- Bitcoin’s whitepaper was released by pseudonymous Satoshi Nakamoto in 2008

- Whitepaper has had a huge impact on world economy and facilitated a shift in paradigms

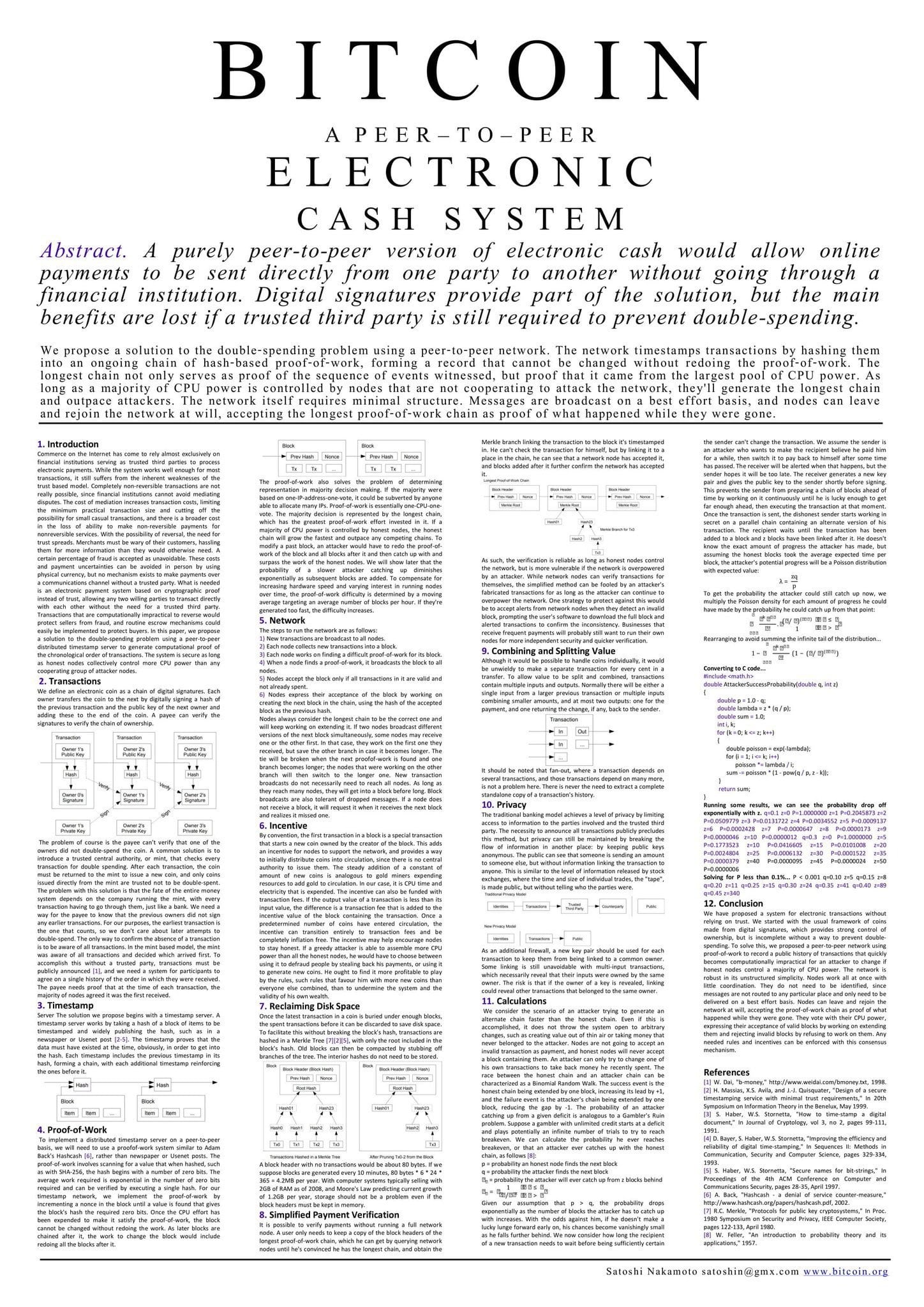

Sixteen years ago, Bitcoin’s (BTC) whitepaper, published by the pseudonymous creator Satoshi Nakamoto, introduced the world to a revolutionary concept – A decentralized, peer-to-peer digital currency.

This groundbreaking document laid the foundation for blockchain technology and sparked the creation of Bitcoin (BTC), the first cryptocurrency.

Bitcoin’s whitepaper didn’t just propose a new type of money; it introduced a vision of financial freedom, allowing people to control their money outside traditional banking systems.

Privacy and ownership

Since its inception, Bitcoin has reshaped the financial landscape by promoting privacy and ownership.

Unlike traditional banking where institutions control funds, BTC has empowered individuals to own and manage their assets directly, without intermediaries.

This shift has driven a financial sovereignty revolution, inspiring people worldwide to explore the possibilities of decentralized money.

The idea of self-custody and privacy resonated with users, creating a movement towards a more transparent and accessible financial ecosystem.

Bitcoin laid the foundation for crypto and DeFi

Beyond privacy, Bitcoin’s whitepaper laid the groundwork for the entire cryptocurrency ecosystem.

Bitcoin’s success encouraged the development of over 20,000 cryptocurrencies, each exploring new applications of blockchain technology.

Bitcoin, often called “digital gold,” remains the most valuable crypto asset and has become a symbol of this digital economic shift. Its impact goes beyond finance, sparking industries focused on blockchain applications, from decentralized finance (DeFi) to tokenized assets.

Bitcoin’s influence also catalyzed the DeFi revolution, where traditional financial services like lending, borrowing, and trading occur without intermediaries. Built on blockchain, DeFi has grown into a multi-billion-dollar sector, attracting both individual users and major institutions. Leading asset management companies like Franklin Templeton have even begun tokenizing assets, further bridging traditional finance with blockchain innovation.

DeFi’s expansion reflects Bitcoin’s core principles, offering a decentralized alternative to conventional finance and fostering broader economic participation.

The release of Bitcoin’s whitepaper not only introduced digital currency, but also initiated a shift in economic and financial paradigms. As more people adopt BTC and cryptocurrencies, financial models are evolving to embrace digital assets.

Bitcoin’s reputation as a “store of value” asset has continued to grow too, positioning it as a hedge against inflation and economic instability.

This perspective has drawn significant interest from institutions. Especially since they view Bitcoin and other cryptocurrencies as essential components of modern investment portfolios.

Looking ahead…

Going forward, Bitcoin’s foundational role could drive further transformations in the global financial system.

Its whitepaper has established a legacy of decentralization, privacy, and financial autonomy, inspiring new generations to reimagine economic structures.

As blockchain technology matures and integrates further into everyday finance, BTC could continue shaping the future of digital money and decentralized finance.

In essence, Bitcoin’s whitepaper laid the first stone in a new economic path, with BTC at the forefront of a financial revolution.