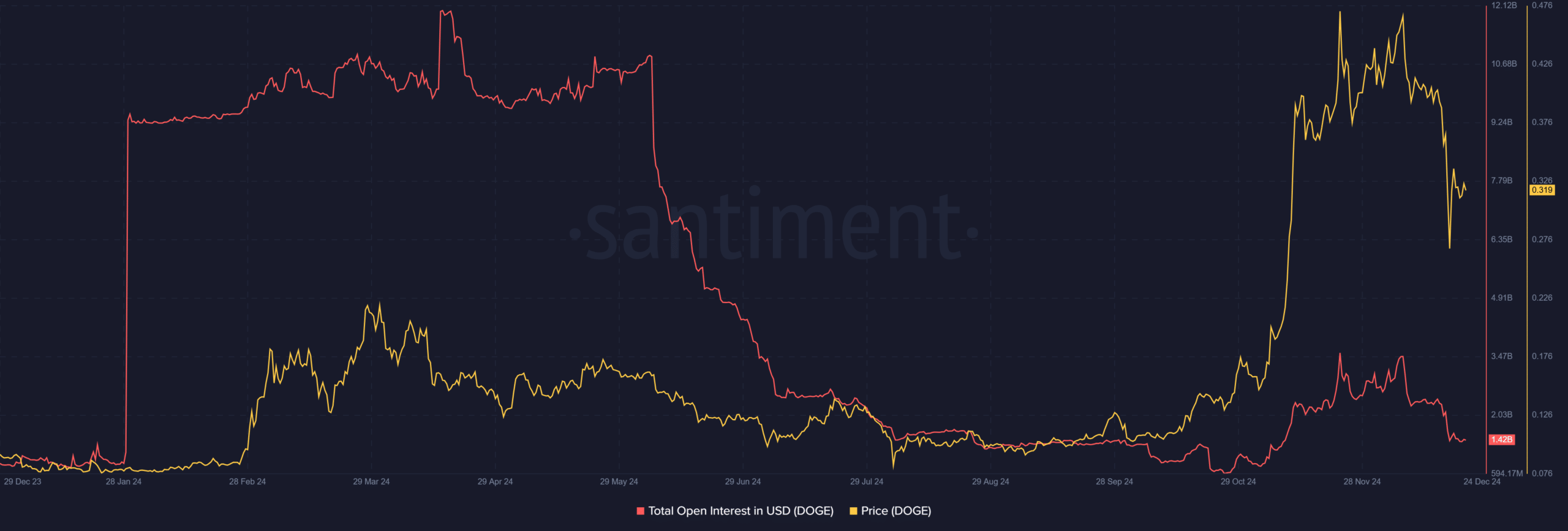

Dogecoin’s open interest has plummeted to $1.42 billion, a stark contrast to its April peak of $12 billion. A sustained drop in OI, particularly during DOGE’s recent price decline to $0.32, points to traders unwinding positions amid reduced optimism.

This bearish trend in OI often indicates waning confidence in short-term price recovery.

Coupled with a 20% drop in DOGE’s price over the past week, the shrinking OI suggests traders are cautious about opening new positions, signaling potential for further correction unless market sentiment reverses.

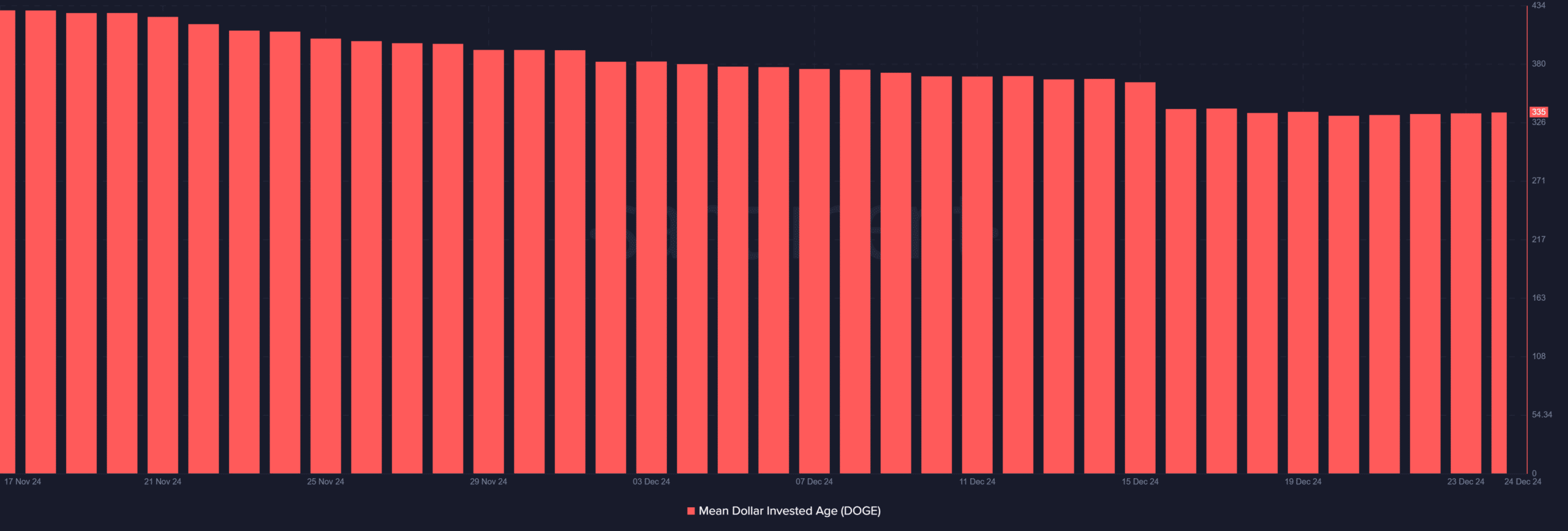

MDIA signals stagnation and cautious sentiment

The MDIA indicates that Dogecoin holders are increasingly opting to hold rather than trade their assets.

