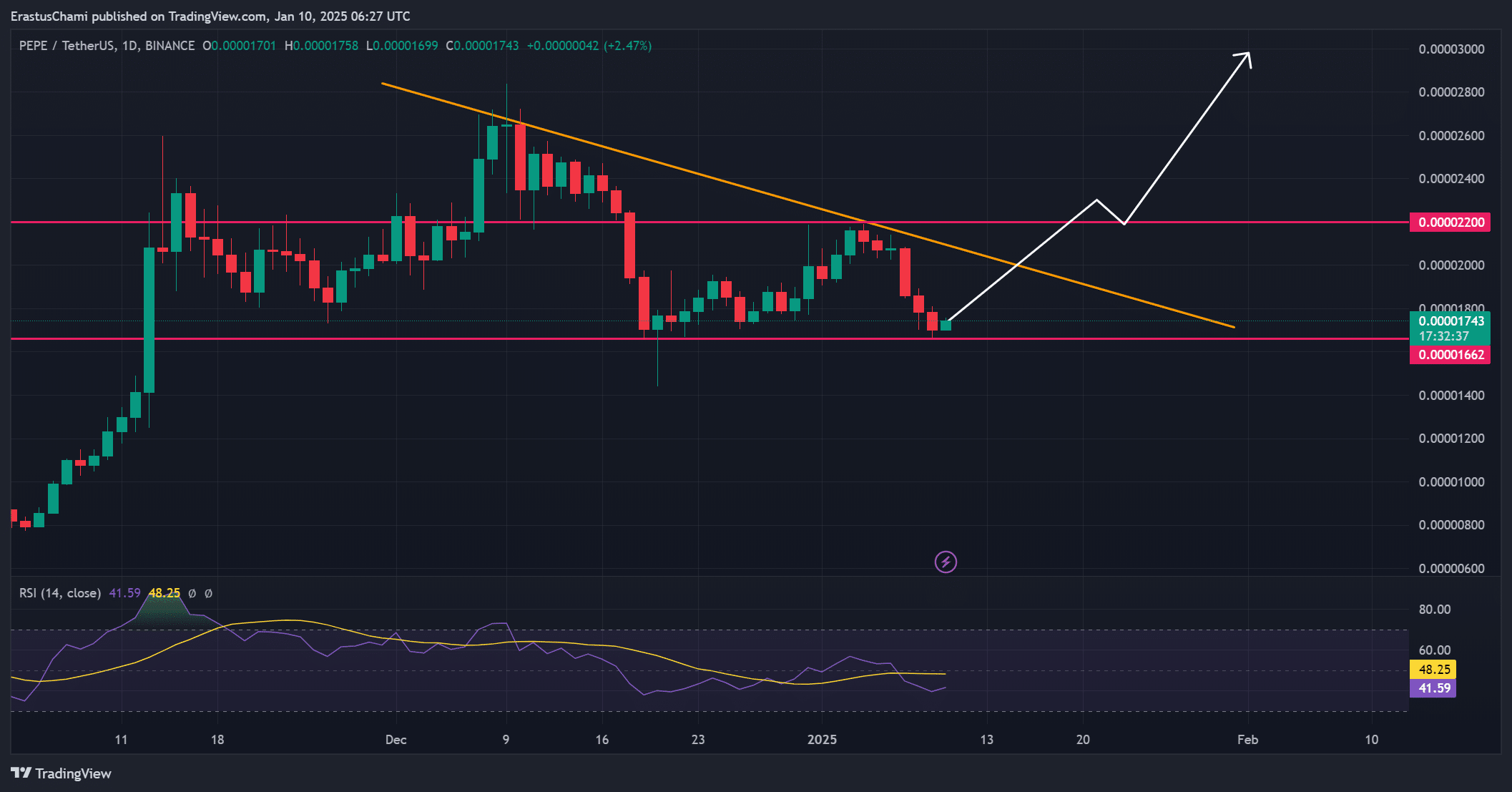

- PEPE seemed to be trading near its support with low RSI as it faces key resistance at $0.00002200

- Retail-driven transactions and liquidation imbalances hinted at potential short-term volatility and recovery

