- Stablecoin reserves surged to 48 billion USDT equivalent, suggesting significant dry powder on the sidelines

- Bitcoin exchange outflows intensified while ETH saw mixed flows

The cryptocurrency market is seeing a significant slowdown as capital inflows fall and trading volume hits historic lows – A sign of growing investor hesitation in the current market environment. In fact, data revealed a dramatic 56.70% fall in capital inflows, dropping from $134 billion to $58 billion, while trading activity has fallen to levels not seen since before the U.S elections last year.

Crypto market trading volume hits pre-election lows

Trading volume across major crypto sectors, including memecoins, AI/Big Data projects, and Layer 1 and Layer 2 protocols, has hit its lowest point since 4 November.

According to Santiment, this decline in activity alludes to a form of “trading paralysis” as investors struggle to make decisive moves in the prevailing market conditions. An analysis of the chart revealed a consistent downtrend across all segments, with particularly notable drops in previously active sectors like AI and memecoins.

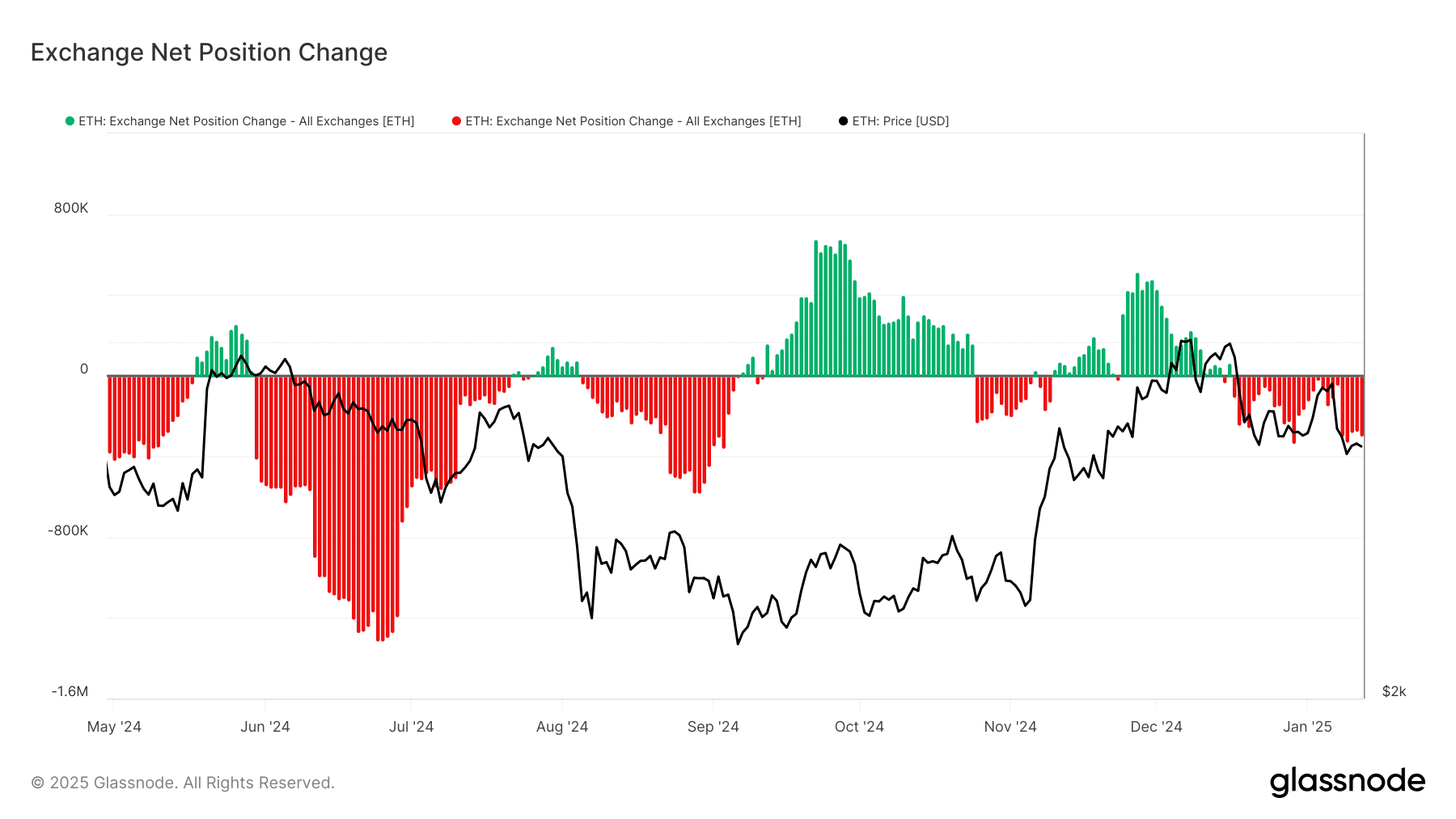

Exchange net positions show mixed signals

Exchange flow data highlighted contrasting patterns between Ethereum and Bitcoin throughout 2024. Ethereum saw its most significant outflows in July 2024, with approximately 1.6 million ETH leaving exchanges, followed by a notable accumulation phase in October when inflows peaked at 700,000 ETH.

In January 2025, Ethereum has seen negative net flows of roughly 400,000 ETH, indicating a return to withdrawal behavior.

