- TON network crossed the $1B milestone in USDT growth

- TON’s price chart has remained muted amid stagnant interest

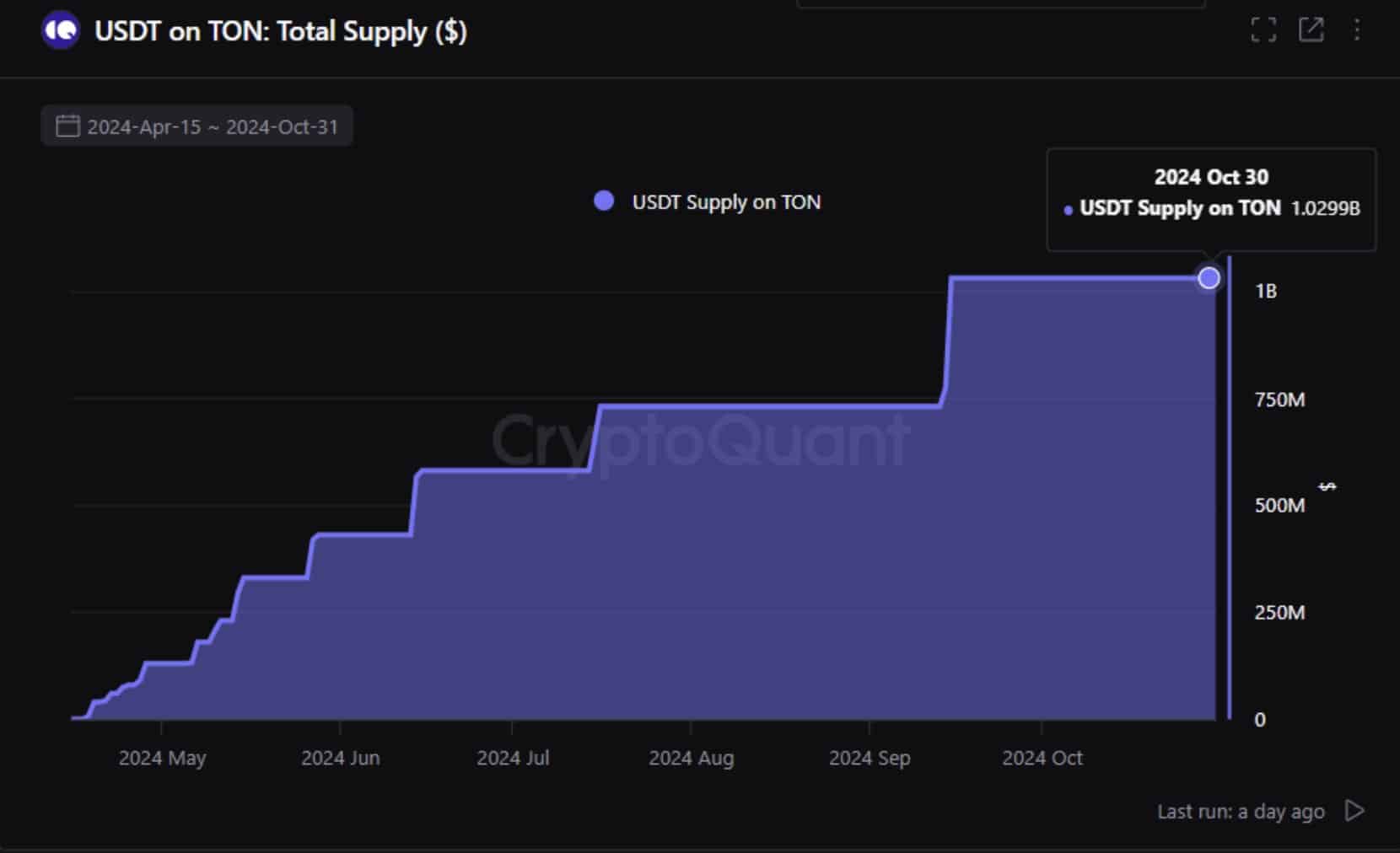

Toncoin’s [TON] USDT stablecoin growth crossed the $1 billion mark after a +670% surge in six months.