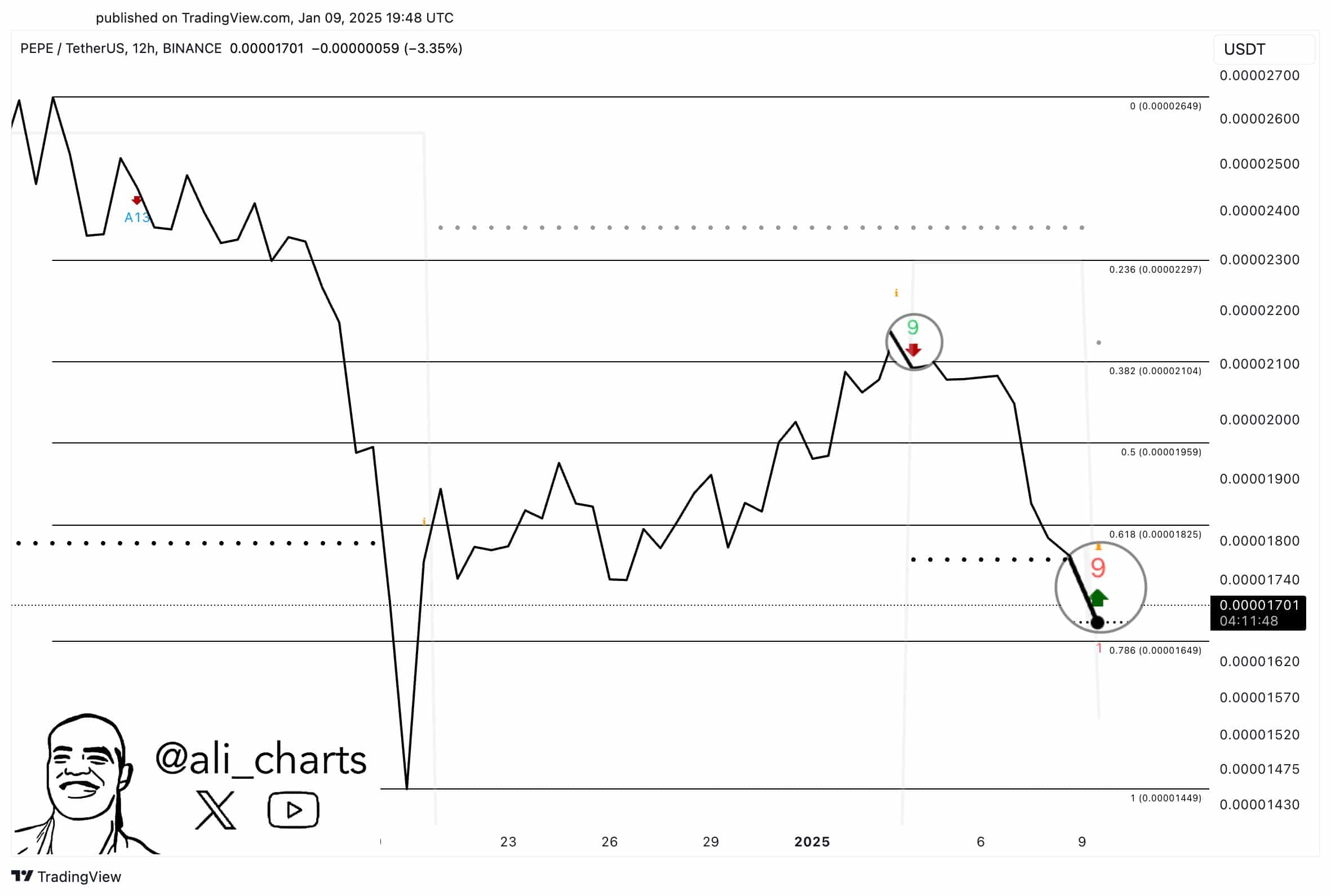

On 04 January Pepe [PEPE] faced a 20% price correction after the TD Sequential indicator flashed a sell signal on its 12-hour chart. However, the same indicator is now presenting a buy signal, sparking optimism for a potential recovery.

At press time, PEPE was trading at $0.00001745, following a 1.89% fall in the last 24 hours. Consequently, traders are closely watching key resistance levels to determine whether PEPE can regain bullish momentum and avoid further consolidation on the charts.

Source: X/Ali

Can PEPE overcome resistance and reignite momentum?

PEPE seemed to be holding above its crucial $0.00001662 support level – Pivotal for any potential upward movement. Additionally, the next major resistance lay at $0.00002200, which traders must monitor closely. The Relative Strength Index (RSI) was at 41.59, suggesting that the token was in an oversold condition.

Therefore, buyers might see this as an opportunity to accumulate, but breaking the descending trendline remains critical to confirm bullish momentum. However, failure to its maintain support could trigger another downward leg.

