- U.S. Appeals court lifted sanctions on Tornado Cash and ruled in its favor

- Subsequently, TORN climbed by 387.51% in the last 24 hours

Following the court’s ruling in favor of Tornado Cash, TORN saw a dramatic surge of over 1000%. Owing to the same, the altcoin jumped from $3.60 to a high of $40 within just a few hours.

At the time of writing, the token was trading at around $18, highlighting a 412% hike in the last 24 hours. This, despite a brief bout of depreciation on the charts.

Court lifts sanctions on Tornado Cash

A U.S Federal Appeals Court recently ruled in favor of Tornado Cash (TORN), lifting the sanctions imposed by the U.S Department of the Treasury. In fact, the court determined that the Treasury exceeded its authority in sanctioning the technology, which anonymizes cryptocurrency transactions.

Tornado Cash’s smart contracts, the court stated, cannot be classified as property. Therefore, it cannot be subject to sanctions, the court said.

The Treasury targeted Tornado Cash back in 2022, alleging that it facilitated over $7 billion in illicit transactions. In fact, this figure included $455 million stolen by North Korea’s Lazarus Group too.

What does whale activity suggest?

On 8 and 11 November, smart money took accumulated 26,359 TORN tokens for around $2.70 each, totaling an investment of $455k through the MEXC exchange. This sharp price hike has led to substantial unrealized profits.

At its press time price, the smart money position had gained $384k in unrealized profit – Marking a 540% return on investment.

The price surge also highlighted the strong market reaction to the court’s ruling – A sign of renewed confidence and interest in Tornado Cash and its token.

