- ETH’s funding rate also increased over the past few days.

- In case of a correction, ETH might drop to $3.3k again.

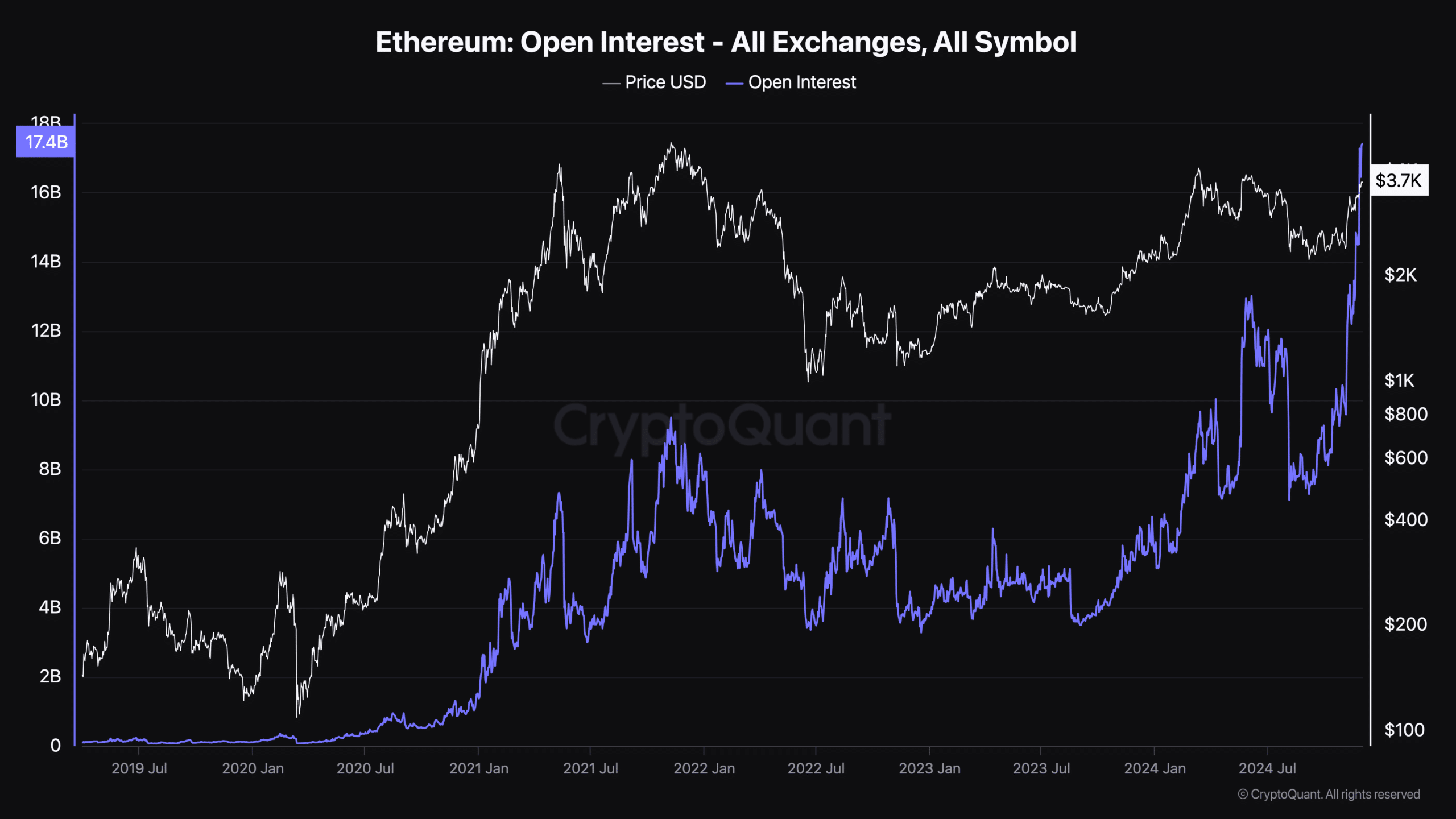

As the king of altcoins, Ethereum [ETH], inches towards the $3.7k mark, it has reached a remarkable milestone. One of ETH’s key derivatives metrics has reached an all-time high. But is this a bullish signal, or will it have a negative impact on ETH’s price action?

Ethereum’s record could attract bears

Ethereum’s Open Interest (OI) has reached an all-time high of over $17 billion. An increase in OI means that more traders are entering positions in a futures or options contract, and more money is likely entering the market.

In fact, another derivatives metric, the funding rate, also witnessed a considerable rise over the last few days. A rise in the metric is bullish, as it usually indicates an optimistic market, where traders are willing to pay more to keep their long positions.

