETF

On the ETF front, Grayscale joined Bitwise with a potential conversion of its latest Dogecoin Trust into an ETF application. Commenting on the Dogecoin Trust move, Grayscale’s Head of Product and Research Rayhaneh Sharif-Askar said,

“Dogecoin has matured into a potentially powerful tool for promoting financial accessibility. We believe, as a faster, cheaper, and more scalable derivative of Bitcoin, Dogecoin is helping groups underserved by legacy financial infrastructure to participate in the financial system.”

However, top ETF experts like Nate Geraci and Bloomberg’s James Seyffart, noted the firm’s plan to convert the Trust into a spot ETF.

Source: X

The aforementioned update saw Polymarket’s odds of a U.S DOGE ETF by 2025 jump to a record high of 58%, before briefly retreating at press time.

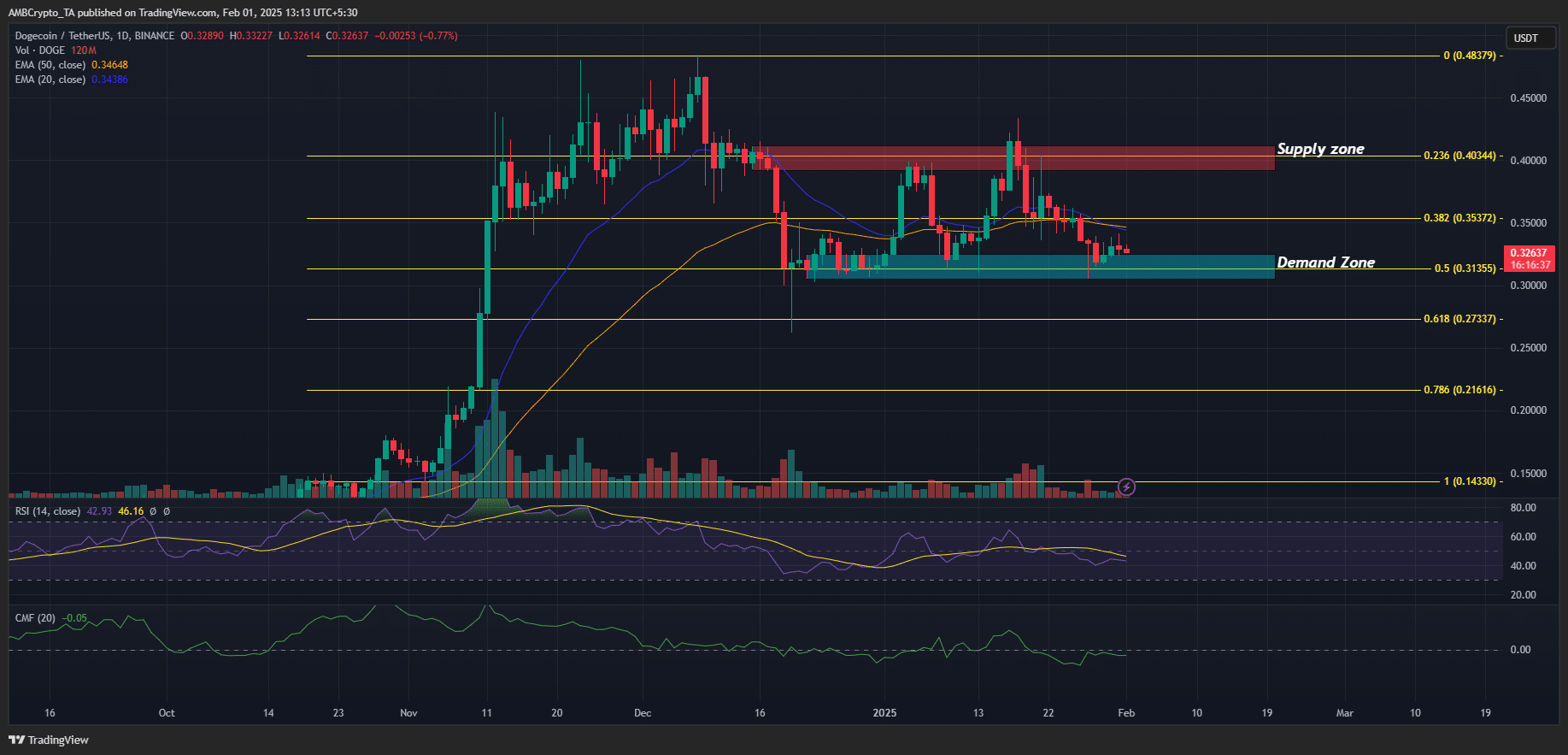

Here, it’s worth noting, however, that the positive update didn’t stir DOGE’s movement on the price charts. In fact, since December, the memecoin has been consolidating between $0.30 and $0.40.

A break below the demand area of $0.3 cannot be overruled amid weak technicals and sentiment in the broader market ahead of the U.S jobs report. However, a positive update on the macroeconomic front can fuel it to $0.4 or higher.