- SOL’s price declined on the charts over the last few days.

- And yet, compared to last year, the altcoin is priced much higher right now

In a major move, a prominent Solana whale recently sold 265,070 SOL worth approximately $43.96 million, capitalizing on a strategic buying spree in 2023. This whale’s calculated timing of both accumulation and profit-taking has raised questions about its potential impact on Solana’s price trajectory. Especially on the broader market sentiment around the altcoin.

Solana whale sells over 200,000 SOL

This whale initially began accumulating Solana between 7 August and 23 October 2023, when SOL was valued at around $23.6. During this accumulation phase, Solana was trading at a relatively low level following a period of consolidation.

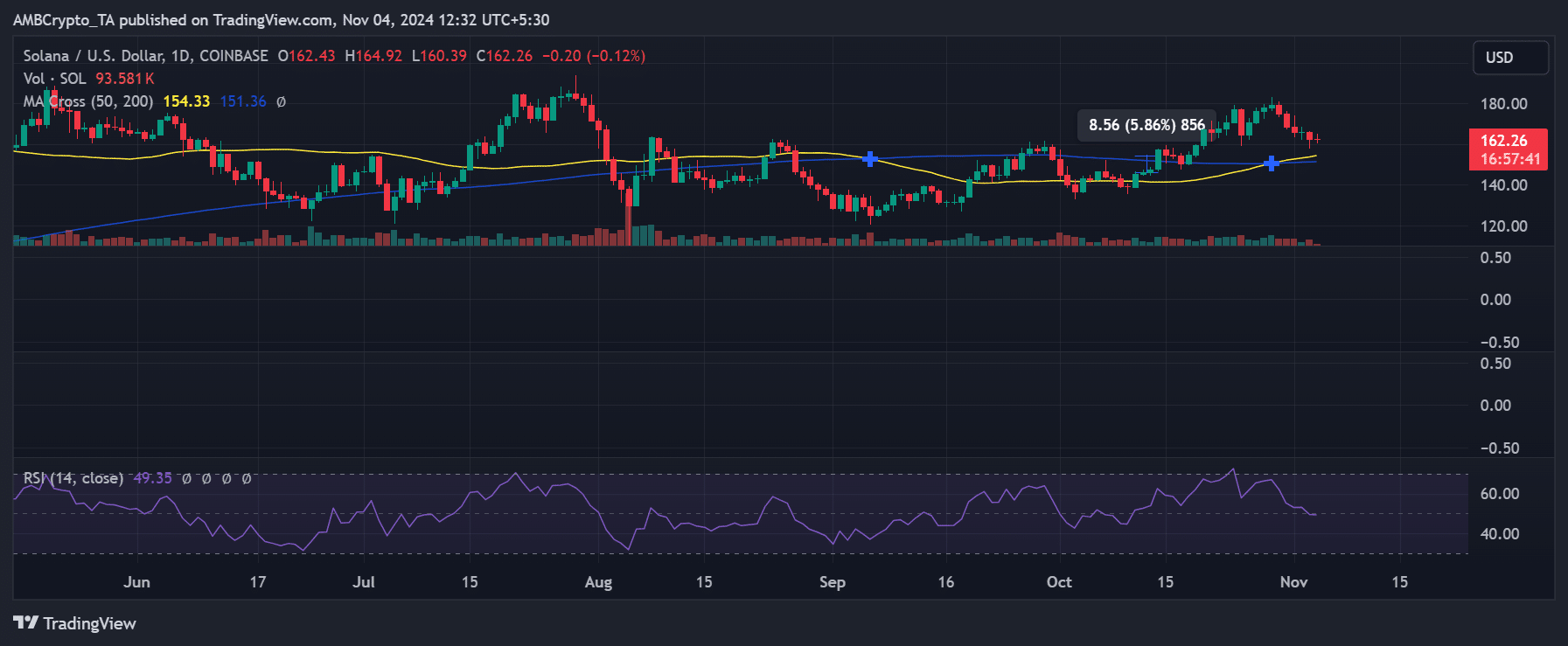

Fast forward to November 2024, and Solana’s price has surged to around $162, marking a significant uptrend. By offloading 265,070 SOL at its current levels, the whale effectively capitalized on a multi-month price rally. The strategy highlighted a 600% profit margin from the initial accumulation phase. This calculated approach allowed the whale to secure substantial returns, with their remaining 126,631 SOL now worth approximately $20.58 million.

At press time, market sentiment around SOL was cautious and the trading volume was modest. This suggested that the whale’s accumulation did not significantly disrupt the market.

Solana volume spike and market impact analysis

Analyzing the trading volume revealed an interesting pattern too. Solana’s trading activity increased noticeably around the whale’s selling period, with daily volumes showing a marked uptick. This rise in volume can be seen as a sign of heightened market interest, possibly due to the influence of the whale’s substantial sell-offs.

