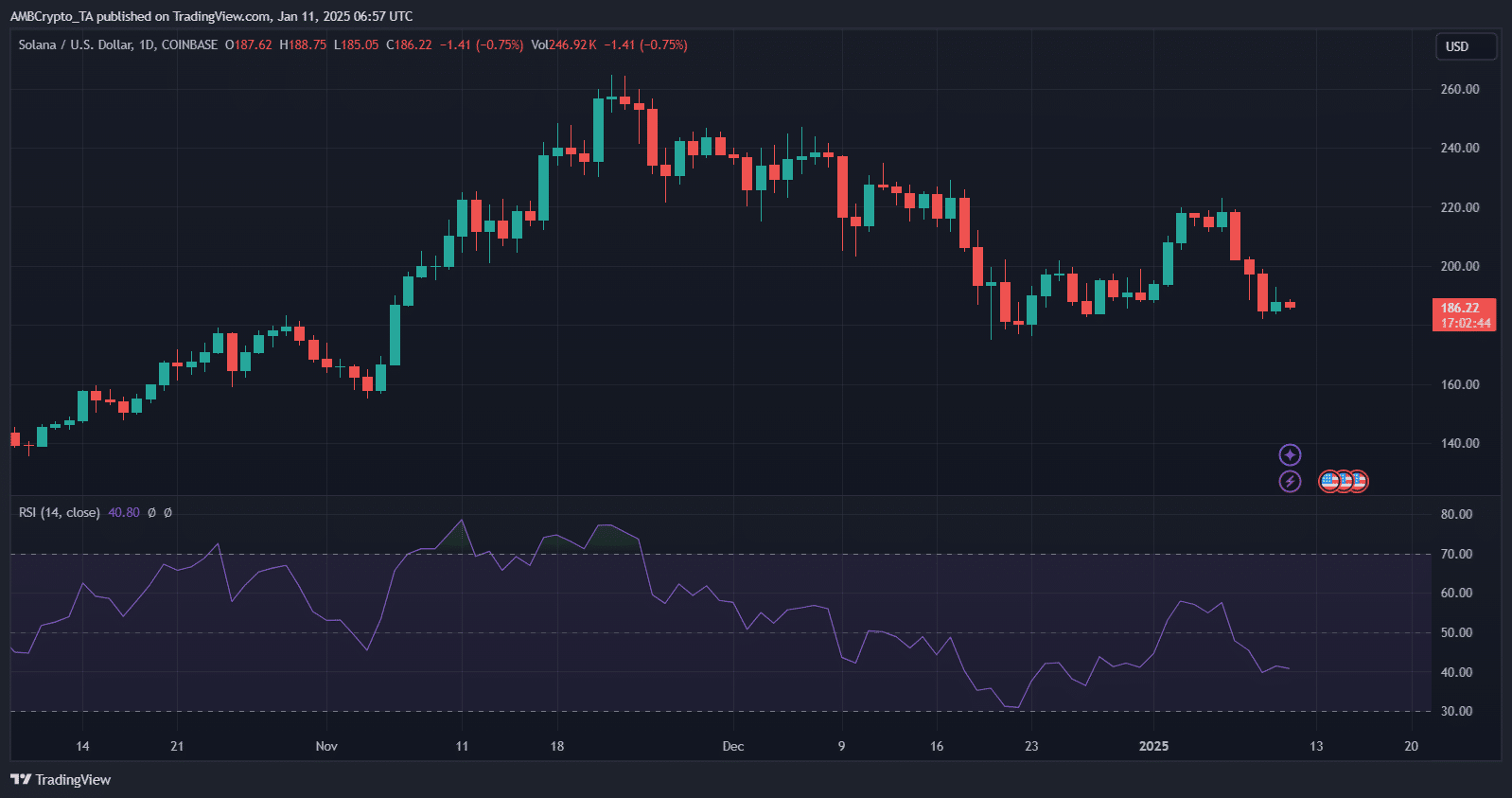

- Solana’s $180 support level is crucial for its price action in 2025

- Social volume and decreasing active addresses may signal further losses for Solana

As we kick off 2025, the crypto market is experiencing heightened volatility, with various assets testing critical support levels. One such asset under close scrutiny is Solana [SOL], which is hovering around the key price point of $180. This threshold has emerged as a pivotal level for traders, as the market braces for potential price swings.