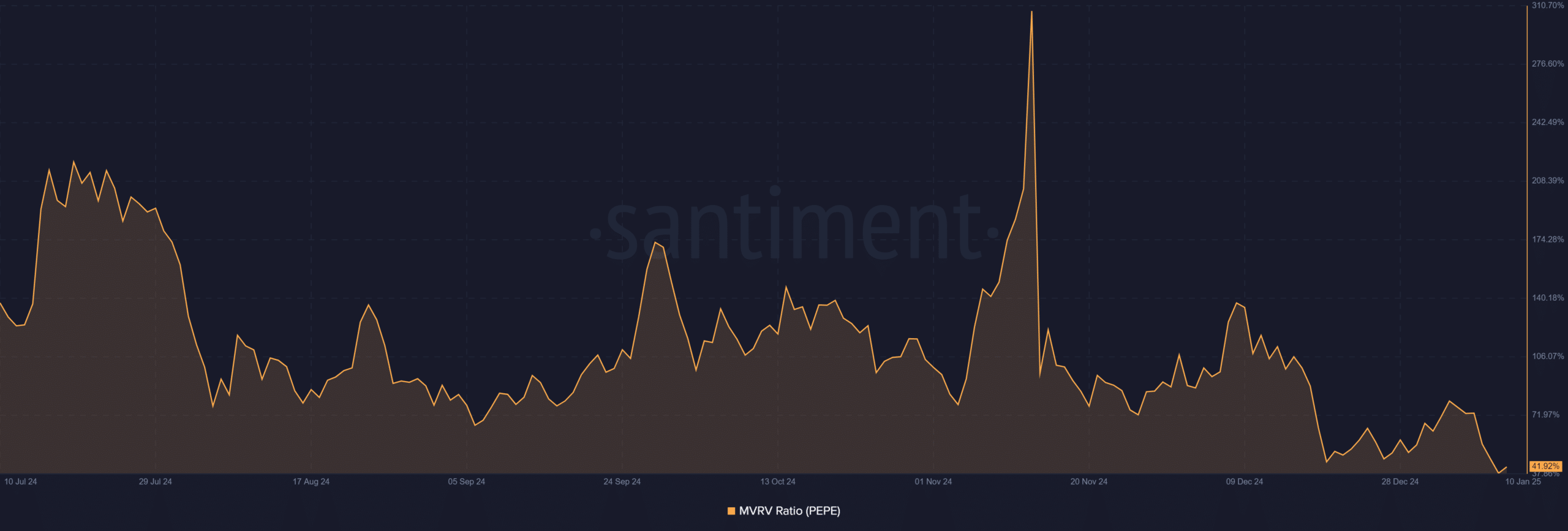

Is the low MVRV ratio signaling a buying opportunity?

Additionally, PEPE’s Market Value to Realized Value (MVRV) ratio dropped to 41.92%, signaling that the token may be significantly undervalued. This level suggests that most holders are at a loss, potentially creating a favorable buying opportunity for new investors.

However, this undervaluation alone might not be sufficient to drive a rally, unless accompanied by stronger market confidence. Consequently, a hike in buying pressure could quickly push PEPE higher, but sustained momentum is necessary to solidify any gains.