Larger trades by whales can often create ripples in market sentiment. And, the hike in volume could indicate that other investors followed the whale’s actions or reacted to the sudden increase in liquidity.

Despite the high trading volume, however, Solana’s price impact from this sell-off has been relatively controlled. While the price saw minor fluctuations, the broader trend remained intact, indicating that market demand was sufficient to absorb the whale’s sell pressure without causing a major correction.

This resilience in Solana’s price can be interpreted as a sign of growing investor confidence and a solid demand base. Even with large players realizing profits.

SOL during accumulation and now

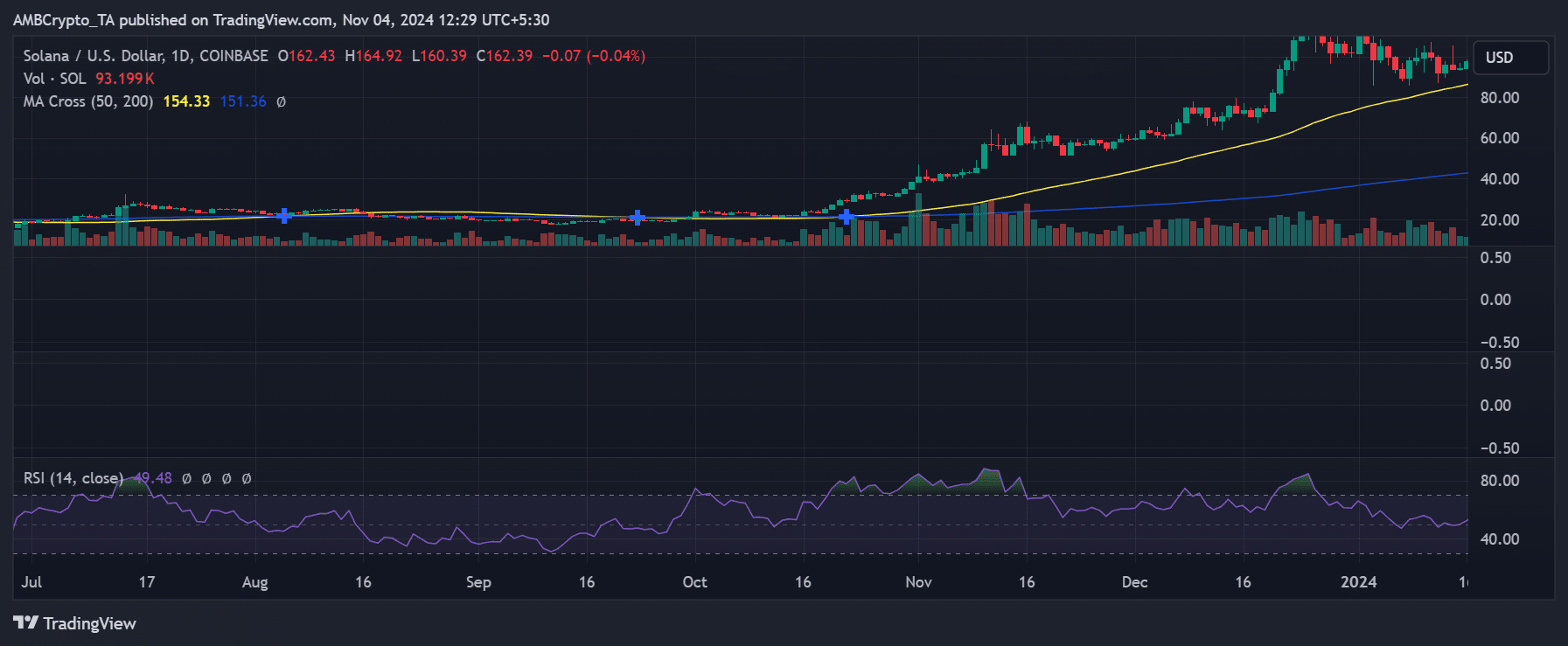

During the whale’s accumulation phase between 7 August and 23 October 2023, Solana (SOL) traded at a low of around $23.6. The price movement showed a consolidation phase with relatively low trading volume. This was indicated by the lack of sharp price fluctuations, suggesting cautious sentiment in the market.

This environment allowed the whale to build up their positions, without having a major impact on the price.

On the contrary, during the recent sell-off phase in November 2024, Solana’s price surged to approximately $162, marking a significant gain from the initial accumulation price. Higher trading volumes accompanied the whale’s profit-taking, though the price impact was moderated, with SOL noting only minor fluctuations.

– Is your portfolio green? Check out the Solana Profit Calculator

This means that the demand for Solana has remained strong, absorbing the sell pressure and keeping the overall trend intact – A sign of strong market support at higher price levels.

![After a 25% price drop, can Kaspa [KAS] crypto rebound to $0.12?](https://hamsterkombert.com/wp-content/uploads/2024/11/After-a-25-price-drop-can-Kaspa-KAS-crypto-rebound.webp-150x150.webp)