- Toncoin Sharpe ratio shows a transitions to a recovery phase.

- Ton has surged by 3.41% over the past day after 4 consecutive days of uptrend.

After hitting a monthly low of $4.7, Toncoin [TON] shows signs of recovery. Over the past four days, Ton has experienced sustained gains, hitting a high of $5.66.

In fact, as of this writing, Toncoin was trading at $5.64. This marked a 3.41% increase on daily charts.

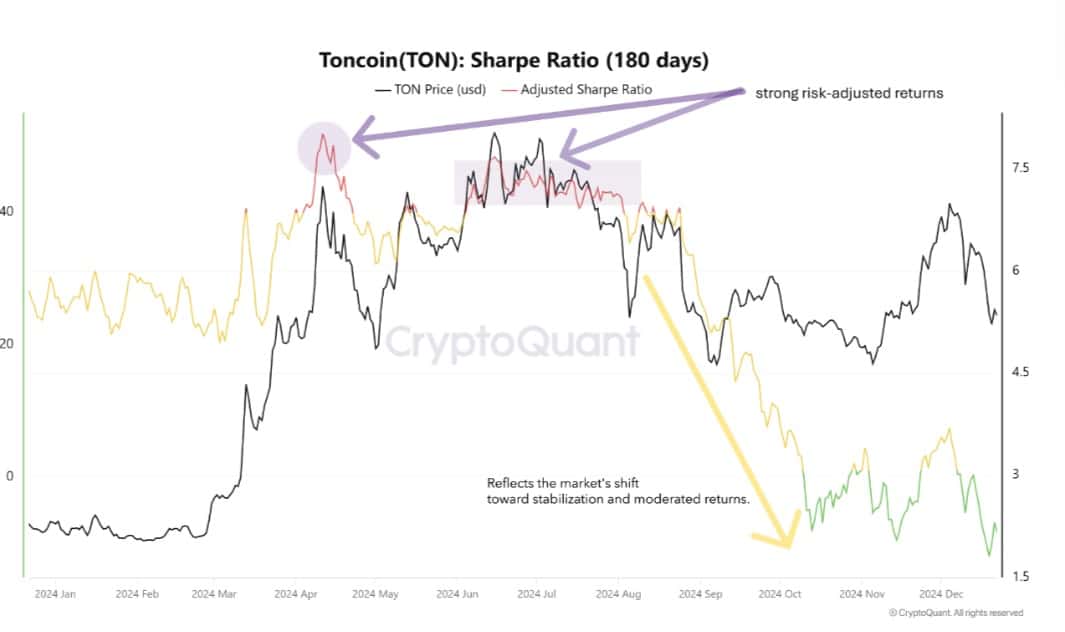

The current market conditions have left analysts seeing a potential price recovery. Inasmuch, Cryptoquant analysis of the Sharpe ratio shows that TON is transitioning into a recovery phase.

Is Toncoin set for recovery?

According to Cryptoquant analyst Shiven Moodley, the Toncoin Sharpe ratio has recently declined from its yearly peak. This dip signals a moderation in risk-adjusted returns as the market stabilizes in anticipation of a potential Altseason.

This stability reflects a market transitioning from a sustained downturn into a recovery phase. Under this shift, both long-term holders and short-term traders actively capitalize on the renewed market interest and optimism.

Therefore, the Sharpe ratio shows a buying opportunity for long-term investors seeking to leverage Ton’s market resilience and growth potential.

