- Solana’s $100 billion monthly DEX volume and $11 billion transactions YTD highlight growing adoption.

- Bullish liquidations and steady development reinforce confidence for sustained upward price movement.

Solana [SOL] has broken records, surpassing $100 billion in monthly DEX volume for November 2024 while maintaining an industry-leading 11 billion transactions YTD. These milestones highlight its rapid adoption and technological strength.

At press time, Solana was trading at $240.77, reflecting a 2.58% dip in the last 24 hours, after hitting a yearly high of $267 earlier this month. Consequently, traders are wondering if this momentum can trigger a sustained price rally or if further corrections are on the horizon.

Price analysis: Can SOL maintain its support levels?

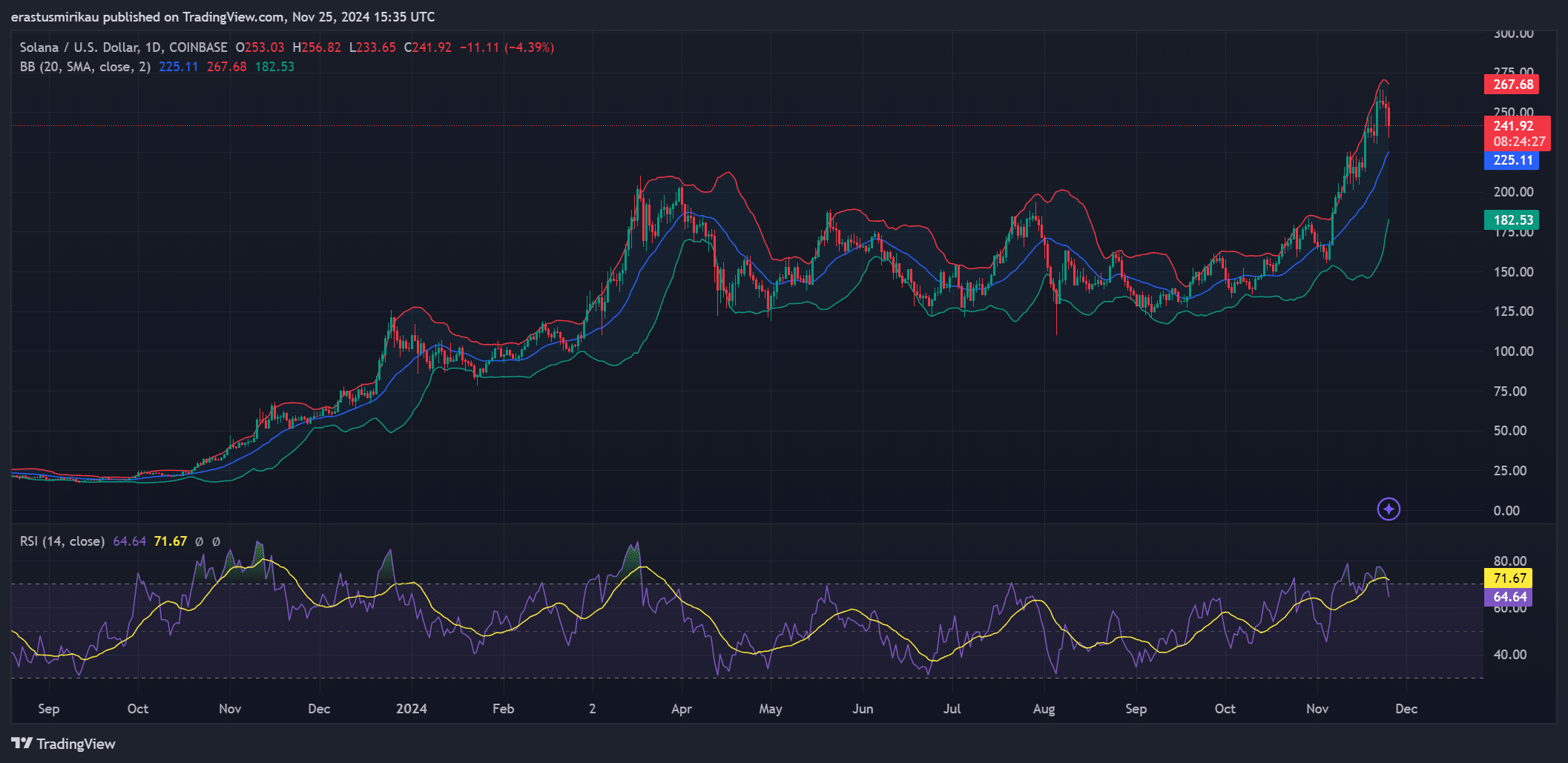

Despite the recent pullback, SOL’s price action shows strength following its significant rally earlier this month. The Bollinger Bands (BB) indicate that the price is retracing from overbought conditions.

The upper BB sits at $267.68, while the middle band provides critical support at $225.11. Additionally, the RSI is at 71.67, signaling a cooling-off phase as Solana consolidates near overbought territory.

However, if SOL fails to hold above $225, it risks a deeper retracement toward $182.53. On the other hand, successfully maintaining support at $225 could allow the asset to build momentum for another rally toward its $267 resistance level.

Therefore, this zone is critical for future price movement.

