- Tron network saw growth as platforms like SunPump continued to expand.

- Despite Tron’s growth, TRX has struggled to maintain an uptrend, dipping by 21% in 30 days.

Over the past year, the Tron [TRX] network has experienced considerable growth and development.

Among these developments, SunPump stands as one of the most significant memecoin projects over the past year.

SunPump growth within Tron and its significance

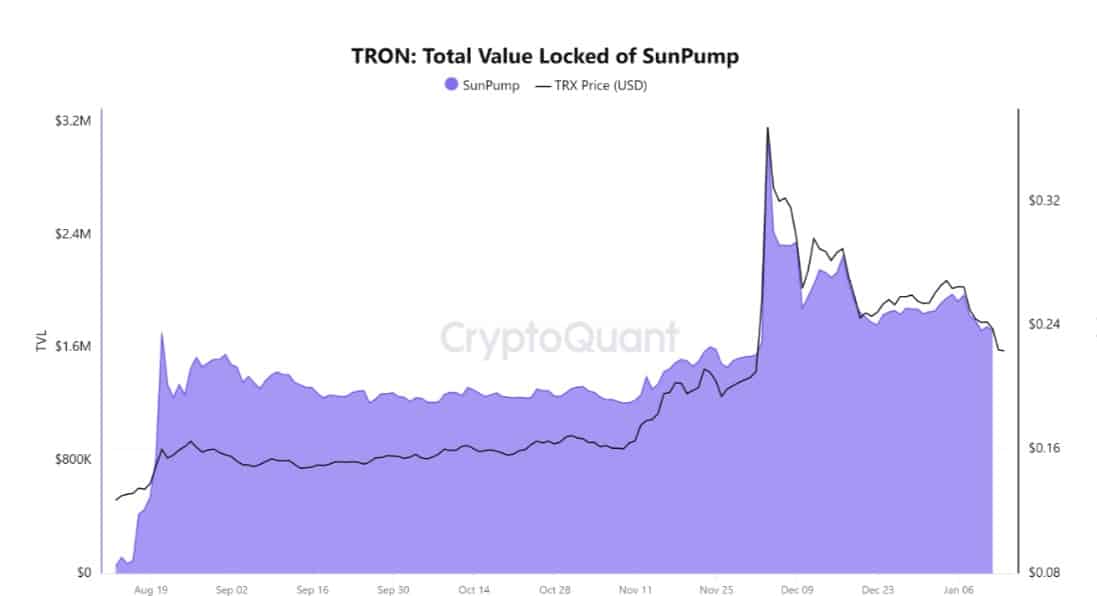

According to CryptoQuant analysis, SunPump in the Tron Network has become the first ever platform within the blockchain solely dedicated to the fair launch and trading of memecoins.

Although the project is still in its early stages, its Total Value Locked (TVL) is nearing $2 million.

In context, SunPump provides creators with an easily accessible, low-cost platform to launch their memecoins in secure and user-friendly environments.

The platform stands out for its fairness and transparency, promoting a more autonomous and empowered trading experience.