Though at first glance this might give a notion of a continued price rise, the reality might be different. As evident from the chart above, whenever open interest spiked sharply, it was followed by price corrections.

Such episodes happened in November 2021 and June 2024. On both of these occasions, the spike in OI somewhat marked a market top.

Will history repeat itself?

To check whether ETH was at its market top, AMBCrypto dug deeper into the token’s on-chain data. As per our analysis of CryptoQuant’s data, ETH’s exchange reserve was increasing—a sign of rising selling pressure.

Additionally, its stochastic was also in the overbought zone, hinting at a rise if sell-offs, which often results in price corrections.

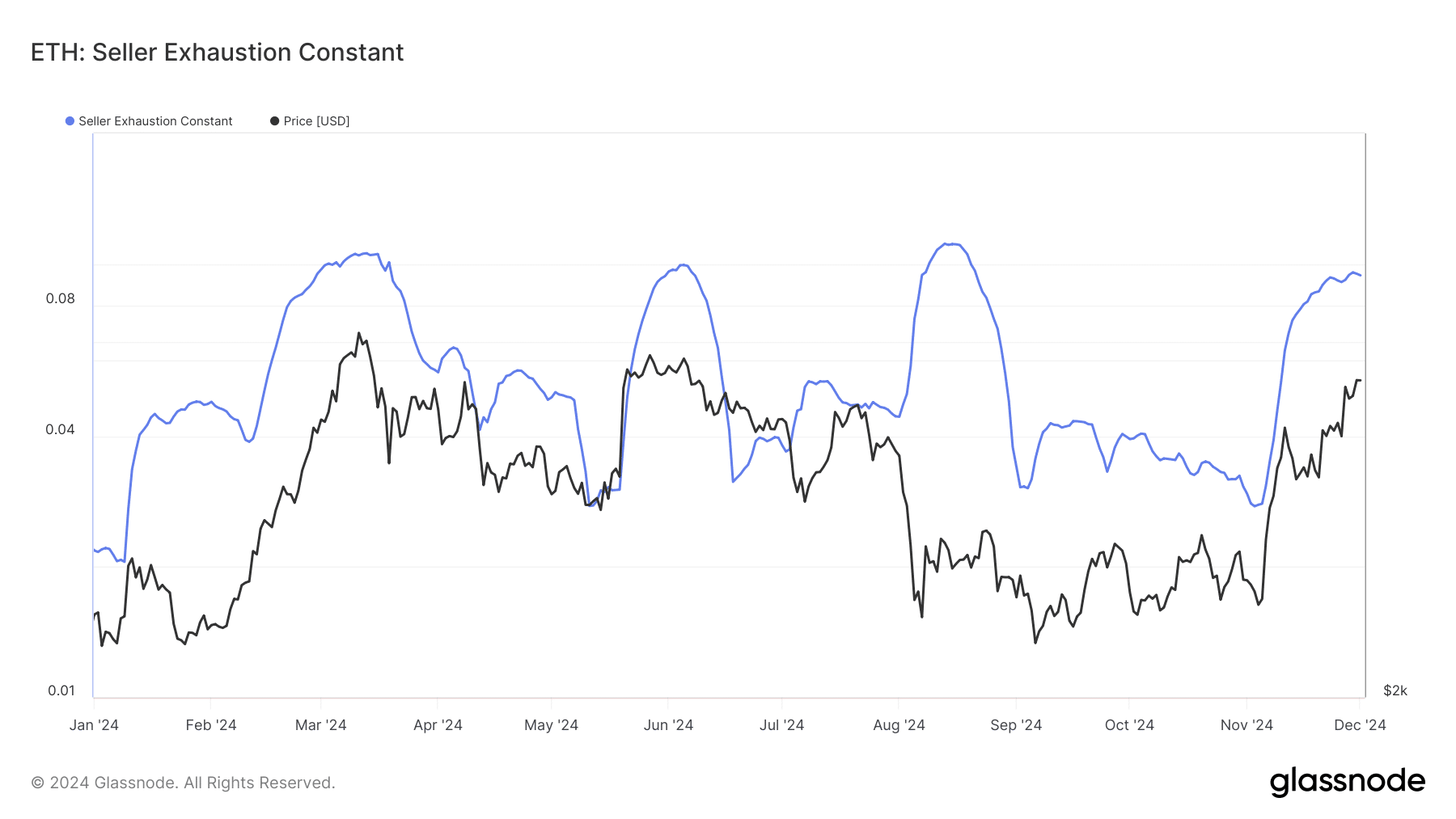

Apart from this, we also found that ETH’s seller exhaustion constant peaked. It was clear from the chart that whenever the metric hit a top, ETH’s price plummeted substantially in the following days.