This has effectively made the Telegram-linked chain the 10th network based on stablecoin dominance, just below Ethereum [ETH]-based Optimism [OP].

Toncoin’s growth drivers

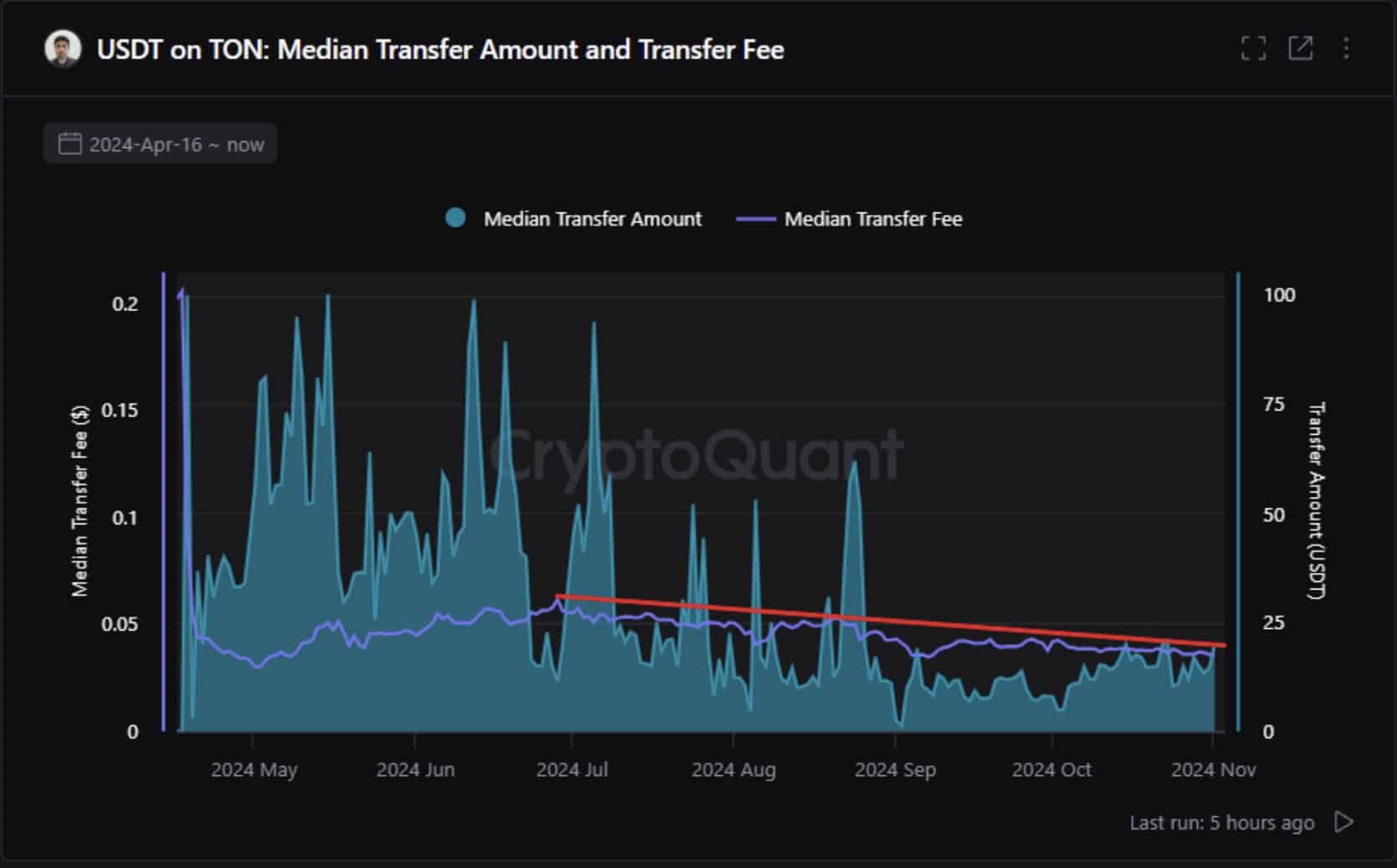

Reacting to the growth, CryptoQuant analyst Burak Kesmeci linked the performance to overall stablecoin growth and Toncoin’s competitive fees. He said,

“I expect USDT supply to expand to $200 billion (from current $120B) during the bull rally. This growth will likely drive further demand for fast and low-cost blockchain networks like TON, leading to continued growth in the amount of USDT on the TON network.”

