Bitcoin as a market anchor

Bitcoin’s dominance, driven by institutional interest, regulatory clarity, and macroeconomic factors, continues to shape the broader market landscape.

As Bitcoin works to approach the $100,000 mark after a steep fall, its influence over altcoins is undeniable, often acting as a barometer for market health.

However, despite its strength, Bitcoin faces short-term volatility as it consolidates. This dynamic opens the door for select altcoins which exhibit unique growth potential and could capitalize on market shifts.

These altcoins, supported by their respective ecosystems, may soon outpace Bitcoin’s performance.

Market dynamics favor altcoins

While Bitcoin’s trading volume remains substantial, altcoins like XRP and SOL are capturing increasing attention due to their heightened activity on exchanges.

XRP’s robust liquidity, boosted by ongoing adoption in cross-border payments, and SOL’s growing appeal position them as strong contenders.

Historically, altcoins have displayed sharper price movements compared to Bitcoin during bullish trends, often delivering outsized returns.

As Bitcoin’s ascent toward $100,000 slows amid consolidation, the trading momentum of XRP and SOL may allow them to outperform the market leader, leveraging lower market capitalizations and increasing investor interest to drive higher percentage gains.

SOL and XRP poised for strong growth in 2025?

In October, Solana’s network activity surged, recording over 120 million active addresses – a 42% increase from September – driven by heightened meme coin trading and DeFi engagement.

This growth enabled Solana to surpass Ethereum in user engagement, with its real economic value reaching 111% of Ethereum’s during the same period.

In contrast, XRP’s network activity remained relatively stable, with its growth largely dependent on regulatory developments and institutional adoption.

However, with recent regulatory clarity, XRP could be poised for considerable growth.

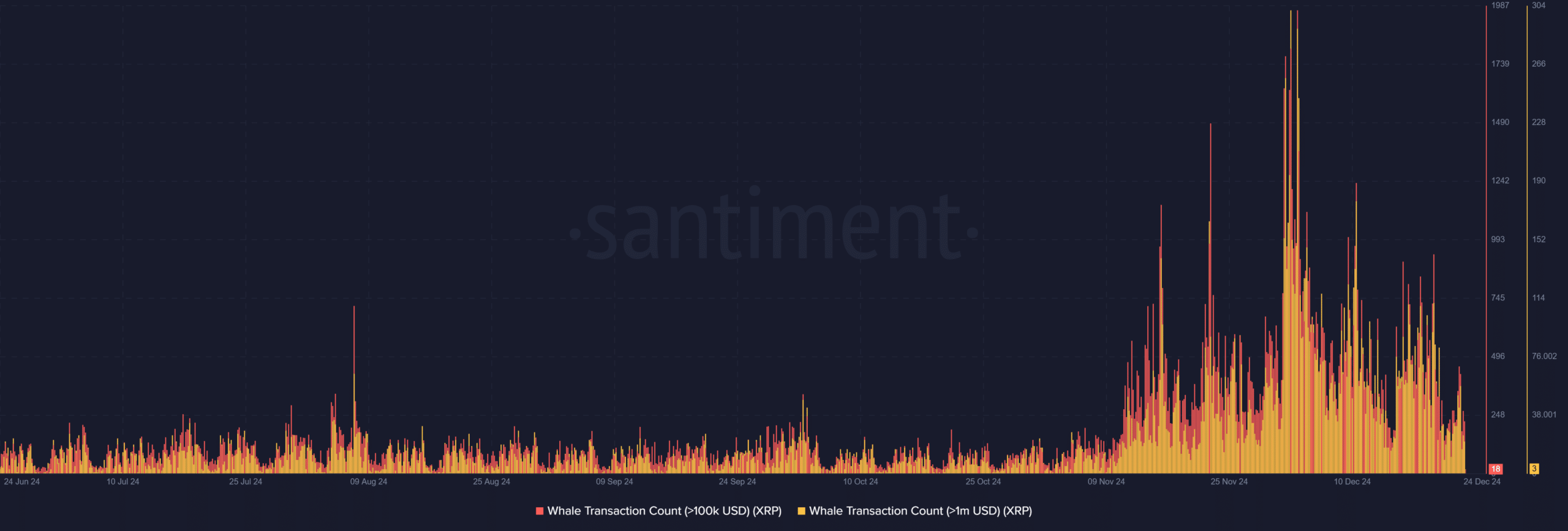

Recent whale activity highlights a notable surge in high-value transactions for XRP and SOL.

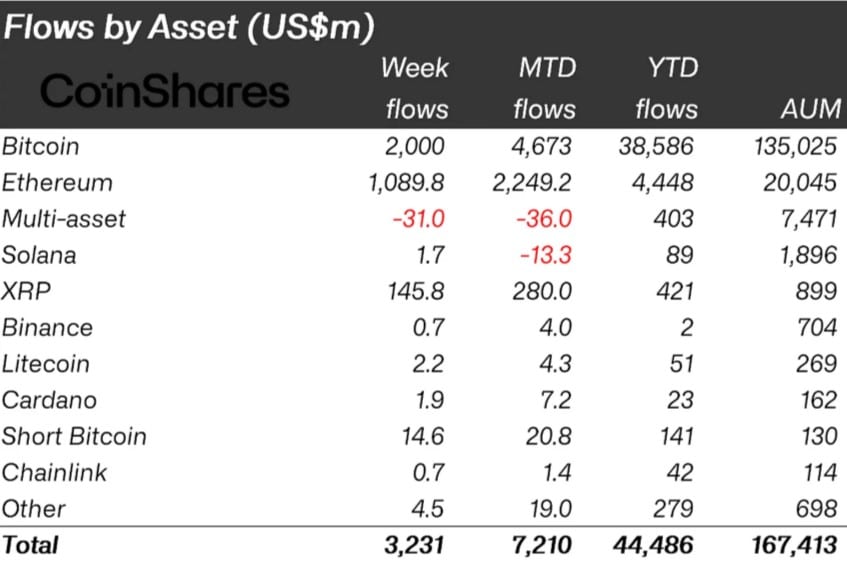

XRP’s whale transactions have increased significantly, signaling rising institutional interest and liquidity. Similarly, according to Coinshares data, Solana has seen recent robust whale accumulation of about $1.7 million.

The uptick in large-scale trades shows growing confidence in these altcoins. Their lower market caps compared to Bitcoin signal potential outperformance in January 2025.

XRP and SOL could capitalize on shifting market dynamics and investor diversification.

Read XRP’s Price Prediction 2024–2025

The case for altcoin outperformance of BTC in 2025

Altcoins historically outperform Bitcoin during bullish market phases due to their lower market capitalizations and greater price volatility.

Inflows into altcoins are rising, with $3.2 billion in weekly fund flows spread across non-Bitcoin assets in late 2024, indicating growing investor confidence.

Additionally, increased whale activity across altcoin networks suggests renewed accumulation by large investors.

When Bitcoin consolidates near psychological resistance levels like $100,000, altcoins would benefit from speculative interest and technological adoption, driving higher returns.

With diverse utilities – from DeFi to cross-border payments – altcoins may well be positioned to capitalize on evolving market narratives and outperform Bitcoin in the new year.