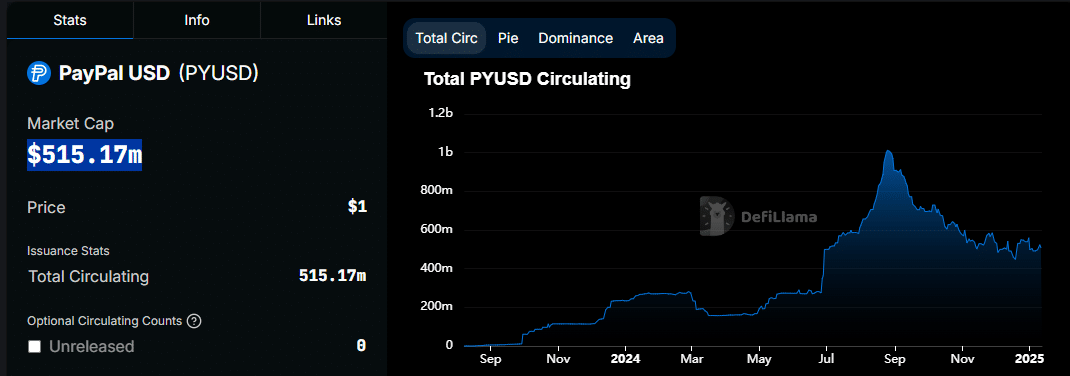

- PayPal USD marketcap is down considerably from its historic peak

- Despite recent recovery, it may not be enough in the long run

PayPal USD made a splash in the market in the second half of 2024 for multiple reasons. It was the first time that a traditional payment provider attempted to venture into Web3 in a mainstream way. It also marked a new dawn for tokenized assets.

PayPal USD’s expectations were high, but fast forward to the present and it appears that the tokenized assets narrative has been running out of steam. The initial excitement after it was launched on Solana was evidenced by its performance, with the same since having cooled down.

The PayPal USD marketcap peaked at $1.01 billion on 25 August. It has been declining gradually since then and even dropped below $500 million in December. PYUSD had a $515.17 million marketcap, at the time of writing.

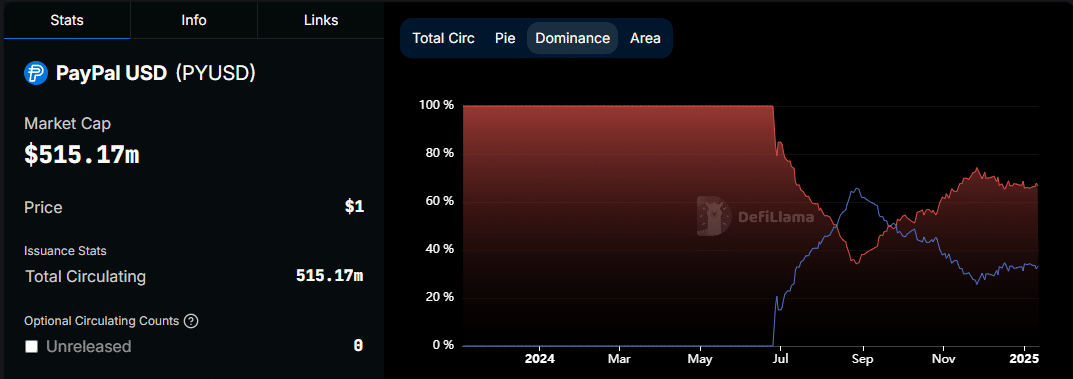

The dip in PayPal USD marketcap occurred around the same time that its dominance on Solana started declining.

Its initial excitement previously allowed PayPal USD’s marketcap dominance on Solana to outperform Ethereum. At its peak, the marketcap dominance on Solana was 65.79% on 29 August. Its dominance on the Solana blockchain bottomed out at 25.42% on 27 November.

The total PYUSD marketcap performance aligned with the Solana dominance. This finding confirmed that its utility on the Solana network was not sustained. In fact, Ethereum controlled 67.21% of the PayPal USD circulating supply, at press time.

What fueled the initial PayPal USD marketcap growth and what’s different now?

The PYUSD marketcap started declining as the crypto market started seeing robust demand. Prior to that, it rallied from 26 June to 30 August 2024. This was just before the period of market excitement. There were more stablecoin holders back then and the PayPal stablecoin offered attractive yields on Solana.

However, with with the market turning extremely bullish, yield miners may have pulled out their liquidity and pumped it into crypto. The fact that PayPal USD was still relatively new meant it had also not managed to procure sustainable transaction volumes.

While the aforementioned may explain why the PayPal-related stablecoin has been losing liquidity, it could be on the edge of speculation. In fact, the stablecoin is still enjoying significant on-chain activity. For example – Its circulating supply on both networks was up considerably in the last 30 days.

For example, it was up by 5.31% on Ethereum and 4.12% on Solana in the last 4 weeks. This seemed to confirm that the stablecoin is still enjoying some demand. However, it is only limited to the two networks and this has been a hindrance as far as adoption is concerned.