Also, the USDT average transfer fee on the TON network dropped from $0.061 to $0.035 – About a 42% fee reduction over the same period.

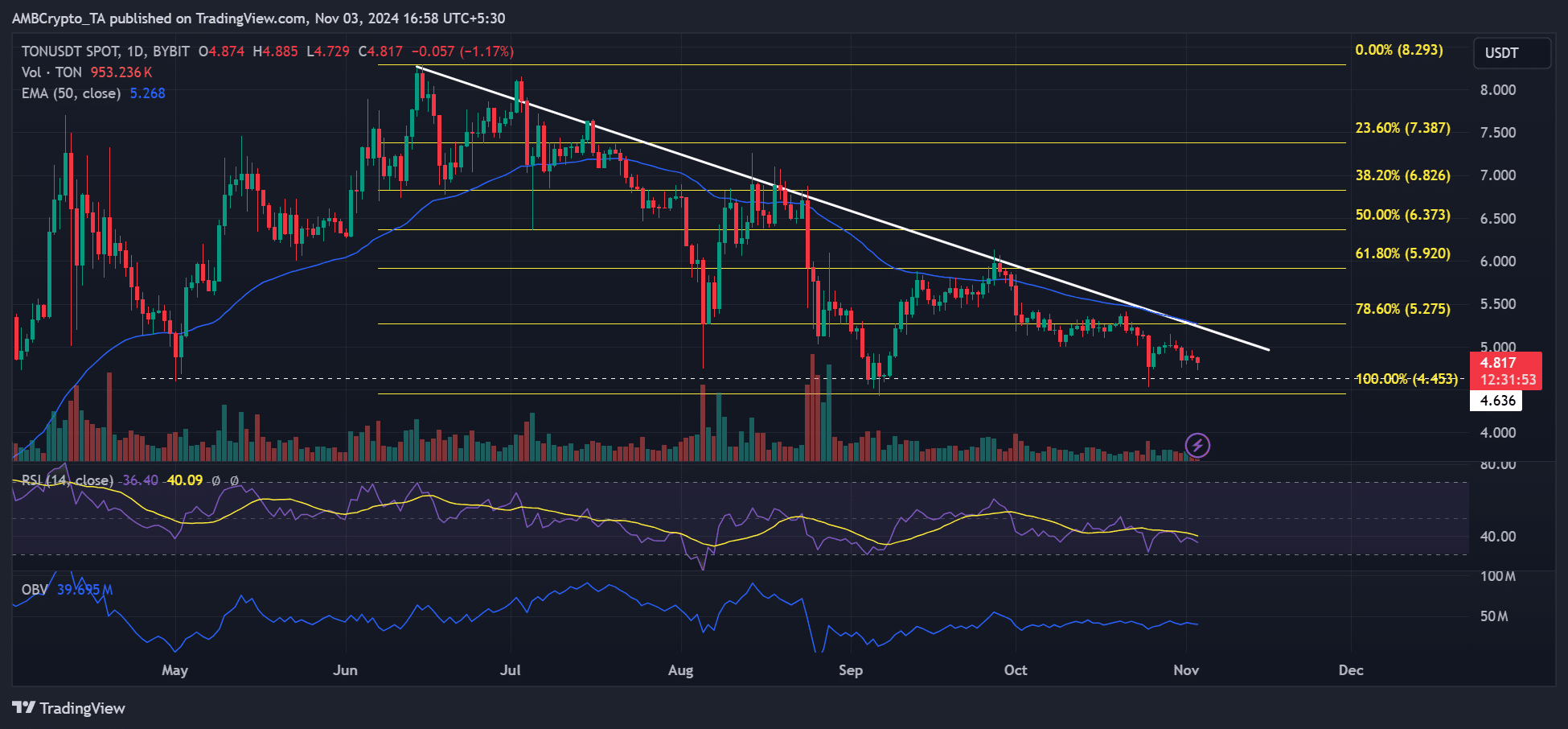

TON climbed by nearly 80% on the price charts between May and June. This slightly mirrored the growth in stablecoins at that time.

