- Recent data revealed a sharp increase in chain netflows, placing SUI ahead of other prominent Layer 1 blockchains.

- Several key indicators and metrics added more to the tendency for the rally to the upside.

Although Sui [SUI] experienced a 4.85% decline over the past week, it has begun to recover, posting a modest 0.69% gain in the last 24 hours.

This rebound adds to an impressive monthly growth rate of 77.91%, indicating a strong upward trajectory.

On-chain metrics and market sentiment both pointed to sustained momentum. According to AMBCrypto’s analysis, these positive indicators suggested that the altcoin’s rally could extend further if the current trends persist.

SUI surges ahead with $23.8M netflow

SUI has recorded an impressive chain netflow of $23.8 million in the past 24 hours, according to data from Artemis.

This places the coin ahead of major blockchains like Arbitrum [ARB], Solana [SOL], Bitcoin [BTC], and Optimism [OP], showing a surge in market activity and investor confidence.

A chain netflow of $23.8 million represents the net balance of funds moving into or out of SUI during this period. It is calculated by subtracting outflows from inflows.

A positive netflow, as seen here, often signals bullish sentiment, indicating growing demand for SUI’s ecosystem and the potential for price appreciation.

SUI has recently announced a partnership with Franklin Templeton, a trillion-dollar asset management firm.

This collaboration is expected to strengthen the coin’s ecosystem by driving further development and attracting institutional interest.

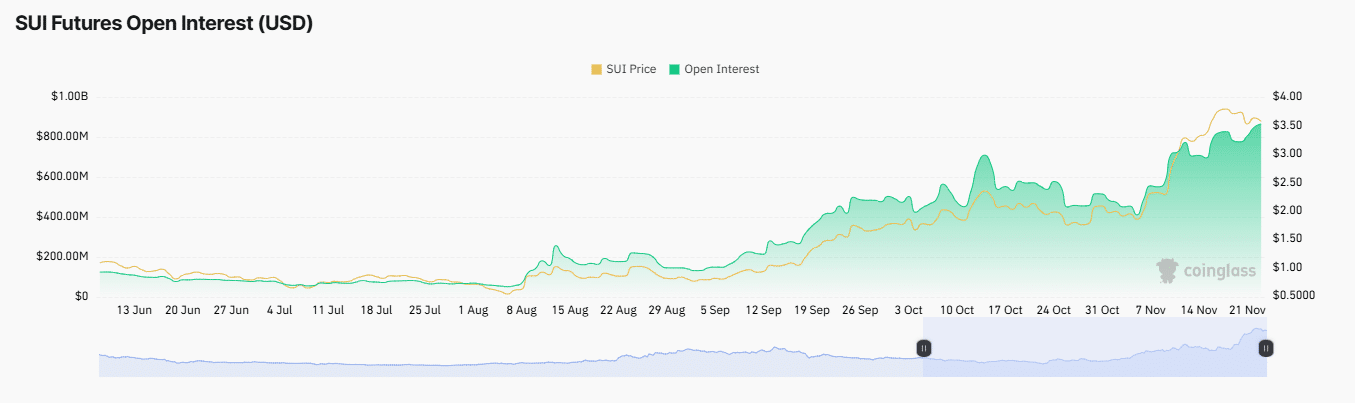

Open Interest hits record high

SUI has reached its highest level of Open Interest (OI) yet, climbing to $858.43 million at the time of writing.

This milestone indicates a surge in demand for the asset, showing heightened trader activity and growing interest in its derivatives market.

OI measures the total number of unsettled derivative contracts, providing insight into market sentiment and demand.

A high OI, like SUI’s 3.56% increase, often signals increased market participation and investor confidence in the asset’s future performance.

Meanwhile, the coin has recorded a negative Exchange Netflow of $8.23 million in the last 24 hours.

This means more SUI has been withdrawn from crypto exchanges than deposited, reducing the circulating supply on trading platforms.

The trend is generally seen as positive, pointing to a shift toward long-term holding rather than selling pressure.

With less SUI on exchanges, demand could rise further, potentially driving upward price momentum.

A slight pause before SUI’s next move

The anticipated upswing for the coin may take longer, as the Long-to-Short ratio was below one, at 0.9227, at press time.

This indicates that short positions outnumbered long positions, potentially limiting upward momentum.

Read Sui’s [SUI] Price Prediction 2024–2025

This suggested bearish sentiment among derivative traders, with more contracts betting on a price decline. Such a condition can create temporary downward pressure or stall a rally, as seen with SUI.

However, if broader market sentiment remains bullish, the alt could still gain momentum and trigger a rally, especially if key indicators align to support positive price action.