- The exchange net flow of XTZ crypto has remained consistently positive.

- XTZ’s Relative Strength Index (RSI) was 74.5, indicating a potential price correction.

Tezos [XTZ] has gained immense gain over the past few days following an announcement by the staking platform Everstake supporting the token.

As a result, on the 24th of November, while other altcoins seemed to be struggling, XTZ gained 24%.

Will the price of XTZ crypto fall?

Following a notable upside rally, the altcoin has reached a level where it has historically experienced selling pressure and price declines.

However, the current sentiment has shifted as the overall market remains bullish, with the blockchain gaining support from Everstake and increased participation from traders and investors.

At press time, XTZ was trading near $1.37 after a price decline of 4.5% in the past 24 hours. During the same period, its trading volume jumped by 31%, indicating higher participation from traders and investors.

According to AMBCrypto’s technical analysis, XTZ was at a strong resistance level of $1.50 and appeared to be struggling.

During its recent price surge, the altcoin breached three resistance levels. Each time it breached a resistance level, there was some price consolidation before breaking out again.

Initially, when the XTZ rally began, it faced resistance at $0.75. Before breaching this level, the price consolidated for four days. When it reached the next resistance at $0.90, it consolidated for two days.

The last time the price hit the resistance level of $1.13, it consolidated for nearly five days.

Now, with the price reaching $1.50, today marks the first day at this level, and there is an expectation of some price correction before a major rally occurs.

Based on historical price momentum, if the altcoin breaks out above the resistance level and closes a daily candle above $1.50, there is a strong possibility it could soar by 40%, reaching the $2.10 level in the coming days.

However, this speculation might take time to execute, as XTZ’s Relative Strength Index (RSI) was 74.5 at press time, indicating that the asset is in an overbought zone.

This RSI value suggested a potential price correction or decline in the coming days.

Bearish on-chain metrics

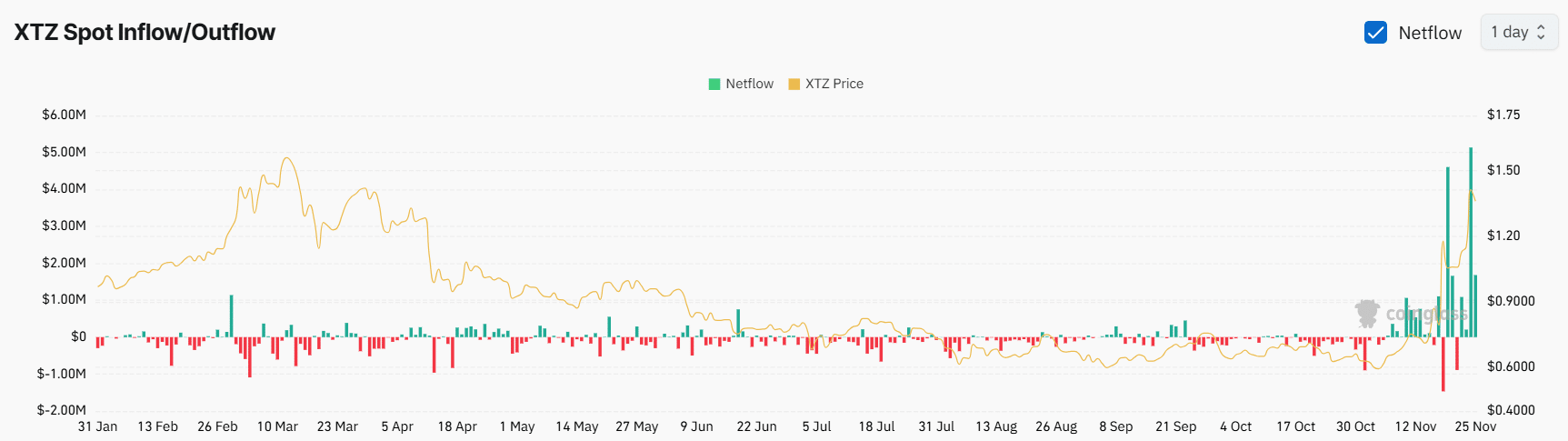

On-chain metrics also point to a bearish outlook for the asset. According to the on-chain analytics firm Coinglass, XTZ’s exchange net flow has remained consistently positive since the 22nd of November.

Read Tezos’ [XTZ] Price Prediction 2024–2025

This suggested that whales and investors have been continuously transferring their tokens from wallets to exchanges, signaling potential selling pressure and reinforcing a bearish outlook.

Meanwhile, XTZ’s Open Interest (OI) has remained unchanged over the past 24 hours, suggesting that traders may be hesitant to open new positions or are waiting for the price to trigger their stop-loss orders.

![Is Tezos [XTZ] crypto poised for a correction? Key data says…](https://hamsterkombert.com/wp-content/uploads/2024/11/Is-Tezos-XTZ-crypto-poised-for-a-correction-Key-data.webp.webp)