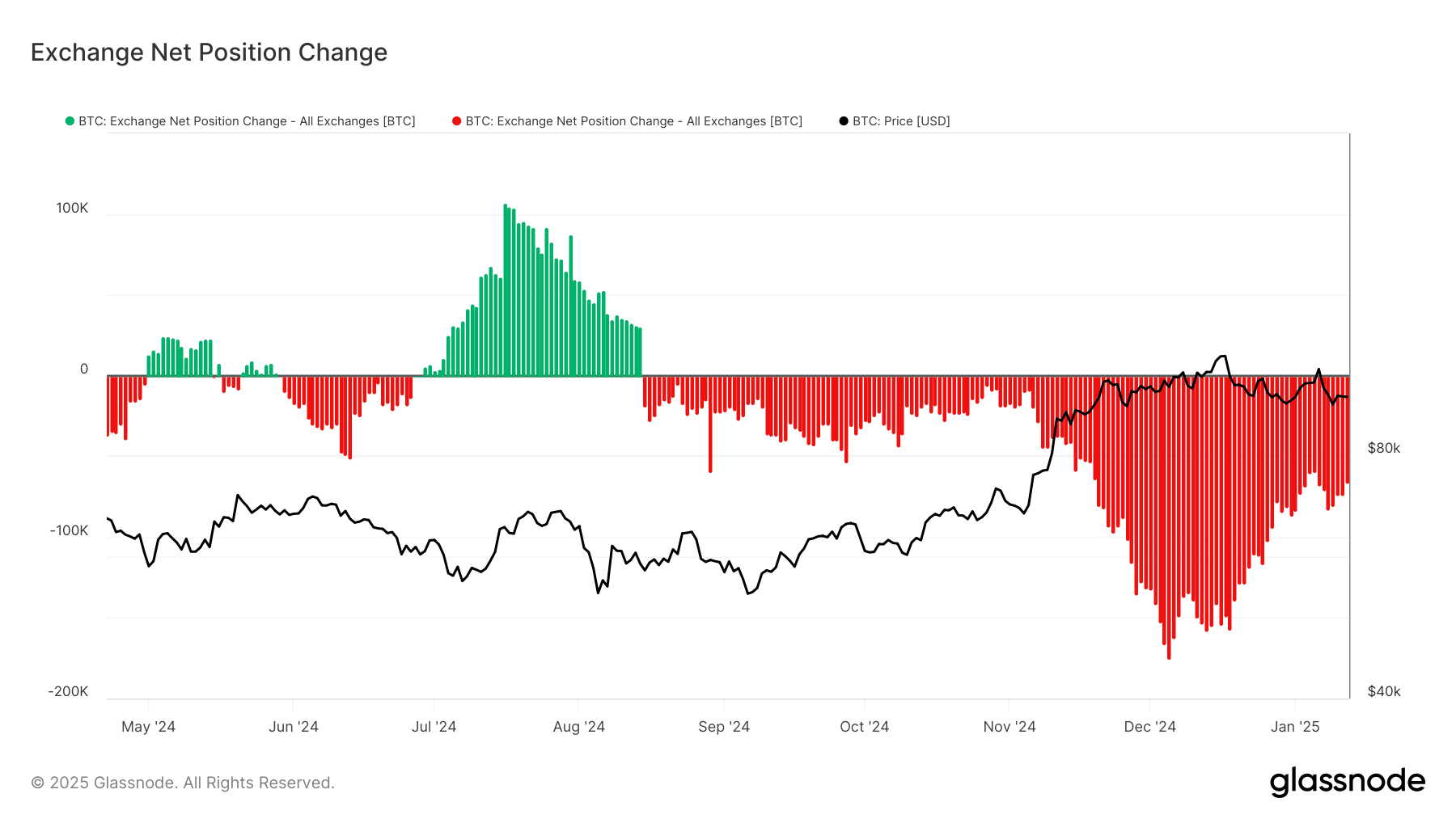

Bitcoin’s exchange positions presented a different narrative though.

August 2024 marked peak accumulation with net inflows of 100,000 BTC. However, December 2024 saw a dramatic shift as outflows intensified to nearly 200,000 BTC – The largest withdrawal volume in the observed period. This trend has persisted into early 2025, with sustained outflows averaging at 80,000 BTC.

Stablecoin reserves signal untapped potential

The stablecoin landscape has transformed significantly since March 2024, with total aggregate supply expanding from 16 billion to 48 billion USDT equivalent.

USDT maintains market dominance, growing from 16 billion to 32 billion, while USDC maintains a stable position between 4-5 billion throughout the period. The aggregate supply demonstrated particular strength in November 2024, surging from 24 billion to 40 billion – A sign of significant dry powder waiting on the sidelines.

