Market sentiment and Futures activity

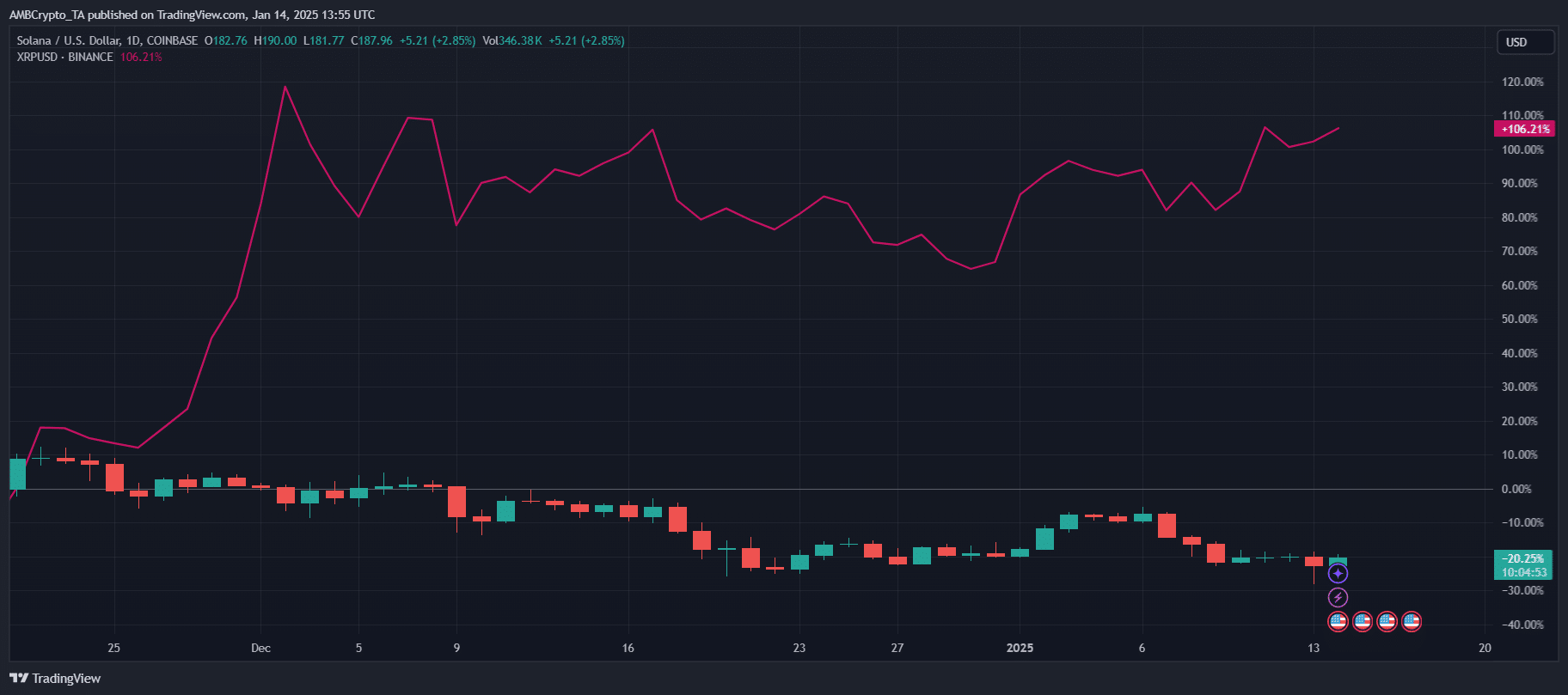

The YTD performances of Solana and XRP revealed a distinct contrast, especially following the report. Prior to the report, SOL saw a gradual decline, reflecting broader market trends and investor caution. However, after the report, SOL rebounded with 2.86% daily gains, pushing its price to $187.97 – A sign of positive market sentiment towards potential ETF approval.

XRP, similarly, followed a downtrend leading into 13 January, but showed greater resilience, posting 106.15% YTD gains. The last 24 hours have also seen XRP climb exponentially on the price charts.