MDIA, which tracks the average age of coins on a blockchain weighted by purchase price, has steadily risen to 335 days. This trend suggests long-term holders are not actively trading or reallocating their assets, pointing to stagnation within the market.

Historically, a rising MDIA has correlated with reduced liquidity and lower demand, often seen as a bearish signal.

If this upward trajectory persists, it underscores a lack of fresh capital or speculative activity in the DOGE market, aligning with its recent price declines. This supports the narrative of cautious sentiment dominating Dogecoin’s short-term outlook.

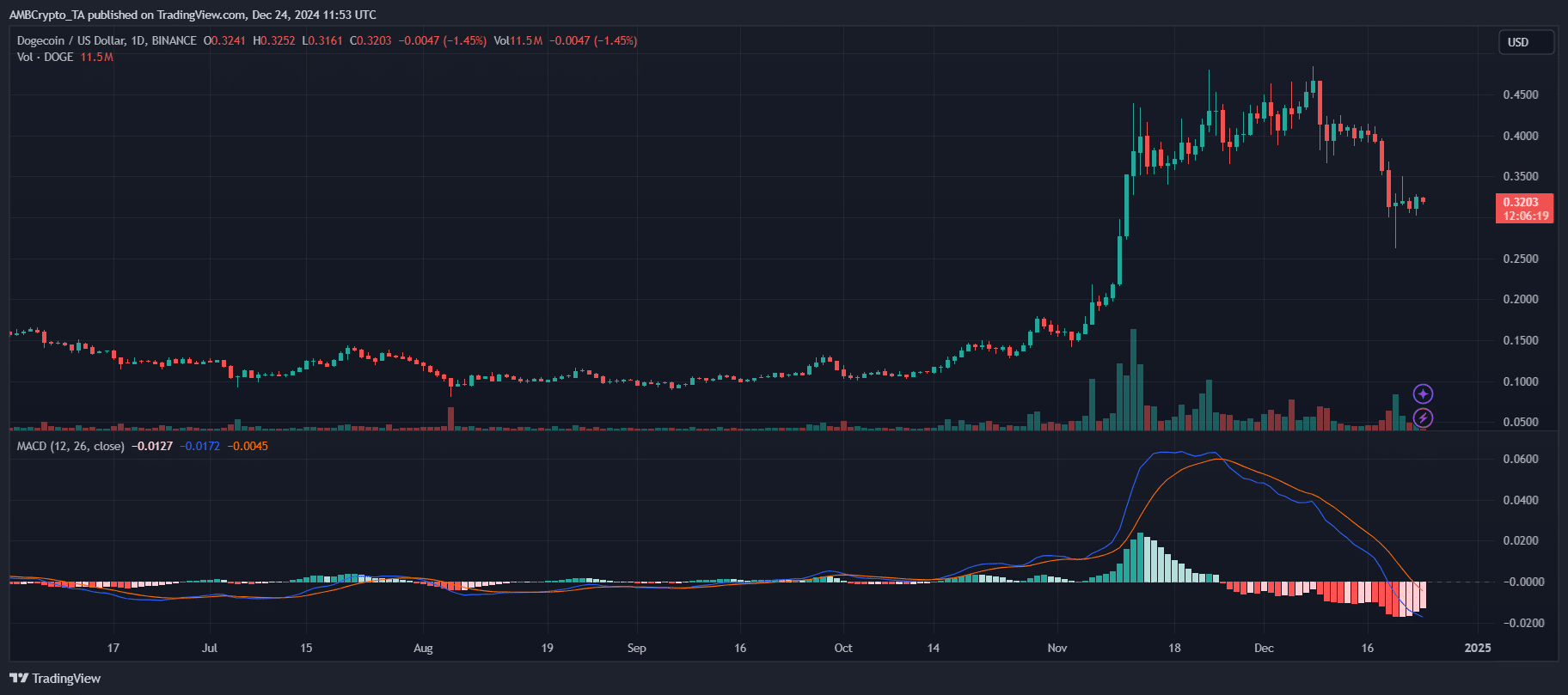

On the daily chart, Dogecoin is struggling to reclaim critical support levels following its recent downturn.

The price has dropped below the $0.35 threshold, which previously acted as a significant support level, suggesting that bearish momentum continues to dominate.

The MACD indicator confirms this bearish outlook. At press time, the MACD line is positioned in negative territory, reflecting downward momentum. The histogram shows fading bearish pressure, but until a clear bullish crossover occurs, recovery prospects remain limited.