- Bitcoin ETFs have attracted strong inflows, outpacing subdued demand for altcoin ETFs like Ethereum

- Layer 2 advancements expand Bitcoin’s utility, challenging Ethereum and bolstering its market dominance

Bitcoin’s [BTC] market dominance is projected to remain strong throughout 2025, according to a recent analysis by JPMorgan. Currently holding around 55% of the cryptocurrency market’s total capitalization, Bitcoin continues to outpace Ethereum and other altcoins. Led by Nikolaos Panigirtzoglou, the team of analysts cited several factors reinforcing Bitcoin’s position as the leading digital asset, signaling its enduring influence in an increasingly competitive landscape.

Bitcoin’s market dominance

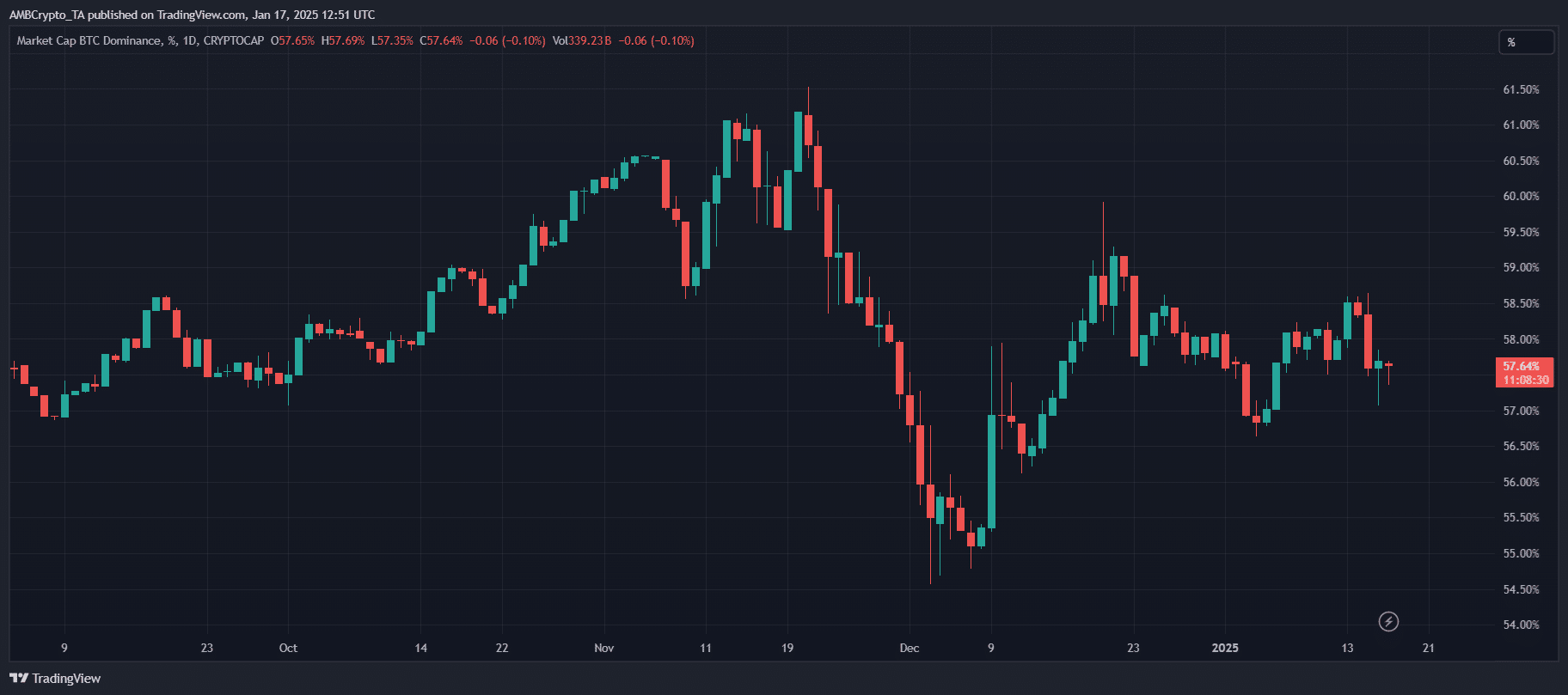

BTC’s dominance has been fluctuating between 57% and 58% lately, showcasing consistent strength despite volatile market conditions. This stability stems from Bitcoin’s status as the go-to store of value amid uncertainty and regulatory challenges faced by altcoins.

With Ethereum’s dominance stagnant and other altcoins failing to gain ground, Bitcoin continues to benefit from institutional interest and its established reputation. In fact, the chart also reflected periodic corrections, which are expected as part of natural market cycles.

Overall, Bitcoin’s dominance trajectory revealed its enduring appeal and highlighted its pivotal role in shaping the market landscape in 2025.

What’s behind it?

JPMorgan analysts have outlined eight key drivers that could sustain Bitcoin’s market dominance into 2025. At the forefront is Bitcoin’s positioning as the digital counterpart to gold, attracting significant inflows into Spot Bitcoin ETFs, while altcoin ETFs, such as Ether’s, have seen subdued demand with only $2.4 billion in inflows so far. Adding to this is MicroStrategy’s ongoing $42 billion Bitcoin acquisition strategy, which is only halfway complete and expected to bolster market momentum.

Future crypto reserve accumulation by U.S. states or central banks is another factor likely to favor Bitcoin exclusively, solidifying its role as a reserve asset. Additionally, advancements in Bitcoin’s Layer 2 networks have enabled smart contract capabilities, challenging Ethereum’s dominance in decentralized applications.

Institutional blockchain applications have increasingly shifted to private networks, reducing reliance on public blockchains like Ethereum. Meanwhile, emerging projects, such as Base, are focusing on infrastructure over token issuance, shifting value away from altcoins. Finally, the uncertainty surrounding U.S. regulatory clarity adds to Bitcoin’s appeal as the market consolidates.

Read Bitcoin’s [BTC] Price Prediction 2025-26