Steady development activity supports long-term growth

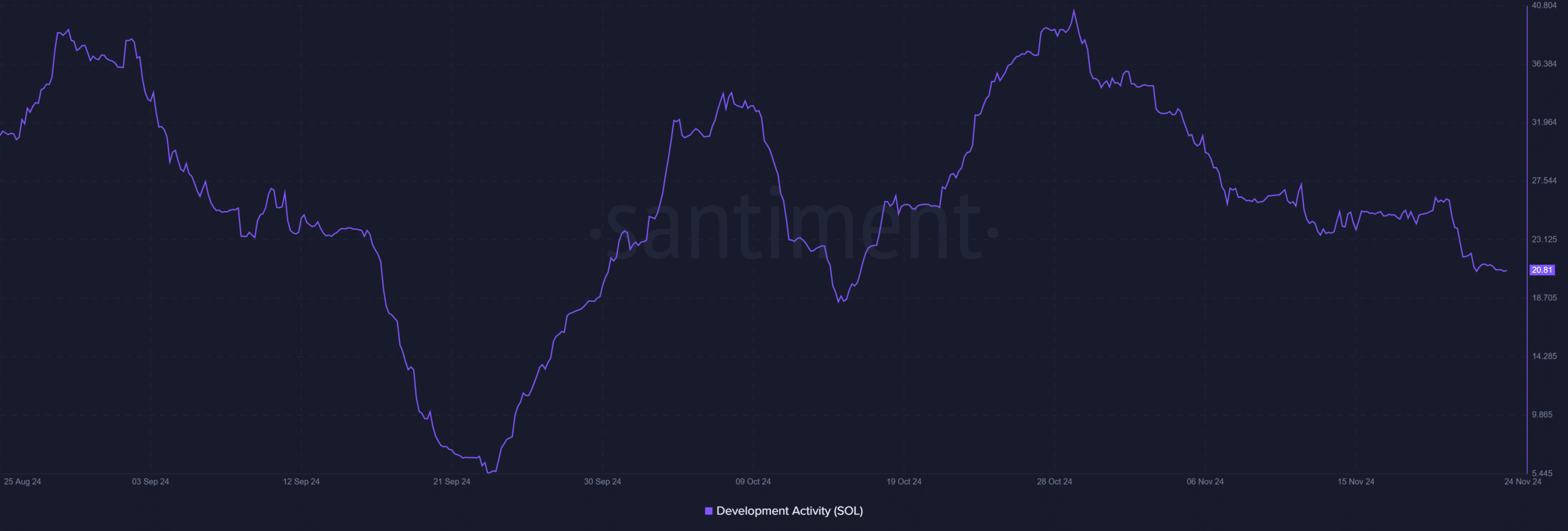

In addition to its impressive market performance, Solana continues to demonstrate consistent development activity. As of November 24, the activity level is at 20.81, slightly lower than previous months.

However, this steady progress underscores SOL’s ongoing commitment to enhancing its ecosystem. Consequently, this consistent development provides a strong foundation for long-term adoption and price stability.

Liquidations reveal bullish sentiment

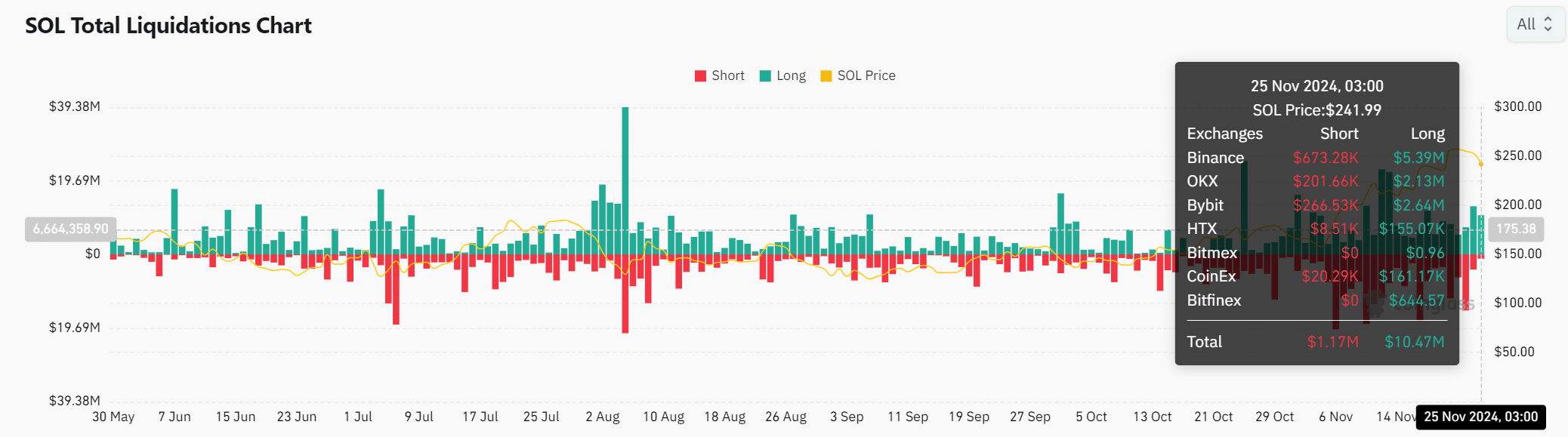

Solana’s liquidation data further reflects market optimism. On 25th November, $10.47 million in long positions were liquidated compared to only $1.17 million in shorts, showcasing strong bullish sentiment among traders.

This suggests that despite recent price dips, the majority of market participants expect Solana to continue its upward trajectory, potentially testing its previous highs soon.

Is your portfolio green? Check out the SOL Profit Calculator

Is SOL poised for another rally?

Solana’s impressive milestones in adoption and transaction volume, combined with strong technical and market fundamentals, suggest it is well-positioned for further growth.

If SOL holds its $225 support level, a retest of $267 and beyond becomes highly likely. However, failure to sustain this level could lead to a temporary correction. For now, the bullish sentiment and solid fundamentals favor an upward price breakout in the coming weeks.