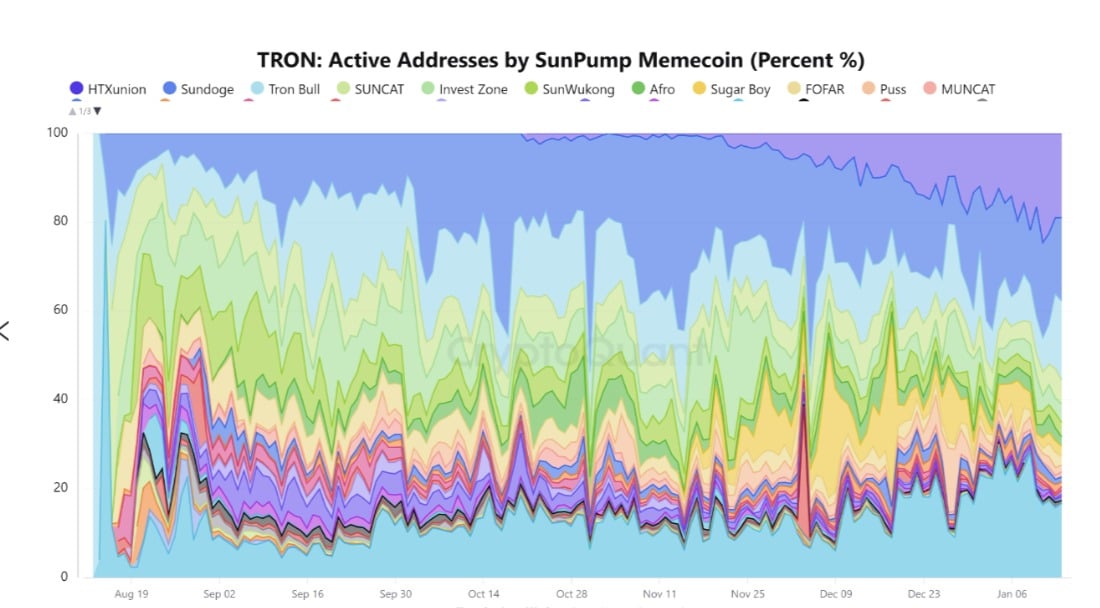

In addition to SunPump itself, various tokens are integrated into the platform, including HTXunion, Sundoge, Tron Bull, SunCat, and InvestZone.

These projects are dominating the number of active addresses within the platform, creating a vibrant and engaged community.

Projects like SunDog, with a market cap of $77.21 million, show how growth on the TRON network can rapidly accelerate.

What does it mean for TRX?

While the Tron network has experienced exceptional growth with platforms like SunPump, its native token TRX has failed to keep pace.

TRX has struggled to record sustained gains on its charts, with bearish sentiments dominating the market.

The altcoin has continued to decline across the charts. According to AMBCrypto’s analysis, Tron is experiencing strong downward pressure as bearish sentiments dominate.

We can see this downward momentum through a declining Relative Vigor Index (RVGI). This has dropped to -0.36 after making a bearish crossover ten days ago.

This is further confirmed by the fact that DMI’s +DI has continued to decline while ADX has been rising.