However, its value declined further in August, partly due to the arrest of Telegram’s Founder’s. Like most altcoins, TON was below its key long-term trendline resistance.

That being said, TON’s flat OBV (on-balance volume) highlighted weak spot market demand and the altcoin’s challenges below the trendline over the past few months.

Only a decisive move above $5 can reinforce a market structure shift, while likely strengthening to the upside.

In the meantime, there was a considerable bullish market positioning on the Binance exchange at press time.

About 53% of Binance’s top traders’ positions were net long on the altcoin, alluding to a moderate expectation of price recovery from its recent lows.

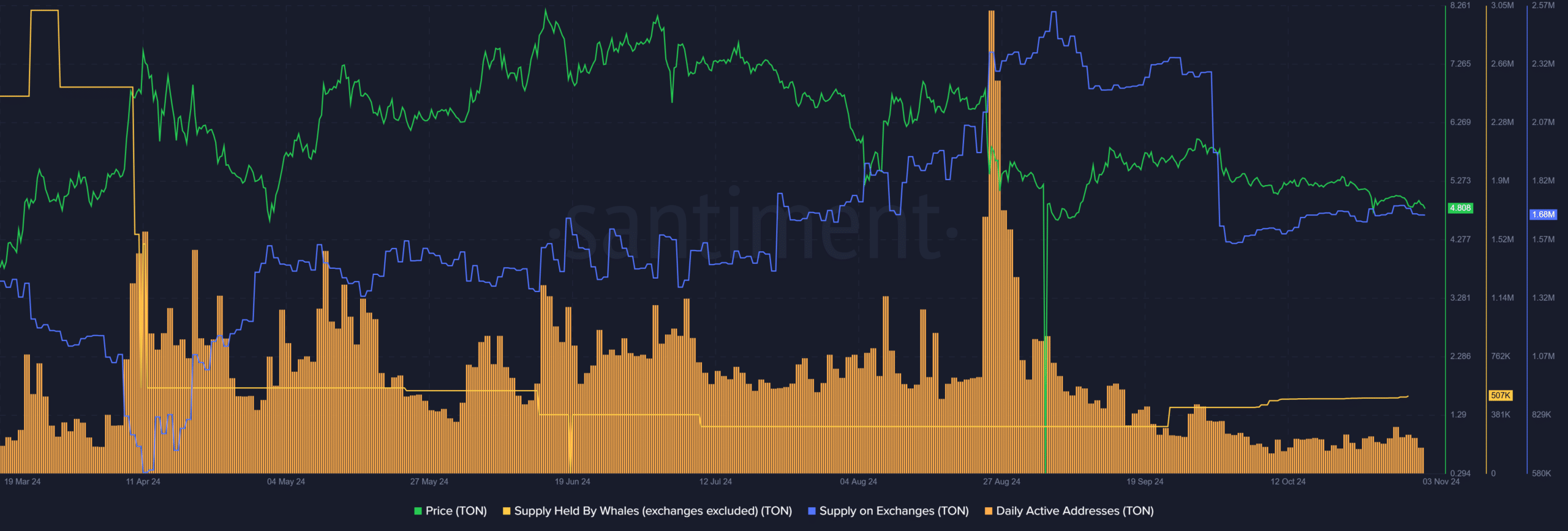

The sell-side pressure for the altcoin also appeared moderate. In September, exchange sell-pressure fell massively, as shown by the drop in supply on exchanges. However, the metric hiked gradually in October – A sign of greater selling.

Read Toncoin [TON] Price Prediction 2024-2025

The supply held by whales has also risen over the same period. It suggested that whales could be grabbing discounted TON from retailers offloading their stash. Hence, the exchange sell-pressure could be zero-sum.

But a strong rebound for TON could be derailed by muted interest, as shown by the low daily active addresses.

In short, it would take more than remarkable stablecoin growth to juice TON’s price chart performance.