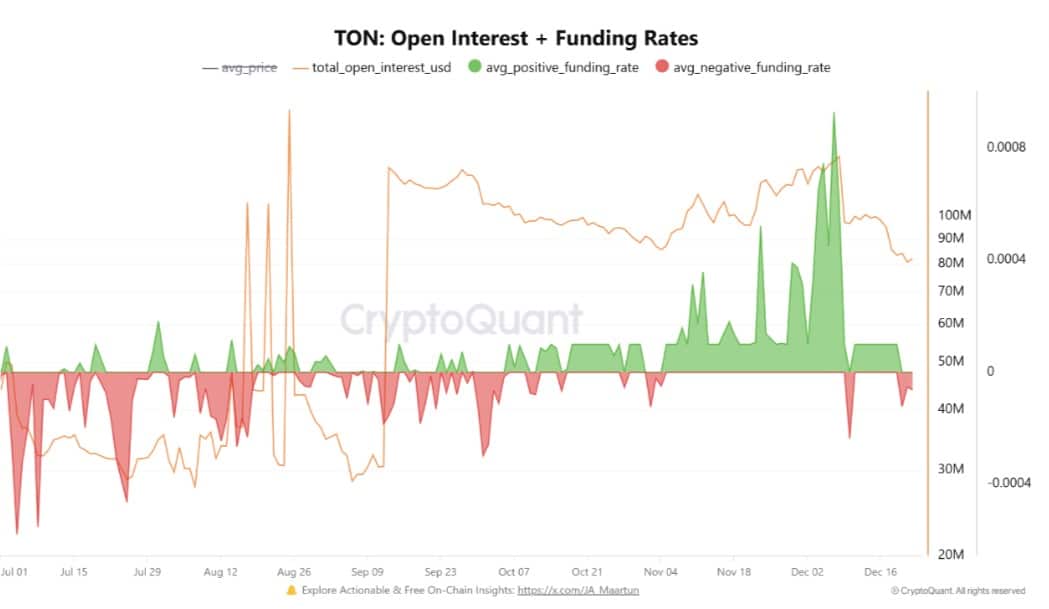

The potential market recovery is further evidenced by the Open interest and funding rate.

With these two metrics rising, it shows increasing participation within the Ton ecosystem which is essential for a market recovery.

Essentially, Ton’s seeing a strongly balanced funding rate further reinforces our analysis that both long and short positions are well balanced indicating market stability and equilibrium.

What Ton charts suggest

As observed above, the prevailing market conditions show that Ton is currently set for a price recovery.

For example, Toncoin’s adjusted price DAA divergence has consistently remained positive over the past week. This shift reflects a healthy usage of the network with rising on-chain activities especially active addresses and transactions.

Therefore, more active addresses indicate higher demand, greater transaction volume, and rising interest for Ton. Thus market sentiments and on-chain fundamentals align with a potential price increase.

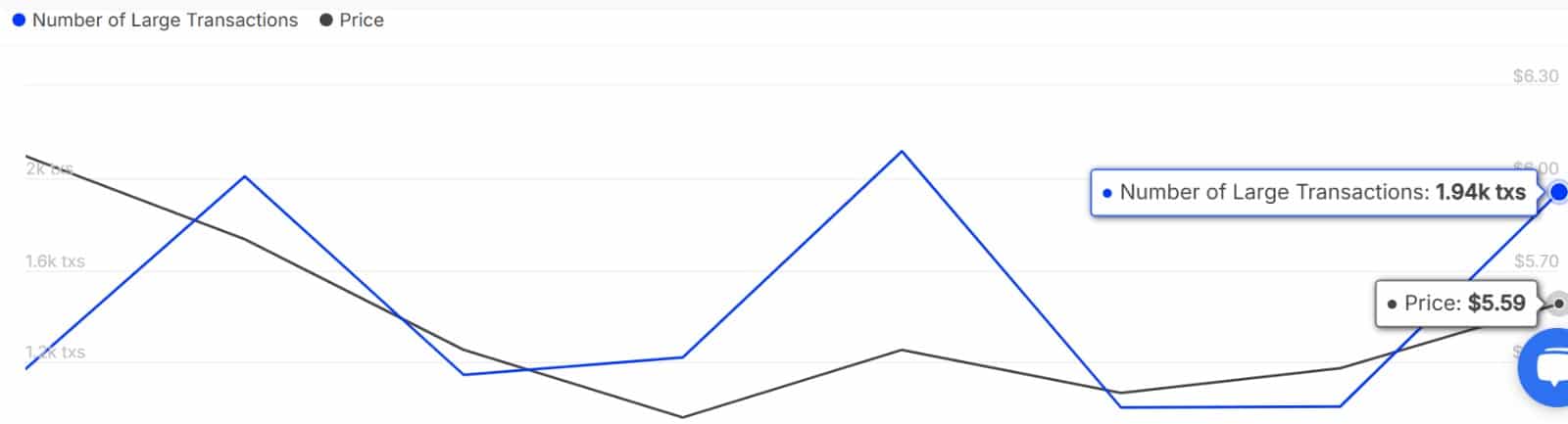

We can see this growth in on-chain activity with the surge in the number of large transactions. This has risen from 1.01k to 1.94k. This marked a 92.08% change over the past 24 hours. With whale activity surging it implies that the market is preparing for further growth.

Is your portfolio green? Check the Toncoin Profit Calculator

With the Sharpe ratio signaling a buying opportunity and fundamentals strengthening, Toncoin seems set for a recovery. Therefore, if the positive sentiment holds, we could see Ton reclaim $5.8.

A breakout from here will push Ton to $6.4. Subsequently, if the current trend fails to hold, the altcoin can dip to $5.2.