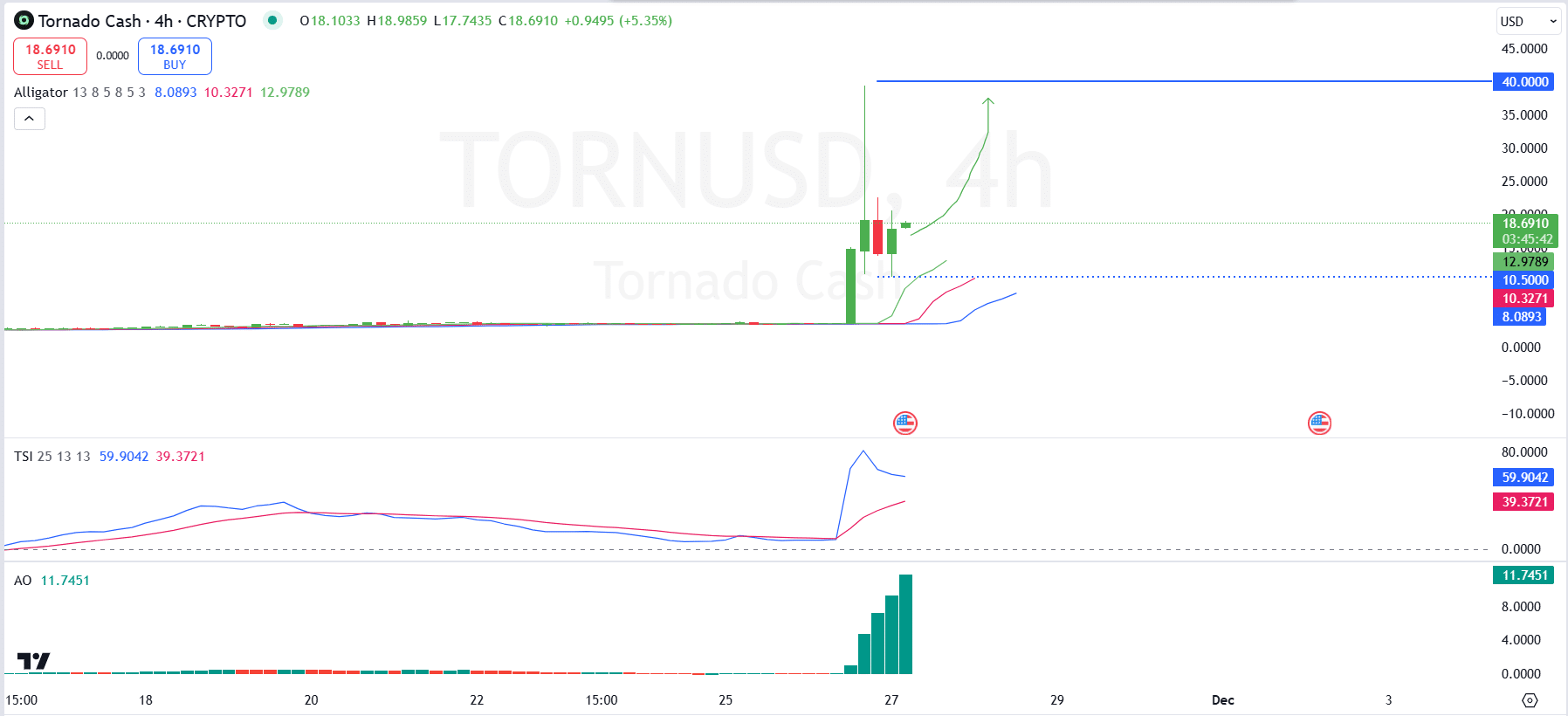

TORN Technical Analysis

Tornado Cash’s 4-hour chart revealed strong bullish momentum, with the altcoin trading at $18.69 after retracing by 55% from its $40 highs.

Indicators like the Alligator suggested an uptrend, as its lines seemed to be aligned for upward momentum. Additionally, the TSI and Awesome Oscillator confirmed buying strength with rising momentum on the charts.

If the price sustains itself above $20, a breakout towards $40 may be likely. However, failure to hold this level could lead to retracements to around $10.

Tornado Cash sees massive volume and activity surge

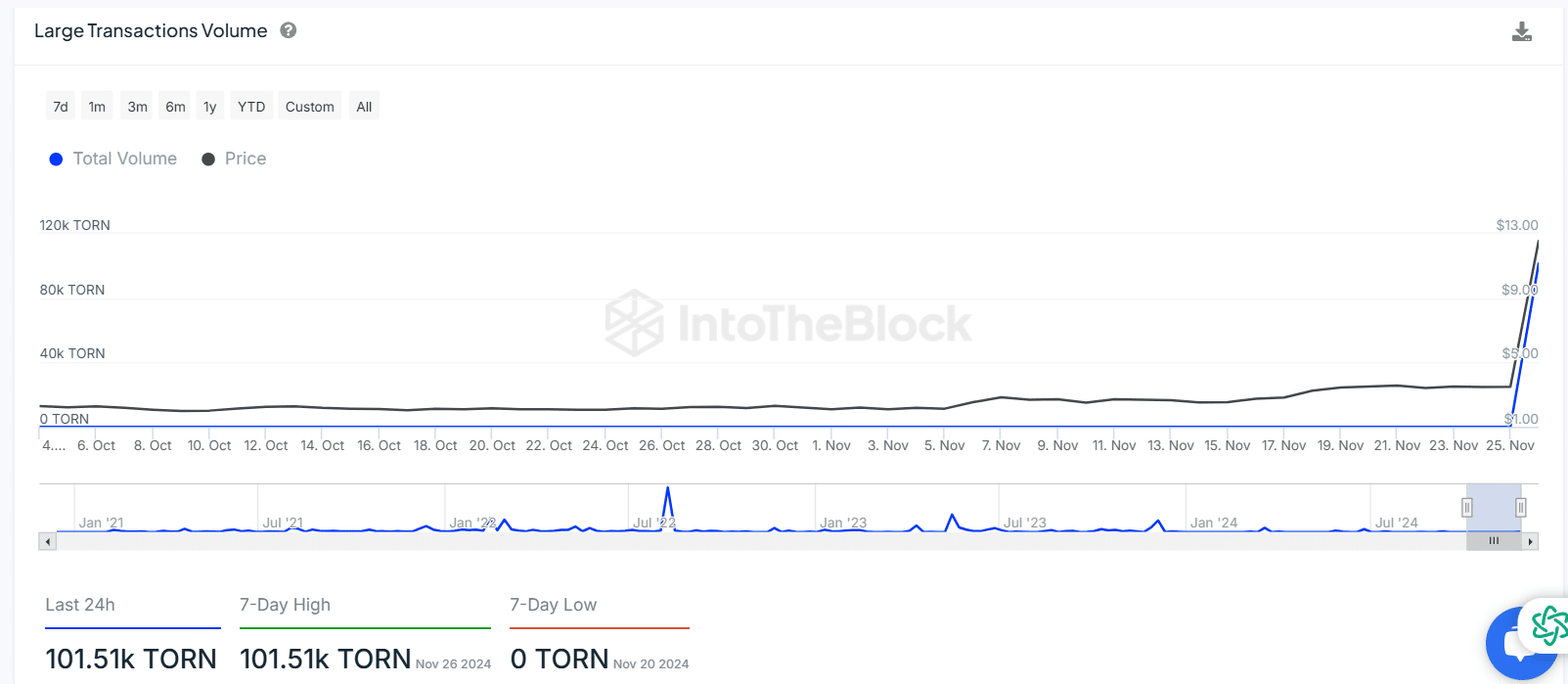

There also seemed to be surge in large transaction volume for Tornado Cash (TORN) in the last 24 hours. Figures for the same hit 101.51k TORN – A 7-day-high.

