- Bitcoin’s volatility intensifies as liquidations trigger sharp price swings, with $337 million wiped out.

- Liquidations amplify Bitcoin’s volatility, creating opportunities and risks as the price tests key levels.

Bitcoin’s [BTC] recent surge towards $100,000 has sparked massive market volatility, with over $337 million in long liquidations within 24 hours.

As the price dips below $93,000, the threat of further sell-offs remains high, especially with $772 million in short positions at risk. With a potential rebound to $98,000 on the horizon, traders must be alert to the possibility of a liquidation cascade driving prices even higher.

Here’s a look at the factors behind Bitcoin’s wild price swings.

Testing the $100,000 Threshold

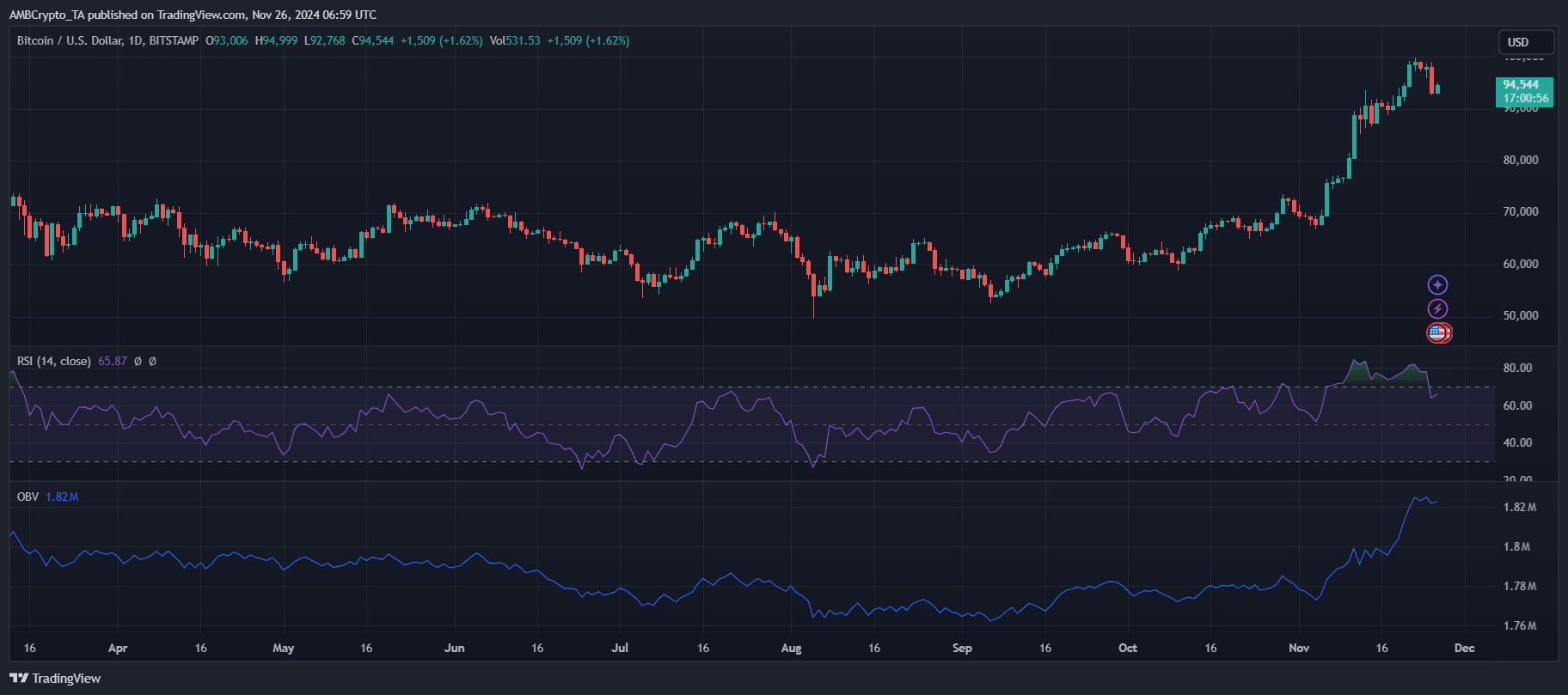

Bitcoin’s ascent toward the $100,000 milestone has dominated market conversations, with its recent price action highlighting both bullish momentum and increasing caution. The cryptocurrency briefly touched $94,999 before retreating to $94,577.

The RSI at 65.91 indicates Bitcoin remains in a bullish zone, but just shy of overbought conditions. OBV, currently at 1.82 million, reflects strong buying interest but hints at slowing momentum compared to earlier spikes.

Volatility persists as Bitcoin’s trading range narrows, suggesting a potential consolidation phase before another breakout attempt.

While the bullish trend remains intact, a failure to maintain support above $93,000 could trigger sell-offs, especially with the elevated risk of liquidation-driven price shifts.

Conversely, sustained buying pressure may push BTC toward $98,000 or higher, keeping traders on edge in this pivotal phase.

The role of liquidation in market volatility

Liquidations are a key driver of Bitcoin’s recent market volatility, amplifying price movements as positions are forcibly closed. In the past 24 hours, more than $337 million in long positions were liquidated, triggering sharp downward price movements.

