- Consistent stablecoin inflows into exchanges are fueling Bitcoin’s price stability above $96,000.

- Bitcoin’s MVRV ratio at 2.69 and rising open interest suggest a bullish trend with minimal risks.

Bitcoin’s [BTC] journey toward breaching the $100,000 mark remains closely watched as the cryptocurrency maintains price stability above $96,000.

Despite achieving an all-time high (ATH) of $99,645 on 22nd November, Bitcoin has resisted significant corrections, trading at $98,083 at the time of writing. This resilience suggests a strong foundation, with market participants awaiting its next move.

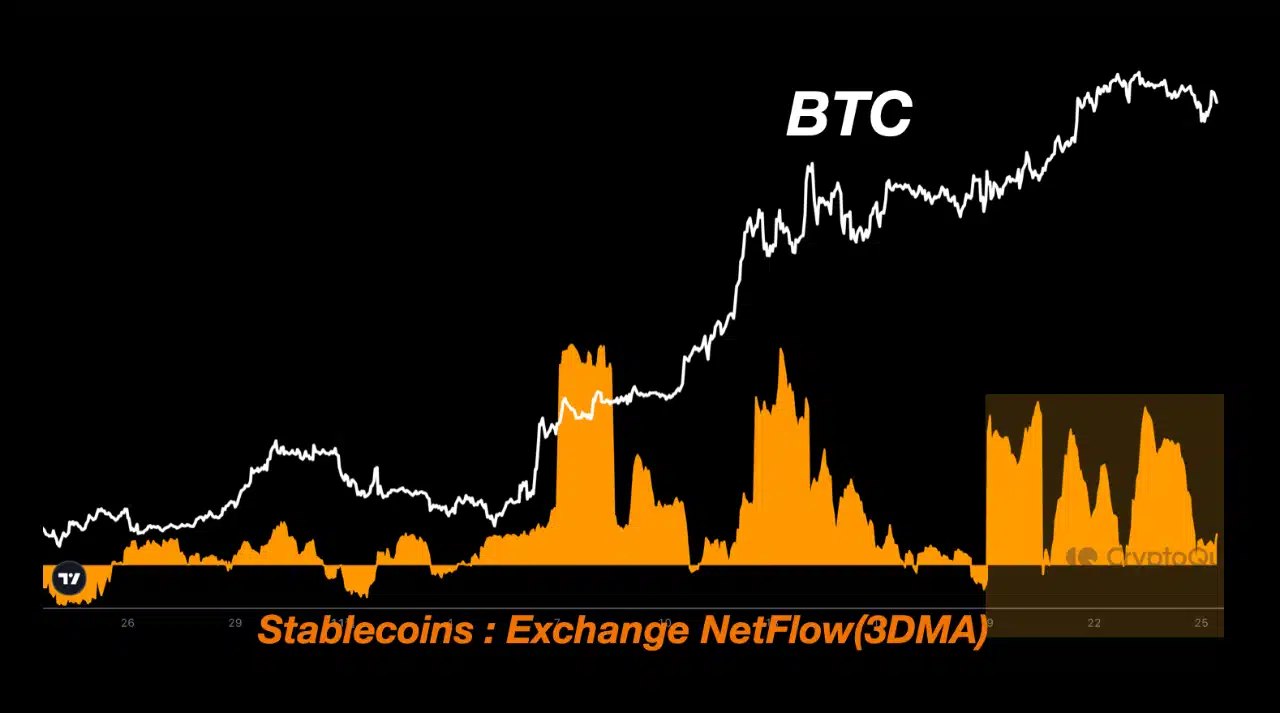

One key observation behind this price stability has been the steady inflow of stablecoins into exchanges. According to SignalQuant, a CryptoQuant analyst, the trend of stablecoin net inflows has boosted Bitcoin’s ability to sustain higher lows.

SignalQuant noted,

“This has allowed the price to continue to make higher lows. Its price will break the $100,000 mark at any moment without a significant correction based on the net inflows trend.”

According to the analyst, this steady inflow has minimized the potential for major sell-offs, reinforcing the bullish momentum seen in Bitcoin’s recent performance.