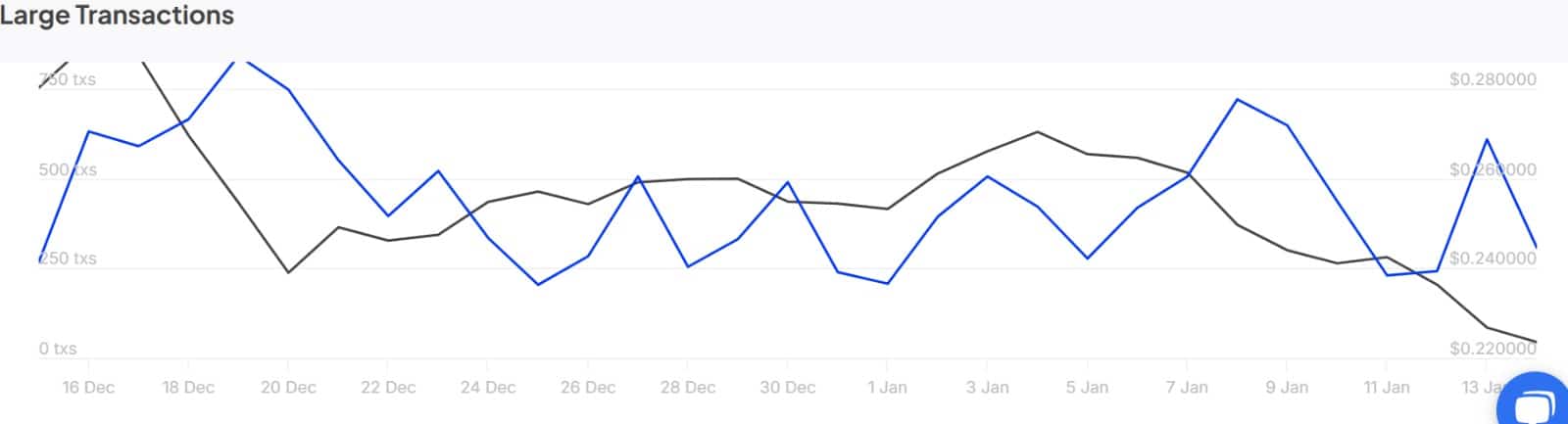

Looking further, Tron is currently lacking support from whales. As such, large holders’ activity has dropped over the past month, dipping by 57.31%. When whale activity declines, it reflects their lack of market confidence.

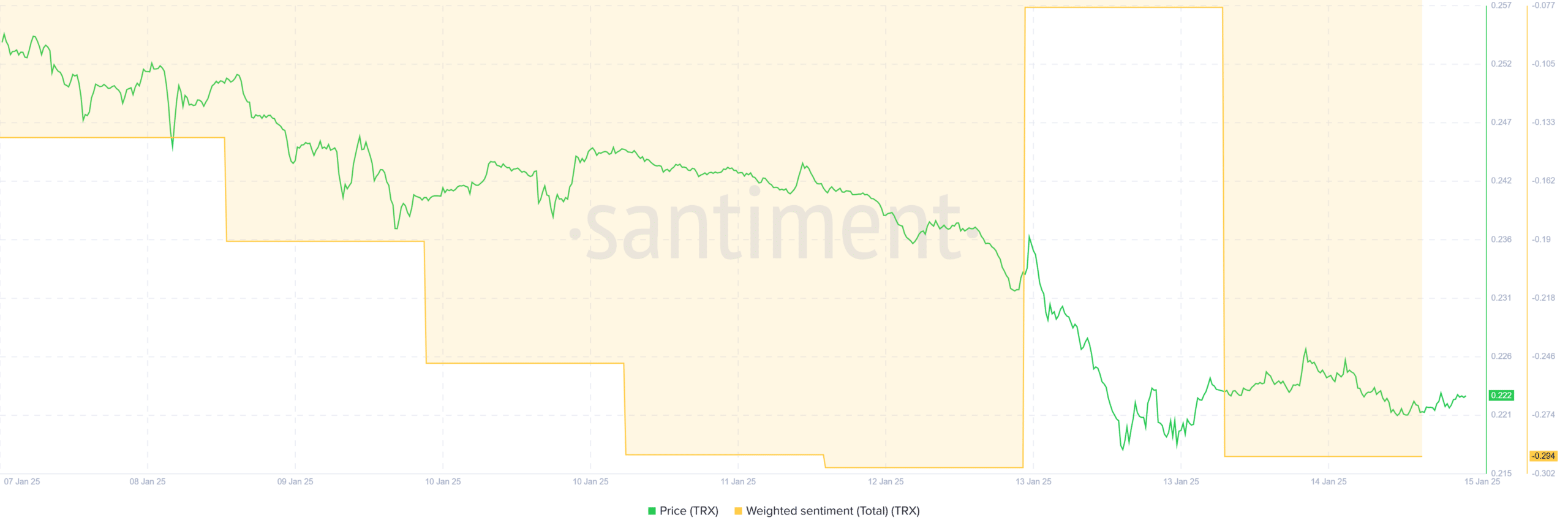

This bearishness among whales is not an isolated case, as the whole market is experiencing negative sentiment.

As such, Tron’s weighted sentiment has remained negative over the past week. This implies that all market participants are bearish and anticipate prices to decline.

Read Tron’s [TRX] Price Prediction 2025–2026

In conclusion, the Tron network has made remarkable progress through platforms like SunPump. However, its native token TRX has failed to keep up with the pace and continues to decline amidst strong bearish sentiments.

If these sentiments continue, TRX could dip to $0.20. However, if this trend ends and a reversal occurs, TRX needs to reclaim $0.25 to see sustained gains.