- Altcoin’s metrics revealed that ETH slipped below its possible market bottom on the charts

- A fall under $2.4k could push ETH down to $2.3k

Like most cryptos in the market, Ethereum [ETH] also fell victim to price corrections over the last 24 hours. In fact, ETH’s latest dip pushed the token towards a crucial support level on the charts.

In the vent of a successful test, what are the chances ETH will return to hit $3k again?

Ethereum’s latest support

Ethereum’s losses over the last 24 hours were over 5%, with the altcoin trading just above $2.5k at press time. In the meantime, Ali, a popular crypto analyst, shared a tweet revealing an important development. According to the same, ETH had previously successfully held on to its support at $2.4k. However, the most-recent price decline might once again push the token towards that level.

Here, it is also interesting to note that ETH has been moving inside an upward channel pattern since 2021. The token has tested the pattern multiple times. If history repeats itself, then it won’t be a long shot to expect the king of altcoins to move towards $3k in the coming days.

In fact, if things fall in place, then ETH might as well touch $4k in the coming months.

Odds of ETH touching $3k

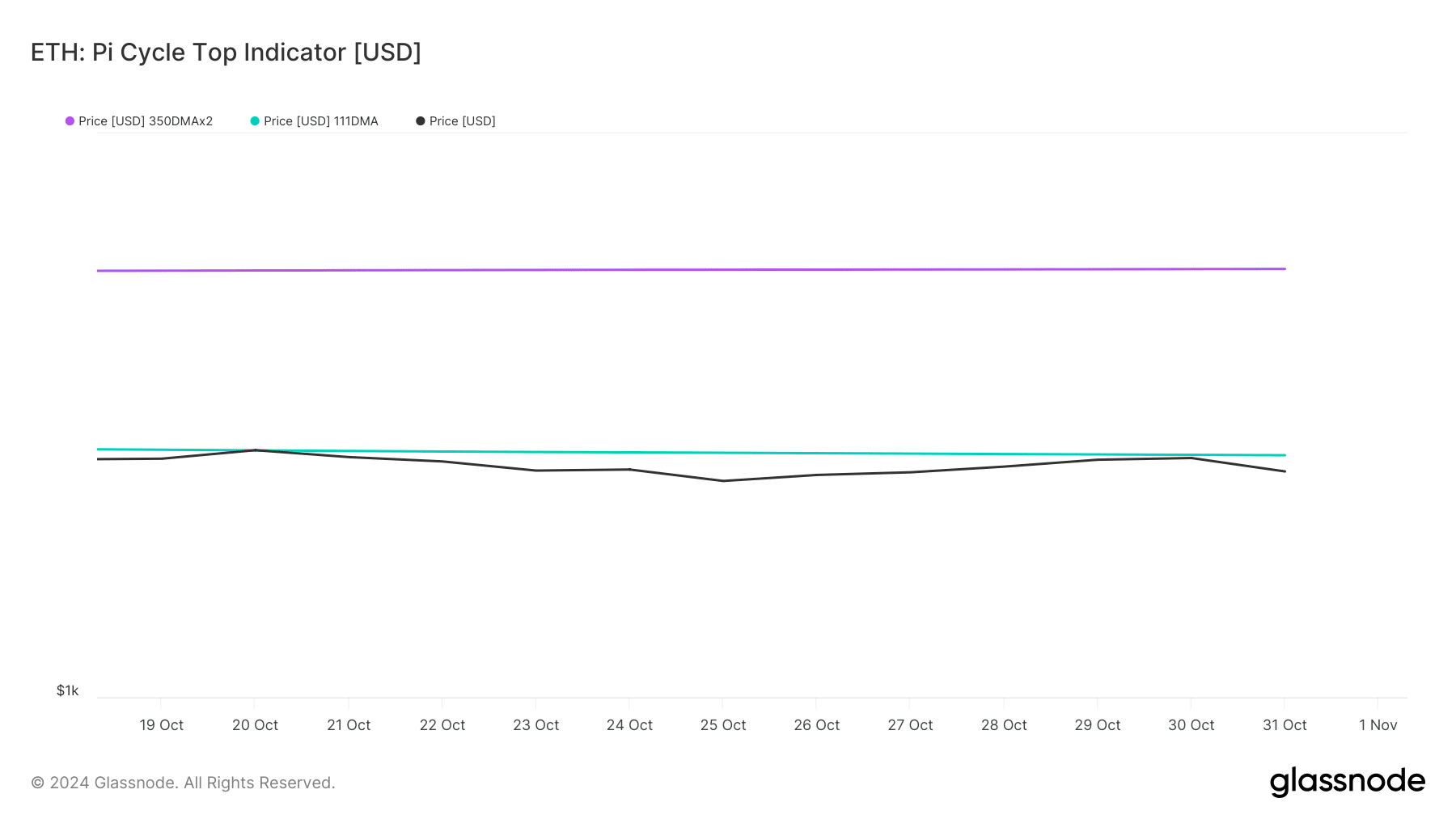

AMBCrypto then checked Ethereum’s on-chain data to find out whether the token can start moving towards $3k anytime soon. According to our analysis of Glassnode’s data, ETH’s price slipped under its possible market bottom of $2.58k.

The Pi Cycle Top indicator pointed out that ETH’s possible market top could be at $5.7k. Therefore, expecting ETH to hit $3k won’t be too ambitious for investors.

Our assessment of CryptoQuant’s data also pointed out quite a few bullish metrics. For instance, ETH’s exchange reserve dropped. This meant that buying pressure on ETH was high, which often results in price upticks.

On the derivatives market front, everything seemed optimistic. ETH’s funding rate suggested that long position traders were dominant and were willing to pay short traders. On top of that, Ethereum’s taker buy/sell ratio turned green. This indicated that buying sentiment was dominant among derivatives investors.

Finally, AMBCrypto’s analysis of CFGI.io’s data suggested that Ethereum’s fear and greed index was in a “fear” position. Whenever the metric hits this level, it indicates that the chances of a bullish trend reversal are high.

Read Ethereum’s [ETH] Price Prediction 2024–2025

However, if the bearish trend persists, then investors might soon see ETH test its $2.4k support. An unsuccessful test could push the token further down to $2.3k in the following days.