- Tether’s CEO clarified the firm’s position on an official blockchain

- USDT hit a new high of $120B, reinforcing its position in the stablecoin sector

Tether CEO Paolo Ardoino is in the news today after he denied claims that the stablecoin issuer is building an official blockchain “Tether chain.”

Reacting to the allegations on X (formerly Twitter), Ardoino clarified that the firm is supporting some L2s opting for USDT as gas fee payments.

“I hear again few rumors about a Tether Chain. Tether is not planning to build an official blockchain at this time. Simply different independent L2 solutions are working to support $USDt for gas fees.”

He added that the firm’s neutrality is crucial to avoid “centralizing everything.”

“One of the main reasons for which Tether won’t launch a chain anytime soon is that neutrality is very important.”

It must be noted though that Ardoino didn’t rule out having a chain in the future.

Tether’s USDT growth

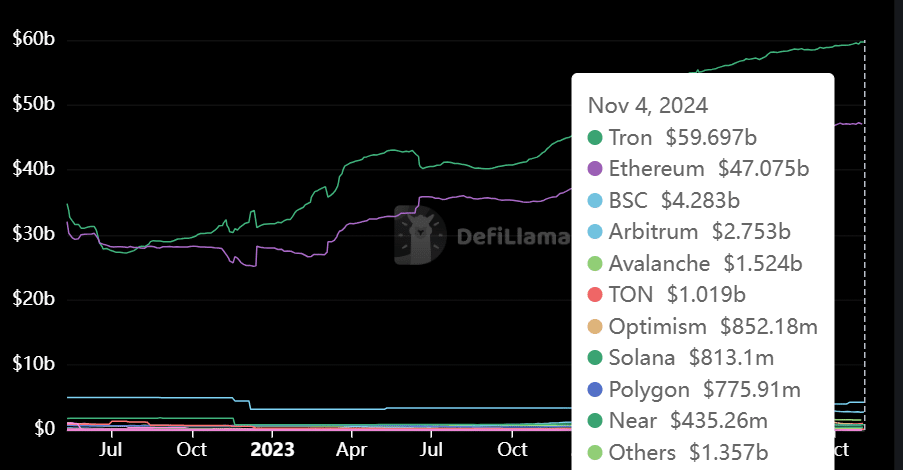

Ethereum L2s like Polygon have already adopted USDT for gas fee payments. However, Tether’s moat has gone beyond just the Ethereum chain.

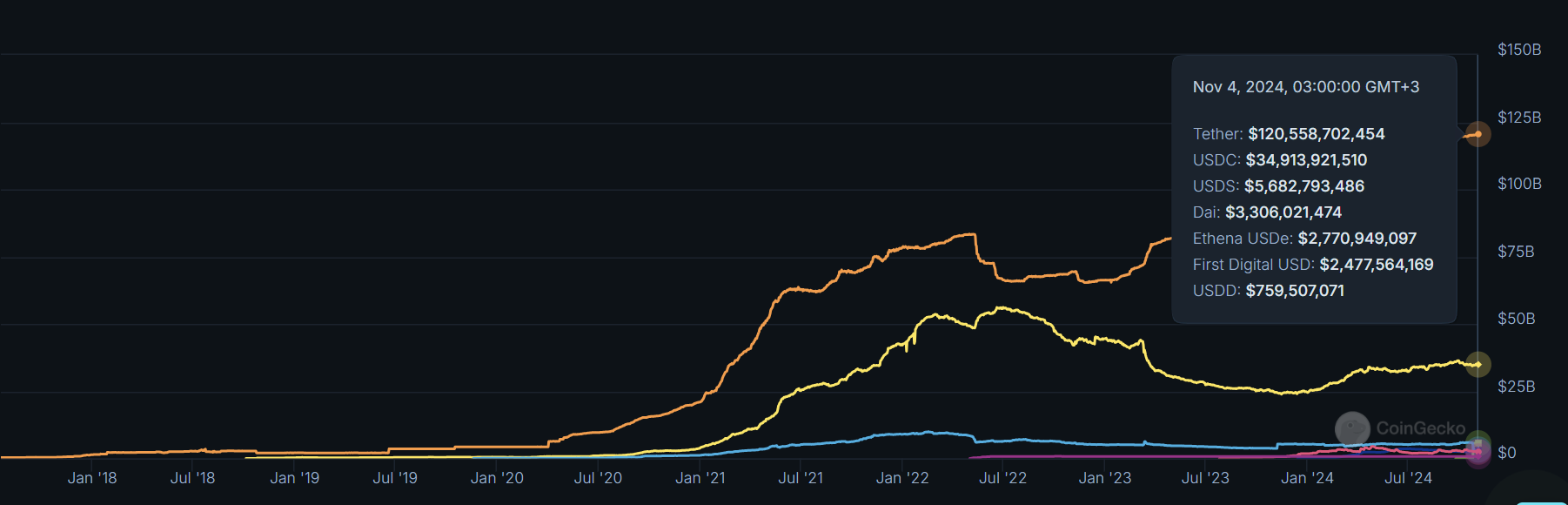

Tether’s USDT has been the dominant player in the stablecoin market for a long time now. Its market cap recently hit $120 billion, surpassing last cycle’s high of $83 billion. Most market trading pairs on centralized exchanges are based on USDT, which is partly driving Tether’s dominance in the sector.

