- Cardano whales bought 100 Million ADA over the past 48 hours, coinciding with the broader crypto market rebound.

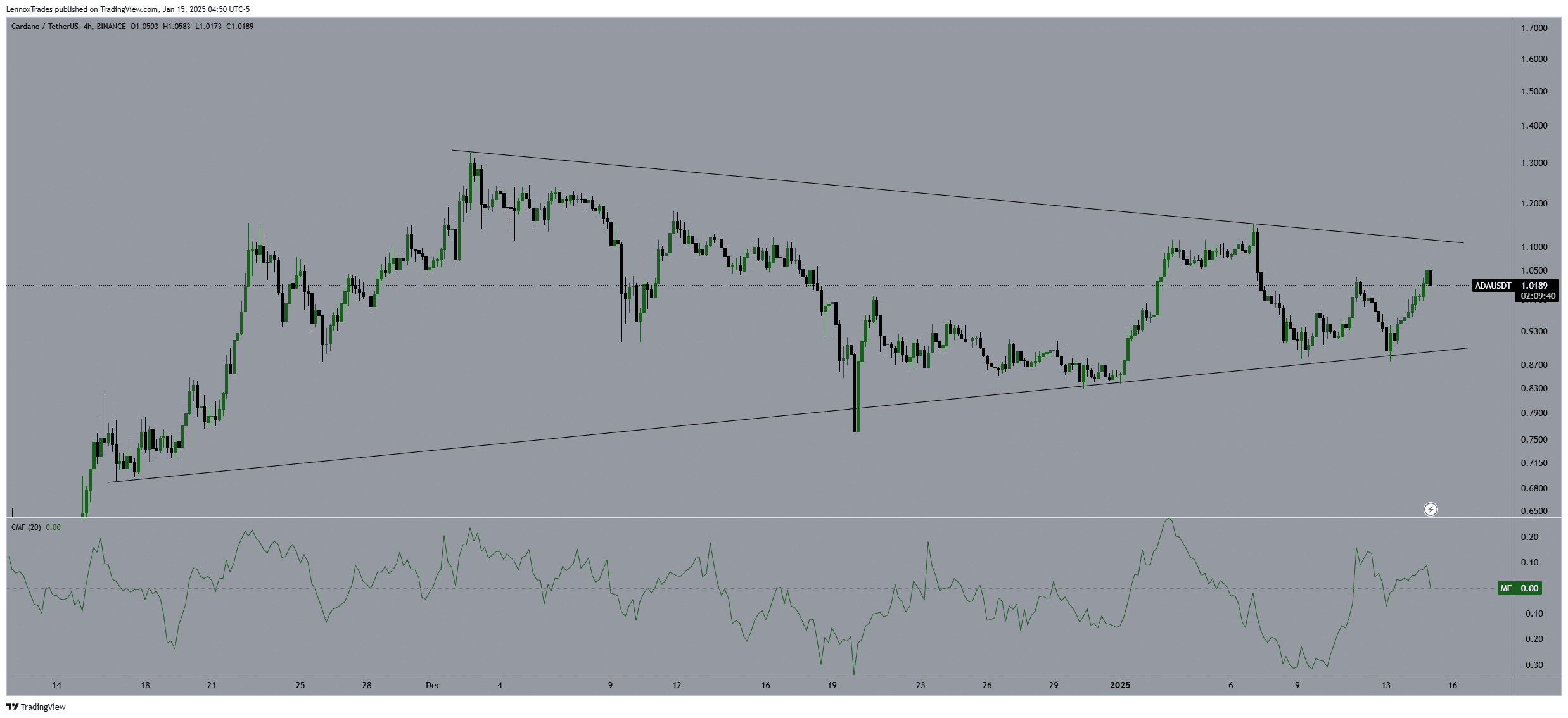

- ADA is back above $1, but the altcoin is consolidating within a bullish pennant pattern on the 4-hour timeframe

Cardano (ADA) is back on the watch of whales as they purchased 100 million ADA, significantly affecting the network and its price. In fact, the price surged from $0.998 to $1.11, reflecting intensified activity by these large holders.