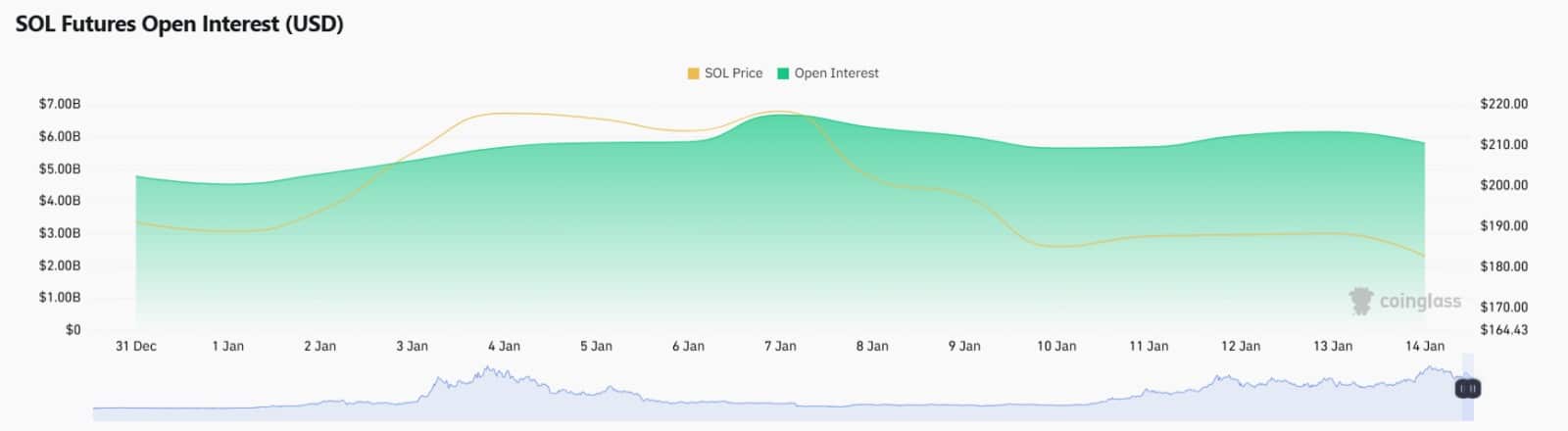

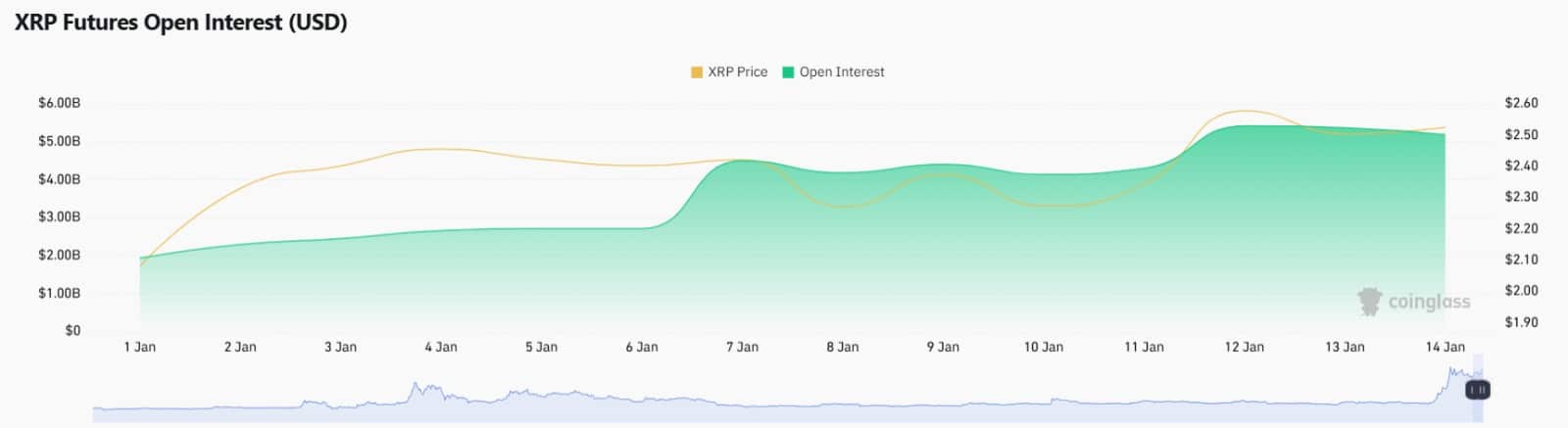

Futures Open Interest data for both Solana and XRP underlined a shift in market sentiment after the report.

For SOL, Open Interest grew steadily before 13 January, ranging from $4 billion to $6 billion. Following the report, it surged to nearly $7 billion – Reflecting heightened investor confidence and bullish sentiment, accompanied by a slight price hike.

XRP’s Open Interest followed a similar pattern, climbing from $2 billion to over $4 billion before 13 January. However, after the report, it spiked to nearly $6 billion. Following the same, the altcoin’s price shot up the charts, highlighting that the spike in OI was backed by strong conviction and not just speculation.

Road ahead for Solana and XRP

Matthew Sigel, Head of Digital Assets Research at VanEck, recently shared valuable insights regarding the impact of cryptocurrency exchange-traded products (ETPs). Sigel’s comments on the performance of Bitcoin and Ether ETFs lent insights into what could lie ahead for Solana and XRP, if their own ETFs are approved.

“ETP assets ($108bn) make up 6% of the total Bitcoin market cap ($1,874bn) after the ETPs’ first year of trading; likewise, ether ETP assets ($12bn) have a 3% penetration rate of the total Ethereum market cap ($395bn) within its first 6 months since launch.”