- The struggle to breach $100k meant some Bitcoin analysts were calling for a deeper retracement

- Though common, such a dip might be unlikely based on the average mining costs trend

Bitcoin [BTC] bulls faced another minor setback above the $98k-mark. Selling pressure sparked up and sent the price tumbling from $98.6k to $96.5k. And yet, even as BTC struggled to conquer the $100k-level, Bitcoin‘s supply on exchanges continued to drop – A sign of accumulation.

Will Bitcoin flip the $100k-level to support this year, or are there too many holders seeking to sell at a profit near this monumental psychological level? Should traders be prepared for a deep price correction in the coming weeks? Well, the average BTC mining cost can give us some clues.

A major retracement is possible, but unlikely in the coming days

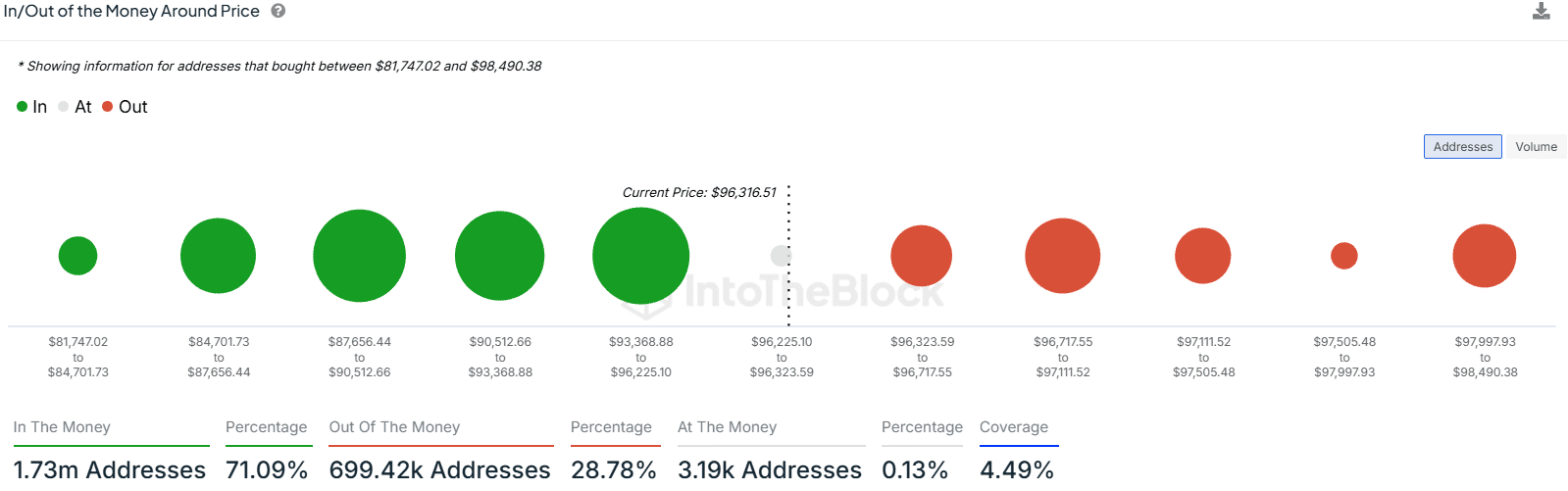

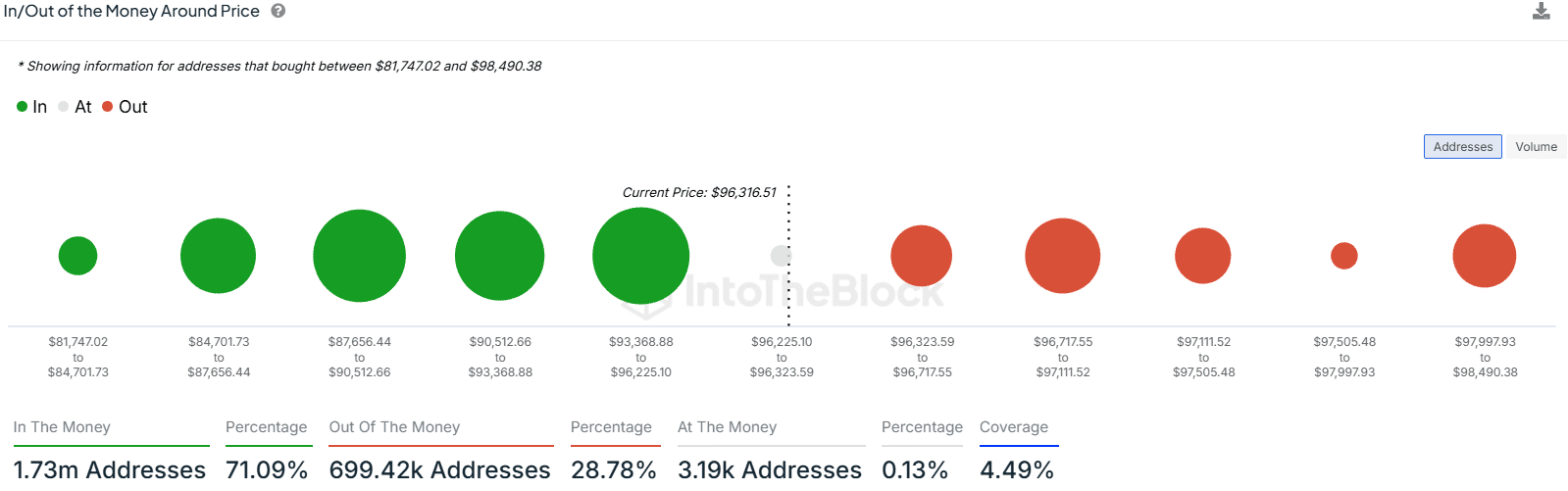

Source: IntoTheBlock

Data from IntoTheBlock showed that the $97.8k-$98.5k zone is a key resistance with lots of sellers. This is why Bitcoin struggled to breach the level over the past week.

The recent dip meant that $96.7k-$97.1k has also become a strong resistance zone.