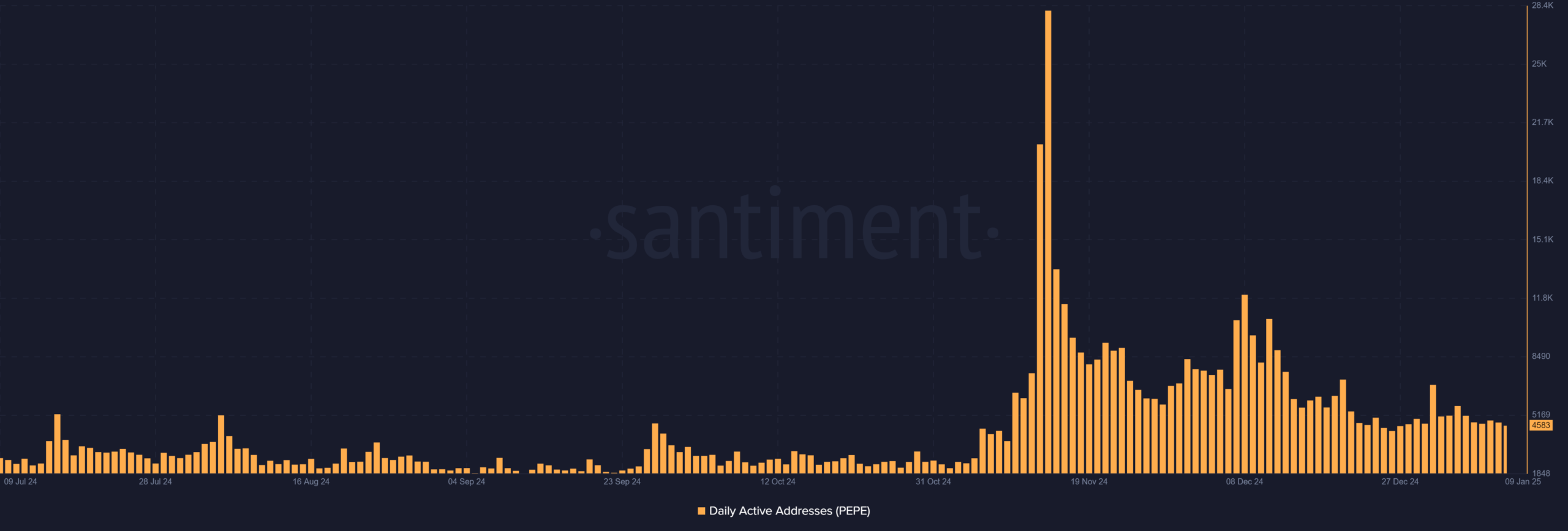

Active addresses indicate limited retail activity

Daily active addresses remained moderate at 4,583, showing steady but unremarkable network engagement. This number alluded to limited activity from retail traders, which could dampen short-term price growth.

Also, a surge in active addresses would be necessary to reignite interest and drive additional demand. However, until participation improves, PEPE’s price action may remain constrained within its press time range.

