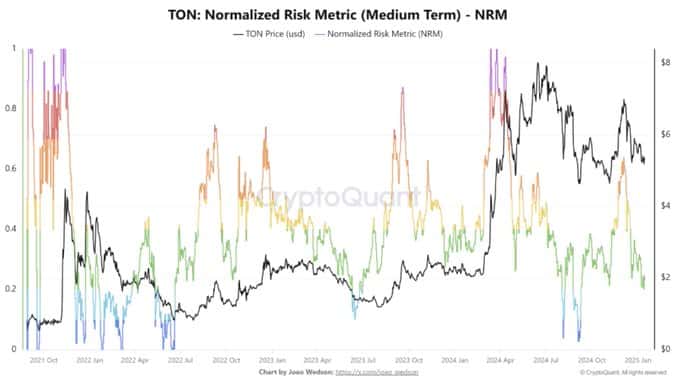

- The normalized risk metrics for medium and long-term trends are approaching a key buying phase, signaling a favorable market position.

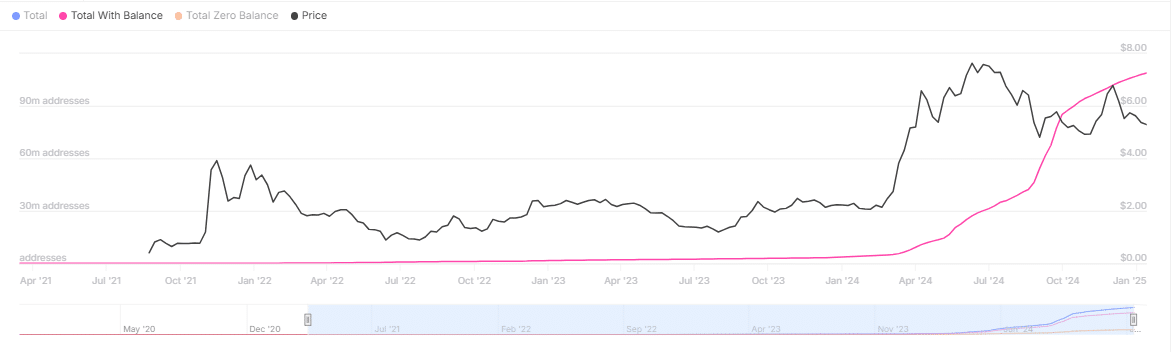

- The number of TON addresses has seen a significant surge, reaching an all-time high.

Over the past 24 hours, Toncoin [TON] experienced a notable upward movement, gaining 1.83%, following a weekly increase of 5.78%. However, trading volume declined by 7.29% to $185.5 million during the same period.

A divergence between price and volume, as observed here, often precedes a price drop. However, if such a drop occurs, AMBCrypto’s analysis suggests it could catalyze the anticipated upward rally.

Accumulation phase ahead?

TON could soon enter an accumulation phase, where the asset is bought in bulk, potentially setting the stage for a significant rally.

This insight comes from sentiment analysis by analyst Joaowedson, who examined the Normalized Risk Metric (NRM) for both long-term and medium-term outlooks.

The NRM compares TON’s price with its Simple Moving Averages (SMA) — the 374-day SMA for the long term and the 50-day SMA for the medium term.

The NRM is color-coded to indicate different market phases, with four distinct colors marking key stages.

Historically, when the NRM turns green, it indicates a rally is near, while a blue NRM signals the final rally phase, as market participants begin to accumulate the asset in bulk.

Currently, the long-term NRM sits at the green line. If it shifts to blue, based on the 374-day SMA, TON could enter a long-term rally with a target price of $8 and above.

If the divergence between price and volume extends further, it could hasten the formation of the blue NRM, influencing the expected price movement.

The medium-term NRM mirrors this pattern, with the green line potentially shifting to blue. If this occurs, it would act as a catalyst, pushing the price upward toward the target.

The alignment of both the medium-term and long-term NRM provides a strong indication that a major rally could be approaching, especially if both metrics turn blue simultaneously. This shift could push TON’s price above $8 and into higher regions on the chart.

TON sees adoption as address growth soars

As TON approaches the low-risk phase, where accumulation typically occurs, price movements are beginning to surge. There has been a notable increase in the number of addresses with TON.

According to data from IntoTheBlock, the total number of TON addresses with a balance has reached a new milestone. Last week, 108.81 million addresses were recorded. This marks an increase of 1.6 million addresses from the previous high set in December 2024.

Read Toncoin’s [TON] Price Prediction 2025-26

Such growth in the number of addresses suggests a rise in market participation, with more buyers gradually accumulating TON. This trend would play an important role in driving TON’s price to higher levels soon.