- DOGE’s trading volume and network activity declined significantly

- A bullish pattern appeared on the memecoin’s daily chart too

After a week of price drops, Dogecoin [DOGE] once again gained bullish momentum on the charts. However, the trend might change soon, especially since the memecoin seemed to be following a pattern similar to that of its previous cycles. Should investors be cautious then?

Dogecoin mimics historical pattern

The world’s largest memecoin witnessed a 6% correction last week, but the bulls managed to push its price up by 3% in the last 24 hours. Here, it’s interesting to note that while several think memecoins are only backed by market sentiment and hype, the reality is a bit different.

Ali Martinez, a popular crypto analyst, recently shared a tweet highlighting one such trend. According to the same, DOGE seems to be following a same pattern witnessed back in 2017 and 2020.

During those cycles, after steep price spikes, DOGE’s value dropped for a few days before resuming its rally. The pullbacks happened as sell signals appeared on DOGE’s TD sequential.

Since similar events happened twice, the chances of the same episode repeating in 2024 are high. Therefore, Martinez mentioned that Dogecoin might be testing investors’ patience during this cycle.

Will history repeat itself?

As a similar sell signal appeared recently, AMBCrypto checked whether investors have started to dump their holdings or not. AMBCrypto found that selling pressure did increase over the last 24 hours.

Dogecoin’s sell volume revealed that the metric hit a value of 100. For starters, a number closer to 100 means a massive hike in selling volume. However, it should also be mentioned that the selling spree cooled off later as the metric dropped to 12.

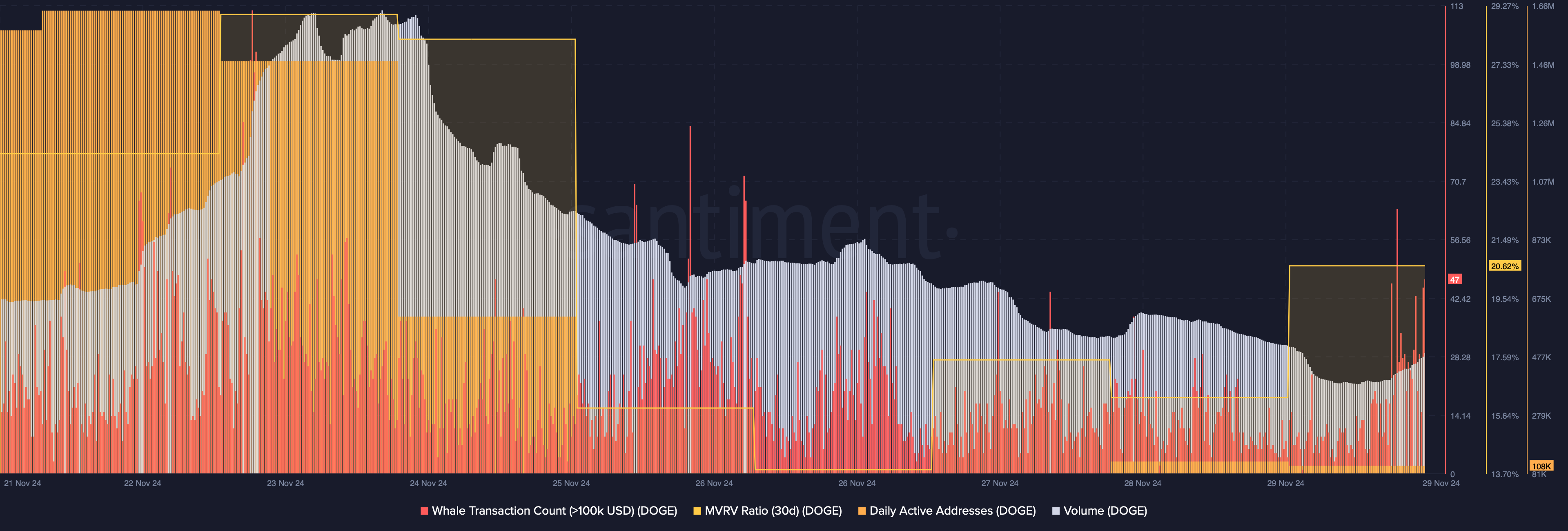

Apart from these, quite a few other metrics also looked pretty bearish. For instance, DOGE’s trading volume declined while its price rose over the last 24 hours – Hinting at a bearish trend reversal.

The weekly price decline pushed the memecoin’s MVRV down — Signaling that more investors have been bearing losses. Whale activity around DOGE also declined last week, as evidenced by the drop in the number of whale transaction count.

Another front on which DOGE witnessed a drop was network activity. In fact, Santiment’s data pointed out that DOGE’s daily active addresses dropped, indicating low usage of the memecoin.

On the contrary, one look at Dogecoin’s daily chart revealed a bullish ascending triangle pattern. At the time of writing, DOGE was testing the resistance of the pattern.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

In case the bulls manage a successful breakout, DOGE might soon kickstart a major rally, a rally which could push its price towards the $1 milestone.