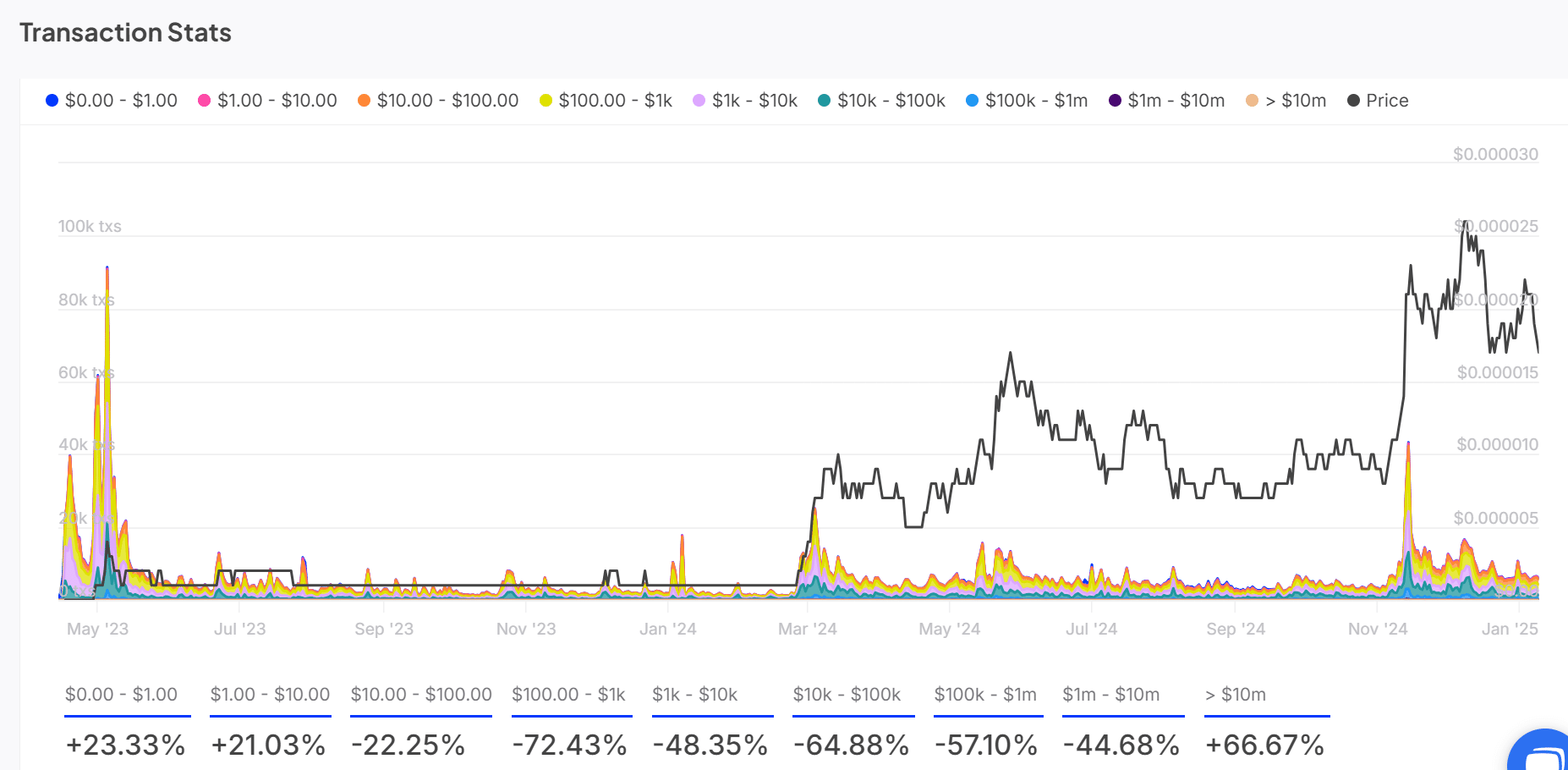

PEPE transaction trends highlight retail activity

Interestingly, transactions in the $10-$100 range increased by 66.67%, suggesting heightened activity among smaller investors. Additionally, this surge highlighted growing interest from retail participants, even as higher-value transactions remain subdued.

Consequently, this retail-driven activity could provide short-term support for PEPE’s price. However, stronger participation from larger investors will be necessary to sustain a meaningful rally.

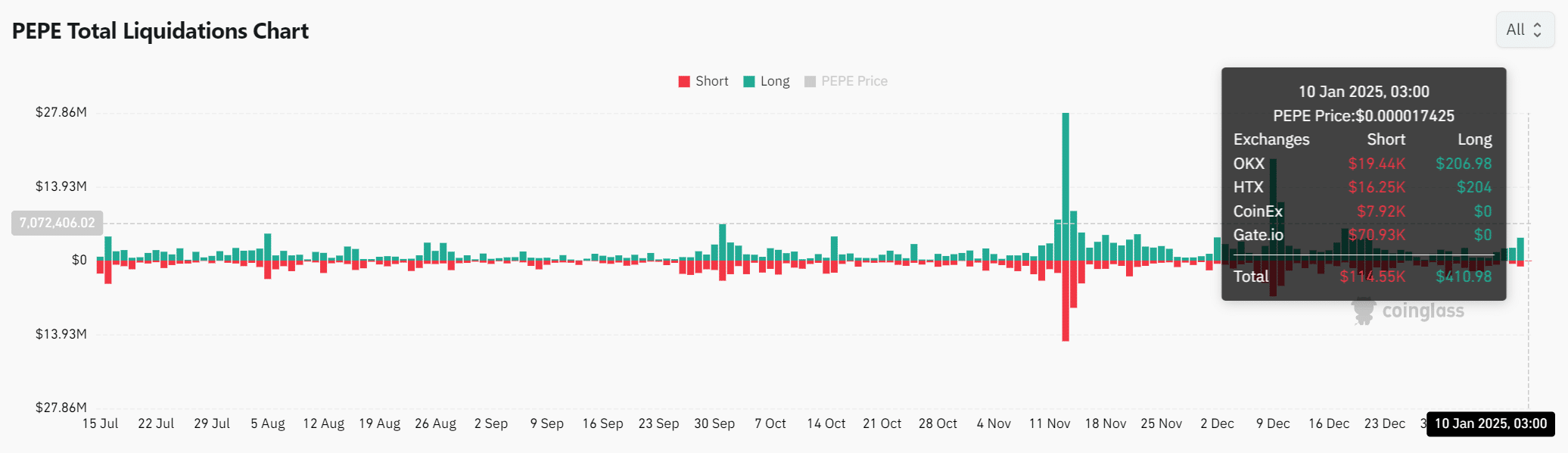

Liquidation data reveals market imbalances

The memecoin recorded $410.98k in long liquidations, compared to $114.55k in shorts – Highlighting a significant imbalance in market positioning. This means that more traders have been betting on price hikes, but over-leveraged positions could result in heightened volatility.

Finally, as short-sellers cover their positions, PEPE might see a temporary upward push. However, sustained momentum will depend on broader market conditions and buying pressure.

Read Pepe’s [PEPE] Price Prediction 2025–2026

At press time, PEPE’s buy signal, undervaluation, and growing smaller transactions hinted at a possible recovery. However, key metrics like daily activity and resistance levels need to show stronger performance.

Therefore, breaking $0.00002200 could confirm bullish sentiment, while failing to hold support at $0.00001662 may lead to further consolidation. For now, PEPE’s recovery hinges on increasing demand and market confidence.