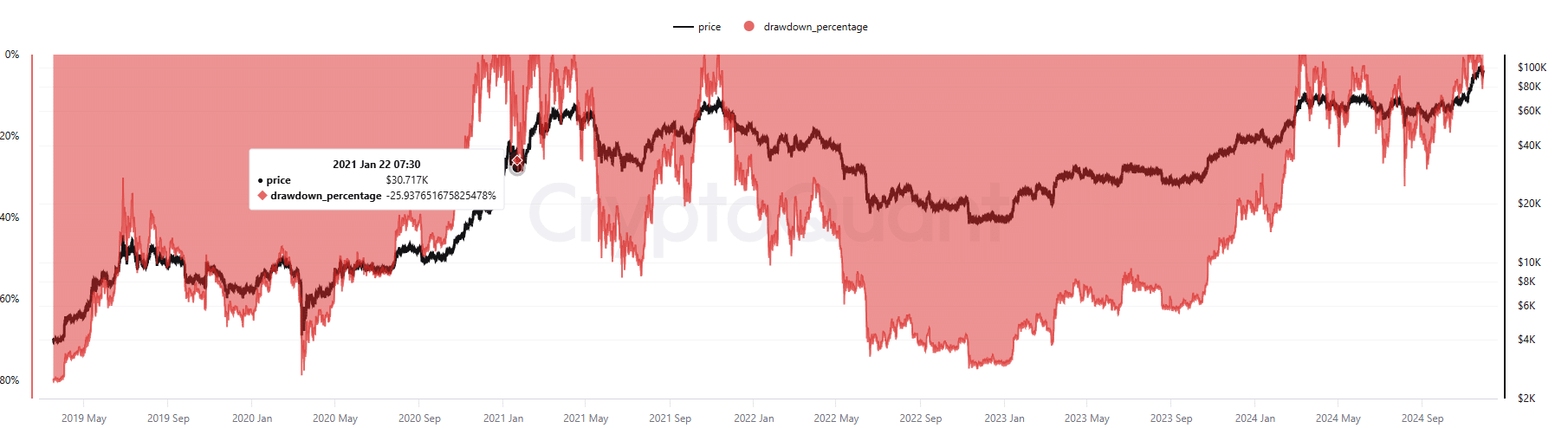

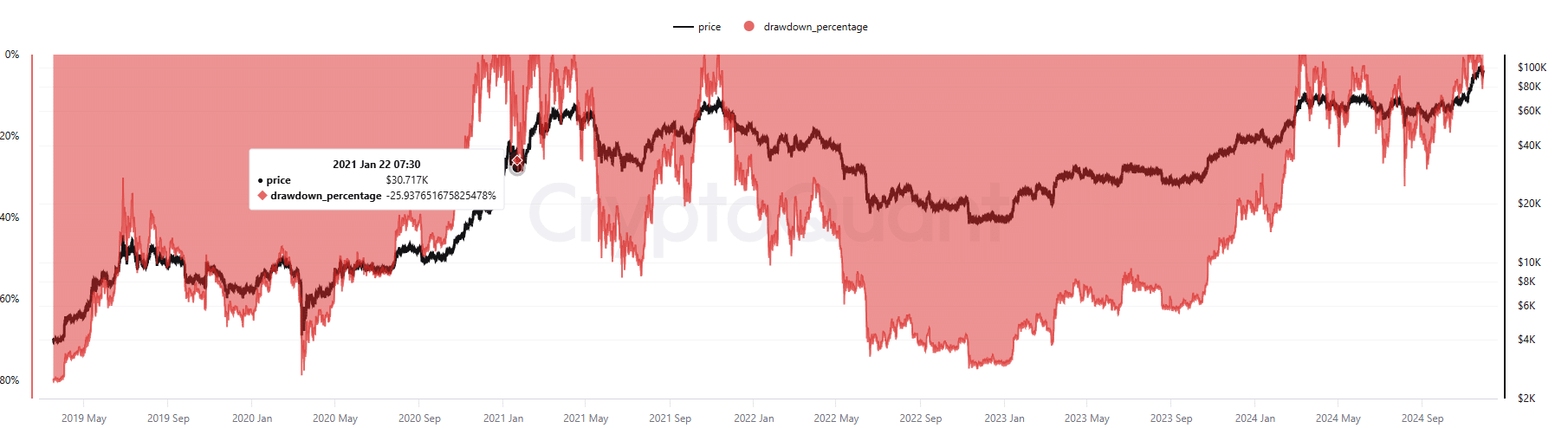

Source: CryptoQuant

Analysts have warned that even in bull runs, Bitcoin has historically seen 20%-30% pullbacks with regularity.

Q1 2021 saw multiple price drops where the drawdown was greater than 20%. And yet, BTC went on to hit nearly $70k in Q4 2024. Hence, holders must not panic when the first double-digit percentage dip occurs.

When will Bitcoin see a large discount?