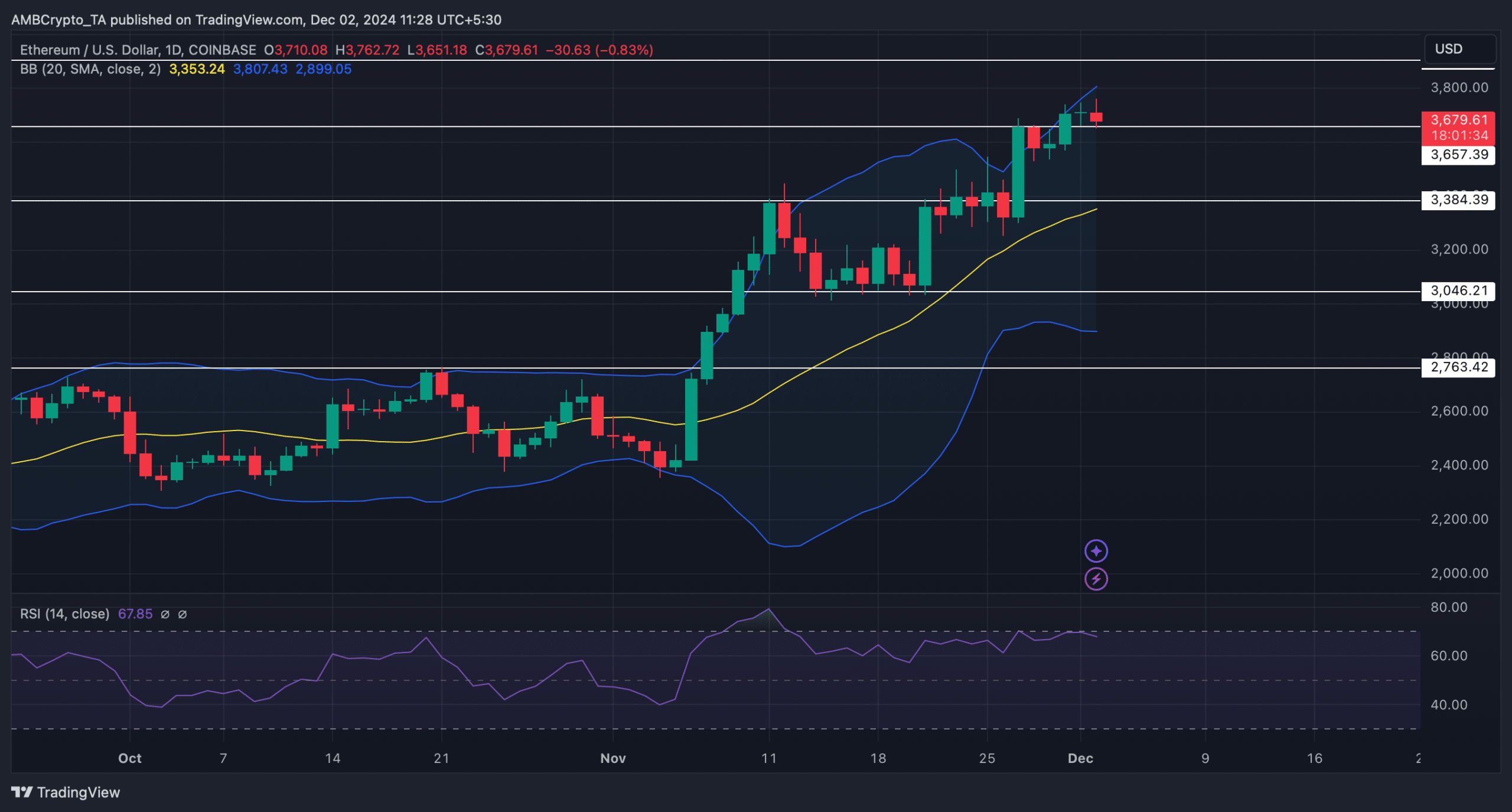

However, it was interesting to note that the Relative Strength Index (RSI) was yet to enter the overbought position. This suggested that there was still room for more buying, which can help Ethereum maintain a bullish momentum.

At the time of writing, the king of altcoins was testing a support. If the RSI is to be believed, then Ethereum might successfully test the level and continue to move northward.

Read Ethereum’s [ETH] Price Prediction 2024–2025

However, if the massive rise in OI and funding rate causes a price decline, like what happened in history, then ETH might drop to its lower support.

To be precise, a drop from the current price level might first push ETH down to $3.38k again.