Market realized value shows declining confidence

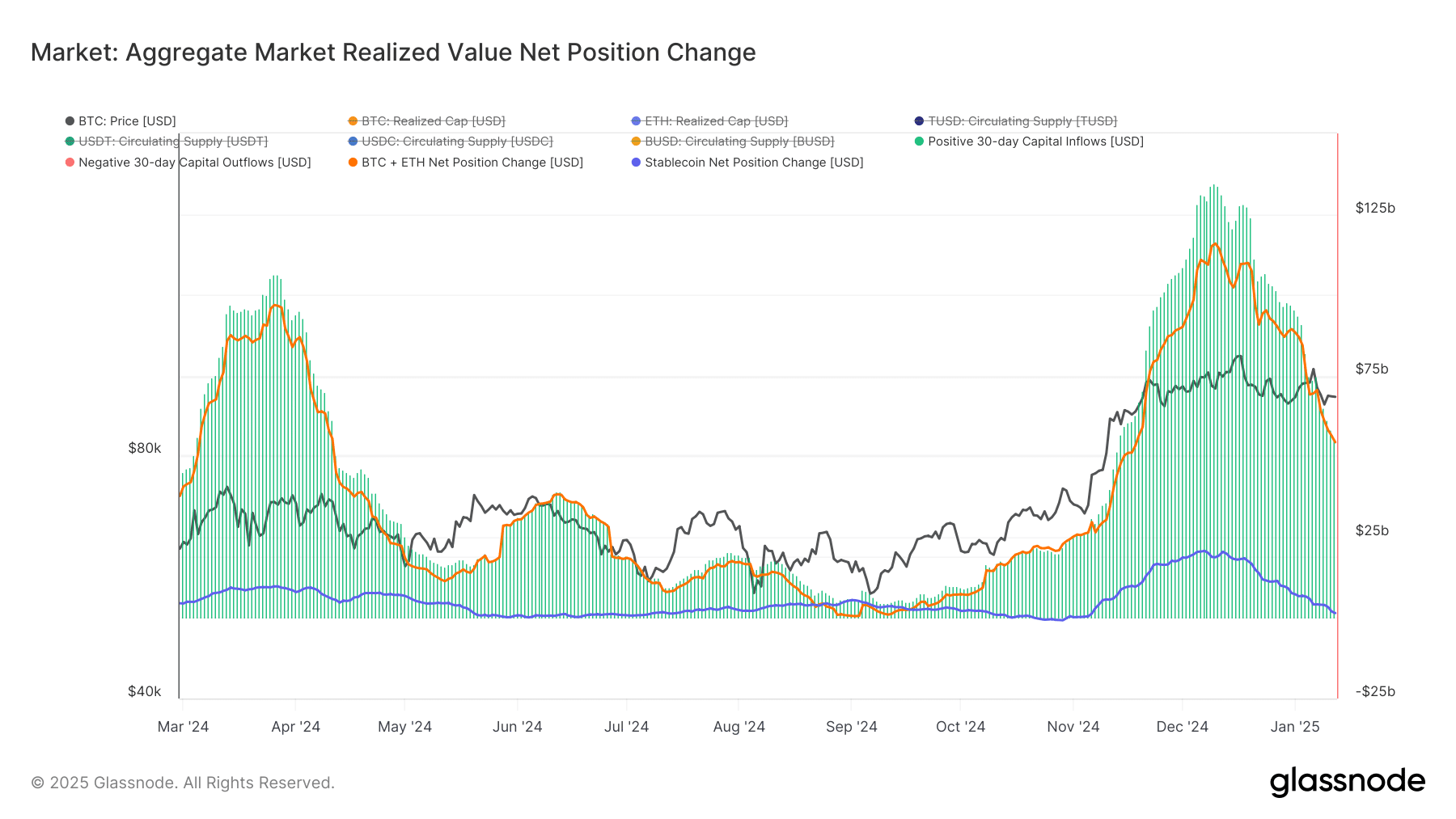

The market realized value demonstrated distinct phases throughout 2024, with capital flows hitting their zenith at $100 billion during March-April, before entering a sustained low period averaging $25 billion from May through September.

A sharp recovery followed in October-November, with inflows touching $125 billion before the latest decline to approximately $58 billion in early 2025.

The drop highlighted weakening liquidity and diminished appetite for risk, particularly following December’s robust market activity. This shift also reflected the broader sentiment across the cryptocurrency space, possibly due to macroeconomic uncertainty, deterring new investments.

Between fear and opportunity

While the current market conditions might appear bearish at first glance, historical patterns suggest that periods of extreme fear and low trading volume often precede significant market rebounds. The significant stablecoin reserves on exchanges, particularly the growth to 48 billion USDT equivalent, could provide the necessary fuel for a recovery once market sentiment improves.

However, risks remain. The sustained decline in trading volume and capital inflows could prolong market stagnation if confidence doesn’t return. The sharp reduction in realized value since December 2024, marking a 56.70% fall from its November peak, underscores the current market uncertainty.

The convergence of declining inflows, historic low trading volumes, and growing stablecoin reserves presents a complex market picture. The substantial withdrawal of Bitcoin from exchanges and Ethereum’s fluctuating patterns suggest varying strategies among different holder groups. Meanwhile, the accumulation of stablecoin reserves alludes to significant potential energy for future market movements.

As the market navigates through this period of reduced activity, the build-up of stable assets on exchanges might signal opportunities for those prepared to act when sentiment shifts. The key will be monitoring how these various metrics evolve in the coming weeks, from exchange flows to stablecoin supplies.