Social volume – A signal for Solana’s price moves

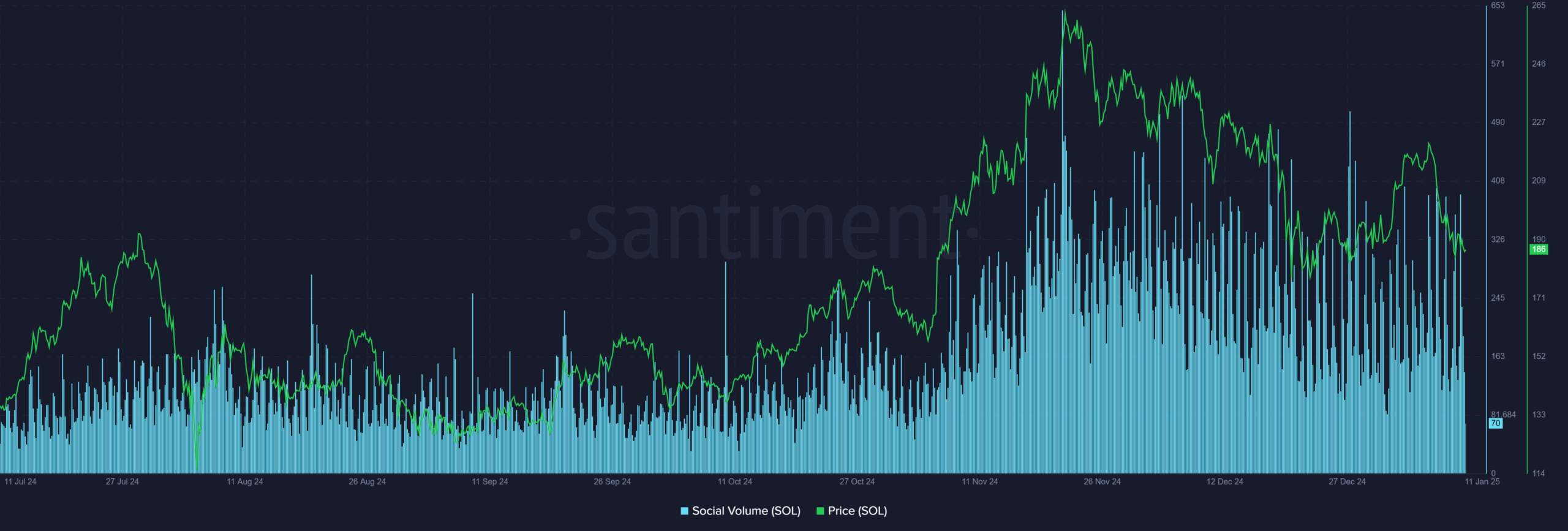

Solana’s social volume has shown a noticeable correlation with its price fluctuations, as evidenced by the accompanying chart. Spikes in social activity often precede significant price volatility.

Over the past few months, heightened social chatter around Solana has coincided with upward price momentum – Alluding to a potential sentiment-driven rally.

However, as social volume remains elevated, it can also act as a double-edged sword, signaling overextended market enthusiasm or the potential for a reversal.

Traders closely monitoring these trends should be wary of sharp sentiment shifts, especially if Solana fails to hold above $180. Sustained hikes in social engagement without price validation might point to weakening support and the risk of further declines.

Decreasing active addresses

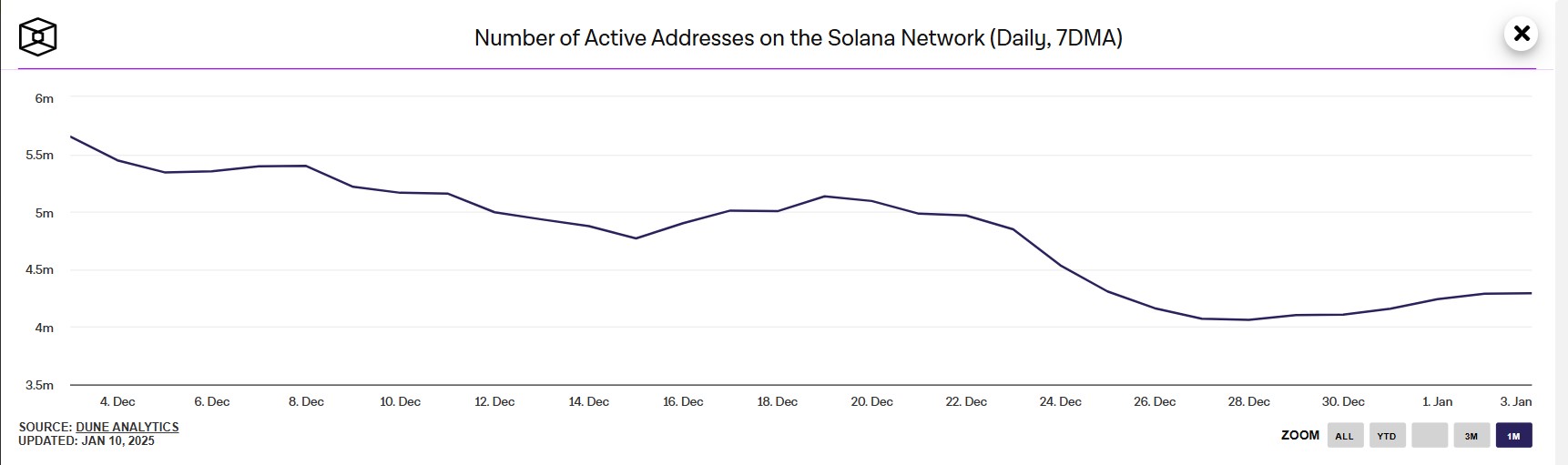

The recent downturn in Solana’s active addresses revealed a troubling trend though. From early December to late December, active addresses fell sharply, dropping from nearly 6 million to just above 3.5 million – A decline of over 40%.

While the metric did see modest recovery towards the start of January, it remains far from its previous highs, signaling reduced network activity and engagement.

This decline in active participation raises concerns about diminishing utility and user confidence. Historically, sharp drops in active addresses often precede downward price pressure, reflecting waning demand.

For Solana, sustaining price levels near $180 may hinge on reversing this trend. Without a significant uptick in on-chain activity, the risk of further price erosion looms large.

Read Solana’s [SOL] Price Prediction 2025–2026