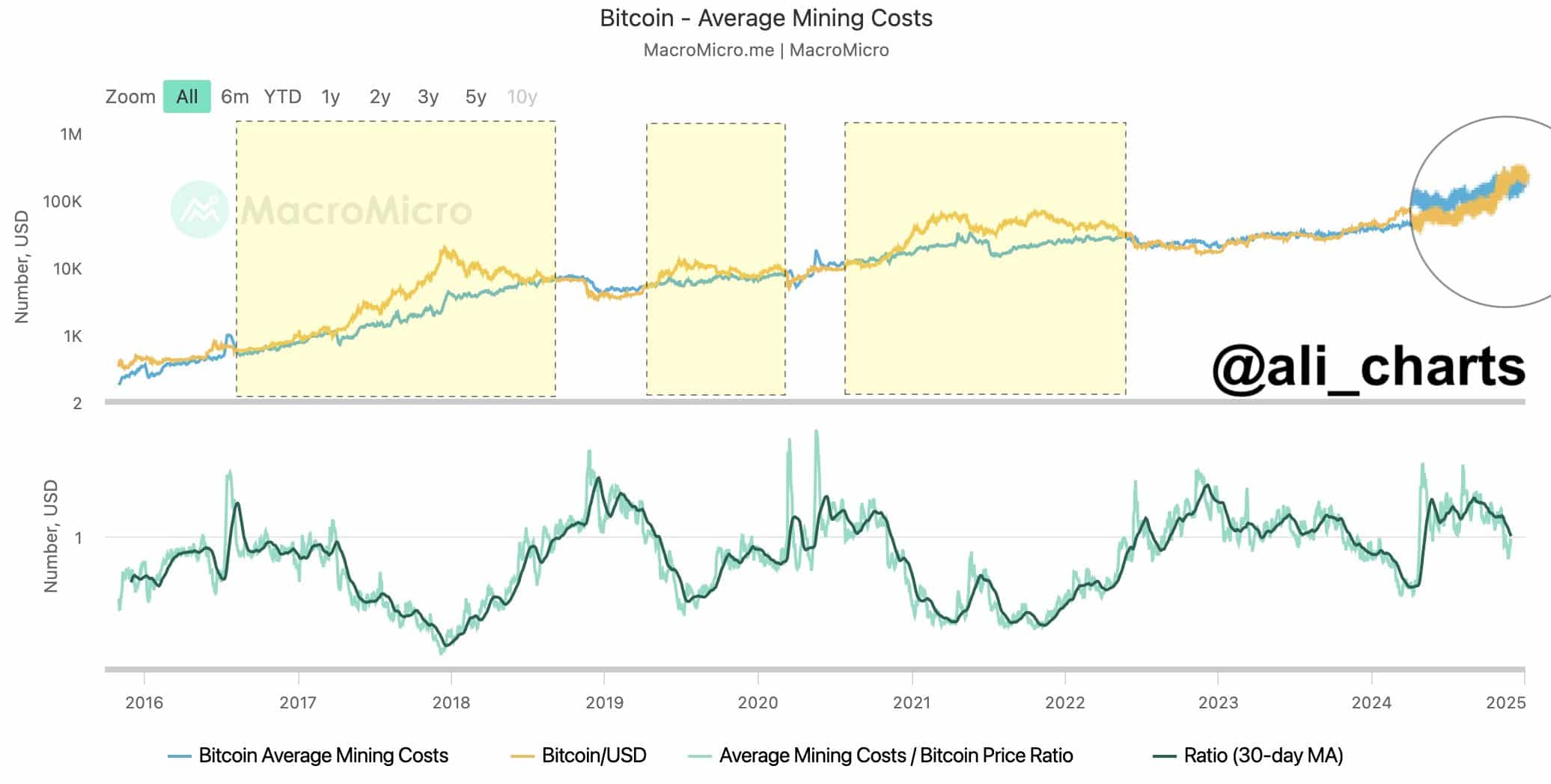

Source: Ali on X

Crypto analyst Ali Martinez pointed out in a post on X that in any bull run, the price of Bitcoin has not fallen below its average mining cost.

In 2020, the halving occurred in May. The average mining cost stayed higher till late October, but once the price crossed over the mining cost, it stayed that way till the latter half of 2022.

A similar crossover occurred on 11 November, when the average mining cost was $82.7k and the price of Bitcoin hit $88k. At press time, the average mining cost stood at $90.5k.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If the present cycle mirrors the previous one, it is highly likely that the $90.5k-level is not breached by the bears for another two years – A hugely optimistic prediction.