Here, it’s worth pointing out that the price sharply rose alongside this volume spike, climbing from approximately $1.00 to $13.00. This can be interpreted to mean heightened market activity and strong buyers’ interest.

This hike in transaction volume indicated growing participation from larger market players, fueling the altcoin’s latest price rally.

The sharp divergence from previous activity levels can point to either a speculative run or significant fundamental developments driving demand.

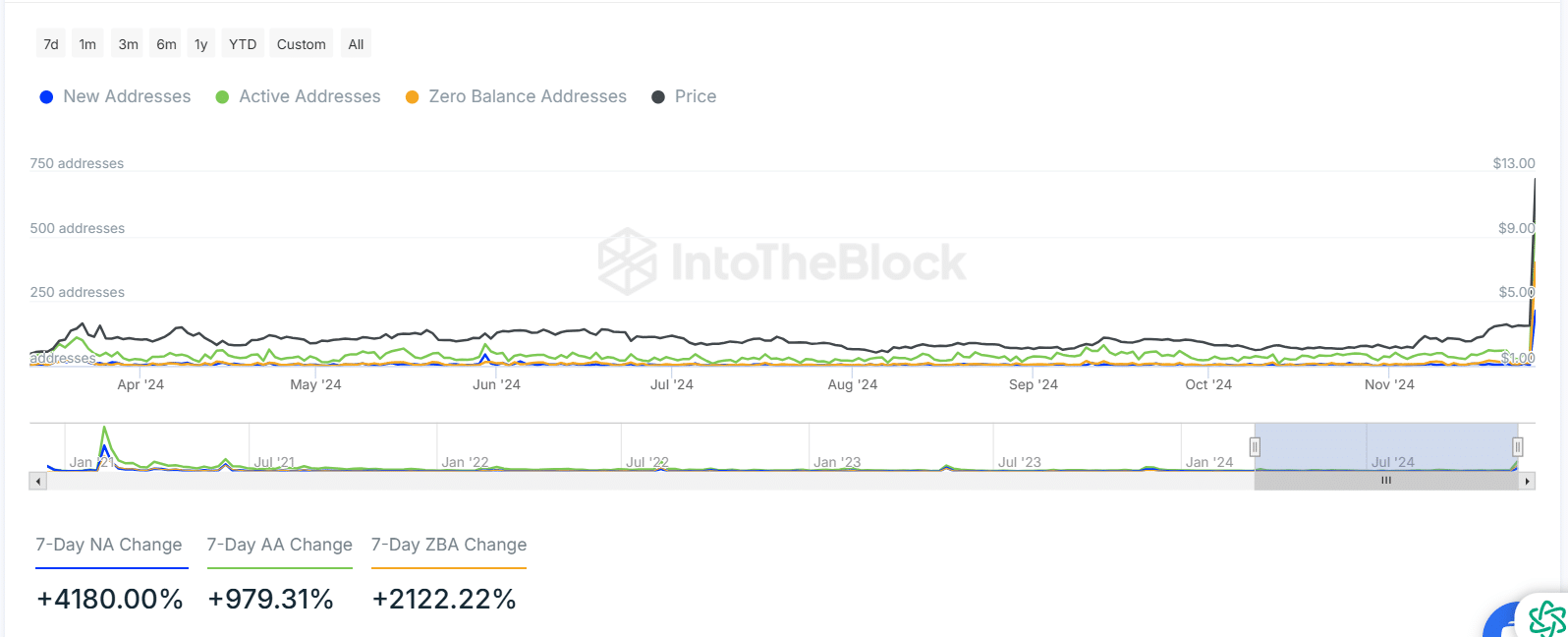

Finally, Tornado Cash’s new addresses surged by +4180%, while active addresses grew by +979.31% – A sign of heightened user participation.

Simultaneously, zero-balance addresses climbed by +2122.22%, indicating potential wallet reshuffling or dormant account reactivations.