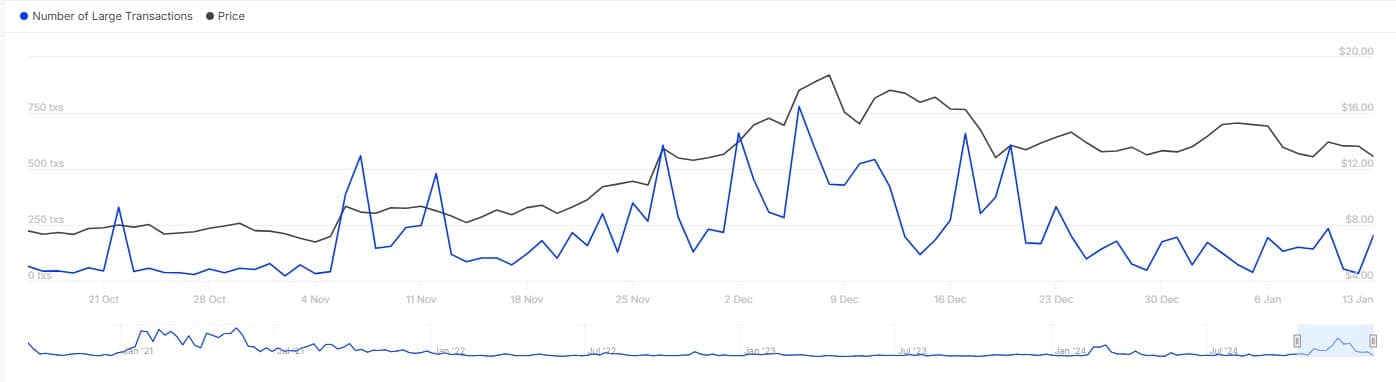

- UNI large transactions have surged by 694% in the last 24 hours.

- Positive on-chain metrics and a bullish long/short ratio suggest the potential for further price gains.

Uniswap [UNI] has seen a significant spike in large transactions recently. The asset’s large transactions have surged by an impressive 694% in the past 24 hours, according to IntoTheBlock’s data.

This surge highlights an influx of whale activity, with big-money players potentially driving the market as UNI’s price finds support at the $12 level.

Historically, heightened whale activity often signals increased confidence in a token. For UNI, it could set the stage for notable price movements.

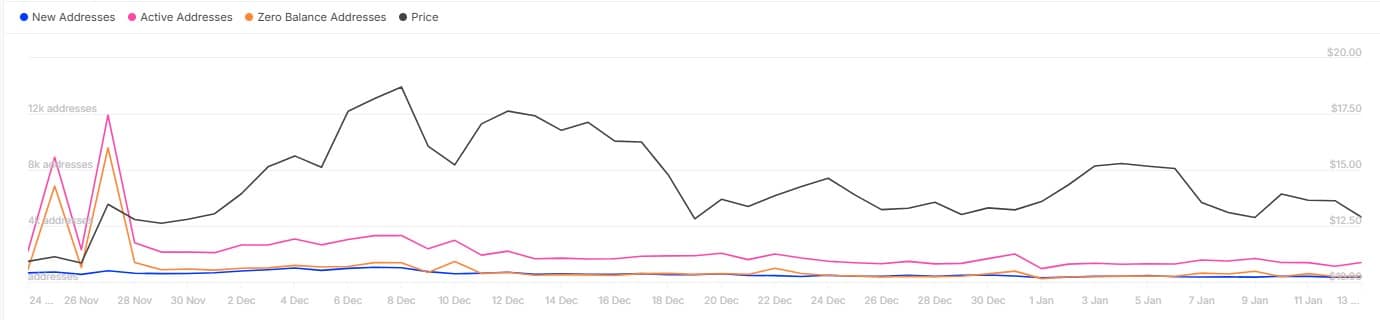

Adding to the momentum, UNI’s trading activity is gaining traction. Active addresses for the altcoin surged by 23% within the same 24-hour period.

This increase in trading activity reflects growing interest and participation in the network, potentially bolstering bullish sentiment.

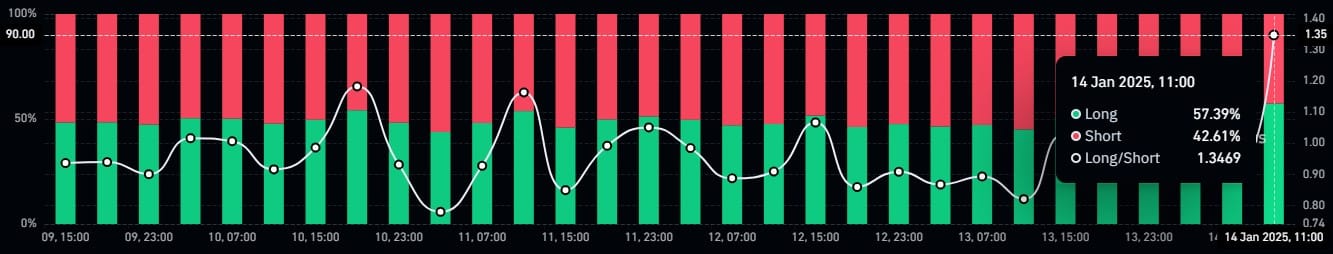

Long/Short Ratio leans to the bulls’ side

Another metric lending support to the optimistic outlook is the long/short ratio. At the time of writing, the ratio stood at 57%. This indicates that long positions are currently dominating the market.

Usually, when long positions outweigh shorts, it often signifies a market-wide expectation of further price gains.

Combined with the increased whale activity and relatively strong trading activity, the surge paints an intriguing picture for UNI’s short-term trajectory.

Key resistance at $17 in sight

Technically, UNI faces a crucial resistance level at $17. If the current momentum persists, a rally to this resistance level could be on the cards. Breaking through this level could signal the start of a further bullish rally.

Whale activity typically acts as a precursor to significant price movements. With whales accumulating, UNI’s prospects look promising.

Moreover, the confluence between whale activity, active address growth, and the bullish long/short ratio creates a conducive environment for price gains.

Can UNI sustain the accumulating bullish momentum?

While the current metrics are encouraging, market conditions can shift rapidly. Broader market trends and investor sentiment will play critical roles in UNI’s ability to sustain its upward trajectory.

Read Uniswap’s [UNI] Price Prediction 2025–2026

UNI’s on-chain metrics and whale activity signal potential bullish moves. With the next resistance level at $17 within reach, the altcoin rally could gain further momentum if the current trends hold.