Market fundamentals and Bitcoin’s future path

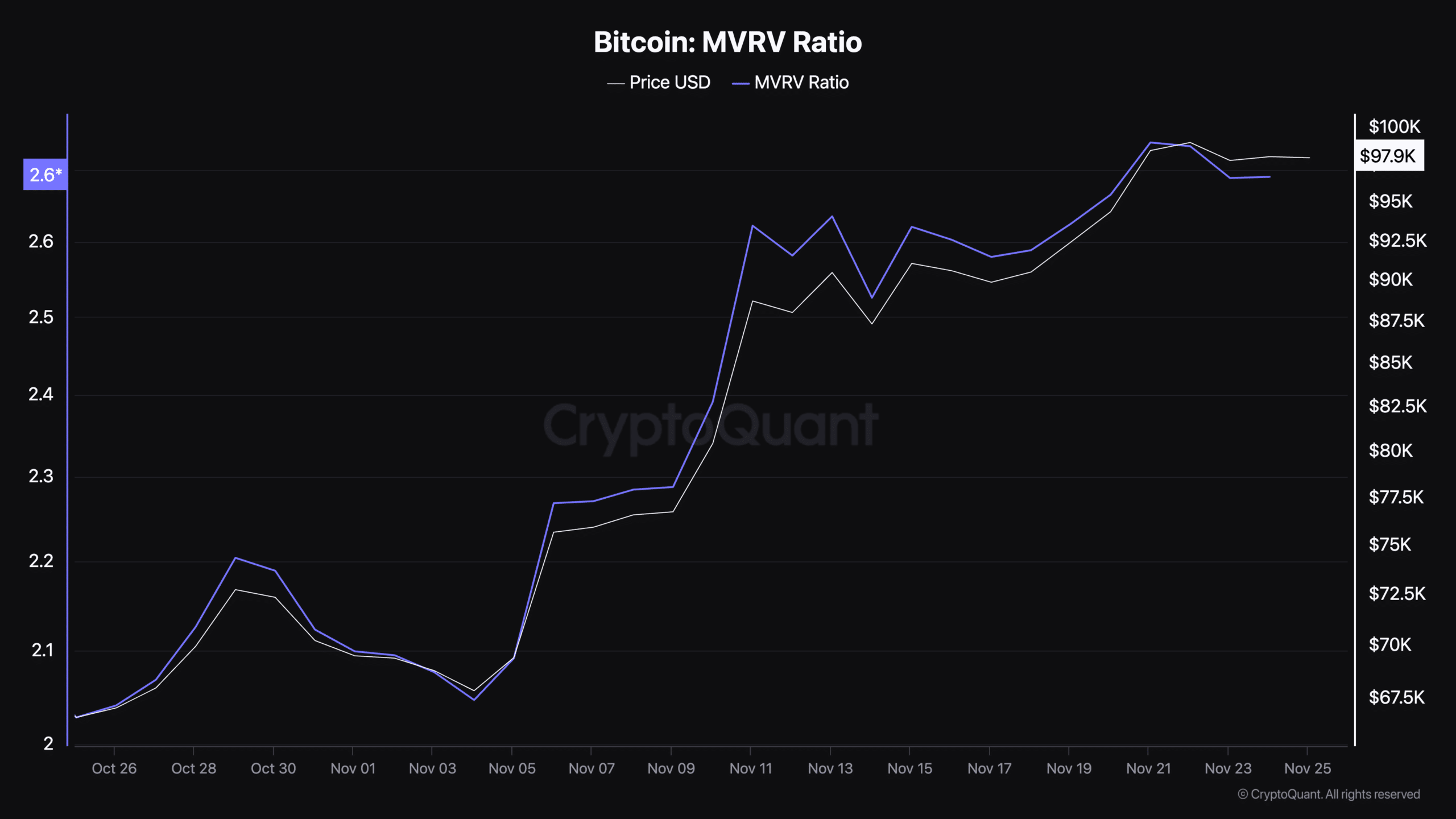

To better understand BTC’s potential trajectory, it’s important to analyze key market fundamentals. The MVRV ratio, a popular on-chain metric, provides valuable insights.

The MVRV ratio is calculated by dividing Bitcoin’s market cap by its realized cap, reflecting whether the asset is overvalued or undervalued.

Historically, an MVRV ratio below 1 signals a market bottom, while values above 3.7 suggest a potential market peak. With Bitcoin’s MVRV ratio currently at 2.69, the metric indicates that the market is leaning toward optimism but remains below critical overvaluation levels.

This suggests room for further price growth while maintaining a cautious stance on overextension.

Read Bitcoin’s [BTC] Price Prediction 2024-25

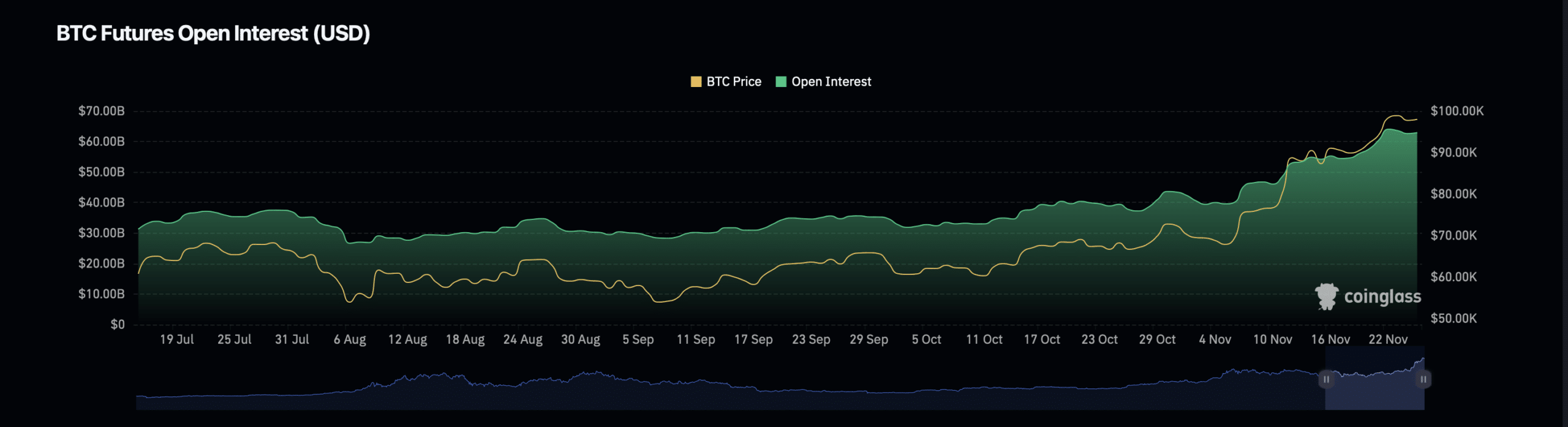

In addition to the MVRV ratio, Bitcoin’s open interest and volume metrics provide a snapshot of trader activity. Data from Coinglass reveals a 0.86% increase in Bitcoin’s open interest, bringing it to $63.16 billion.

Similarly, the open interest volume has surged by 47.13%, reaching $81.33 billion. These figures highlight a strong market appetite for Bitcoin, with traders positioning themselves in anticipation of further price action.