- Smart Money, whales, and KOLs re-accumulated VIRTUAL after the price dipped below $2.50 levels, leading to a rebound.

- VIRTUAL’s positive momentum towards the Ichimoku Cloud suggested a bullish outlook, reinforced by the MACD.

The recent activities of Smart Money, whales, and Key Opinion Leaders (KOLs) in the Virtual Protocol [VIRTUAL] market signified a notable phase of re-accumulation. This occurred particularly as the price of VIRTUAL dipped below $2.50.

Prominent buyers made significant purchases at average prices of $2.35 and $2.45, infusing over $551K into VIRTUAL, as captured on DEX position. These transactions marked their initial foray into this asset, highlighting a strategic entry point.

A surge in buy volumes coincided with these acquisitions, pointing to a broader consensus among smart money circles. This suggests that the lower price threshold presented a buying opportunity.

This influx, particularly after a dip, likely catalyzed the short-term rebound observed in VIRTUAL’s price, affirming the impact of substantial, coordinated buys in steering market dynamics.

This trend underscored the influential role of significant market players in precipitating price recoveries during downturns.

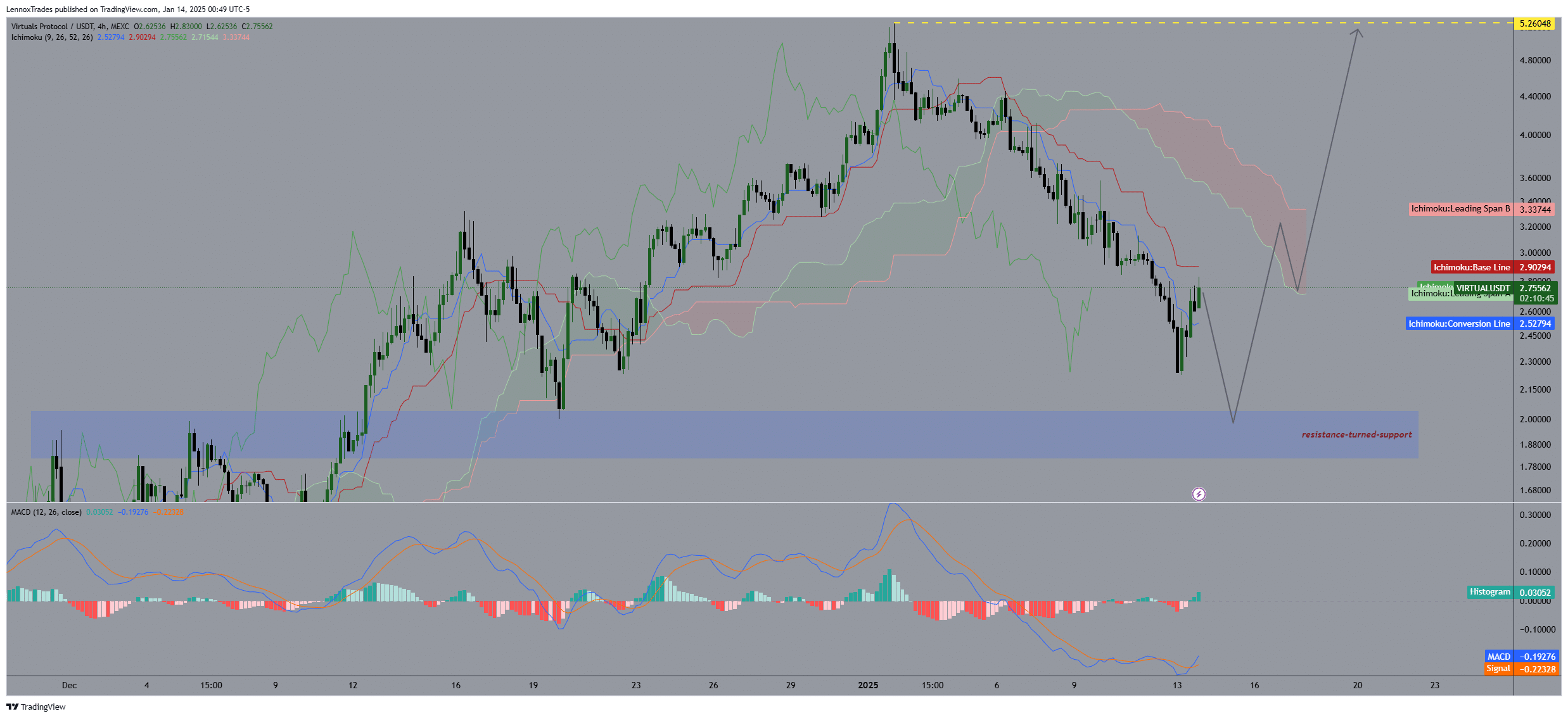

VIRTUAL price action and prediction

The VIRTUAL/USDT chart analysis shows significant resilience as it navigates through the Ichimoku Cloud.