However, the dollar-pegged stablecoin has also emerged as a favorite for cross-border payments. Especially in emerging markets struggling with massive local fiat currency inflation.

To this end, Tron [TRX] has emerged as a top chain for low-cost USDT transfers (nearly $60B), surpassing Ethereum. However, other low-cost alternative chains are also emerging to drive cheaper USDT transfers. The Telegram-linked TON (The Open Network) is a case in point here.

The firm’s current position has made it a target of critics and regulators. In fact, Ardoino recently slammed another FUD, one which claimed that the firm is now under investigation for illegal activities.

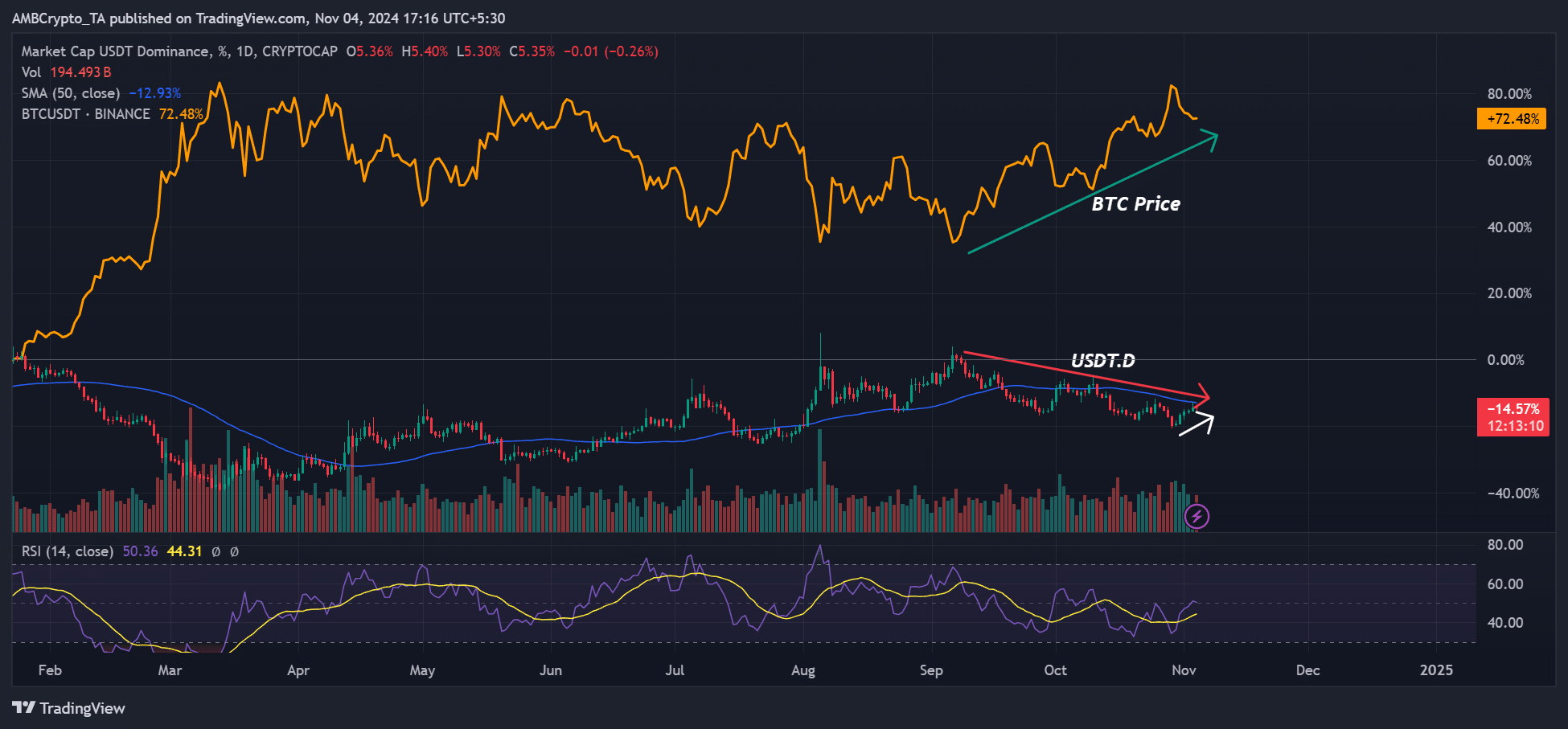

That being said, USDT’s dominance also doubles as the sector’s health barometer and sentiment. While its rising market share indicates rising market liquidity, USDT’s dominance (USDT.D) also gauges whether investors are fleeing to stables (risk-off) or massively accumulating (risk-on).

At press time, USDT.D seemed to be on a long-term declining trend, one corresponding with BTC’s surge. On the contrary, a strengthening in USDT.D would suggest risk-off and panic in the market.