This buying spree coincided with a general market rebound, suggesting potential for further price hikes if whale acquisitions persist. Conversely, a slowdown in whale activity could see ADA retract to its lower support levels on the charts.

The market’s trajectory hinges on sustained large-scale investments and broader market trends. These are crucial in determining whether ADA will challenge higher resistances or consolidate at its current levels, underlining the pivotal role of whale transactions in shaping market directions.

ADA future price relies on…

Following a broader market rebound, Cardano’s price action ascended past the $1.00 threshold, indicating robust buying momentum.

This movement on the 4-hour chart saw ADA oscillating within a defined bullish pennant, with the price currently near $1.08. Notably, ADA recently touched a low of $0.87 before rebounding to its press time levels – A sign of strong support within this zone.

A breakout from this pennant, particularly above the $1.10 resistance level, would point to a potential rally towards $1.50. This would align with the altcoin’s historical resistance points.

Lending more weight to the analysis, the Chaikin Money Flow (CMF) index hovered around the zero line to reflect balanced market pressure, while also supporting a stable ascent. This, despite the broader correction that was seen in the crypto markets.

Hence, targeting the resistance at $1.50 becomes feasible. Especially if the CMF remains above the neutral threshold – A sign of sustained buying momentum.

However, ADA’s current consolidation within this pattern also presented caution for possible pullbacks if a breakout fails, underscoring the criticality of market sentiment and trading volume in determining the next significant price movement.

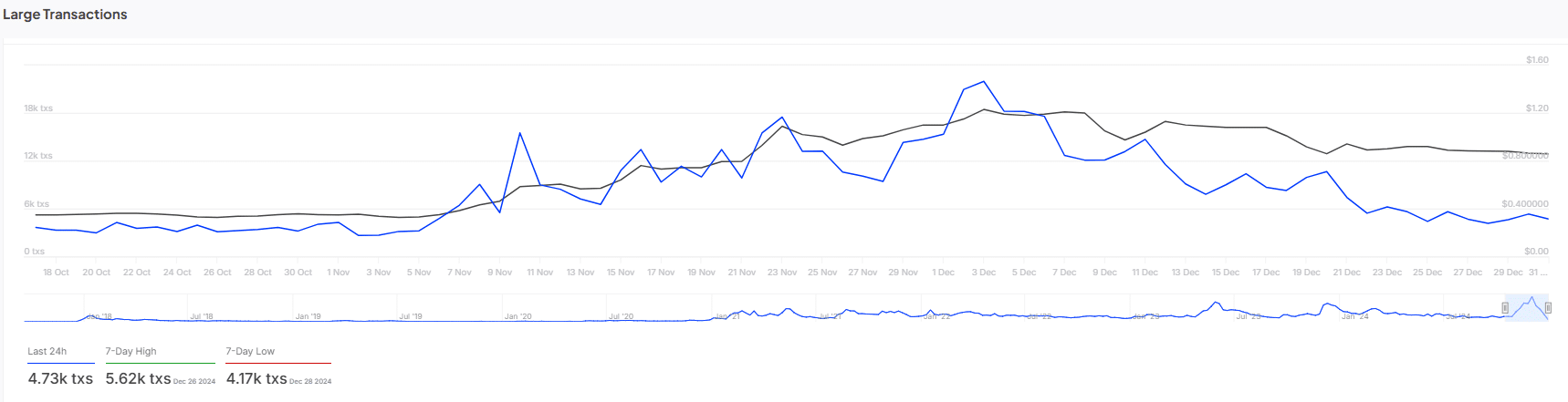

Number of large transactions

The number of large ADA transactions spiked, hitting a high of 5.62k transactions in early December, particularly on the 3rd. Since then, this activity has steadily fallen, even as ADA’s price stabilized around $1.20.

Right now, large transactions have settled at a 7-day low of 4.17k – Highlighting the decreased volume of significant trades.

This fall in large-scale trading activity could signal a weakening of buying momentum or a consolidation phase, which might cap further price gains in the short term.

If this trend continues, ADA might struggle to sustain higher price levels, potentially leading to sideways or downward price movement. Unless renewed large transaction activity emerges to drive the price north again.