The Conversion Line at $2.50 highlighted its role as pivotal short-term support, facilitating an initial rebound. This upward movement could find further support at $3.00, reinforcing the asset’s potential for stability.

The MACD indicators support this optimistic perspective. The MACD line crossing above the signal line is a classic bullish signal, suggesting an increase in upward momentum.

Furthermore, the price successfully tested the resistance-turned-support level at $2.2, validating it as a key support zone for future price actions. VIRTUAL now targets resistance level at $5.26 as a significant potential high if the bullish trend continues.

However, caution remains advised as a reversal below the $2.2 support could trigger a downward trend, challenging the current optimistic scenario.

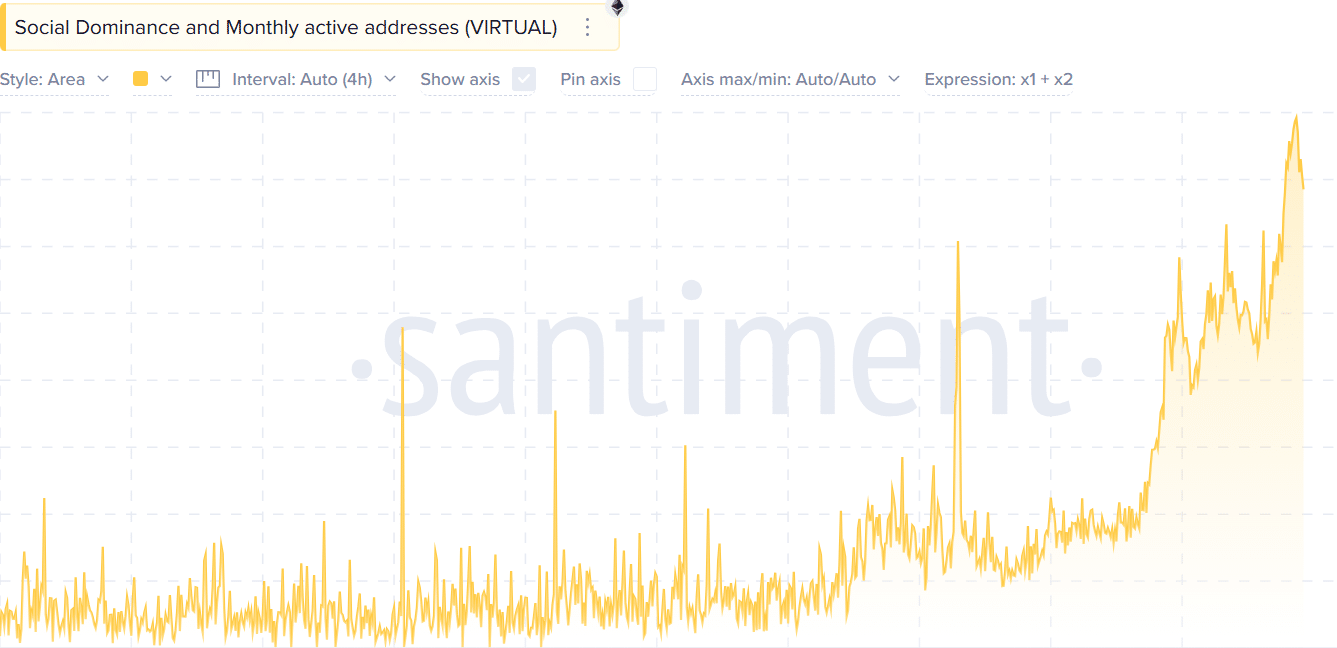

Social dominance and monthly active addresses

The combined social dominance and monthly active addresses of the Virtuals Protocol show a clear correlation. As social dominance spiked, reflecting heightened community interest, active addresses also rose.

This trend suggests increased user engagement and possible speculative activity.

Read Virtuals Protocol’s [VIRTUAL] Price Prediction 2025–2026

Historically, such spikes aligned with upward price movements. Heightened social attention and active participation could lead to price increases.

However, these metrics also warn of potential volatility. Rapid rises often precede corrections. If this pattern holds, VIRTUAL’s price might experience significant fluctuations in the near term.