- Toncoin surged over 27% after breakout from the symmetrical triangle.

- Large leveraged TON positions risk liquidation at $5.85 and $6.32.

Toncoin [TON] surged impressively, trading 27% above its breakout level from a descending triangle pattern, hinting at a potential local top at $6.32 level as price has made a pause.

This breakout from a downtrend that previously suppressed its price marked a significant shift in market dynamics.

The resistance along the descending trendline, consistently formed lower highs, flipped as TON burst through, suggesting a change from bearish to bullish sentiment.

A huge green candle captured the intense buying pressure, indicating a sharp increase in value within a brief period.

Toncoin now testing new levels as price surges following the breakout, with the MACD confirming a bullish crossover—an optimistic signal for further upward movement.

This technical momentum could push TON toward the $9 mark if it maintains support above current levels, drawing more traders to capitalize on its newly bullish trend.

This scenario beckoned the question: Can TON sustain this rally?

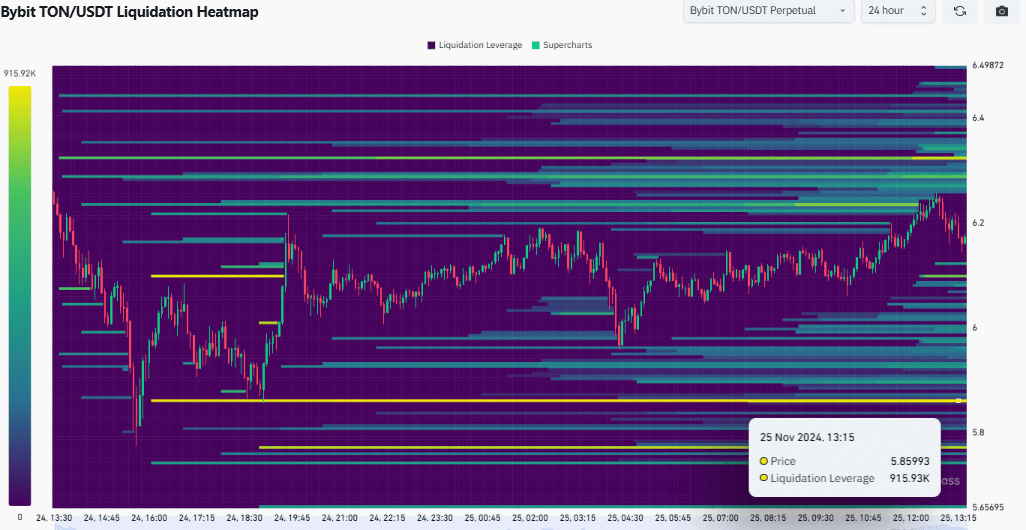

TON liquidation heatmap

The TON/USDT pair also experienced notable volatility, particularly around key liquidation thresholds.

At $6.50, large leveraged positions risked liquidation, potentially driving price action toward these zones due to the high liquidity present. Notably, $915K and $701K were at stake at $5.85 and $6.32, respectively.

The market’s liquidity map revealed that these areas could either provide substantial resistance or support, depending on whether traders decide to cut losses or capitalize on lower prices.

The heatmap visually represented these dynamics with distinct bands, signaling densely packed liquidity zones.

This setup suggested that TON could either rebound off these levels or plunge through them if sell-off pressures increase, making these points critical for traders to watch.

Such insights were vital for market participants aiming to navigate the intricacies of leveraged trading within volatile markets.

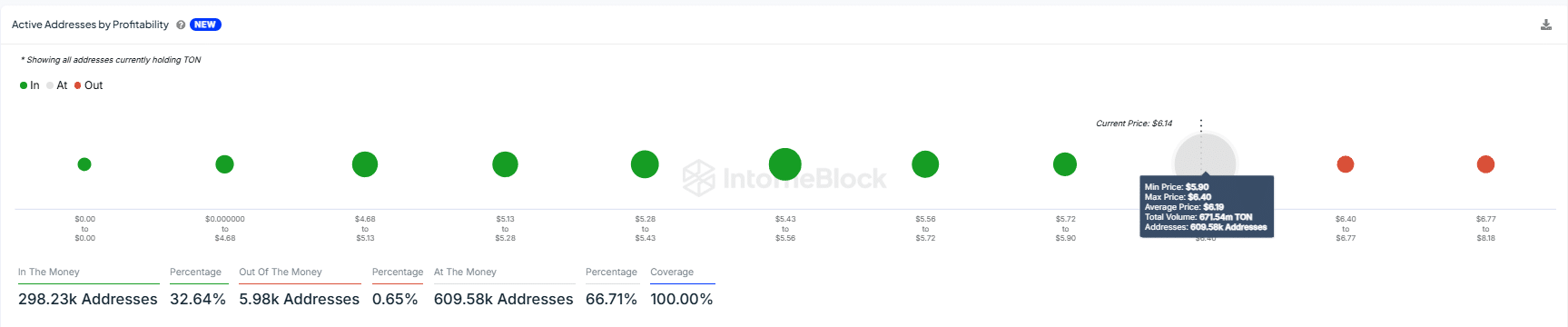

Active addresses by profitability

Additionally, most TON holders saw profits, with 32.64% of addresses ‘In the Money’. This represented 298K addresses, indicating positive sentiment that may encourage price increases.

Read Toncoin’s [TON] Price Prediction 2024–2025

A significant 66.71% of holders are ‘At the Money,’ at a break-even point, showing potential volatility. These holders might sell as prices rise or hold for further gains, influencing TON’s potential to hit targets like $9.

Only 0.65% are ‘Out of the Money’, showed minimal immediate sell pressure from losses. This distribution indicated a basis for growth, with most holders not pressured to sell, potentially enabling a gradual rise to $9.