As Bitcoin’s price dips below $93,000, the risk of further sell-offs intensifies, with $772 million in short positions at stake.

If Bitcoin rebounds toward $98,000, it could spark a cascade of liquidations, further driving the price upward.

This liquidation cycle creates heightened volatility, making it crucial for traders to remain vigilant and monitor key price levels to avoid being caught in a sudden market shift.

Strong bullish momentum for BTC

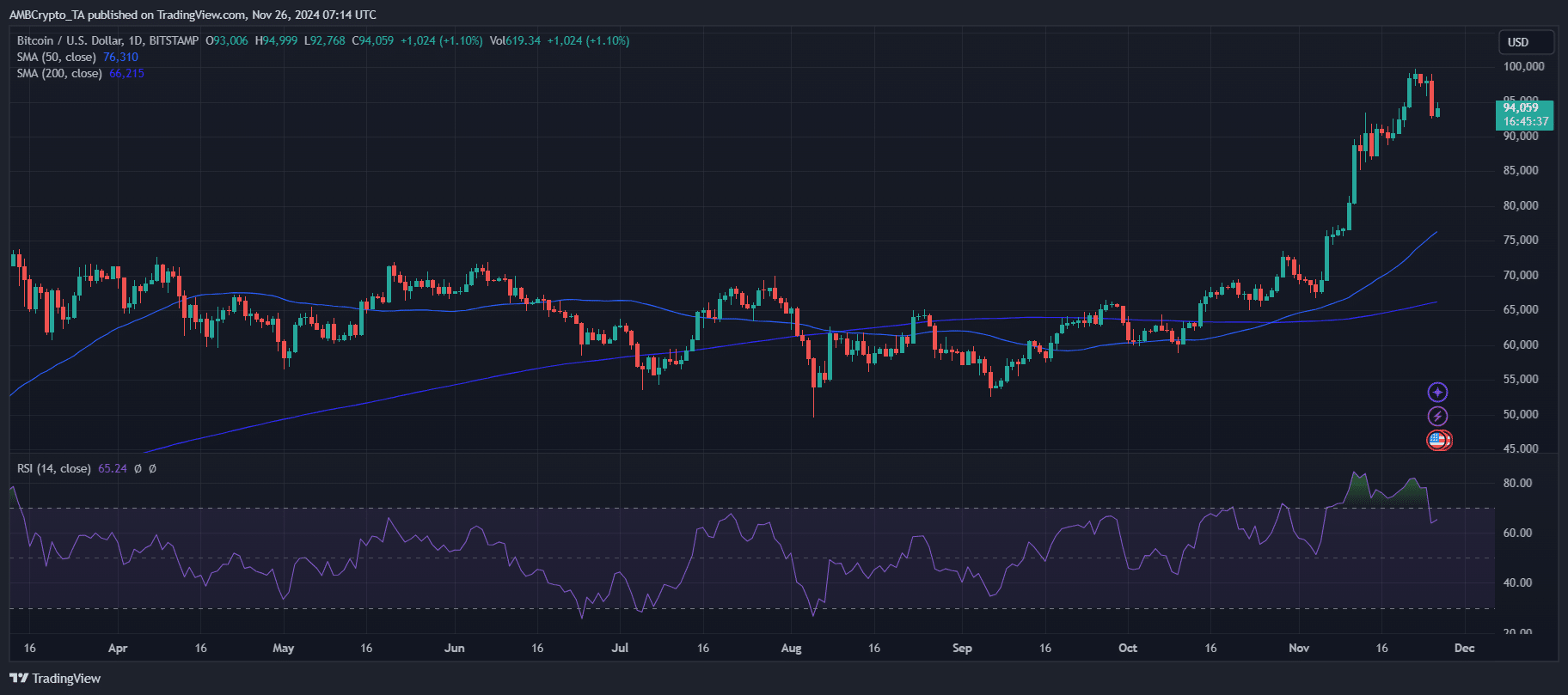

Bitcoin’s price remains well above the 50-day SMA ($76,311) and 200-day SMA ($66,215), reinforcing the long-term bullish trend. The wide gap between these moving averages underscores strong upward momentum, with the 50-day SMA acting as a key support level.

Trading volume shows consistent activity, but a decline from recent peaks suggests a cooling phase in buying pressure. RSI at 65.29 maintains a bullish posture, aligning with current price action.

These indicators point to a market still primed for upward moves, but caution is warranted as reduced volume could limit immediate breakouts or amplify volatility on retracements.

Short-term predictions

As Bitcoin navigates this volatile phase, short-term predictions hinge on key support and resistance levels. If the cryptocurrency can maintain support above $93,000, a rebound toward $98,000 seems likely, potentially triggering a liquidation cascade that could propel prices even higher.

A break below $93,000, however, may lead to further sell-offs, with $88,000 or lower becoming the next critical support zone.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Traders should watch for signs of sustained buying pressure or a shift in volume, as these could signal the next direction.

While the long-term bullish outlook remains intact, the short-term price action could be unpredictable, and caution is advised for those looking to enter positions.